The song, The Living Years, was written from the viewpoint of a son who regrets not having a more open relationship with his father. In 1989, it reached Number 1 on the Australian, US and Canadian charts for Mike + The Mechanics, which was a side project of Mike Rutherford, guitarist for Genesis. Here is the youtube link to this legendary song. It’s hard to believe the hit is over 30 years old, and the eight-year-old son of Rutherford who features in the video is now 40.

What’s the connection to the dramatic changes we have seen in the investing landscape in recent years? The opening lyrics provide some clues:

“Every generation

Blames the one before

And all of their frustrations

Come beating on your door

I know that I'm a prisoner

To all my Father held so dear

I know that I'm a hostage

To all his hopes and fears

I just wish I could have told him in the living years”

Experienced investors including high profile market veterans have missed the tech growth stocks, criticise the valuations of companies like Tesla and Afterpay, denounce cryptocurrencies and label a Non Fungible Token costing US$69 million as absurd. Are they right or are they missing a generational change?

Prisoners to what we hold dear

There is no limit to the examples of valuations and market events that seem crazy to many seasoned investors. Jeremy Grantham has long called the current conditions a bubble, but he has seen many cycles over his decades in the market. Here he discusses the 'Top of the Cycle' in August 2021:

“I think it’s clear that we’re deep into bubble territory ... most of the data suggests that this is the new American record for highest priced stocks in history. Then there’s the most important thing of all, which is crazy behavior, the kind of meme stock, high participation by individuals, enormous trading volume in penny stocks, enormous trading volume in options, huge margin levels, peak borrowing of all kinds, and the news is on the front page. This is all characteristic of the handful of great bubbles that we’ve had.” (my bolding).

Two long-term charts are popular with analysts to show market values over time, and both are at extremes.

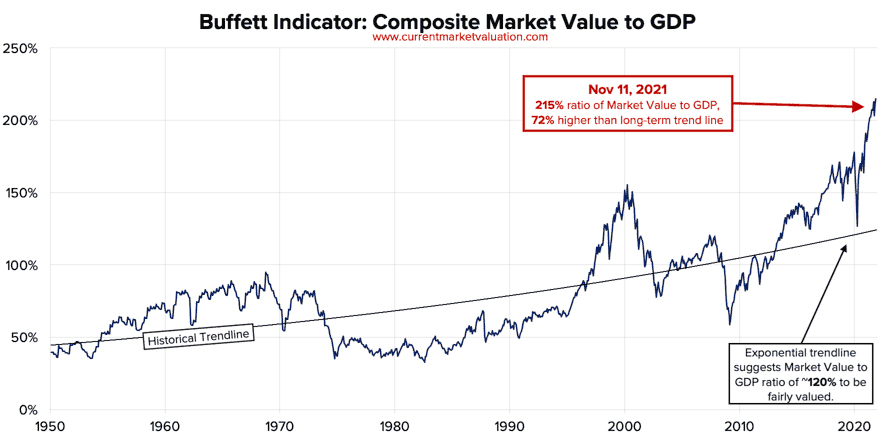

1. The ‘Buffett Indicator’ of total market value to GDP

Warren Buffett calls this ratio “probably the best single measure of where valuations stand at any given moment”. With the current market value of US stocks reaching US$50.8 trillion versus US GDP of around US$23.7 trillion, the ratio has hit a record high of 215%. Prior to the year 2000, it was normally around 50%, and even allowing for the fall in interest rates and a rising trendline, a number of 120% looks fairly valued. At 2.4 standard deviations above historical average, the market is testing those who look for value signals. But is this time different?

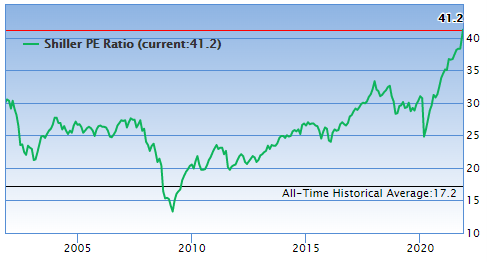

2. The Shiller PE ratio

Again, a widely-accepted measure for the value of the S&P500 is the Shiller PE, and currently it is over 41 times when the long-term historical average is 17.2. It was as low as 4.8 in 1920 or as high 44.2 in the dot-com boom of 2000.

