An inversion of the US yield curve has led to fears of a recession as investors rebalance portfolios and invest in the relative safety of bonds.

The inversion, which refers to US 10-year Treasury yields dropping below US policy rates, indicates markets believe the US Federal Reserve has made the wrong call on interest rates and that the US economy is not as resilient as previously thought. There are similar concerns about the Australian economy.

An inverted yield curve is unusual because it means investors are prepared to take a lower return on a longer-term investment even though it carries more risk than a higher-yielding short-term investment. It is essentially a flight to safety and an indicator that the market is expecting the next US interest rate movement to be downward.

Citi analysts see the RBA cutting 25bps at the May Board meeting followed by a further 25bps potentially as early as June. Both economies have strong employment but while the US also has robust wage growth, it is glaringly lacking in Australia. However, both scenarios feed into policy limbo for the central banks until more reliable long-term trends emerge from the data flows.

How is the inverted yield curve impacting investor behavior?

Markets are moving in anticipation of a rate cut, and in Australia that expectation has pushed both equities and bond demand higher. However, it is not uncommon for bonds and equities to rally when interest rates are expected to move lower. The Australian 10-year bond rate has fallen to a record low of 1.76% with markets pricing in two rate cuts by the end of 2019 in Australia.

The shift into bonds is a trend we observed in our high net worth client base in the last quarter of 2018, and it continued into the first period of this year. The rate of flow is evident when compared to last year, as we’ve seen a 273% increase in bond volumes.

Since the yield curve inversion, clients have been rebalancing portfolios by taking profits from part of their fixed coupon exposure and shifting into floating rate bonds. We view spreading exposure across different durations a prudent move, because investors are not adequately compensated for taking on additional duration risk when the Australian yield curve is flat, as it is currently.

Alert but not alarmed

Floating rate bonds allow investors to benefit from a rise in interest rates as the bond is tied to a benchmark rate like the Bank Bill Swap Rate. A shift to floating bonds is based on an expectation the market will lower its rate cut expectations. It also acts to decrease duration in a bond portfolio.

While a yield inversion has often in the past been a pre-cursor to a recession, we hold it as reason to be alert but not alarmed. It is a reminder of the importance of asset allocation across multiple asset classes. The increased demand in bonds from our clients is a strategy to seek higher returns than a term deposit without taking on equity risk.

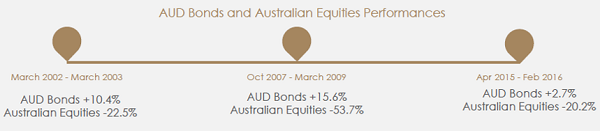

This is why we have seen a demand for high quality investment grade corporate bonds – in both US and Australian dollars. Some clients are adding bonds as a way to diversify across multiple asset class rather than time markets, given the traditional low correlation between bonds and equities.

The strong flows we witnessed from fixed rate bonds late last year was concentrated in the 8-10-year maturity space, which offered yields of about 4.5% in the investment grade space. Clients locked in those yields before markets priced in the rate cut expectations, which pushed bond prices higher.

Should investors be factoring in a recession?

The last time the yield curve inverted was in 2007 and historically it has been a reliable indicator of an upcoming US recession. However, we feel it may be premature to anticipate a recession on the back of this one and there have been a couple of past instances of inversion without a recession. While we take the recent inversion seriously, we believe a recession can be avoided if policy makers make wise choices. This means equities may both perform better and be more volatile than many expect this year.

Traditionally bond market movements are a precursor of where more broadly markets are heading. So its perhaps not surprising the yield curve began to flatten in 2018 when markets become concerned that the Fed may over tighten and this would slow down economic growth. At the time the Fed indicated it would tighten four times in 2018 and two more times this year.

In January 2019, the Fed indicated it would be more data dependent rather than tightening on autopilot. The markets took that to mean that the economy was not as resilient as anticipated. The view in the market is that the Fed may have over tightened and may now be forced to lower the overnight rate to avoid derailing US economic growth.

Peter Moussa is an Investment Specialist - High Net Worth at Citibank Wealth Management. This article is general information and does not consider the circumstances of any investor.