The Medibank and ahm private health insurance brands serve over 4.2 million customers and play a vital role in funding medical care in Australia. In the most recent financial year, Medibank paid out $6.3 billion in health insurance claims, taking a significant burden off the public healthcare system.

Yet recently, the sector has come under fire from both the government and hospitals accused of making too much profit. In this article, we explore this regulatory tension and why we think Medibank looks an attractive investment opportunity.

Private hospital profits affected by new models of care

There is no doubt the past few years have been challenging for hospitals – labour shortages have affected service levels and inflation has been rampant. Private hospital operators have responded by launching a campaign against the health insurers and pressuring the government for a bailout. While additional payments or a tax may provide short-term relief to hospitals, they do not solve the structural issues facing the sector and ultimately would drive up the cost of healthcare and premiums for millions of Australians. To build a sustainable private healthcare system, all participants must work together to find efficiencies and drive down the overall cost of care.

Medibank is doing its part to lower costs by investing in new models of care away from overnight stays in expensive acute care hospitals to virtual, short-stay hospitals and home care. Without this transition, Medibank estimates the government will need to spend 50% more on healthcare as a percentage of GDP in 40 years. While this transition does come at the expense of hospitals that typically earn more for longer in-hospital stays, it is beneficial for the wider healthcare system. Higher hospital costs would simply translate to higher premiums, which are likely to push more members out of private health insurance and place further strain on an already stretched public healthcare system.

It is for this reason the Federal Health Minister following a review has conceded, “There’s no silver bullet from Canberra or funding solution from taxpayers to deal with what are essentially private pressures in the system”. Ultimately, it is not the government’s job to prop up unprofitable business models and in some cases, it is healthy for some private hospitals to shut where there is overcapacity in the system.

Has Medibank profited at the expense of hospitals?

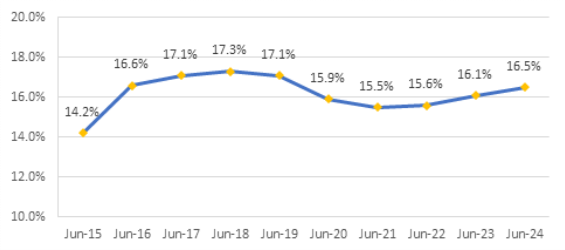

Medibank has stuck to its promise not to profit from the pandemic and returned a total of $1.46 billion in givebacks to customers for permanent claims savings due to COVID-19. This is evident in the chart below which shows Medibank’s health insurance gross profit margin is still below FY19 levels.

Figure 1 – Medibank Health Insurance Gross Margin

Source: Company filings

Fear of regulation creates opportunity to invest

While there remains uncertainty as to how the regulatory situation will unfold with a federal election coming up, we think it’s unlikely the government will step in and prop up private hospitals where there is a clear shift to lower-cost care outside the hospital. In the meantime, we believe this creates an opportunity to invest in Australia’s largest health insurer, which has grown its earnings per share at 8% p.a. over the past decade.

Medibank screens as a high-quality business under our investment process for the following reasons:

- Financial strength: Medibank has a strong capital position with a capital ratio of 14.1%, well above its 10-12% target range, and has zero debt on its balance sheet.

- Business quality: Medibank is Australia’s largest health insurer with 4.2 million members (27% market share). This scale enables Medibank to negotiate better terms with hospitals keeping a lid on claims inflation while sharing these savings with members to lower premiums and improve retention.

- Management quality: David Koczkar has been the CEO since 2021 and prior to this was the COO since 2014. Over this period, the company has seen a return to policyholder growth, expanded its health offering and tightly managed its costs.

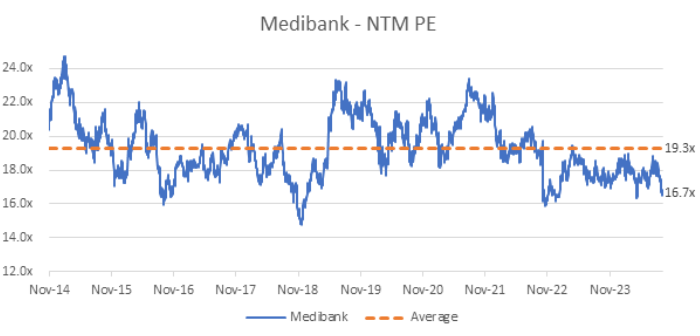

Finally, from a valuation perspective, Medibank is trading on less than 17x P/E (below its long-term average of 19x) and offers investors an attractive dividend yield of 4.6%.

Figure 2 – Medibank NTM Rolling PE

Source: FactSet

Emma Fisher is a Portfolio Manager and Deputy Head of Australian Equities, and Vinay Ranjan is Deputy Portfolio Manager at Magellan-owned, Airlie Funds Management. Magellan Asset Management is a sponsor of Firstlinks. This article has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not consider your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.