Here are a few examples of valuations and actions testing the incredulity of long-term market watchers:

1. Last week, Rivian raised US$11.9 billion in its IPO, valuing the company at over US$100 billion at issue. At time of writing, it has doubled in price. It is the second-most valuable car maker in the world behind Tesla, recently worth over US$1 trillion. Ford Motor Company is valued at about US$77 billion and sells over 4 million vehicles a year. In its IPO prospectus, Rivian advised:

“In the consumer market, we launched the R1 platform with our first-generation consumer vehicle, the R1T, a two-row five-passenger pickup truck, and began making customer deliveries in September 2021. As of September 30, 2021, we produced 12 R1Ts and delivered 11 R1Ts, and as of October 22, 2021, we produced 56 R1Ts and delivered 42 R1Ts.”

2. Elon Musk is the richest person in the world. Can you imagine Warren Buffett taking investment advice from a Twitter poll? Musk recently tweeted:

“Much is made lately of unrealized gains being a means of tax avoidance so I propose selling 10% of my Tesla stock. Do you support this? … I will abide by the results of this poll, whichever way it goes.”

The poll closed with 57.9% of the votes in favour of Musk selling 10% of his stock. Tesla's share price fell and wiped US$200 billion off its market value in two days, which is more than the value of Ford and GM combined. By 16 November, Musk was halfway through his sales for a value of US$8.8 billion.

3. The total market value of cryptocurrencies has reached US$3 trillion, with Bitcoins valued at US$60,000 each and a total market cap of US$1.1 trillion. In 2011, a Bitcoin was worth US$1. Is this time different? Financial markets have never experienced a new technology like this, and while billionaire investor John Paulson cannot be branded as someone who does not understand markets, he told Bloomberg recently:

“I wouldn’t recommend anyone invest in cryptocurrencies. I would describe them as a limited supply of nothing. So to the extent there’s more demand than the limited supply, the price would go up. But to the extent the demand falls, then the price would go down. There’s no intrinsic value to any of the cryptocurrencies except that there’s a limited amount.”

And Australia’s own Hamish Douglass made similar arguments in this article in Firstlinks where he predicted Bitcoin would become worthless. The market cap of all cryptocurrencies is shown below.

Source: https://coinmarketcap.com/charts/

Over the long term, does it matter?

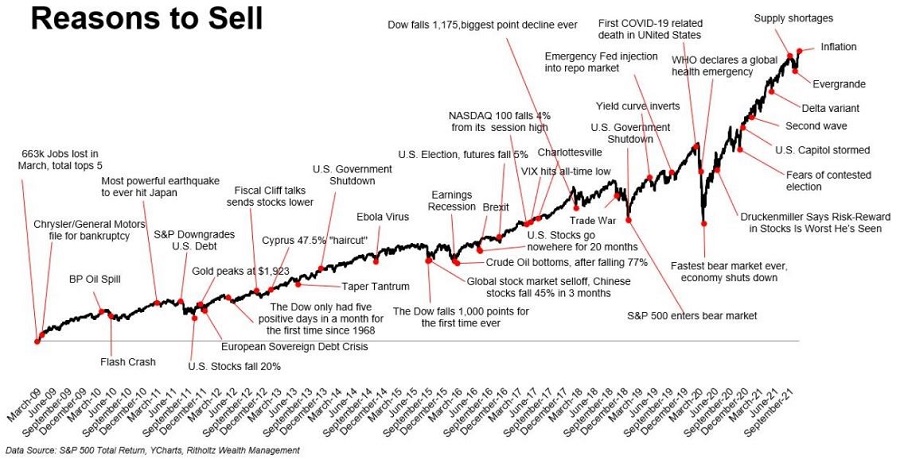

Part of the market's unlimited optimism stems from recent experience that the US Federal Reserve and other central banks will protect the market. Central banks inject liquidity and lower rates during a crisis. In any market condition, there are always reasons to sell, but even in a global pandemic, the market recovered quickly.

So is all this talk of bad news and excessive valuations just noise in the long-term growth of the equity market and the success of wonderful companies?

