with Dr. Chloe Ho, Dr. Hue Hwa Au Yong, and Dr. Chander Shekhar.

As part of our research on capital raising by public companies in Australia, we've investigated how the regulators changed the rules during the COVID-19 pandemic, and how this affected company behaviour. A key concern of securities regulators should be the protection of small and minority shareholders against loss in voting power and dilution of wealth when companies issue new equity. Reflecting this, public companies in Australia have normally been restricted to raising no more than the 15% of their existing capital base, unless shareholders approve the issue.

In addition, in recent years the Australian Securities and Investments Commission (ASIC) has emphasised the ‘equal opportunity principle’, which aims to give retail shareholders access to, otherwise dilutionary, discounted offers to institutional shareholders.

The changes to capital raising during COVID

In response to the 2020 onset of the COVID-19 pandemic, the Australian Securities Exchange (ASX) and ASIC made changes to capital raising regulations through waivers to existing Listing Rules. In particular, they lifted the cap on capital raising (without shareholder approval) from 15% to 25% of existing capital but required that such issues incorporated either an entitlements (rights) offer or Share Purchase Plan for retail shareholders, resulting in a ‘packaged’ offer, that at least partly protected small shareholders from dilution.

The changes were temporary, initially applying until end June 2020, with subsequent extensions until 30 November 2020. Were they needed? Were the outcomes desirable? Should such a regulatory change be considered in the event of a future, similar, shock to the economy? Did such regulatory changes have a continuing effect on company behaviour?

How companies responded to the temporary regulations

Managers of Australian companies like private placements (PPs) to institutional investors because of the speed and certainty of amount raised. But the discounted price generally involved imposes a dilution cost on non-participants such as retail shareholders. In contrast, pro-rata rights offers (ROs) are the most equitable means of raising equity capital, but take time and can involve uncertainty over the amount ultimately raised. The third method, share purchase plans (SPPs) are not pro-rata. With each shareholder permitted to purchase shares up to a fixed dollar amount (currently $30,000), an SPP sits in the middle of the three methods in terms of equitable outcomes for shareholders.

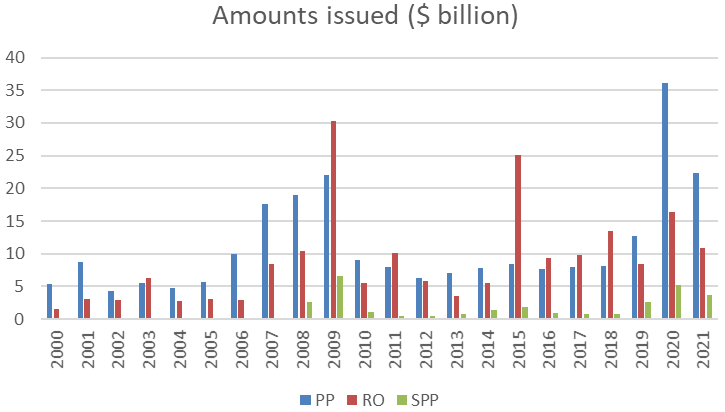

The figure below shows the amount raised from each type of issue over the years 2000 to 2021, where the total amount raised in a ‘packaged offer’ (such as a PP combined with a RO) is allocated according to the size of its components. A consistent pattern can be seen. PPs dominate each year in terms of total funds raised, followed in turn by ROs and SPPs. In total, over the period, PPs raised approximately $244 billion, ROs $196 billion and SPPs $30 billion.

Not surprisingly, in the years 2009 (the financial crisis) and 2020 (the onset of the COVID pandemic), the largest total yearly dollar amounts ($58.9 billion and $57.6 billion respectively) were raised. The increase in 2020 resulted both from the need for capital and the new higher regulatory limits.

Source: Authors’ calculations

The 2020 regulatory change required issues over 15% (up to the new cap of 25%) to follow a PP with an SPP or RO, thus addressing some of the dilution to small shareholders arising from the private placement. For issues less than 15%, combining a RO or SPP with a PP was optional.

We find in our research that in the pandemic year 2020, around 26% of total funds raised were by companies using a PP followed by an SPP with the new higher cap of 25% of existing shares. In the accompanying figure, this is reflected in the spike in PP funding in 2020 and the jump in funding sourced through SPPs from 2019 ($2.6 billion) to 2020 ($5.2 billion).

It is evident that for companies raising above the previous cap of 15%, the response to the mandate from the regulator was to choose a PP followed by an SPP. Very few capital raisings in 2020 using the new higher cap were via a PP followed by an RO. ROs (which are the fairest in terms of equitable outcomes for small shareholders) suffered a drop in relative contribution to equity capital raising in 2020, which was taken up by the issuance of a PP followed by an SPP, reflecting the direct impact of the regulation changes. Nevertheless, it is also clear from the figure that ROs remain an important source of capital.

With the challenging market conditions in early 2020, companies reacted quickly to the new higher capital raising limits, the original intention of which was to help companies survive the pandemic. A few opportunistic companies flouted this intention and launched placements up to the new 25% cap largely unrelated to the pandemic.

However, and on the positive side, our research finds that during 2020, even companies issuing less than 15% of existing capital, had a significantly higher propensity to follow the PP with an SPP, even though they were not required to do so under the regulations. The important contribution of our research is to show that the changes to regulations in response to the onset of the COVID pandemic, had both a direct and an indirect effect on company choice of capital raising method, which both worked towards reducing the dilution of small shareholders.

Changes to company behaviour have proven sticky

Shedding an even more positive light on the impact of changes to the regulations, this modification in company behaviour continued into 2021. In the pre-COVID years 2000-2019, around 18.5% of total funds raised over the period was via a PP followed by an SPP. In 2020, this figure was 44.3%, reflecting the new higher capital limits for this method during the pandemic.

However, in 2021 when the cap on capital raising had reverted to normal, companies continued to favour the PP followed by an SPP, with the method raising 45% of total funds for 2021. The increased importance of a PP followed by SPP suggests that company behaviour adjusted (at least in the short term) with potential benefits for smaller shareholders, who have the opportunity to invest in discounted capital raisings.

In conclusion, changes to the capital raising regulations at the onset of the COVID-19 pandemic, provided companies easier access to needed capital and at the same time, went some way to protecting small shareholders from dilution.

Christine Brown is Emeritus Professor, Banking & Finance at Monash University.

Dr Chloe Ho is a Lecturer, UWA Business School at The University of Western Australia.

Dr Hue Hwa Au Yong is a Senior Lecturer, Banking & Finance at Monash University.

Dr Chander Shekhar is a Senior Lecturer, Finance at The University of Melbourne.

The full research paper can be accessed here: Brown, C. and C. Ho. Raising Equity Capital during the COVID-19 Pandemic in Australia: The Efficacy of Regulatory Interventions, The Company and Securities Law Journal, 39, 4-18 (2022).