There’s a misperception that equity income investing is as easy as ranking the market’s highest-yielding stocks and building a portfolio from that basis. While on the surface stocks that yield in excess of 7% might look attractive, it may be a complete illusion if one looks closely at the market’s fundamentals. It is what we refer to as an 'income trap' or an 'income illusion'.

There are countless examples of ASX100 companies that trade on attractive dividend yields. Often investors support these stocks based on yield alone, compounded further by passive 'equity income' ETFs.

In investing parlance, a 'value trap' refers to a stock that looks cheap on the surface, but the trap springs into action when the fundamentals continue to deteriorate and investors lose patience and sell out.

Watch for the 'income trap'

We call it an 'income trap' when a stock may look attractive from the headline dividend yield alone, yet is unsupported by robust company fundamentals. As a bottom-up value manager, fundamentals are crucial to us, be it the quality and transparency of the earnings, cash flow generation, gearing levels or balance sheet strength. When the fundamentals are weak or challenged for a prolonged period, more often than not a dividend cut is inevitable, springing the 'income trap'.

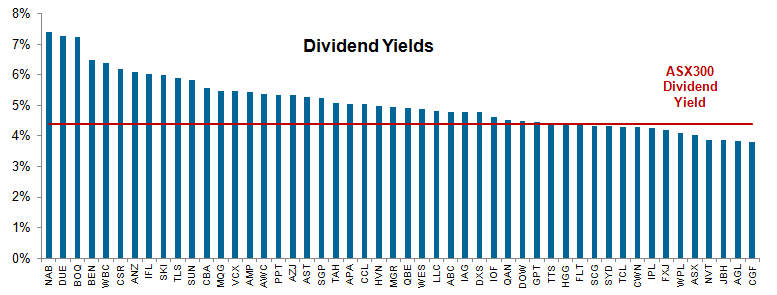

Additionally, while passive ETFs can play a role in equity investing, investors should be cautious when investing from a headline yield perspective. A look at 50 of the most widely-held names on the ASX ranked for yield in the table below shows the vast majority of companies yield over the ASX300 headline yield, which currently stands at approximately 4.5%. While attractive on the surface, this does not justify constructing an income-generating portfolio around these seemingly high-yielding companies.

Companies yielding over the ASX300 headline

Source: Factset, 12 August 2016

Questions to ask when investing for yield alone

Before investing in an equity for income alone, ask:

- Why is the yield at an elevated level?

- Has the stock fallen and is this a potential value trap?

- Is the company’s payout ratio too high?

- Is the company putting its balance sheet at risk by maintaining the dividend?

- Do cash flows reconcile with underlying earnings?

The two most important attributes of a retiree’s stock portfolio are high levels of income and lower absolute risk than the overall market. By investing in a portfolio of quality companies, drawdowns are reduced with a higher probability of capital preservation.

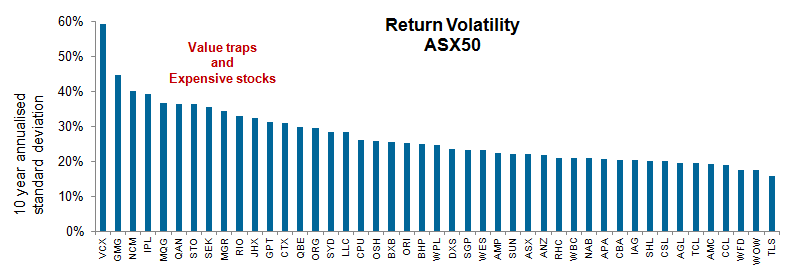

Companies ranked by their absolute historical volatility

Source: Factset, June 2016

The left-hand side of the chart represents those companies with meaningfully higher historical volatility on an annualised 10-year basis, symptomatic of the curse of either being value traps or simply too expensive. Beholden to exogenous shocks or wider economic shifts, these companies have shown over the longer term to be much more volatile, given the cyclicality of their business or financial models. While the investment case for a number of these stocks can be made for those in the accumulation phase chasing capital growth, in our view they are simply not suitable for retirees.

Retirees have special needs

So what should we invest in on behalf of retirees? A portfolio of companies with recurring earnings that provide a healthy, consistent dividend trading at reasonable valuations can significantly reduce aggregate volatility.

