I interviewed Harry Markowitz in 2013 and 2014, and to celebrate his 94th birthday, we have edited three previous articles into one piece on asset allocation and portfolio selection.

Harry is the 1990 Nobel Laureate and Pensions & Investments Magazine's 'Man of the Century'. In these interviews, he explains his views on risks and returns and how he arrived at his Modern Portfolio Theory and Efficient Frontier.

His 1952 seminal paper Portfolio Selection pioneered our understanding of risk, return and correlation in investment portfolios. His Efficient Frontier and Modern Portfolio Theory ideas are still taught in universities and business schools.

Harry Markowitz was born on August 24, 1927 in Chicago. He studied economics at the University of Chicago under important economists, including Milton Friedman. While still a student, he was invited to become a member of the prestigious Cowles Commission for Research in Economics, leading to his 1952 breakthrough work.

Markowitz now divides his time between teaching (he is an adjunct professor at the Rady School of Management at the University of California at San Diego) and consulting (out of his Harry Markowitz Company offices). He is co-founder and Chief Architect of GuidedChoice, a managed accounts provider and investment adviser.

This discussion with Harry Markowitz took place at the Research Affiliates Advisory Panel Conference, Laguna Beach, California, 30 May 2014.

Markowitz identifies the development of databases and ability to model expected outcomes as the major recent improvements in his portfolio construction work. Given a set of investments with forward-looking returns and defined risks, portfolio theory will show an efficient frontier for the investor. This principle has guided asset allocation and diversification for the 64 years since his original ideas. Says Markowitz, “I lit a small match to the kindling, then came the forest fire.”

Long-term asset allocation

Markowitz tells me he has a wall in his office dominated by a cork board, and on it, a large graph shows returns over time from various asset classes. It shows $1 placed in small cap stocks in 1900 growing to $12,000, while the bond line has reached $150. I asked whether this shows that for anyone with a long-term investment horizon, their portfolio should be heavily dominated by equities, maybe even 100%.

He said he is asked this asset allocation question all the time. His advice is different to a waitress in a coffee shop versus a well-informed investor with good professional advice. He tells the waitress to go 50/50, a mix of growth from a broad stock fund and security from bank deposits, because she cannot tolerate the volatility of a 100% equity portfolio. But an educated investor with good advice should take their current portfolio mix, find the most efficient frontier, then simulate possible future outcomes focusing on income expectations. The investor can then better judge whether the portfolio is the right mix to achieve the end goals.

Markowitz believes active stock selection is for a few highly skilled people who usually find returns not from stock-picking on the market, but by participation in private placements. He cites Warren Buffett and David Swensen (of Yale University) as consistently delivering excess returns but mainly because of the private deals they are offered and their ability to value them. Otherwise, outperformance is not worth chasing.

His own portfolio is currently equally weighted municipal bonds and equities, the latter with an emphasis on small caps and emerging markets, but with a stable core of blue chips. This is because he feels so many stocks are overvalued at the moment, and his portfolio is also influenced by his age. “I want enough bonds that if I die, and the equity market goes to zero, my wife will have enough capital and income to live well.” His current objective is to reach 100 without appearing on the right-hand column of The Wall Street Journal, with the heading “Harry Markowitz f*cked up”.

He is a great believer in rebalancing, and this is one reason why a cash reserve is always required. As equity markets rise, shares should be sold to retain the same proportional asset allocation mix. This provides a natural protection from overvalued stocks. He recalled working with a major Fortune 500 client in November 2008, after the rapid stock market fall, allocating more to equities in a rebalancing exercise. This has subsequently paid off handsomely. But it was scary at the time, and as the market continued to fall, he thought if he keeps allocating more to equities at this rate, the whole place will be owned by him and Buffett. He likes the expression ‘volatility capture’ for this process, which is why there is a role for bonds as part of the reallocation mix.

