(This article is republished by Morningstar from our archives).

There is no greater accolade for a social commentator than having an idea enter the national lexicon. So it was with due pride that demographer Bernard Salt showed his unmitigated delight at the way his 'smashed avocado' reference now sums up an entire generation of Millennials and their spending habits. Salt was speaking at a Colonial First State Global Asset Management Forum on 1 May 2018, and he explained how media companies from all over the world have contacted him to discuss his smashed avos.

Salt’s reference to $22 avocado on toast for breakfast in the original article in The Australian has become a touchpoint on housing affordability and even intergenerational conflict. He said of young people:

“Shouldn't they be economising by eating at home? How often are they eating out? Twenty-two dollars several times a week could go towards a deposit on a house.”

However, at the panel discussion, he said the real purpose of the column was misunderstood, as he subsequently wrote:

“It was intended not as a criticism of youth but as a parody of middle-aged moralisers, using the setting of a hipster cafe to showcase the conservatism of middle-aged thinking.”

The mistaken message has more merit

Notwithstanding most people mistaking the original interpretation, the incorrect meaning surely carries more gravitas. This struck me while attending a concert at the ICC Sydney Theatre a few days after hearing him speak. It was the highlights from the BBC series, Planet Earth II, ‘live in concert’ with the Sydney Symphony Orchestra playing an original score to match the action. The theatre holds about 9,000 people, and the only empty seats were the cheap ‘bronze’ sections at the side.

Now here’s the thing. The audience was overwhelmingly young people, say under 30, and most of the tickets were in the ‘platinum’ and ‘gold’ categories. The ticket tiers are shown in the extract. With mediocre wine in a plastic cup at $10 a pop, many young couples were up for $400, and the ‘BBC Earth Lounge’ was full at $1,000 a couple. People queued impatiently to buy drinks and chips while the free water sat unloved.

Now here’s the thing. The audience was overwhelmingly young people, say under 30, and most of the tickets were in the ‘platinum’ and ‘gold’ categories. The ticket tiers are shown in the extract. With mediocre wine in a plastic cup at $10 a pop, many young couples were up for $400, and the ‘BBC Earth Lounge’ was full at $1,000 a couple. People queued impatiently to buy drinks and chips while the free water sat unloved.

For what? It was a great show, but BBC nature documentaries and David Attenborough are at saturation levels on free-to-air and pay television. They can be watched for free online 24/7. Most people have big flat screens and good sound systems, and could watch the animals with great sound any night of the week. This was not a once-in-a-lifetime chance to see a music legend. It was a good night out watching something readily available, acknowledging that the SSO made it extra special.

Smashing Pumpkins 30th anniversary tour

In a couple of months, the legendary band Smashing Pumpkins will start a 30th anniversary reunion tour in the United States, the first time most of the band has toured together in almost 20 years. The band has a big Australian following, and if the tour makes it here, they will sell out at an average of $200 a ticket.

In 2013, Pink sold out 46 concerts for over 600,000 fans, with the cheapest seats at $150 and the ‘True Love’ package of meaningless stuff at $400. Justin Bieber’s recent VIP experience was over $500. Adele sold 200,000 tickets for two open-air Sydney concerts in 2017 with D Reserve, up in the heavens at the ANZ Stadium, costing over $100, and A Reserve nearer the stage at over $300. Ed Sheeran’s 2018 Australian tour sold over 1 million tickets with 225,000 in three shows in Sydney, slightly more than AC/DC in 2010.

The list is endless, week after week, worth billions a year, and Australia can’t get enough of it.

What do some young people earn?

Clearly, many young people are well-paid and $400 is the cost of a decent night out, but it is common to read young journalists bemoan their inability to ever buy a house in Sydney or Melbourne. The gig economy is making more jobs part-time and removing job security and benefits. Many struggle to make rental payments, never mind borrowing half a million.

Writing in The Sydney Morning Herald on 7 May 2018, a Fairfax contributor, 27-year-old Joshua Dabelstein said he does not know anybody who has ever considered buying property. He said his generation is more concerned with paying the rent.

“A friend of mine’s boss convinced her that paying $17 per hour at a café was a great deal because she wouldn’t have to pay tax on it … In the past 48 hours, two close friends have been fired. One has spent seven months working for a restaurant that paid him a flat rate of $19 an hour.”

So without entering the debate on what’s fair and whether small business can afford to pay penalty rates, there are vast numbers of young people earning less than $20 an hour. Perhaps these are not the people going to many concerts, but when Ed Sheeran sells one million tickets and Pink and Adele sell 600,000, there are a lot of gig economy and casual workers among the audience.

What do banks now require for a home loan?

In the last year, qualifying for a home loan has changed dramatically. Lenders want to know far more details than they did at the start of the residential property boom that has now ended. The Financial Services Royal Commission produced much evidence in Round 1 on how easy it was to obtain finance. Now, lenders want to know about day-to-day living expenses, down to details such as how much is spent on fuel, eating out and, yes, going to movies and concerts. There is more checking of bank statements by line item, and reports of lenders asking why borrowers needed luxury items like gym memberships. The Royal Commission’s honing in on responsible lending obligations has changed mortgage industry procedures. ANZ Bank CEO Shayne Elliott said the more risk-averse mood would make it harder for some consumers to borrow for a home.

