In a monthly column to assist trustees, specialist Meg Heffron explores major issues on managing your SMSF.

Download Meg’s Facts and Figures 2023/24 for your records or print it out so you have all the latest information at your fingertips.

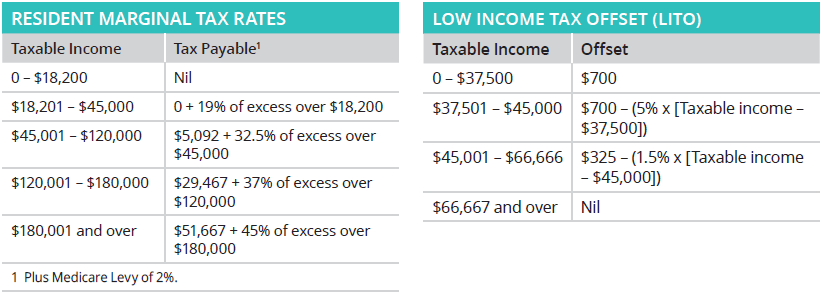

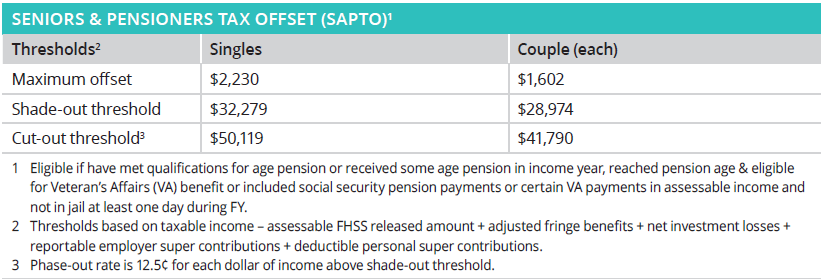

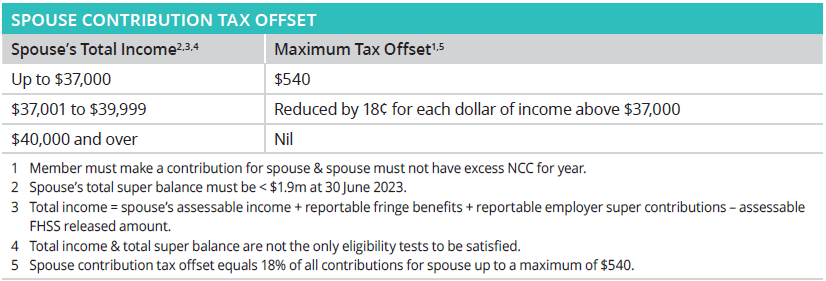

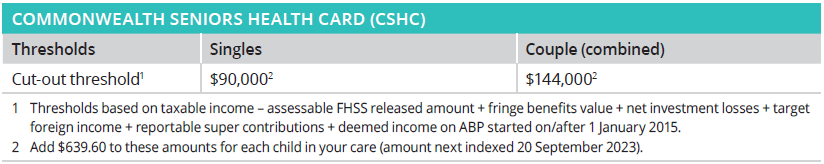

Personal tax rates & offsets

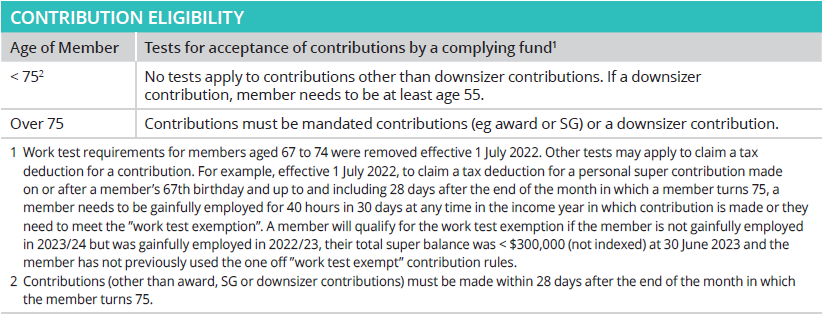