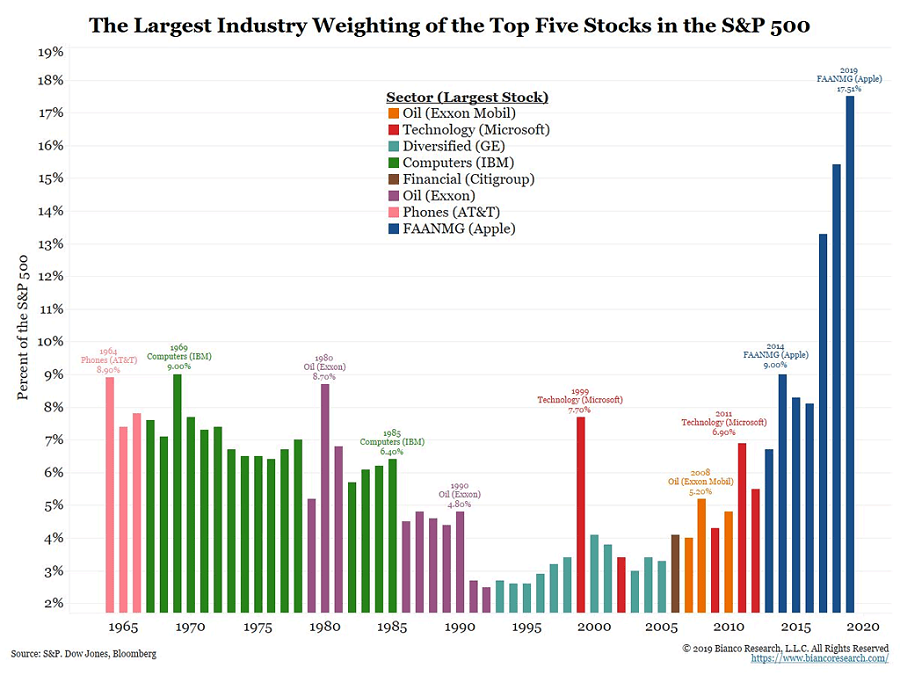

It is with some justification that the market is expensive because it is driven by wonderful tech companies with strong growth prospects which deserve their high P/E ratios. For example, Microsoft’s P/E is about 42 but Apple is only 27, then we have the super-bullish examples of Nvidia at 90 and Tesla 230 (or thereabouts). The concentration of the largest five stocks in the S&P500 is higher than it has ever been in history and the destiny of the index lies significantly in the fortunes of a few great companies.

Conversations with a 25-year-old

In this survey, we want to draw on the experience of our readers. While this is not necessarily a father/son (or mother/daughter) piece - although it is an opportunity to share opinions with the next generation - what would you now say to someone who is 25-years-old and starting out on investing?

Do you feel you have learned life-long lessons or are conditions so strange to you that you are wondering if times really have changed? For example:

* Should a young person go heavily into shares and remain invested?

* Is active stock management a waste of effort and it's better to stick to indexes?

* Is investing via an SMSF more trouble than it is worth?

* Is it better to invest in a diversified fund and leave it to the experts?

Nobody knows the future, and it does not matter if your opinions are imperfectly formed …

“Oh, crumpled bits of paper

Filled with imperfect thought

Stilted conversations

I'm afraid that's all we've got

You say you just don't see it

He says it's perfect sense

You just can't get agreement

In this present tense

We all talk a different language

Talking in defence

Say it loud, say it clear

You can listen as well as you hear

It's too late when we die

To admit we don't see eye to eye”

Let’s open up a quarrel …

You may have a new perspective on a different day, but as the market now stands, what do you think? Take it away Mike + The Mechanics …

“So we open up a quarrel

Between the present and the past

We only sacrifice the future

It's the bitterness that lasts

So don't yield to the fortunes

You sometimes see as fate

It may have a new perspective

On a different day

And if you don't give up, and don't give in

You may just be okay … “

(Songwriters: B.A. Robertson and Mike Rutherford, The Living Years lyrics © BMG Rights Management, Concord Music Publishing LLC)

What do you think?

Let’s take the pulse of our audience with two big questions.

- Is this time different? Do you think investing has fundamentally changed in the last 5-10 years?

- What investment advice would you give to a 25-year-old starting an investing journey?

Full results will be published next week and all responses are anonymous. Meanwhile, note that the other big hit for Mike + The Mechanics was a prophetic “All We Need Is a Miracle”.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.