Reece Birtles has been Chief Investment Officer at Martin Currie Australia since 2006 and is the lead Portfolio Manager on several funds including the Equity Income Fund. Martin Currie is a Franklin Templeton investment manager.

GH: In your presentations, you talk about having ‘sufficient income for life’. How does this investment method differ from other equity income funds?

RB: Going back to the late 2000s, a few of us in the investment team had parents approaching retirement and it was also the time of the GFC with massive market volatility and uncertainty. There was a perception that equity portfolios were very risky, so we set about designing a portfolio specifically for Australian retirees and their circumstances. When a typical couple retire, they might have about $600,000 in superannuation and they need about $50,000 a year of income to support their standard of living. They want the $50,000 to grow with inflation over time as they still have a very long life expectancy.

GH: What are you assuming about age pension entitlement?

RB: Yes, they are probably eligible to get the pension of about $20,000, so that means they need about $30,000 a year from the super portfolio. As an investment objective on $600,000, we need to generate about 5% to give $30,000, but more than aiming for a percentage income, we want to produce $5 on each $1 growing on a steady and reliable basis, faster than inflation. That's what we think is a sufficient income for life for an Australian retiree.

We also want to reduce the risk and the variability of that income. We take franking into account and we ignore the benchmark weight for individual stocks and sectors. We don't want 40% of the portfolio in one sector where all the dividends could get cut at one time and we don't want 15% in one stock. We're building a highly-diversified income stream that can grow over time.

GH: You are asking retirees to think in terms of income rather than volatility. Do you think this message and the strategy has worked and is understood?

RB: The standout feature of this equity income strategy compared to say a term deposit as a retirement income investment is that the latter has fallen by about 80%. So the income volatility of a term deposit is amazingly high, even though it is capital stable. Whereas when you look at equities, whilst the share price volatility might be 15% to 20% per annum, the variability of the dollar income stream from the dividends of companies has been significantly lower. The COVID year was a big challenge to dividends and the income stream on our strategy was down about 20%. It was significant but far less than the 34% fall that the ASX200 dividend stream suffered. The income stream has now fully recovered, driven by the diversification and owning high quality companies.

GH: In the last six months, there has been a change in the investment environment with an acceptance that inflation is rising, central banks increasing interest rates and now a war in Europe. Have these factors changed the way you're investing?

RB: In the current environment, there's more appeal in industrial-style businesses that can pass on price increases to their end customers, given demand is strong and they're not impacted by travel restrictions. Commodities have more appeal, and we're also looking at names such as Aurizon (ASX:AZJ) where demand is locked in and, if anything, improves with the current market. We look for regulated assets where inflation flows through to increases in prices automatically.

GH: Are there other Australian companies you feel have this strong pricing power and can withstand the inflationary shock.

RB: We like Medibank (ASX:MPL), it has a strong market position and lower cost to serve than its competitors. While there are always discussions about private health insurance increases, it’s the best player in a regulated business. It’s the type of resilient income stream we look for. We think Telstra (ASX:TLS) is strong, mobile phones are not a discretionary purchase and the demand for data is always rising. We also look at companies which benefit from change, such as the demand for renewables construction and a name like Downer (ASX:DOW) has improved the quality of its business and become a more reliable dividend-paying company.

GH: So how does Equity Income differ from the Real Income Fund, launched in 2010 with positive returns every year except 2020? And what happened in that year around COVID?

RB: The Real Income Fund is designed with the same purpose for retirees to have a stable growing income stream, but it is focussed on what we call hard assets or real assets, such as property, infrastructure and utilities. The idea is that they're less susceptible to the business cycle and they have pricing power with mechanisms on tariffs or rents and they benefit from population growth over time. In 2020, COVID changed the circumstances for many of those assets significantly, such as consumers not able to go to shopping centres and less travel on toll roads. There was even a reduction in demand for electricity and gas due to industrial closures. But income streams and dividends did significantly better than share prices, and then the income recovers as the economy reopens.

GH: Does that Fund have fewer opportunities in Australia with ongoing privatisations, such as Sydney Airport and CIMIC leaving the ASX?

RB: Yes, it's true that a some high-quality companies have been privatised given how attractive these real assets are in an inflationary environment, so we’re increasingly looking to offshore stocks such as Zurich Airport to find suitable replacements such as for Sydney Airport while retaining a predominantly Australia-orientated exposure.

GH: We're seeing a stock rotation in Australia with some hefty corrections in company share prices that did well over 2020 and 2021 but are there market segments that you consider expensive or cheap at the moment?

