Australian energy policy is a mess. Investors should ignore the arguments. The antagonists are stuck in a perpetual time shift, prosecuting cases from five to ten years ago, ignorant of the incoming change in solar economics.

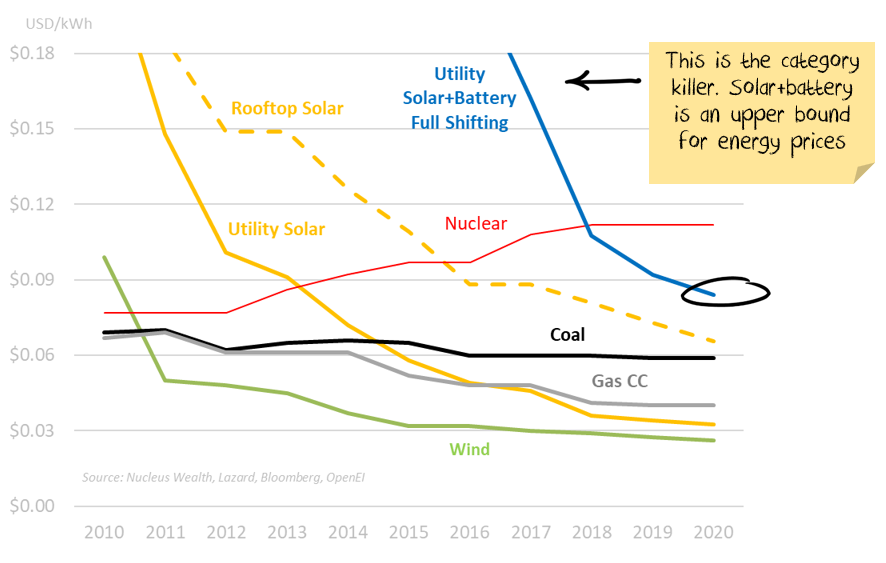

Five years ago, coal and gas were the cheapest sources of energy in most countries. Now wind and solar are.

“But but but, gas and solar are intermittent. YOU NEED BASELOAD!!!” cry the fossil fuel defenders.

The more solar we develop, the cheaper it becomes

Sure, battery + solar is currently more expensive than baseload coal. The problem is you don’t have to look too far forward to see that it won’t be like that for long. Coal, gas and oil have economics based on a scarcity curve: the more we use, the deeper we need to dig and the more expensive it is to extract. Solar and battery power is on a technology curve, the more the world produces, the cheaper it becomes:

Solar + batteries are the 'killer app'. They are extremely scalable once they reach an acceptable cost. All the current trends point to energy parity soon for electricity.

Relative cost of energy

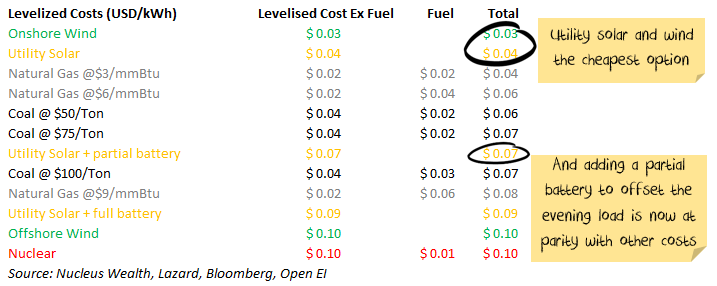

The figures in the table below are USD/kWh for international comparability. We use levelised cost of energy, which adjusts for the up-front cost of building power plants or solar arrays, asset life and tax issues. These numbers are approximate, rely on a lot of assumptions and vary by country and region. In general, the numbers are for new installations with recent technology.

Gas is no longer a transition fuel

Note the fuel cost of natural gas in the table above. Electricity prices from gas are more sensitive to fuel prices than other technologies. Fifteen years ago, there was a push in Australia to use gas as a transition fuel from coal to renewables. And gas was viable. But 15 years later, solar + battery option has fallen so much that gas is no longer feasible across Australia.

If you live in a country (say the US) or state (say Western Australia) with lots of gas and domestic reservation, then gas is still a viable option. Prices are US$3 per mmBtu or lower.

Energy companies have co-opted energy policy in the rest of Australia. Narrabri coal seam gas, the centre of a current battle in NSW, at best will be around $6 per mmBtu. As you can see from the table above, solar + partial battery is almost cost-competitive at that price.

