The Reserve Bank of Australia (RBA) and Amazon have a lot in common in 2021. They have both positioned themselves as the premier high volume, low price, low margin product provider. They are redefining logistics in their distribution channels. Their current market position on price competition and sheer scale of influence unleashes factors of productivity improvement and makes it difficult for others to compete on traditional business models.

The message of 'lower for longer' interest rates has been heard loud and clear from a cheerful and optimistic Governor of the RBA, Philip Lowe, including an unrelenting expansion of its balance sheet. Last week alone it grew by another $10 billion to $344 billion. This is $66 billion higher since 30 June 2020 and deposits from Australian banks (in the form of Exchange Settlement balances) have risen by $94 billion.

The banking system is literally awash with cash and banks are turning away deposits while rapidly reducing the rates paid to savers. A cash flow optimisation strategy by the Government to stimulate activity is the current modus operandi, and it’s creating favourable conditions for risk assets.

RBA lavishes the funding

At the start of 2020, before COVID-19 struck, the RBA balance sheet was worth about 9% of Australia’s GDP, down from a peak of about 13% during the GFC. Following a year of bond purchases to hold down the three-year rate and fund government expenditure, the balance sheet has doubled to 18% of GDP.

But the RBA’s control of the supply and price of funds comes not only from the way it sets targets for low bond rates, but also its Term Funding Facility (TFF). It offers three-year funding to banks (actually, authorised deposit-taking institutions or ADIs) to reduce funding costs which are then passed on to borrowers. It is specifically aimed at ADIs if they expand their lending to businesses, notably small and medium-sized enterprises (SMEs).

The Reserve Bank largesse with loans and liquidity is changing the bank deposit market. The amounts involved are extraordinary, as explained by the RBA, with the funds available being:

“five times the dollar increase in SME Credit Outstanding from the three months ending 31 January 2020 through to the three months ending 30 April 2021”

Five times! And here’s why retail deposit rates have fallen. The interest rate for the TFF for three years is only 0.1%.

There is so much liquidity in the banking system that the bank bill rate, the benchmark against which many other facilities and securities are priced including bank term deposits and hybrids, is only 0.01%. That’s right … one basis point. Easy monetary policy has reduced the burden for borrowers and is now driving up residential house prices, but it has not helped the millions of savers and retirees who live on deposit income. As recently as a decade ago, term deposits offered a reasonable 4-5%.

An example of a big winner is Judo Bank, which made a pre-tax loss of $50 million in 2020. Judo Bank will draw on $2 billion of the TFF from an allocated allowance of $6 billion. Judo’s substantial growth of $1.3 billion in SME lending in the year ending 31 January 2021 has been multiplied by the factor of five and a supporting internal securitisation framework acceptable to the regulators has been reached. Judo is a startup bank but it will not have any funding problems for years.

Reducing Judo’s cost of funds will materially improve its profit as it has been competing aggressively for retail deposits, previously its main source of funding. It is currently paying up to 1.2% for retail deposits and attracting strong inflows as deposits up to $250,000 are protected under the Australian Government Guarantee (the Financial Claims Scheme).

Joseph Healy, CEO of Judo Bank, told Banking Day on 3 February 2021:

“Our focus on marketing term deposits of more than 12 months duration will continue but accessing the TFF will reduce our appetite for deposits of shorter duration.”

Judo Bank has a real economic advantage now to reduce its cost of funds and recalibrate its wholesale and retail pricing, probably to the disadvantage of current investors. However, actions will be tempered by the desire to build long-term relationships on both sides of the balance sheet to prepare for the day when the RBA is not as benevolent.

