[Vanguard has released its second annual report called 'How Australia Retires'. It surveyed more than 1,800 people about our attitudes towards retirement and how we feel about this phase of life. Here is an extract from the report.]

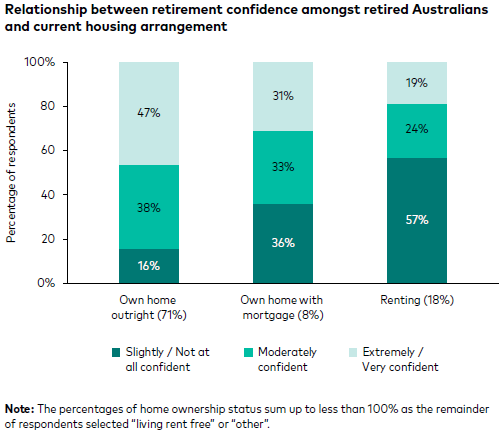

Housing, and whether or not it is owned outright, was found to have a material impact on a retiree’s retirement confidence level. Of the 18% of retired Australians who are renting their home, more than half (57%) said they were slightly or not at all confident in their ability to fund their retirement. This contrasts with the 71% of retired Australians who owned their home outright, of whom only 16% said they were slightly or not at all confident, suggesting renters are more than 3 times as likely to be of relatively low retirement confidence than those who own their home outright.

Only 8% of retired Australians owned a home but still had a mortgage to pay. Of these retirees, retirement confidence was lower than for those who owned a home outright, but higher than for those who rent.

Role of housing in retirement

Australians have long harboured a strong affinity for property, with 72% of Australians believing that home ownership is a very important factor that contributes to retirement readiness. In 2019-20, the family home was the largest asset held by Australians households, making up 37% of net household wealth, ahead of superannuation at 22% 1.

Home ownership not only contributes to wellbeing in the form of shelter and security, but it is also a key factor in determining retirement outcomes as housing costs such as rent and mortgages impact retirement wealth. The rate of home ownership however is changing, with particular decline amongst Millennials aged 25 to 39 years old 2.

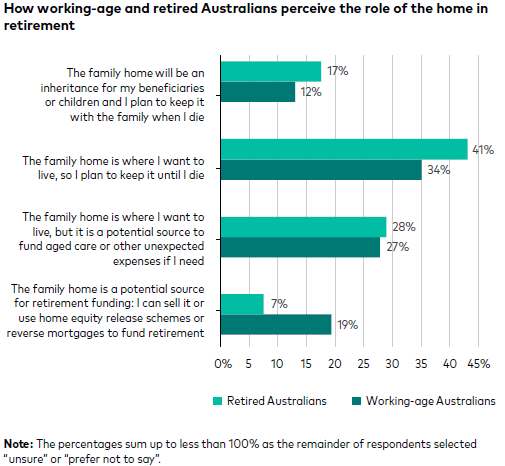

Australians have a strong emotional attachment to the family home; only 1 in 7 Australians see the home mainly as a source of retirement funding.

Most Australians believe the family home is where they will age. 34% of working-age Australians and 41% of retirees are most aligned with the statement that “the family home is where I want to live, so I plan to keep it until I die”, showing significant emotional attachment to the family home, and highlighting the unique role of housing in retirement assets.

27% of working-age Australians view their family home as where they want to ultimately live, but also believe it can potentially fund aged care or unexpected expenses if needed. 28% of retired Australians believe the same.

19% of working-age Australians view their family home mainly as a source of funding, willing to sell it or use home equity release schemes or reverse mortgages to fund their retirement. In contrast, only 7% of retired Australians echoed this sentiment.

A lower percentage of working-age Australians (12%) than retired Australians (17%) considered their family home as an inheritance for their beneficiaries or children.