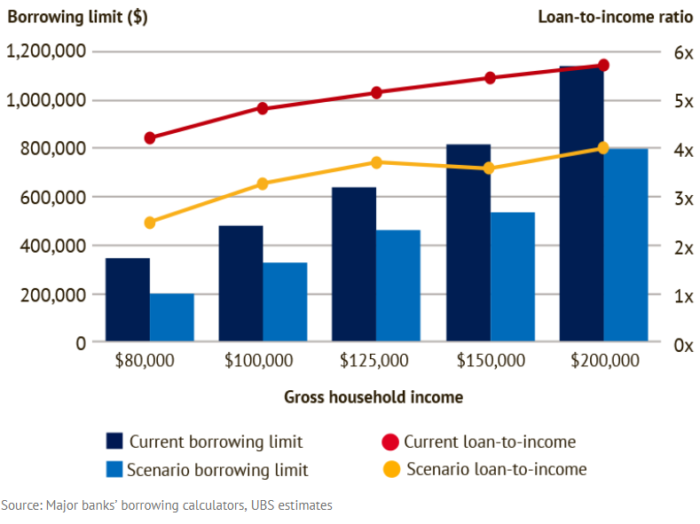

The investment bank UBS has done an estimate of how borrowing conditions have changed, as shown below, with a decline in loan size for given levels of household income, and lower loan-to-income ratios based on new lending scenarios.

Following the Royal Commission, much larger deposits will be required, and most people will only achieve this by reducing their spending or going to the Bank of Mum and Dad.

What could be achieved by smashing the concert desire?

Life is for living and café breakfasts and concerts are fun and part of the joy of an Australian way of life. I get that. But for the sake of the exercise, let’s see what could be achieved by salary sacrificing into superannuation instead of buying a $200 concert ticket (or finding some other saving) each month.

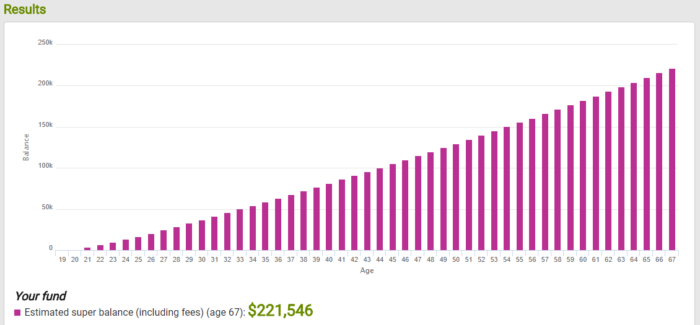

These calculations are made using ASIC’s MoneySmart Superannuation Calculator where anyone can experiment with the numbers. Check the website for the underlying assumptions but this example uses the following:

- Age at start, 20

- Annual income before tax and super, $40,000

- Desired retirement age, 67

- Employer contributions, 9.5%

- Low-Medium fund with fee of 0.9% pa plus $50 pa admin fee

- Growth fund with investment return of 5% pa.

The estimated fund balance at age 67 is $221,546. Of course, investments markets do not deliver smooth, predictable results as this chart implies, but it's an ASIC-approved picture of long-term potential.

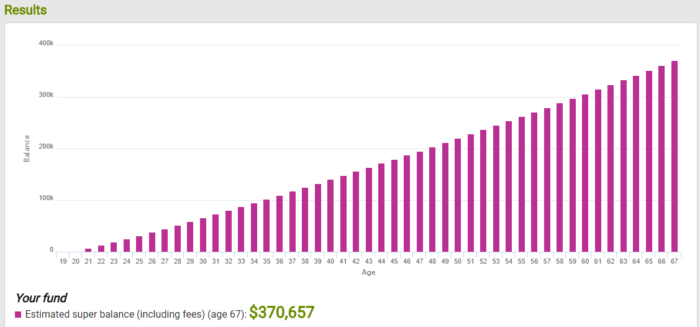

Now let’s change only one assumption, with the saver making additional salary sacrifice contributions to superannuation of $200 a month. All numbers are adjusted for inflation.

The balance at age 67 is now $370,657, an increase of about $150,000 or nearly 70%.

Sacrifices are needed

It doesn’t matter whether the $200 a month comes from missing a concert or avocado on toast, the numbers show the remarkable impact of disciplined saving and a relatively modest amount extra each month. Of course, many people would struggle to find $50 a week, but missing a coffee a day would go half way there. It’s a matter of lifestyle and future financial security at the cost of current consumption and enjoyment.

Seeing Smashing Pumpkins, Pink, Justin Bieber and animals on a big screen are all fun to somebody, but having financial security at age 67 is fun for everybody. Bernard Salt was right when he wrote that saving all the little extras for many years could go towards a home deposit or a decent retirement.

If his original article was a “parody of middle-aged moralisers”, the queue starts here.

Graham Hand is Managing Editor of Firstlinks.