“It wouldn’t surprise me to see a bubble develop in equities, perhaps over the next year or two, before a more serious correction.” That was the assessment I gave, shooting straight from the hip, to an investor in rural New South Wales recently who asked me to abandon any ‘fence sitting’ and offer my unadulterated ‘gut feel’.

In the absence of possessing a crystal ball, the equally useless gut feel was all I could offer. Of course, such musings cannot be inputs into a serious, repeatable investment strategy.

But the subject of the tension between gut feel, even if born of experience, and the execution of a highly repeatable and replicable investment strategy, driven by evidenced fundamental drivers, is the subject of today’s article.

Picking market direction consistently accurately is almost impossible. Witness, for example, the stock market's falls whenever Trump pulled ahead of Clinton during the US Presidential campaign. Of course, fears of a potential Trump victory gave way to euphoria after its confirmation.

Market rally sustained by ‘animal spirits’

The US stock market is at the late stages of a rally whose length has few precedents. Indeed, according to one definition of a bull market - a period in which the market rises 20% or more after a decline of at least 20% - the S&P 500 is enjoying its second-longest bull run ever. But equally, until recently there has been few indications of euphoria, an ingredient that tends to precede any serious correction.

Since Trump’s election the market has extended an eight-year bull run, with the Dow exceeding 21,000 for the first time amid its longest run of record closes since 1987.

Such observations are interesting but meaningless from an investment perspective except that, given historically high price multiples, if you are a buyer of the broad index today you are expecting immediate returns that history has not delivered.

The stock market might be rising because investors are paying more attention to the pro-business individuals surrounding Trump than to the President himself. Along with promised tax cuts and deregulation of the financial and energy industries, including rolling back Dodd-Frank, many suggest the market is being driven now by ‘animal spirits’.

Curiously the accelerated rally in stock markets is coinciding with a clear end to lower interest rates. Stock market rallies continue during the early phase of interest rate rises amid expectations that the economy is strengthening and earnings growth is due to emerge. But as rate rises continue, and expectations of inflation emerge, the combined effect on present values overwhelms the positive effect from earnings growth, and the market begins a correction.

It certainly appears the combination of excitement over deregulation and tax reform with its delayed delivery provides fuel for an extended period of euphoria. And if euphoria generally precedes a correction, the stage may be prepared for a script-following bubble prior to a bust.

How should an investor respond?

Should we as professional investors join others, back the truck up and fully invest, in anticipation of the expected rally, hoping to be equally adroit at exiting at precisely the right time? That sounds like ego-fuelled speculation to me.

Instead, should we follow our process, holding almost maximum cash weightings amid a general absence of bargains, knowing that it is better to be six months early than six minutes late. We have to accept being chastised for missing any ensuing rally, because we have written about it presciently here in Cuffelinks.

It is likely that some, if not many, investors will exit our funds if we miss a continuing rally. After merely treading water for the last 12 months, while the market rallied 17%, it’s hard to imagine many investors would persist with a fund manager taking fees for two years and delivering naught.

The major driver of the market’s recent returns however has been the materials sector. A booming iron ore price has rendered even the highest-cost producers profitable. Understandably, the prices of Rio, BHP and Fortescue have rallied significantly with the latter two up over 70% and 240% respectively in the last 12 months. Expectations of rising steel demand in China has lit a fire under the share prices of our domestic iron ore miners. Strangely, the price of coking coal has collapsed since hitting $308 in November last year.

Putting aside predictions of iron ore prices amid record inventory on major Chinese ports, a simple examination of the economics of the iron ore businesses, and comparing them to the economics of our preferred entities, suggests we would merely be ‘lucky idiots’ if we bought in and made money from any ongoing rise in share prices of materials stocks.

The rally is about resources, so let’s look at BHP

Imagine kicking the BHP business off in 2007 – a decade ago – with $36.7 billion of your own money (equity) and borrowings of $14.6 billion. Now suppose a net profit after tax is realised of $15.9 billion in the first year of business. It’s fair to say you would be delighted with the 43% return on your initial equity in just one year.

Following one of the biggest resource booms in history, it would be reasonable to expect that borrowing more money, reinvesting profits and injecting additional equity, to expand the business, would also expand the profits of BHP.