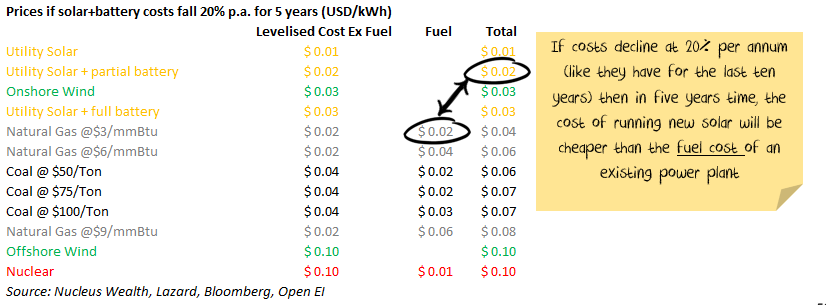

Future prices

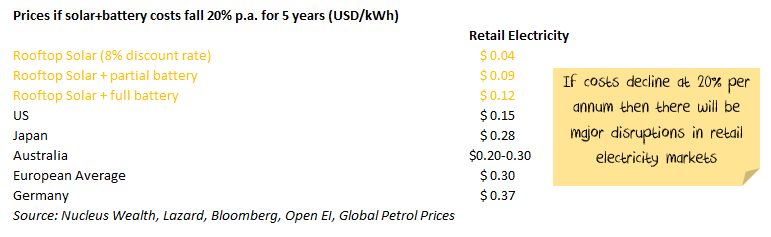

In the last 10 years, solar costs have fallen around 20% per year. Given how low solar costs are, the critical assumption is battery prices. A 20% fall in battery prices will have a much larger impact than a 20% fall in the cost of solar. I suspect this will slow a little, but if it doesn’t the impact will be immense:

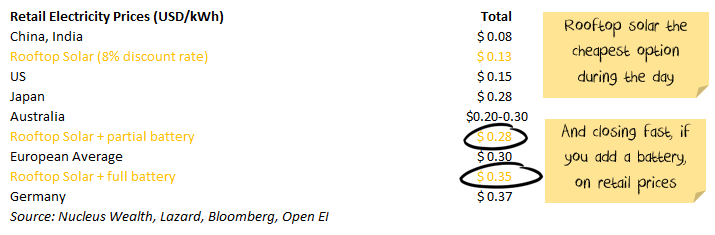

Rooftop solar

I have deliberately left rooftop solar out of the above tables, as it is less comparable than might be expected. Rooftop solar has costs of around $0.13 assessed on the same basis as above.

But that is not important. Rooftop solar is not competing with a coal plant, it is competing with grid power + grid infrastructure, which is an important distinction.

I don’t care whether my rooftop solar produces energy cheaper than the local coal-fired power station. I care whether it produces at a cheaper rate than I pay for power – and it does:

But my panels provide power during the day when everyone else’s panels are also producing electricity. At $0.28 for partial shifting (i.e. generating enough power to get you through the evening peak) having some battery capacity is profitable in the right climate, but the return is low.

Looking at the 20% cost reduction scenarios again:

There are lots of questions that the above table raises. If everyone starts going off-grid, who pays for the poles and wires? Do we end up in a ‘death spiral’ where more people leave the grid, raising the cost for those who remain, which means more people leave and so on?

My best bet is that it is going to be a battle of vested interests. Wealthier people will leave the grid when it becomes economic as they can afford the upfront cost. This leaves renters and the poor left paying higher bills to account for the transmission assets. Governments will have three options:

- Prevent retail electricity price rises, support the rights of the many over the few and make the asset owners pay the cost of their mistaken investment.

- Socialise the losses and bail out the transmission asset owners.

- Let the asset owners raise prices, shift the cost of adjustment onto the poor.

While option 1 would be my preferred choice, the cynic notes option 3 will be the path of least resistance. The lobbyists will no doubt be hard at work on option 2 in case any government has the fortitude to explore option 1.

Investment outlook

Battery costs are the primary determinant at this point. If the rate of improvement slows significantly, then it may take 10 years. My base case is that battery improvement will be sustained, but it is far from a given.

The US is not the market to watch. Energy costs are lower there than almost any other developed market. A better indicator of the future will be developments in Europe.

Key investment sectors and opportunities

- Coal/gas: I’m not saying that coal and gas will cease to be used when we hit parity. However, the price will be limited to no more than solar + battery, and that cost will fall year after year. Any investment in these companies should be made with falling commodity price expectations – i.e. value them in run-off. There may be short-term shortages and price spikes, but these are selling opportunities. Increases in electric car penetration may limit the downward trend for a few years.

- Solar companies: Solar manufacturers are difficult. The technology is moving too fast to work out if there will be a ‘winner takes all’. Service providers to the solar industry are probably a better investment if you can find one that’s not already very expensive. We have made a few profitable investments in semi-conductor stocks that manufacture ‘commodity-type’ parts for solar companies. It is not a sexy area of the market with thin margins, but at the right price, some of these stocks are interesting.

- Industrials: Companies that have high electricity bills during the daytime (or can shift costs to the daytime) will benefit. There are many European materials and refining companies that struggle to compete with US companies because of the lower-cost US energy in recent years.

- Oil: At the margin, less diesel will be used for power generation in remote areas. Expect this to continue. It is not a large part of the oil market, but it will mean oil demand will be weaker than they would have otherwise been.

- Electricity transmission: Will these companies get bailed out? Will increased prices to offset falling customers be allowed? Or will companies take the pain of the ‘death spiral’? It is a country-by-country decision with lots of risk in this trade.

- Electricity production: The toughest thing about an investment today is that the company which builds a solar array next year will have lower costs than the one who built last year. Plus there’s the regulatory risks from the ‘death spiral’. Another risky trade.

Damien Klassen is Head of Investments at Nucleus Wealth. This article is general information and does not consider the circumstances of any investor.