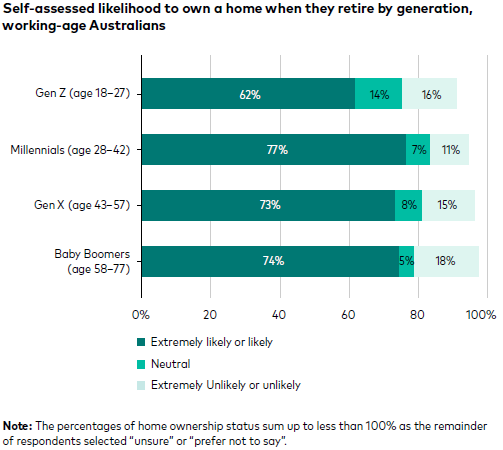

Most working-age Australians find home ownership likely but 30% still expect to pay a mortgage in retirement.

Positively, expectations amongst working-age Australians of home ownership in retirement are generally high amongst all generations. Compared to older generations, however, Gen Z are the least optimistic about their chances of home ownership in retirement (with 62% finding it extremely likely or likely that they will own a home, compared to 77% of Millennials, 74% of Baby Boomers and 73% of Gen X).

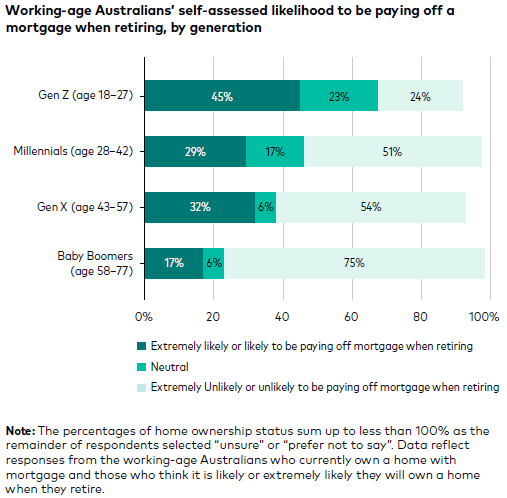

Gen Z is also the generation most likely to believe that they will be paying off a mortgage at retirement, with almost half (45%) of respondents in that generation who expect home ownership citing it is extremely likely or likely that they will still be paying off a loan.

When it comes to Millennials, 29% who either currently own a home or find it likely they will own a home in retirement also believe they will still be paying off their mortgage at retirement.

Perhaps of most concern is 32% of Gen X respondents who currently own a home with a mortgage or expect to own a home in retirement believe it is extremely likely or likely they will still have a mortgage in retirement, despite approaching the traditional age of retirement and therefore likely to have the least amount of time (when compared with other generations) to pay off debts before retiring. When asked about their plan to pay off their mortgage, 38% of these Gen X respondents intend to keep paying their mortgage through retirement and 18% would consider selling their home and using the proceeds to repay their mortgage. 25% of these Gen X respondents have plans to use their superannuation to pay off their mortgage in one transaction.

Working-age Australians who believe they are unlikely or extremely unlikely to own a home when they retire are also more likely to not have a clear plan for retirement (55% vs 33% who expect to own a home in retirement) and are also more likely to be of relatively low retirement confidence (55% vs 23%).

Nearly 1 in 5 retired Australians are renting

Given those who rent in retirement are more likely to exhibit lower retirement confidence than those who own their home outright, a lack of home ownership remains a key issue, considering its impact on retirement savings and financial security.

18% of retired Australians are renting in retirement, and 8% own their home but with a mortgage. The percentage of retirees renting or with a mortgage is significantly higher (31%) for those who are not in a relationship (separated, divorced, widowed or never married) than those with a partner (8%).

Daniel Shrimski is Managing Director of Vanguard Investments Australia, a sponsor of Firstlinks. This article is for general information and does not consider the circumstances of any individual. Additional contributors: Junhao Liu, Ph.D., Timothy Smart, Martha Wood, and Sarah Ge.

For articles and papers from Vanguard, please click here.

1 2023 Intergenerational Report published by the Federal Government Treasury, p169.

2 Australian Bureau of Statistics (20 October 2022), ‘Owning a home has decreased over successive generations’ [media release].