Inflation is a fact of life. It’s also not so great for retirees. In fact, it’s one of the biggest risks that retirees face. By constantly eating away at the value of our savings and income, inflation will slowly reduce our purchasing power in retirement – if we don’t do anything about it.

This means that we need to figure out how to deal with the effects of inflation over time. It’s not always easy, but there are a number of different ways to tackle inflation that you can use depending on your approach to retirement income. The first step is your social security benefits.

Beyond social security is your security blanket

There are a lot of reasons to like social security, but from a financial planning perspective, one of the big ones is that your social security benefits are adjusted for inflation. However big of a piece of your social security benefits make up of your retirement income, you’ll always be able to (roughly) buy the same amount of stuff with those benefits.

So, it’s essential to ensure you get the most out of your social security benefits as you can.

As great as social security is, it’s unlikely that it will cover all of the spending that you want to do in retirement. So how do you want to deal with the rest of your spending?

Well, that’s going to depend on how you want to approach your retirement income. There are two basic approaches to retirement income: Safety First and Probability-based planning. Their overall philosophy is pretty clear from the names. But in short, the Safety First approach is based around having enough reliable Income to cover at least your most essential expenses. Reliable income is income from sources that you know, to some very high degree, and usually contractually obligated, will pay you a specific amount of money on a specific date. Probability-based approaches are more willing to deal with uncertainty in how they are funding retirement income in return for higher levels of expected return.

As you would expect, these approaches will go about keeping up with inflation in very different ways.

Safety First planning and inflation

Annuities are the other big source of reliable Income. So, what can we do here?

The inflation adjusted options here for reliable income are a little thin, but we can get creative.

Even though we are focusing on reliable Income, it is worth mentioning variable annuities. There are variable annuity products that offer varying levels of reliability and inflation protection. The specifics will depend on the individual annuity that you are looking at, but the inflation protection will likely be tied to some form of investment in some way (I think I’ve put enough qualifiers here.) These can be great tools, but how you feel about the investment risk involved will play a big role in whether you think variable annuities are a viable solution.

So that leaves us with income annuities. Which means we need to get creative.

One approach that you can use is what you might call ‘sequential’ deferred income annuities to top up your reliable income over the course of your retirement when you start feeling the pinch of inflation. By using multiple annuities over time (or partially annuitizing one annuity over time) you have a good amount of control over how your income level evolves over time. You likely will not track inflation exactly, but that’s okay because your desired spending won’t track inflation exactly either.

Using this approach means that you will need to estimate how much inflation we are likely to see over the course of our retirement (and how our spending will evolve, but we need to do that anyway) so that you can create a large enough pool of deferred annuities to (roughly) maintain your desired spending levels.

Probability-based planning and inflation

If you are comfortable using risky sources of income, like your investment portfolio, to generate your retirement income (or at least part of that income – retirement planning is very rarely all or nothing), dealing with inflation is a little more straightforward. Instead of trying to tie your income to inflation, the probability-based approach is just to try and outgrow inflation and increase your distributions to keep up with inflation.

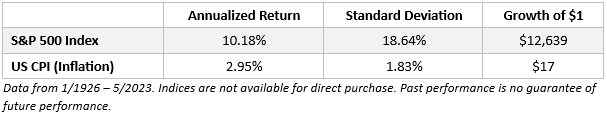

Just like anything with your investment portfolio, this approach comes with risk. Your portfolio isn’t always going to beat inflation, but it’s worked well historically. To see this, let’s start by looking at the returns of the S&P 500 over time compared to inflation, ass the US has a long history of data that we can analyse.

It’s not a particularly big shock that stocks beat inflation over the long term. Though, it is still impressive by how much. With how much stocks bounce around, we should be thinking about what the short term looks like - how often would stocks lose to inflation when we actually want to spend our money?