I was still curious why a person with good savings at age of say 40, and strong income flows, would not invest 100% in equities, given their long-term outperformance versus cash or banks. He said,

“They may think their income is assured, but then may hit a rough patch and need to sell equities at the worst moment.”

He highlighted that many people have jobs which are also heavily exposed to the strength of the economy, and that they should also “diversify their own job and other income sources”. He suggests investors should not become too smart, using leverage and unusual investments, and not try to become rich overnight.

He is also keen on using simulation to determine possible future outcomes. In his financial advice business, GuidedChoice, and especially in their new work on GuidedSpending, they ask clients to define an upper band of future income requirements, which might be say $50,000. Clients then define a ‘scrape through’ amount, such as $30,000. Simulations are done based on variables such as living longer and market returns “to capture the essence of the spending problem”. Clients can vary scenarios to see the outcomes. The most common consequence of the process is that people save more, often dramatically and commonly 50% or more.

What else would he do all day?

While the technology behind the scenes is complex in this modelling, it is presented in ways the client can easily understand. But he dislikes mechanical rules such as taking 4% from the portfolio each year. “Why should someone who is 90 only take 4% if they want to spend more?” he says.

I ask him how a fund with investors aged from 16 to 90 should allocate its assets. “It’s like a family,” he responds. “There is a trade off in a family structure between paying for the education of the children, versus the future retirement of the parents. All families make these ‘social choices’, and so must the fund. Their decisions may not be ideal for the 16 year old or the 90 year old but everyone makes these choices in life”.

And one of Markowitz’s choices is to keep working as hard as ever. “I enjoy this, and what else would I do all day?” He now dedicates every Friday to writing to ensure he meets his deadlines, spends every Thursday afternoon at GuidedChoice where he consults to their institutional clients, and he maintains a heavy teaching and advising schedule. If his health allows it, he’ll still be doing it when he’s 100, and that right hand column of The Wall Street Journal will be singing his praises.

I interviewed Harry at the 2013 Research Affiliates Advisory Panel meeting in San Diego.

GH: I'd like to start by going back to 1952 and your seminal paper, Portfolio Selection. Did the idea of mean variance and efficient frontier and risk reward come to you while you were having a shower, or was it more systematic that that?

HM: There was a moment of truth, a ‘ah ha’ moment. Let me give you some background. I was a PhD candidate at the University of Chicago and the reading list included Graham and Dodd, Weisenberg and John Burr Williams, The Theory of Investment Value, from 1939.

So I'm in the Business School Library, and Williams says the value of a stock should be the present value of its future dividends. I thought to myself, dividends are uncertain, so he must mean the expected value. So I thought if we’re only interested in the expected value of a stock, we must be only interested in the expected value of a portfolio, but to maximise the expected value of the portfolio, you must put all your money into the one stock with the highest expected return.

But that can't be right, everyone knows you should not put all your eggs in one basket, Weisenberg had shown people are willing to pay for diversification. So people diversify to reduce risk and volatility, and standard deviation is a measure of risk.

GH: So you knew statistical theory, you had that background?

HM: Yes, I had the usual courses you’d expect from an economics major in the leading econometrics school. So I visualised the returns on the securities as random variables, so that means the return on the portfolio is the weighted sum of the returns on those random variables. I know what the expected value of a weighted sum is, but I don't know off hand what the variance of a weighted sum is. So I get a book off the library shelf, Introduction to Mathematical Probability. I look up the formula for the variance of a weighted sum and there it is, covariance. Not only does the volatility of the portfolio depend on volatility of the individual securities, but the extent to which they go up and down together.

GH: That was the magic moment.

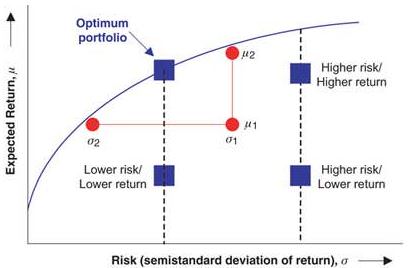

HM: That was the moment. So now I have two quantities, risk and return, and I know economics so I draw a trade-off curve. I’d heard of efficient and inefficient allocation of resources, Pareto optimums and so on. So I now had efficient and inefficient portfolios. In that flash, in that moment, much of Markowitz 1952 came together.

