Last month, I explained that without making any extra contributions, a 30-year-old couple would run out of super at age 75 if they needed a combined income of $59,160 a year after retiring at age 64.

But this isn’t the only problem facing many couples today. The cost of housing means that not only will they struggle to make extra super contributions, they will have real problems buying a home. Based on my experience with clients, it’s a major issue for almost every Australian under 30.

Who can afford a Sydney house?

A measurement of official house price data and mortgage costs by comparison website RateCity looked at the salary required for a single person to afford repayments on a 30-year loan. The main criterion was that the individual could not spend more than a third of their income on housing costs. Here are the results for Sydney:

- Median House Price: $825,000

- Loan Size: $660,000

- Interest Rate: 4.74%

- Monthly Repayment: $3,439

- Annual Income Needed: $137,556

Are these figures an accurate reflection on what is happening? I would suggest not. First, few single first home buyers earn $137,556. Secondly, the median house price in Sydney is now a lot more than $825,000.

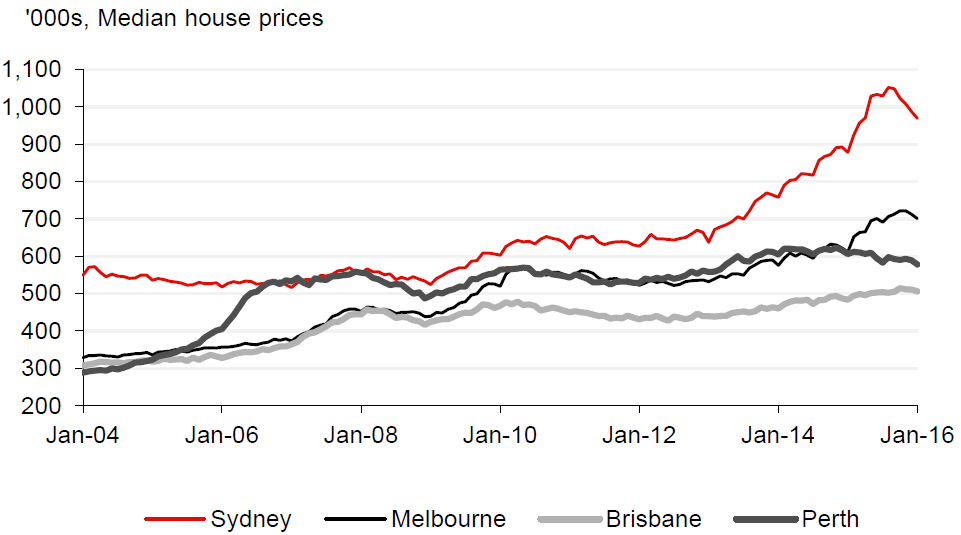

Source: Macquarie Equities, APS and UBS

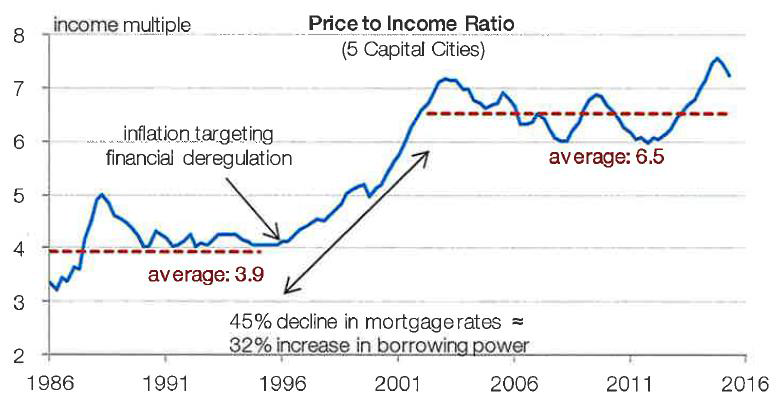

Thirdly, people are clearly spending more than one third of their income on loan repayments. As you can see from the chart below, property prices are more than seven times average income levels.

Source: Morgan Stanley and Macquarie Equities

What caused the surge from 1996 to 2003? Consumer confidence, immigration and housing shortages are possible reasons, but I suspect rising wages and dual household income earners were the key factors.

Whilst not many 30-year-olds earn $137,556, it’s quite possible that a 30-year-old couple can be jointly earning $120,000. Given the lower tax rates that two incomes generate over the single person, a 30-year-old couple could generate sufficient income at today’s interest rates to make the necessary mortgage payments listed above. However, home ownership in Australia has fallen from 71% to 67% in the last 20 years, and more significantly, for Australians aged between 25 and 34, the proportion has fallen from 39% to 29%, and for ages 35 to 44, from 63% to 52%. First home buyers now make up only 13% of new home loans.

Other buyers and finance sources

Obviously, there are far more people buying properties than only 30-year-old couples. Overseas buyers and investors appear responsible for much of the post-2010 surge, and favourable tax concessions are pushing homes out of reach for a high percentage of younger Australians.

Anecdotal evidence from clients suggests that the desire to get a foothold in the property market is causing many people to adopt strategies that are increasingly risky.

Living with parents is a popular solution to the housing problem, but that becomes strained after a while. Many parents now use equity in their home to finance a mortgage for their children. A major bank recently confirmed that 10% of its property loans were guaranteed by people other than the purchasers.

This is fine if the debt is not too large and the children can pay it off quickly. But the risks with this strategy are high. If the debt repayment becomes difficult due to unemployment, interest rate rises, a property downturn, divorce or an unexpected pregnancy, both the parents and the children could suddenly have a major cash flow problem. It wouldn’t take much for both to lose their homes.

Buying an investment property whilst living with your parents or renting is another popular strategy. This has some positives if the rent covers the loan interest and expenses while benefitting from a rising property market. Negative gearing allows an offset of the excess loan interest and costs (above rent received) against other income tax.

However, many investors underestimate the costs involved, especially if they never live in the property later. Land tax, capital gains tax, stamp duties, council rates, strata levies, repairs and maintenance, etc could render the whole venture uneconomic. Many people look to maximise deductions by taking out an interest-only loan, but this can backfire if the property is worth less than the loan when it comes to sell.

Policy inequity will lead to change

The idea of renting somewhere before buying and hoping for a significant decline in the housing market is not popular with my clients. The overwhelming feeling is that rent is dead money and pays off someone else’s mortgage. The reality is, though, that the vast majority of people under 30 have little choice but to adopt a ‘wait and see’ approach. Despite the inequality, the Federal Government appears to have little desire or perhaps ability to rectify this imbalance. Tax policies such as negative gearing and capital gains tax concessions favour those with capital or access to it, and even the Reserve Bank has admitted the tax breaks encourage investors to increase the prices they will pay.

Unlike in the US with the rise of Donald Trump, in the UK with Brexit and throughout Europe with the growth of right-wing parties, in Australia any middle-class resentment is still largely hidden. Although real wages and salaries have not increased much in recent years, the substantial rise in property prices has made large sections of the population feel much wealthier. However, negative gearing is the enemy of most Gen Y and Millennials wanting to find their own home, as they are outcompeted by investors. In my opinion, the days are numbered for negative gearing and the 50% capital gains tax discount in their current form.

Rick Cosier is a financial adviser and Principal of Healthy Finances Ltd. This article is general information and does not consider the circumstances of any individual.