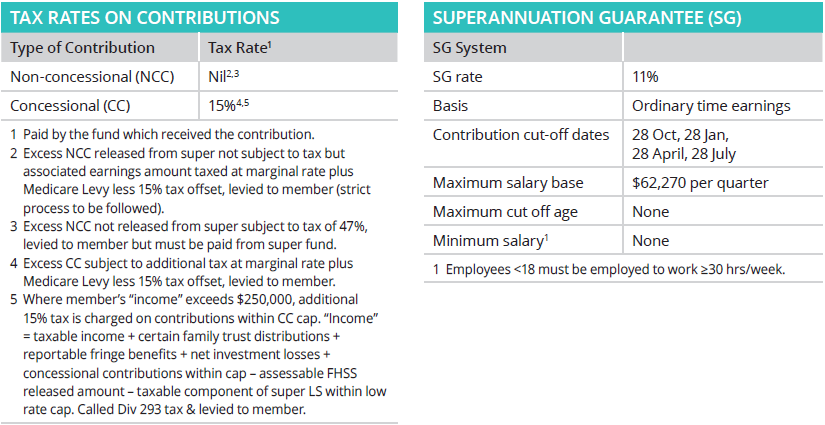

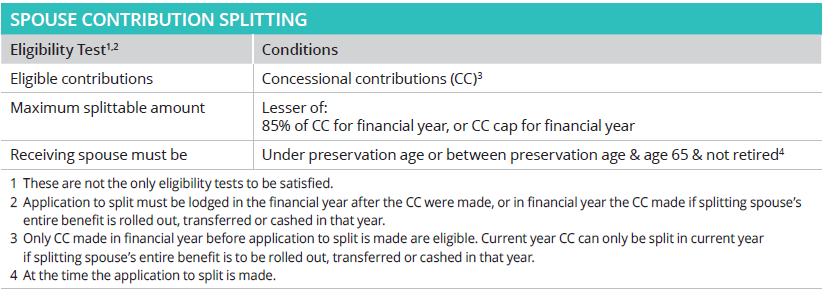

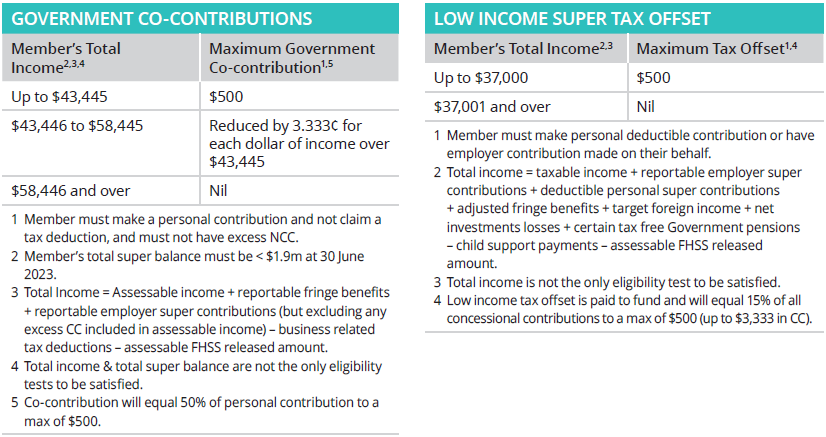

Superannuation contributions

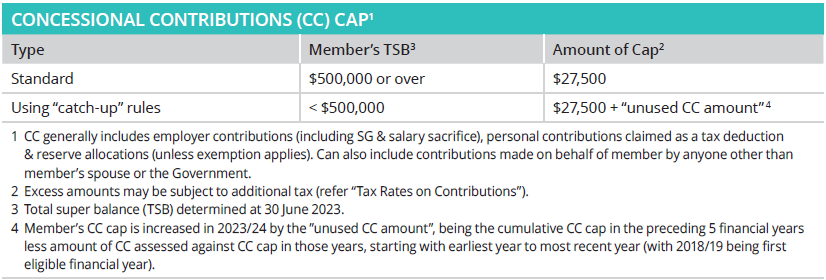

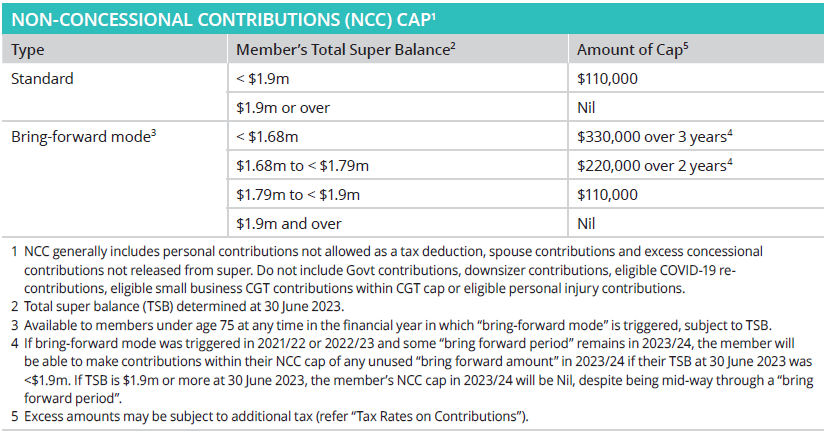

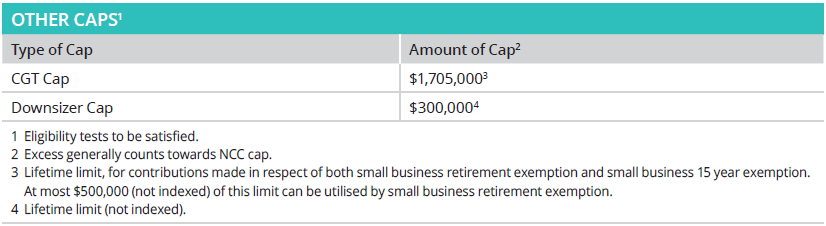

Superannuation contribution caps

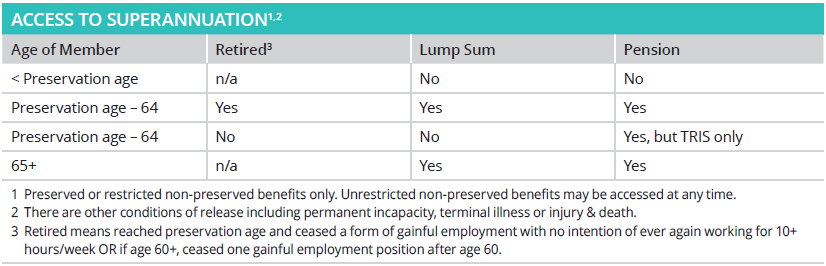

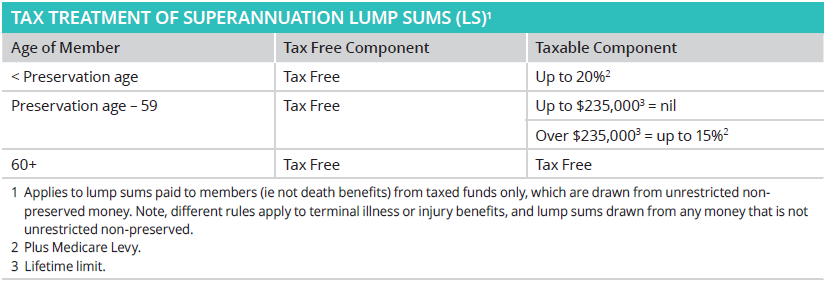

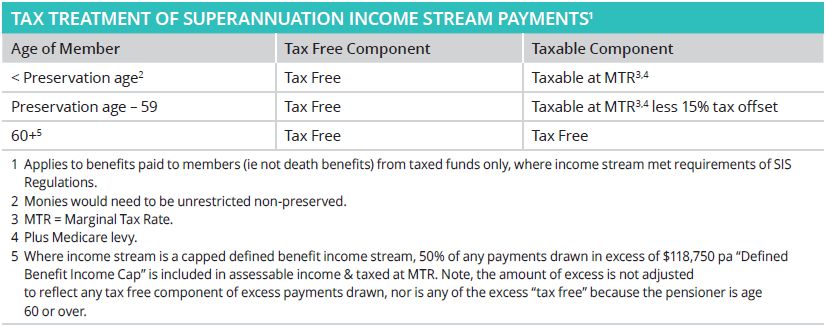

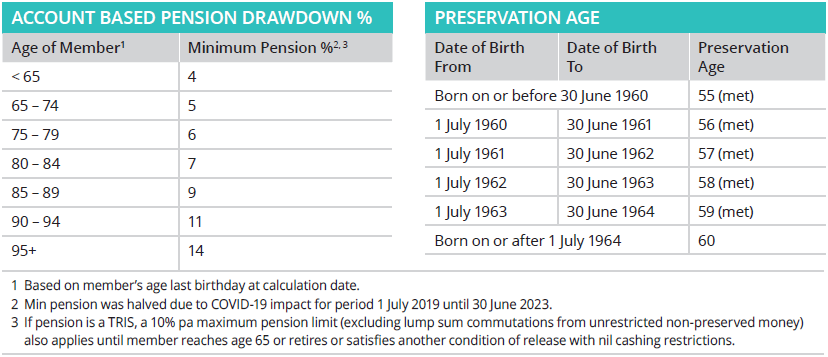