GH. So although there was this moment, there was a massive body of knowledge already built up.

HM. Sir Isaac Newton said, “I saw so far because I stood on the shoulders of giants.”

GH: Also in your career, you are credited with running one of the first hedge funds, doing arbitrage.

HM. No, a long way from the first. A bit of history. My first job out of college was with the Rand Corporation, where I developed a programming language called SIMSCRIPT, for simulation. The guy who wrote the manual was an entrepreneurial-type, he said, “Harry, let’s form a company.” We founded CACI in 1962, it still exists, it’s a big company now. Then UCLA invited me to be a full professor, full tenure, and another entrepreneur decided to form a hedge fund called Arbitrage Management, based on Thorp and Kassouf’s book, Beat the Market, doing all sorts of arbitrages. I was a consultant, then the portfolio manager. We made a decent return for clients but not really for us, we were generating a lot of brokerage, so we became a wholly owned subsidiary of a brokerage house before I left.

GH: Given it’s now 60 years since Portfolio Selection was published, do you feel any sense of disappointment about our profession, we haven’t really had any major breakthrough theory of investing since the 1950’s.

HM: A lot has happened. We have a lot of data now. In 1952, we hired a student to collect data on securities. But between the top down view, knowledge of data, and our experience, we are better now. When I was at Rand in 1950, I just did 50/50. That’s all I knew then, it’s not what I would do now and it’s not what I would recommend to a 25-year-old. My profession and I have learned a lot.

GH: I don’t like how so many investment discussions end up talking in generalisations.

HM: It’s a good point. There’s a big difference between my article of 1952 and book of 1959. In chapter 13, I talk about the division of labour between the computational part and the intuitive part. Computational part can show probability distributions of returns you can have at your disposal, we can tilt them so they’re correlated with inflation or whatever. But which particular probability distribution you want to have at this time of your life, for this year – you know, your kids go to college, you’re not feeling well, people might be dying in your family, etc - is beyond any model. We don’t understand all that goes on. If we could understand it, we couldn’t model it. If we could model it, we couldn’t estimate it. This year is different from next year.

A continuation of the 2013 interview in San Diego.

GH: Can we talk about you do with GuidedChoice? I’m especially interested in how you advise people, how you manage asset allocation and issues such as longevity risk.

HM: What we do is Monte Carlo analysis to get a probability distribution of how well you will do if you invest in a certain way, and save a certain amount of money. You’re familiar with Gary Brinson’s writings on asset allocation?

GH: Where 90% of your returns come from asset allocation, not manager selection.

HM: Yes. The important thing about Gary Brinson’s work, which has persuaded trillions of dollars of funds to do this top down analysis, is where you first decide to be on an efficient frontier at the asset price level. Then you figure out where you should invest, you might consider the managers to use or ETFs. The beauty of that is that people who have no ability to pick stocks can still get good advice.

We do this top down analysis, for all our clients, we do forward-looking estimates of variances and covariances. We don’t reestimate values very often because we use long-dated series. A few years back we said we’ve got to reduce our forward-looking estimates on fixed income because we’re obviously in a low rate environment, but we don’t change equity estimates very often. We are doing principal component analysis of the factors, but it’s not completely mechanical. When it’s finished, we take all the asset classes with estimated expected return on one axis and estimated standard deviation on the other axis.

For everybody, we generate an efficient frontier at the asset class level, and we pick off 7 portfolios, number 7 being the riskiest, 1 being the most cautious. Then for specific plans, which have allowed investments, we have a separate optimisation which tries to figure out what are the real investible securities permitted by particular plans in order to match these asset classes. We take into account tracking error, expense ratio, historical alphas. For each participant, we receive a lot of data from their company, and we ask questions like, “When do you plan to retire?”