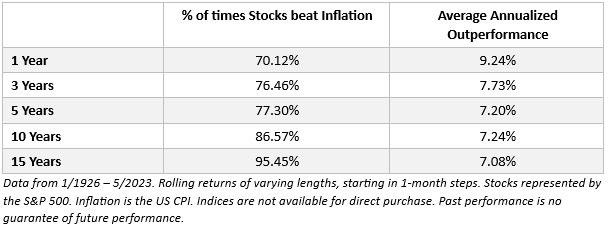

To get at this, we can use rolling returns of different lengths of time and see how often stocks beat inflation.

As you can see, stocks do well against inflation even over shorter time periods. Even for periods as short as one year, the S&P 500 Index outperformed inflation (just) over 70% of the time – and by a lot. In the average one-year period stocks outperformed inflation by 9.24%. Though it’s always important to turn these sorts of statistics around – that means that stocks lost to inflation a little less than every third year. However, outperformance here makes up for a lot, as we can see in the longer time periods.

As we would expect, the longer the time frame we are looking at the more likely stocks are to outperform inflation (though the average outperformance does come down a bit). Once you get out to 15-year periods you have a better than 95% chance of outperforming inflation. As always, with a probability-based approach, we’re talking about probabilities, but stocks definitely seem to outgrow inflation, even over reasonably short periods of time.

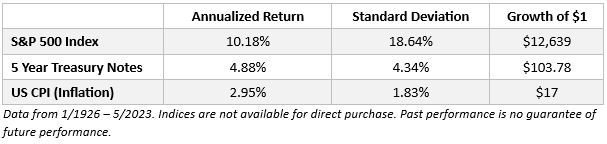

But very few retirees are using a 100% stock portfolio. So, let’s bring bonds into the picture. How do they do against inflation? To keep things simple, we’ll use 5 Year Treasury Notes as our stand in for bonds.

Bonds obviously don’t have (nearly) as high returns as stocks, but they also don’t have (nearly) as much volatility as stocks. There’s less randomness around those returns. So how often do bonds beat inflation?

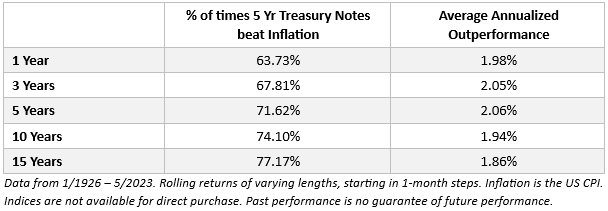

Still often. Not quite as often as stocks. And certainly not by nearly as much as stocks do, but it’s likely that even a 100% bond portfolio would stay ahead of inflation, even over short time periods.

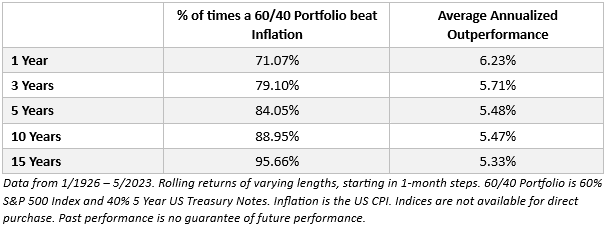

But, again, most retirees don’t have a 100% bond portfolio. You build your portfolio to fit your risk tolerance and goals. You intentionally find the mix of stocks and bonds that fits you. So, let’s take the stereotypical ‘retirement portfolio’ of 60% stocks and 40% bonds and see how it does over time.

It does well. In fact, this is a good example of the magic of diversification. If you go back and compare the numbers, over every length of time we looked at, the 60/40 portfolio is more likely to beat inflation than the 100% stock portfolio (though not by quite as much).

But even over a 15-year period, there’s still a nearly 5% chance that our 60/40 portfolio won’t outpace inflation. That’s not a big chance, but it’s something – and longshots do land once in a while.

There is no perfect solution to inflation. It’s like most things in retirement planning – there are a whole bunch of different solutions, all with their own set of tradeoffs. The trick is finding the set of solutions that has the right mix of tradeoffs.

Bob French is an investments specialist at Retirement Researcher and the Director of Investment Analysis at McLean Asset Management. This article was first published by Retirement Researcher and is reproduced with permission. This article provides general information only and as such, does not consider your personal financial situation or goals.