While most investors think that investment in emerging markets (EM) must be through equities, it may be that emerging market debt is the better option. EM debt offers diversification and potentially a more attractive risk return profile for investors wanting to benefit from exposure to emerging markets.

Of course, the past 12 months has been a challenge for equity and fixed income investors globally. We have seen inflation surprises in almost all countries and central bankers have been forced to pivot to extreme hawkishness as a result. Adding to this global stress is the ongoing geopolitical tension caused by the war between Russia and Ukraine.

Clearly, this year has been particularly challenging for fixed income investors, who are not used to seeing equity-like market downturns.

However, there are still plenty of opportunities in this asset class in certain sectors and we would argue that EM debt is one such area that investors should explore.

Potential benefits of emerging market debt

EM debt is well diversified across countries and types of debt. In a fully ‘blended’ EM debt approach (three equal parts sovereign, corporate, and local debt), the top 10 countries combined only have a 50% share. More than 80 countries are represented in EM debt indices, versus 52 countries between the mainstream/frontier EM equity indices. The main EM equity index is almost one-third China risk, while the top four countries (China, India, Taiwan and South Korea) together make up about 70% of the opportunity set.

EM debt investors engage with both governments and companies, and almost all their return is derived from income, with capital appreciation playing a minimal role in the long-run return.

EM debt also offers more return for less risk than EM equities. Over the past 20 years, the main EM equity index has approximately 2.5 times the volatility of the main EM debt indices (either sovereigns or corporates). And while EM equities have generated higher absolute returns over this time, when adjusted for the volatility, EM debt returns are about 40% higher than EM equities.

Where are the opportunities?

While fundamentals are under varying degrees of pressure the world over, within the diverse EM debt market there are some countries that are holding up better than others.

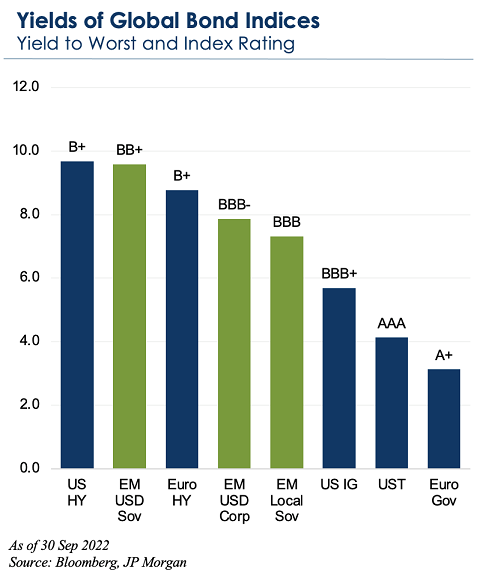

The key opportunity that has emerged is the long-run carry available to investors in EM debt. The EM sovereign debt index offers a yield of over 9%, EM corporate debt is yielding almost 8%, and many EM local markets (aside from China) offer yields of 7-13%. Based on history, the forward-looking return profile for entering EM debt markets today looks attractive.

Cyclically, the best opportunities are likely to be in EM high-yield credit. While a few countries and companies are struggling in this environment, many have sold off based more on market conditions than any fundamental issue. As a result, we see yield levels in high-yield credit that don’t come around often.

We like exposures in Mexico (particularly corporates and local rates), Brazil (also corporates and local rates), Indonesia (sovereign-related and corporate issuers), South Africa (local rates), India (corporates), Uruguay (inflation-linked local rates), and among high-yield sovereigns we favor Ivory Coast, Dominican Republic, Guatemala, Paraguay, Angola, Jordan, and Uzbekistan.

In these markets there are opportunities across proactive central banks, resilient sovereign and corporate balance sheets, issuers with less reliance on regular market access (or those that still have market access), beneficiaries from commodities - like higher food and energy prices, and countries maintaining some reform momentum and/or fiscal discipline, sometimes along with support from institutions like the IMF.

In corporate debt, we prefer exposures in utilities, telecoms, consumer names and infrastructure. Good investors need to focus on issuers that are resilient to the current backdrop and look for names that have healthy and predictable cash flows, stronger sovereign support, good transparency, and/or investor-friendly structures.

Here are three examples that we believe exhibit those characteristics.

Central America Bottling Corp. (CAMEBO)

Central America Bottling Corp is a leading producer, distributor and seller of beverages in Latin America. The company has been the anchor bottler for PepsiCo in Central American since 1998 and has a joint venture with Ambev for distribution in Guatemala, El Salvador, Honduras and Nicaragua. The company is well-diversified geographically and experiences limited foreign exchange volatility given the currencies in the countries it operates in are relatively stable. Camebo has a long-standing relationship with PepsiCo and has a 30-year contract with Pepsi in Peru and Ecuador. The company has low net leverage of 2.3 times debt to equity, and revenues of US$1.9 billion with EBITDA of US$250 million. We think the bonds are attractive based on the 7.5% yield for bonds that mature in 2029 and think the company will be relatively defensive in the face of weaker global growth trends.

Cable & Wireless (CWCLN)

Cable & Wireless is a telecom provider offering mobile, broadband, video and fixed-line services for residential customers in Panama, Jamaica, The Bahamas, and Barbados. C&W also has IT and wholesale services for the commercial segment. The company is owned by Liberty Latin America and has moderate net leverage of 3.8 times debt to equity. In the most recent quarter, revenues were up 5% year on year to US$596 million and EBITDA was up 9% year on year to $254 million resulting in relatively high EBITDA margins of 43% (up by 200 basis points relative to last year). Subscribers increased by approximately 11,000 over the quarter, to 2.1 million. The company maintains strong liquidity with cash of US$770 million and US$792 million of undrawn credit facilities. We think the unsecured notes due 2027 are very attractive at 11.5% yield.

India Cleantech (ACMSOL)

India Cleantech is a solar power producer based in India. The company has 12 solar facilities across India, totaling 450 MW of capacity. About 60% of India Cleantech’s counterparties are central government entities and the remaining 40% consists of seven state electricity distribution companies. Total debt at the entity is approximately US$325 million and we estimate scheduled amortization for 2023 will total US$6 million. This compares to EBITDA of US$55 million, providing for a significant cash flow buffer relative to debt service. Given the strong cash flow generation, we expect additional amortization of approximately US$15 million in 2023, which will enable the company to organically deleverage. Moreover, India Cleantech’s parent company Acme Solar has a strong financial profile, with US$1.7 billion of assets and 3.4 GW of total operational capacity. ACMSOL 2026 notes yield 13.5% which we find very attractive relative to BB credits within emerging markets.

Final points

Overall, we believe a lot of the global bad news has already manifested in valuations this year, and more nuances will emerge into 2023-24 as inflation rolls over, growth slows, and central banks pause or even turn to easing. The playbook for investors will likely change considerably over the next 6-12 months, so being nimble and alert to the evolving economic data will be important.

Kristin Ceva is Managing Director at Payden & Rygel, a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. The information in this article is provided for informational purposes only. Any opinions expressed in this material reflect, as at the date of publication, the views of Payden & Rygel and should not be relied upon as the basis of your investment decisions. EM debt exposure is included in the Payden Global Income Opportunities Fund.

For more articles and papers from GSFM and partners, click here.