Introduction. A Firstlinks reader, Derek O’Hare, asks whether superannuation unfairly advantages wealthier people, and he suggests an alternative taxation structure. We asked David Knox of Mercer to respond.

Hi Firstlinks

I’ve been following your content for a couple years now and have found it informative and helpful in many ways. I wondered if I could suggest a further avenue for discussion?

I’ve read articles elsewhere that point out the inequitable distribution of the tax advantages of super. The vast majority of taxation benefit goes to those with the highest incomes and those least likely to ever need the age pension in the first place. Some articles suggest that instead of 15% flat tax rate on super contributions and earnings, a 15% discount off the individual's marginal rate would be a more sensible option and more in line with the idea of propping up retirement incomes and reducing age pension reliance from the less wealthy. They argue that the tax breaks given to those people who don’t need them is better off (and will far outweigh) spent on the age pension down the line.

I find their arguments to be compelling and apparently sound. I think I would find it helpful if Firstlinks – which has no particular bias as far as I can tell – could provide some opinion and discussion on these matters.

Kind regards,

Derek O’Hare

Hi Derek

Good question. Let’s go back a step or two.

The Government supports the provision of retirement income over an individual’s lifetime in two ways:

- The means tested age pension

- Taxation concessions to superannuation

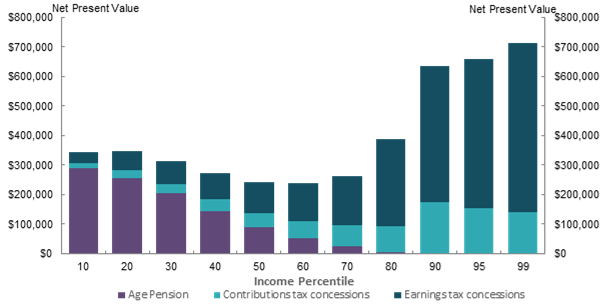

Not surprisingly, lower income earners receive more age pension and higher income earners receive more superannuation. This is confirmed in the following graph from the consultation paper issued by the Retirement Income Review.

However this graph is misleading as the present values of future payments and support are calculated at a high 5% pa.

In our submission to the Review we made the following comments.

Although this rate (5%) represents a reasonable estimate of the average increase of nominal GDP in recent years and hence the likely growth in future tax receipts, it is not a measure that reflects inflation, wage growth or even the government’s borrowing rate. All these rates are much lower and better understood by the community and are often used to calculate net present values. The use of a lower discount rate would increase the relative value of future age pension payments due to the fact that they are assumed to be paid in 40-65 years’ time and so change the shape of the graph.

It is also worth noting that the graph is in respect of individuals and therefore could be considered from a per capita perspective. Hence the nominal GDP increase may not be appropriate. In short, it must be recognised that the selection of the discount rate, in particular, is critical as it inevitably influences the outcome.

If one allows for a lower discount rate, the value of the age pension increases, thereby benefitting lower income earners. In fact, it becomes a U-shape.

I would also note that the value of the earnings tax concessions for higher income earners shown in the graph assumes that if these individuals did not have their money in super, they would be paying the top marginal tax rate on their investment income. This is clearly not the case, as there are many opportunities for them to reduce the tax on investment eg negative gearing, low income partners, trusts etc.

In fact, when you consider the full picture of retirement income and allow for realistic assumptions, the level of Government support over a lifetime is remarkably level across different incomes.

I might add that when you consider the 30% tax rate on contributions for high income earners and 15% tax for average income earners, together with the LISTO, we are not far away from a 15% rebate on super contributions for everyone.

Hope that helps and happy to discuss.

Dr David Knox is a Senior Partner at Mercer. See www.mercer.com.au. This article is general information and not investment advice.