GH: So there’s a type of online questionnaire that the individual fills in? I’m wondering how you work out the client’s risk appetite.

HM: Yes, it’s interactive online, but we do not ask whether you sky dive. We look at what you already have in your portfolio, assess your current risk level, and we propose to you a portfolio. Then we show you the consequences of changing from your current one to a proposed portfolio. We show you three points on the probability distribution of how much you can spend in current dollars when you retire – in a weak market, an average market and a strong market. You can fiddle with it, you can go up the frontier, or you can save more.

GH: You have these seven asset class portfolios with different risks, how does someone decide?

HM: You’re a client, you’ve told us when you want to retire, you’ve said at what rate you are willing to save, told us whether you have a spouse, we can see your existing portfolio. We show you a portfolio which has a similar risk level but maybe a bit more return, and we show you three points off the probability distribution showing the rate you can spend when you retire. You might not want Risk Class 4, so they try 5, and we go back and forth.

Source: GuidedChoice website.

As an aside, you should read a paper I wrote called The Early History of Portfolio Theory 1600-1960. I chose 1960 because that was when Bill Sharpe knocked at my door and asked what he should do his dissertation on. And 1600 is when The Merchant of Venice was written and Antonio said, "My ventures are not in one bottom trusted, nor to one place; nor is my whole estate, upon the fortune of this present year.” Shakespeare knew about diversification.

GH: So portfolio diversification had already happened by 1600. How far have we come since then?

HM: Well, now we know how to measure covariance. We know diversification will eliminate risks if they’re uncorrelated, but not if they’re correlated.

Another thing I should say is that GuidedChoice now has another product, GuidedSpending, which has to do with how fast you can spend in retirement. We assume your spending rate will depend how well you do in the market, and we ask you for two consumption levels: upper level where you can put away any surplus for a rainy day, and a lower level where you have to see if you can hold out for a while. Depending on how you set your levels, plus all the other factors, we assign a probability distribution on the rate at which you can spend when you retire. For any time pattern of consumption, we assign a utility based on the average consumption you can achieve.

GH: But how do you plan for how long a person is going to live?

HM: Currently, we assume you will drop dead precisely 10 years after your actuarial time, but I have been promised some day we will have a stochastic model.

GH: So you use actuarial life tables. What do you think about the basic default savings plans, such as the 60/40 model or lifecycle funds with more allocated to the defensive asset over time?

HM: The problem with 60/40, it’s a little chicken for people early on, it’s not right for everybody. 90/10 might be best for a young person. The problem with lifecycle is I’m 85 and I have more in equities than I’ve ever had, but I have a wealth level that means I am many standard deviations away from not being able to eat.

GH: So you need to consider your income-earning ability and other factors, not just your age.

HM: You need to look at the probability distribution of what they can spend, what they can earn, how long they will be employed. Our models will always be grossly inadequate because there are more things on heaven and earth than we can ever capture in our models. We have to do the best we can but we get a lot closer than 60/40 for everybody.

GH: What do you think of the merits of Tactical Asset Allocation where someone takes a view on the market and changes the asset allocation?

HM: There’s my official view and my unofficial view. My official view is that nobody seems to be very good at picking the market. But it does seem plausible that when price earnings ratios are historically high, we should lean towards less to equities. In my own funds in 2007, I sold my ETFs, I didn’t get out of equities completely, and I went back in in December 2008 expecting a January effect. Which came in March. On some occasions, it has merit.

But if someone reads a weekly newsletter about whether you should be betting up or down this time, going in and out, you’ll lose money on average over the long run. There’s a wonderful behavioural finance guy, Terrance Odean, who studies the track records of individual investors, and he finds both active and passive investors gross roughly what the market makes, the active do worst due to brokerage.

Graham Hand is Managing Editor of Firstlinks.