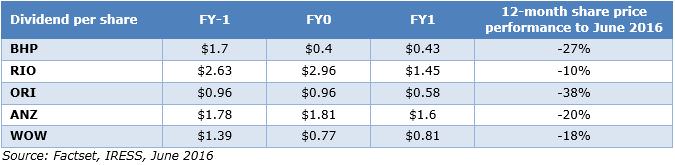

The table below shows a number of blue chip companies that are well represented in retiree portfolios. When a company cuts its dividend it is a clear signal to the market that its earnings are challenged. The implications for retirees holding these stocks is bad – generated income is falling while the share price is also under duress.

These companies have cut their dividends due in part to a low-growth environment but also because of problems with their business models. Mining-related companies are suffering from low commodity prices and supermarkets and banks are suffering from margin pressure and increased competition. Investors need to pay greater attention to the company’s fundamentals and its earnings sustainability before jumping on board because it appears attractive on a dividend yield basis.

In minimising volatility within your stock portfolio, avoiding both income traps and overvalued stocks is paramount. Being aware of what cues to look for in individual companies and understanding trends of underlying fundamentals can assist greatly in picking stocks for your retiree portfolio.

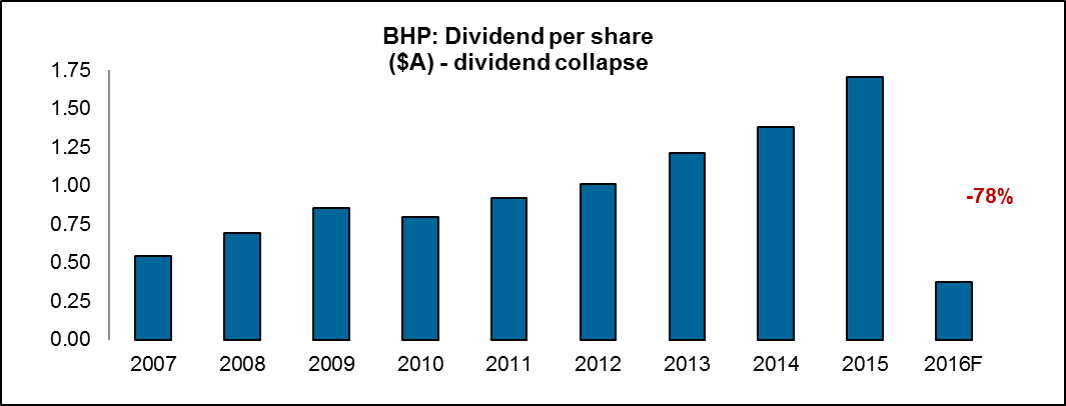

Case study: BHP Billiton (BHP)

In 2015, BHP traded with a perceived healthy dividend yield of 7-8%, seemingly attractive from a retiree’s perspective. However, as commodity prices collapsed through 2015, the company’s fundamentals continued to deteriorate, their earnings fell and gearing levels increased. The unsustainable payout ratio reached almost 400% as the company tried to maintain its promise of increasing dividends over time. It was unsustainable.

In February 2016, the company took the prudent step of cutting their 'progressive dividend' to protect the company’s balance sheet, reduce its gearing and thus preserve its credit rating. The decision was encouraging from a capital management view as it will help BHP stabilise its balance sheet. Yet, from a retiree’s perspective, a cut of this nature can have a significant impact on the dividend income received as an investor.

Source: Factset

Conversely, Spark Infrastructure is an owner of regulated electricity transmission and distribution assets, primarily located in South Australia, Victoria and New South Wales. Like BHP, Spark also had a strong CAPEX programme over the past five years. However, unlike BHP, Spark took the prudent measure of de-gearing its balance sheet, whilst maintaining a low pay-out ratio, in order to assist in funding the company’s growth projects. Ultimately, Spark has a stable earnings profile given it operates as a regulated monopoly. When the CAPEX programme slowed down, Spark decided it was in a position to reward investors by raising the dividend.

Fundamental analysis is paramount when building retiree portfolios. We have always believed that companies that can grow their earnings through their own initiatives, that offer a degree of immunity to the economic cycle, and are backed by robust fundamentals are best suited for retirees.

Anton Tagliaferro is Investment Director at Investors Mutual Limited. This article is for general educational purposes and does not consider the specific circumstances of any individual.