So, let’s suppose between 2007 and 2017, you do exactly that, investing an additional $1.4 billion of equity directly, reinvesting $34.4 billion of profits rather than paying out dividends and borrowing an additional $34.3 billion on top of the $14.6 billion already held.

Clearly it would be reasonable to hope that three times as much debt and twice as much equity would yield an increase in profits over 10 years. Unfortunately, BHP’s 2017 profit is forecast to be 42% less than it was in 2007. And in 2016, it was 87% less than in 2007! Sadly, if you were the single owner of BHP, every dollar of equity invested and reinvested by you over the last decade, has yielded a return of minus 18%.

To our way of thinking, BHP’s longer-run economics are not attractive. And the economics of the underlying business are, unsurprisingly, reflected in BHP’s share price being lower today than it was 10 years ago.

Contrast BHP with REA Group for the same period

Now assume you kick REA Group off in 2007 with $67 million of your own money (equity) and borrowings of $8 million. In the first year of business a net profit after tax is realised of $15 million. It’s fair to say you would also be delighted with this 22% return. Over the subsequent decade, you inject an additional $41 million, reinvest $573m of profits and pay off the debt.

With almost 10 times as much equity, profits in 2017 are forecast to be almost 17 times higher than in 2007. Every dollar of equity invested and reinvested by you, as the owner of REA, over the last decade, has yielded a return of 38.8%.

Warren Buffett, quoting Ben Graham, once said, “In the short run the market is a voting machine, but in the long run it is a weighing machine.” In other words, in the short run the market price might disengage from the fundamentals of the business thanks to popularity and fads. But in the long run the market price cannot escape the performance of the underlying business.

Buffet added, “If you aren’t prepared to hold the whole business for 10 years, don’t own a little piece of it for 10 minutes.”

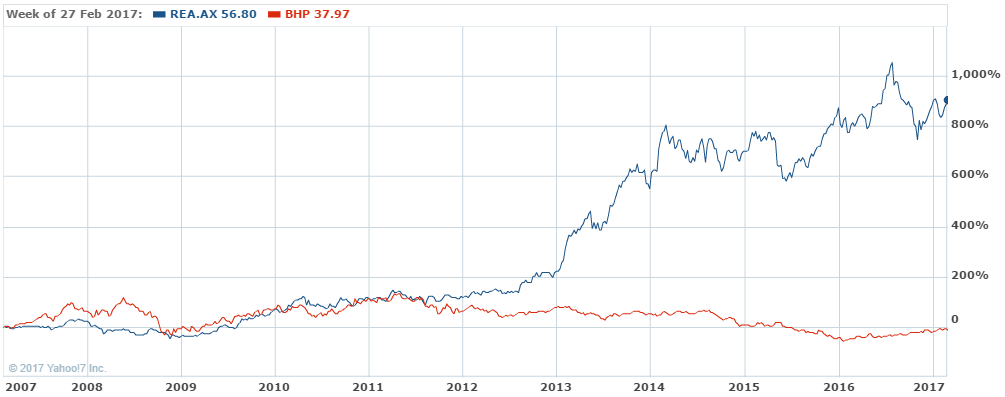

BHP’s share price is lower than it was 10 years ago, while REA Group’s share price is more than 10 times higher than its $5.00 price of early 2007.

Sadly however, many investors miss wonderful opportunities such as REA because the share price doesn’t always reflect its superiority. In the short run, share prices can rise and fall on fads, fashions and factors that have no relevance to the underlying business.

Last year was a case in point. While BHP’s share price rose over 75% in 12 months, REA’s share price slipped 30% from its high in July 2016 to its low in November 2016. And while REA’s share price has recovered since November it remains below its July highs. Contrast this 12-month picture with the far more meaningful last decade.

BHP v REA Group, 12 months to February 2016

BHP v REA Group, 10 years to February 2016

Source: Yahoo!7 Finance

For many ‘investors’ it matters not whether the economics of the business are attractive. For those people, all that matters is that the share prices are rising, and a rising share price is a sign of a good business and a falling share price is a sign of a poor one.

Never take a cue from share prices. We might be a smaller fund manager because we don’t pick the next sector ‘rotation’ but we’ll do just fine in the long run.

Roger Montgomery is Chairman and Chief Investment Officer at Montgomery Investment Management. This article is for general information only and does not consider the circumstances of any individual.