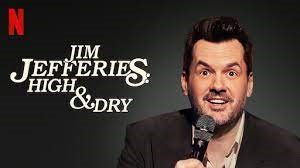

Comedians are a foul-mouthed bunch though their humour can bring nuggets of wisdom. In his latest Netflix series, Australian-born, US-based Jim Jefferies, recalls a recent trip back to his homeland.

“I just got back from touring Australia; the whole place was flooded. Remember three years ago, the whole place was on *** fire. Remember that, just before Covid, all of Australia was on fire, and we’re all like, “The world can’t get any worse than this”.

People died. People lost their homes. But the only thing reported in North America about the fires was … the koalas, yes. You all seemed very concerned about the koalas…

The koala is the laziest animal on earth. It sleeps for 22 hours a day. The sloth sleeps for 21.

It only eats eucalyptus leaves. Eucalyptus leaves are its source of food and water. There is a chemical in eucalyptus that reacts the same way to them that THC reacts to us. So, they’re stoned all *** day.”

Source: Netflix

In his off-beat way, Jefferies highlights that the koala is not only an adorable animal but a highly specialized one. It’s found a way to survive over thousands of years by finding a niche: only feeding on the leaves of eucalyptus trees. It’s restricted to areas that have eucalyptus trees i.e., certain parts of Australia. And some koalas specialize even further by only eating leaves from one or two specific trees.

Eucalyptus leaves are poisonous to most animals and humans. Consequently, koalas have little competition when it comes to living off these leaves. The downside is that the eucalyptus leaves have limited nutritional value. That’s why koalas have little energy and sleep so much.

Most other animals also find a niche – a method of behaving and competing for survival. They usually select one for which they’re best adapted. If they compete for the same niche with other species, then they risk limited resources running out. That’s how species become extinct.

Today, we’re going to talk about biological niches, how they may apply to markets, and how understanding them can help you become a better investor.

Ecological niches

In ecology, there are two types of niches: general and specialist. Classifying a species as a generalist or a specialist is a way to identify what kinds of food and habitat resources it relies on to survive. Generalists can eat a variety of foods and thrive in a range of habitats, while specialists have a limited diet and stricter habitat requirements.

Koalas are specialists. Another example of a specialist is the Canada lynx (pictured below). Unlike koalas, the lynx is a carnivore. It preys on snowshoe hare that are mainly found in forested, mountainous areas. The lynx has adapted to hunt in deep, soft snow.

Source: National Geographic

Raccoons are an example of a generalist species. Raccoons can live in a diverse range of environments. They live in large cities, mountains, and forests throughout North America. And they can eat a variety of foods – everything from eggs, to nuts and fruit, and even insects, frogs, and human garbage.

Niches aren’t just confined to the animal world; they’re also found in plants. Some plants need a narrow range of rain, soil conditions and temperatures to survive, while others don’t. For example, a cactus is a specialist species as it will die if it gets too much water or if it spends time during winters at high altitudes.

There are pros and cons to being specialist and generalist organisms. Specialists have more clearly defined niches and encounter less competition from other species. But when environmental conditions change, they can struggle to survive if they don’t adapt quickly.

Generalists have more competition from other species and therefore less resources to source. Yet, they are more adaptable to changes in the environment than specialists. This has been particularly advantageous with the acceleration of climate change in recent years.

The ideal business

This distinction between generalists and specialists can be applied to the business world. Some businesses thrive by being highly specialized and operating in an environment with little competition. Former investment newsletter writer, Richard Russell, once told a story of such a business:

“I once asked a friend, a prominent New York corporate lawyer, “Dave, in all your years of experience, what was the single best business you’ve ever come across?” Without hesitation, Dave answered, “I have a client whose sole business is manufacturing a chemical that is critical in making synthetic rubber. This chemical is used in very small quantities in rubber manufacturing, but it is absolutely essential and can be used in only super-refined form.

My client is the only one who manufactures this chemical. He therefore owns a virtual monopoly since this chemical is extremely difficult to manufacture and not enough of it is used to warrant another company competing with him. Furthermore, since the rubber companies need only small quantities of this chemical, they don’t particularly care what they pay for it — as long as it meets their very demanding specifications. My client is a millionaire many times over, and his business is the best I’ve ever come across.” I was fascinated by the lawyer’s story, and I never forgot it.”

This business has, in Morningstar’s parlance, an economic moat, or sustainable competitive advantage. Because of the moat, it presumably generates a high return on capital.

Specialist businesses can be highly profitable. Though like in the ecological world, changes in the environment can prove their undoing. For instance, the business above could have a competitor move in with the production of a similar chemical. Or synthetic rubber may go out of fashion in favour of a superior product. In these cases, the business would have to adapt or die.

Other businesses are generalists rather than specialists. Think of large conglomerates like Wesfarmers. Or the big four banks. Or for that matter, giant resource companies such as BHP and Rio Tinto.

All these companies operate across multiple segments. If one segment doesn’t have a bright future, they can invest in another one that may provide a better return on capital.

Yet, because they’re generalists, they compete against many other companies. And this competition brings lower returns as the products are largely commoditized.

Investment niches

Niches are also present in the investment world. Generalists include multi-asset funds, most Australian equity funds, and macro funds. In the case of multi-asset and macro funds, they trade across a broad range of asset classes. If one asset class isn’t doing well, they can invest in an alternative class.

Most Australian equity funds are generalists. They trade the whole, or large parts, of the market. For instance, if they take a dim view of banks, they can switch into commodities or industrials.

All these funds are highly adaptable. But they compete against many other funds and ETFs which are trading the same stocks.

Then there are specialist investors. Think of micro-cap funds, arbitrage funds, specialist property funds, and a host of others. These investors focus on a small segment of the market, where the competition is less crowded. They hope that gives them a sustainable edge.

Specialised investing can be difficult. Consider value funds since the GFC. Value focuses on buying stocks cheaply. This style of investing has been out of vogue for 15 years, while so-called growth investing has thrived. It’s been almost impossible for value funds to keep up with their benchmarks and many have shut down because of this.

What can the average investor learn from this?

As an individual investor, you need to decide whether you want to be a generalist or a specialist. That decision entails knowing yourself and what you might be good at. It also entails how much time you can devote to investing.

Being a generalist is a lot of work as it requires being across the whole market and all its businesses. For the average investor, that requires too much time.

There is the option of outsourcing your investing to a generalist fund or an ETF which covers the broader market.

If you choose to invest yourself, then it’s easier focusing on one or two segments of the market. One idea is to devote your time to an industry where you have some background knowledge. If your background is in insurance, perhaps you should focus on insurance companies and brokers. Or if you’ve had experience in retail, the retail sector would be a great area to apply your knowledge. Or if you have owned businesses in the past but don’t want to compete against the big institutional funds, then companies with market capitalisations under $50 million may be a happy hunting ground.

Investing in what you know can give you an edge over the competition, as Peter Lynch outlined in his famous 1989 book, One up on Wall Street.

James Gruber is an Assistant Editor at Firstlinks and Morningstar.