Banking system awash with cash

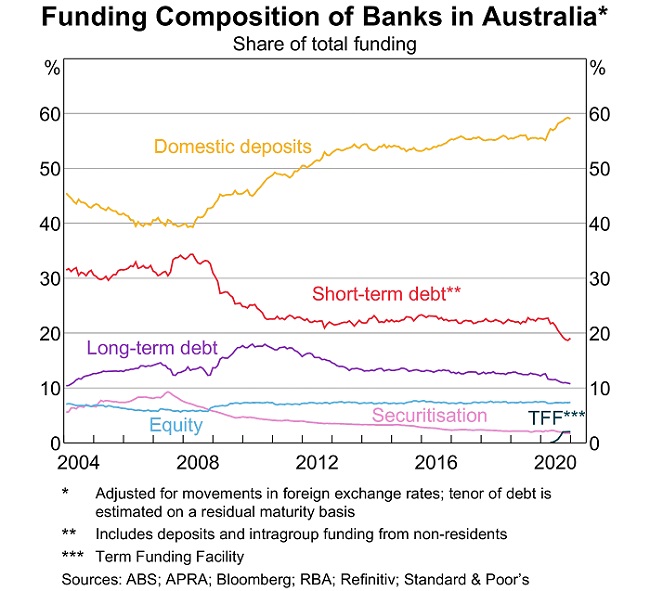

One reason the major banks have not tapped into the TFF in a bigger way is they are flooded with cheap retail deposits. The banks are literally saturated with deposits and are turning away institutional money so they can provide some capacity to their retail customers. As the chart below on bank funding shows, domestic deposits are now satisfying more of the funding needs of Australian banks than ever before.

What do banks do with their surplus cash, since they cannot lend it quickly enough? They deposit with the RBA at 0%. Funds on deposit at the RBA at 0% are $160 billion and rising rapidly, and we estimate they could rise to $360 billion by 1 October 2021. The RBA balance sheet is set to grow from $344 billion to a forecast $500 billion over the same time.

Traditional lenders to banks such as councils are finding it difficult to place their money. Each bank is travelling a slow, last kilometre in heavy congestion to position their middle market and retail pricing at the 'what we can get away with' level. The correct pricing and allocations of quotas to identified 'customers of the future' take up most of the strategic decision-making of bank treasurers and liability management committees at the moment.

Price discouragement strategies are the new playbook.

On the asset side, expect marketing campaigns on credit availability and price to be sweetened with loyalty recognition in many forms. St George’s “Switch banks, get a $4k thanks” campaign is the latest one.

Plenty of money to finance asset price surge

Cash investors realise they have no pricing power these days and they are evaluating their alternatives. Watching the billions of dollars of cash looking for a home each day leads to the view that the current debate raging around speculative asset bubbles is far too early in the investment cycle. We are now only emerging from a pessimistic phase and are in the early stages of an optimistic mindset. The euphoric phase is much further into the future.

Those wary of inflated prices should be more worried at the end of Governor Lowe’s three-year timeframe. The real economy will be the major beneficiary of all this liquidity and lending capacity over the next few years, until 2024 at least.

The post COVID-19 recovery period could parallel two key economic periods in our past: the ‘Roaring Twenties’ of a century ago and more recently, the post-WWII recovery period of the 1950s to early 1970s. Financial markets were heavily regulated and the real economy was the powerhouse of the global economy. In the latter stages inflation surged with the oil price shock of 1972 and interest rates violently adjusted to dizzying heights over a span of nearly two decades, but the inflationary consequences of central bank expansion are not on the short-term radar at the moment.

Retirees planning for spending in retirement who once believed the bond or term deposit part of their asset allocation would deliver income to live on now need to go up the risk curve, or draw down their capital. Banks will be awash with liquidity for years and will not compete for the retiree dollar.

Even the new banks who once paid up for deposits now have retirees in a judo hold with the RBA providing another source of cheaper funds. The RBA has become the equivalent of an online retailer who undercuts all other prices in the market.

Peter Sheahan is Director, Interest Rate Markets at Curve Securities Australia, with input from Graham Hand, Managing Editor at Firstlinks. This article is general information and does not consider the circumstances of any person.