Superannuation benefits paid to members

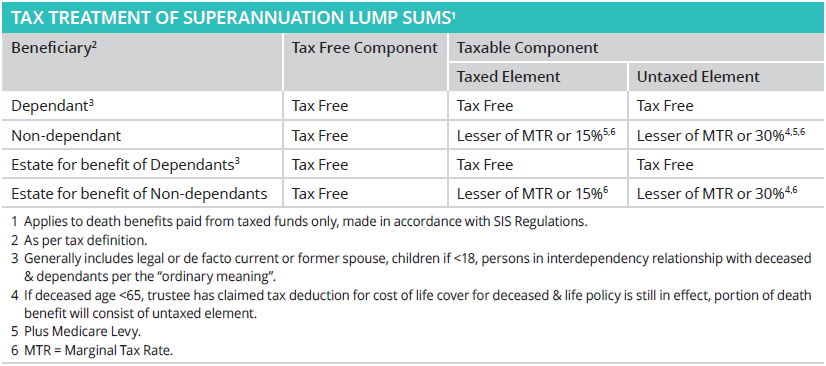

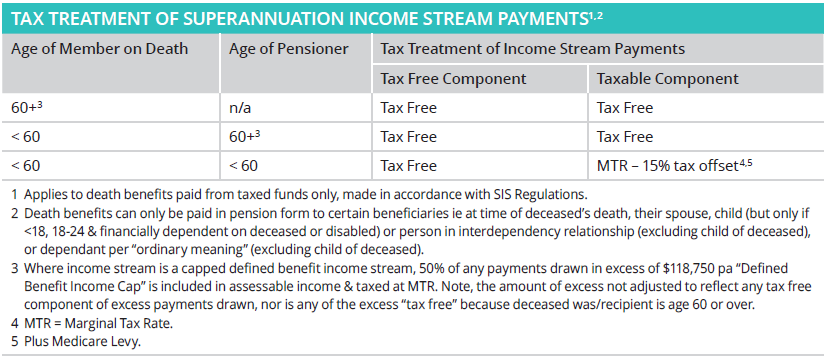

Superannuation benefits paid on death

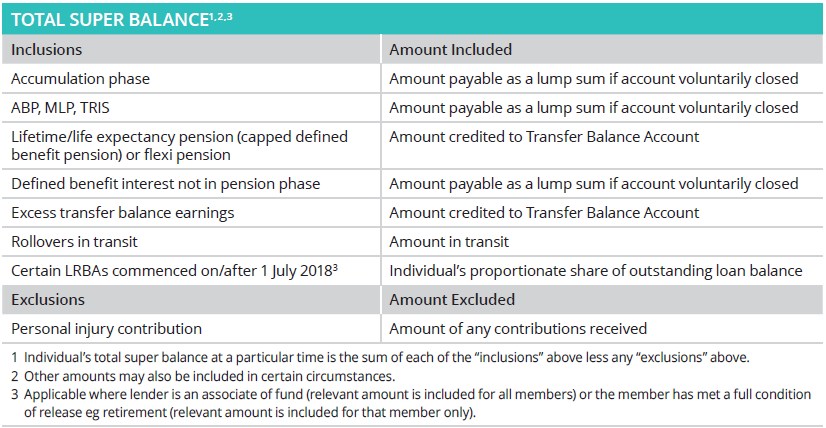

Total super balance

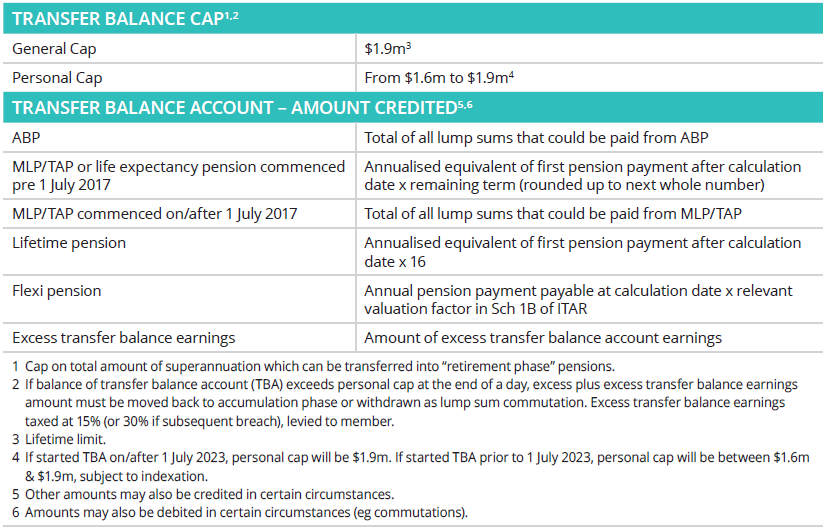

Total balance cap and transfer balance account

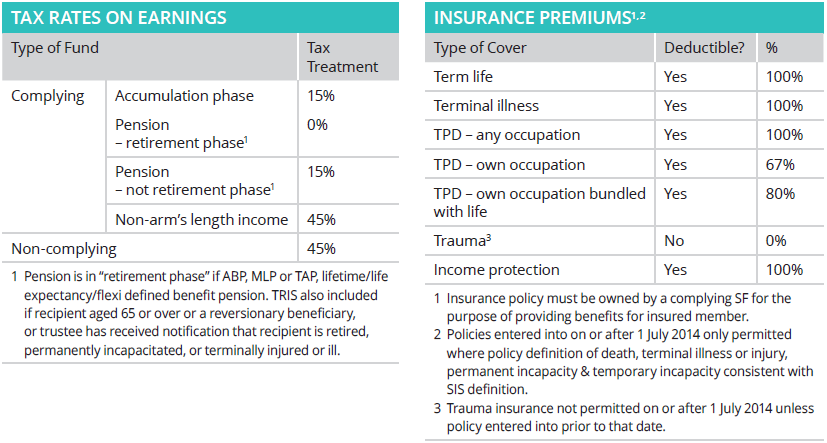

Superannuation funds

Disclaimer: The information, representations & statements expressed or otherwise implied in this article are based on laws in place at 30 June 2023, made in good faith and derived from sources and research believed to be reliable and accurate. Heffron Consulting Pty Ltd accepts no liability in respect of such representations or statements, whether by reason of negligence or any other matter whatsoever. This article is written without any specific knowledge of individuals’ situations. Any person acting upon such information without receiving specific advice does so entirely at their own risk. All rates are for the period 1 July 2023 to 30 June 2024 unless otherwise indicated. © Heffron Consulting Pty Ltd 2023.

Meg Heffron is the Managing Director of Heffron SMSF Solutions, a sponsor of Firstlinks. This is general information only and it does not constitute any recommendation or advice. It does not consider any personal circumstances and is based on an understanding of relevant rules and legislation at the time of writing.

For more articles and papers from Heffron, please click here.