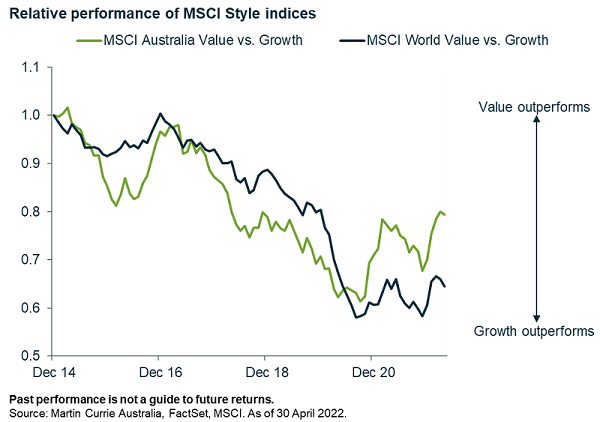

RB: There’s still one of the biggest distortions in markets as the price of typical value-type stocks versus growth-type stocks has been extraordinarily wide. If you look at the Price to Earnings (P/E) ratio, for example, of the MSCI Growth Index versus the MSCI Value Index, we're coming off one of the most extreme events.

The biggest dispersion in P/Es have been in the tech bubble, during the GFC and in 2020. Clearly, that has started to reverse, but we started with a P/E on the Growth Index in excess of 30 times and the Value Index was around 15 times. The typical spread is about three points, and the current spread is still over 10 points. We think there's been a great distortion in terms of valuation across stocks.

The inflation dynamic is driving a rebalance back to more normal levels, especially as inflation is better for value stocks. They tend to be more ‘materials-type’ businesses, with pricing power when demand for goods is strong, supply is restricted and even with ESG pressures. We think this will play out over 10 years.

GH: Do you think the market has missed a big theme that is undervalued or under-appreciated?

RB: The strongest when we look at the stocks that we own that we think are undervalued is what we call ‘ESG inflation’ and the clear path needed to reach net zero and reduce carbon exposures. It creates a supply reduction in some parts of the economy but also the amount that needs to be spent to achieve net zero is over US$3 trillion a year over the next 30 years. Whereas we used to fund the world economy on about $500 million a year of fossil fuel investment. We need to create a new fleet of energy generation rather than use aged equipment, with the capital intensity of renewables higher dollar per unit of generation than traditional sources across a range of fossil fuels.

It includes different types of fuels, commodities, construction requirements, engineering skills and the like. A name we really like is Worley (ASX:WOR), not only do they service traditional oil and gas companies, but also the engineering required for large-scale renewable projects such as carbon capture or offshore wind projects. Already, 30% of their order book is in the renewable space and we expect that to grow strongly.

GH: It’s easy to be a fan of resource stocks at the moment but they have a boom-and-bust reputation including in the good times, not spending capital well. How do you feel about resources?

RB: We’ve been overweight in Woodside (ASX:WPL) and Worley, leveraged to the energy cycle, but we’re underweight iron ore. There's been a shortage of iron ore and strong demand out of China but that’s changing and the long-term price for iron ore looks a lot lower than where it is today. We like to buy the names that are unpopular, but right now, it's hard to find a commodity that is not trading well above normal. We owned South32 (ASX:S32) and did well out of it.

GH: Can we turn to identifying something which has not gone well in your portfolio, perhaps a stock you strongly believed in but eventually, you decided to sell because the thesis didn’t played out? What did it tell you about your investment process?

RB: Yes, QBE (ASX:QBE) has been difficult for us. We avoided it for so long from about 2000 when it was an extremely strong stock and they had some management changes. It was hit by the commercial pricing cycle and it came back a long way, and it was looking attractive to us. New management was in place, building trust and we took a long time to build faith in the new management. Then COVID came along and they had greater losses from credit insurance than we expected and then they did a rights issue. We thought we had taken the time to understand it but there were further management issues. The lesson is that in many opaque types of companies such as insurance, management trust and board competency are really important. QBE is resetting itself again and the fundamentals are there, there’s a new CEO and a recent profit downgrade but things look better now.

GH: And every investor has the one that got away, the one that you were looking at but maybe it didn't meet your price target. Is there a company that has done a lot better than you expected?

RB: In recent times, it's the copper names. We were very positive on the demand side but found copper stocks expensive for a long time. Then in March and April 2020, there was a great opportunity to get those copper exposures at a good price and we missed that one. There was so much happening but we didn't buy into it at the right price and it got away from us.

GH: And on the positive side, something you own that has delighted you?

RB: We have owned JB Hi-Fi (ASX:JBH) for so many years and thought it was a quality retailer, a great brand proposition, best in class and yet it always traded as a consumer cyclical. Most people didn't have much faith in it, and it traded at low multiples and sold off every time a problem hit the economy. But what they achieved and executed especially during COVID led to a rerating and we did remarkably well out of it, we owned about 8% of the company at one point.

GH: Last question, what do you think are the key requirements of a fund manager?

RB: The importance of team and investment process. It’s a complex, uncertain world and the benchmark has lots of names in it. You need a disciplined investment process with experienced analysts and investors on the same page in what they are looking for. You need to capture people's insights in the art of investing and getting that blend right takes time.

Graham Hand is Editor-At-Large for Firstlinks. Reece Birtles is Chief Investment Officer at Martin Currie Australia, a Franklin Templeton specialist investment manager. Franklin Templeton is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any individual. Past performance is not a guide to future returns.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.