The main issue in Australia’s election has been around cost-of-living, which is closely linked to the cost of energy. Previously, energy discussion centred on oil and the security of supply and the cost of downstream refined products of petrol and diesel. Any movements fed into transport and manufacturing costs which were passed through to the consumer, whether positive or negative. Headline inflation was affected.

Things have changed. Now the security and price of electricity has become the focal point with energy transition away from fossil fuels and the setting of future zero emission targets. This, while the significant growth of artificial intelligence and associated data centres and other digital services has added a meaningful new driver of demand for reliable 24/7 energy. The Future Made in Australia economic plan along with federal and state government plans to build over 1.5 million new homes, likely 100% electricity powered, by 2030 will add to electricity demand.

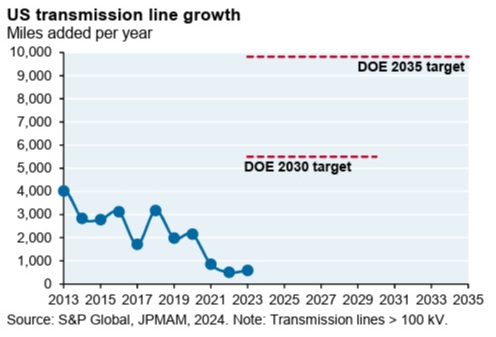

This change will require a significant increase in investment across generation and transmission, to a lesser extent distribution. Once generated from the combination fossil, renewable, and hydro sources, the efficient and uninterrupted transmission and distribution of electricity is critical for economic growth. Generated electricity must reach households and commercial and industrial consumers via efficient transmission and distribution networks. Transmission networks, the grid, have a defined capacity. Increased electricity demand will require a significant increase in transmission capacity. Transmission is the vital link between generation and distribution.

The issue has become a political football

Both the US and Australia are well behind the eight ball as are most other countries. In Australia, electricity generation has become deeply politicised, and its transmission is dividing communities as towers and power lines march across private land, while land-grabbing renewable generation gobbles up thousands of productive acres. Shamefully, the environmental issues are being bypassed, as the cheapest route is often selected.

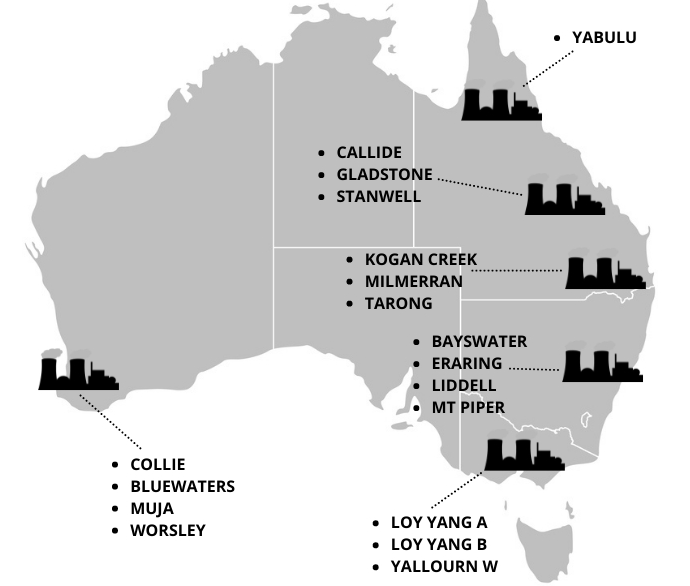

In Australia, the energy transition from fossil fuels, mainly coal, to renewables has seen a seismic change in the location of generating capacity. Our coal-fired power stations are located close to coal mines, mostly down the east coast. Over 90% of our population live within 100 kilometres of the coastline. The five mainland state capital cities account for almost 65% of our population, dominated by Sydney, Melbourne and Brisbane. In the past, households and industry has been well serviced by the electricity transmission and distribution networks. Transmission was relatively short haul.

The gradual closure of coal-fired power stations and the growth of renewables, mostly solar and wind has altered the generation map as renewable zones are established in regional areas well away from the coast and most consumers.

The Climate Change and Energy Minister Chris Bowen has a target to add 10,000 kilometres to the national transmission network by 2030. Put in context, it is 2.5 times the east/west distance of the Australian mainland or 11 hours flying in an A380 which has a cruising speed of 910 km/h. It is highly unlikely the target will be achieved, and the cost will be in the tens of billion.

A NSW case study

A prime example is the 365km HumeLink in southwest New South Wales, which is well behind schedule and the cost estimate has blown out to almost $5 billion to ultimately connect with Snowy Hydro 2.0, where the cost has soared more than sixfold from an original estimate of $2 billion to well over $12 billion.

The issues in the South West Renewable Energy Zone (SWREZ) of New South Wales are symptomatic of the problems facing energy transmission. Recently, Origin Energy won the transmission access for the zone and is in the process of tying up most of the capacity for its Yanco Delta project. It is one of Australia’s largest proposed wind projects with 1.5 GW wind farm (208 turbines) and an 800 MWh battery strategically located next to key transmission infrastructure. It is located some 530 kilometres from Sydney versus coal-fired power stations Eraring (120) and Mt Piper (160). Both Bayswater and Liddell stations in the Hunter Valley have been closed. Eraring generates approximately 25% of NSW’s power requirements.

Should Yanco proceed, several other proposed wind and solar projects in the SWREZ would become stranded if completed. Origin could divest up to 80% of Yanco, but capital partners may be thin on the ground. Management is widening its strategy to expand renewable energy and storage in its portfolio, while limiting ownership.

To address the transmission shortfall, potentially stranded developers are now engaging with data centre developers to relocate within the SWREZ, with the words from Francis Bacon’s essays of 1625 ringing, “If the mountain will not come to Mohammed, Mohammed will go to the mountain”.

Chris Bowen has repeatedly pointed to the jobs created by the investment in renewable generation and transmission. The ongoing issue is where is the skilled labour coming from and where will they be housed during the construction phase. Regional tourism is already being impacted with transient workers taking accommodation normally satisfying tourist demand.

Australia’s energy transition will take decades to complete. Gas generation backed up by and efficient transmission pipeline network throughout the eastern states and South Australia is the ideal transition fuel. Gas generated electricity from well-located plants feed into the existing transmission grid. New renewable generating capacity in the far-flung renewable energy zones will require transmission capacity to be added. This will take years and be very costly.

Transmission issues aside, when discussing renewable generating capacity, the focus should be on its availability. In normal circumstances and with scheduled maintenance, coal and gas plants can generate electricity over 90% of the time. For solar the availability (sunlight) is near 45% and optimal wind speeds occur about 50% of the time. There are over 95 million solar panels in place in Australia and recycling is not an easy process. Less than 20% of material can be recycled. These along with the disposal of used wind turbine blades could be the next environmental issue to be faced.

Electricity costs are likely to remain elevated. Government subsidies are a band aid on a meaningfully larger problem.

Peter Warnes is a market strategist and commentator, and former head of equity research for Morningstar in Australia. He was also the founder and long-term editor of Your Money Weekly before retiring in 2024 after a career spanning six decades.