In 2019, APRA wrote to all life insurers and friendly societies to advise them to ‘get their houses in order’ in relation to pricing, especially insofar as this pertains to disability insurance premiums.

For example, if a 30-year-old effects an income protection policy with a benefit period to age 70, the expectation is that the product, whether funded on stepped, level or hybrid premiums, will protect them throughout their working life at a fair and correctly costed price. Unfortunately, this is currently not the case and the client will be price-forced off their policy in later years. This happens most notably in respect of Income Protection, Total and Permanent Disability (TPD) and Trauma cover.

To further exacerbate the problems relating to pricing, insurers have been offering discounts to obtain new business at rates that are not sustainable. These ‘campaign’ discounts of up to 25% of premiums in the first year of a life policy make a mockery of the Life Insurance Framework (LIF) reforms. Lapses are up but not because of ‘churn’. They have increased due to issues relating to affordability.

Poor pricing practises have gone on for decades, occur on multiple levels and simply cannot continue. This article outlines ‘what occurs’, but also notes numerous ‘potential solutions’, which, if considered, we believe could help solve the problem.

What occurs

- Insurers bring to market new policies at lower premium rates than their closed product, or prior series offerings. Insurers have done this for years knowing this is unsustainable.

- Insurers under-price products to artificially drive new business knowing they will need to increase base rates regularly and within a short space of time.

- Discounted premiums that are offered to new clients are not passed on to existing clients. How can insurers argue the need to increase rates for existing clients while offering lower rates to new clients?

- Insurers provide lower rates for new clients on policies within a series. This results in consumers being insured under the exact same product, but at different premium rates depending on when they took out their policy.

- Cross-subsidising or providing package discounts and in some cases providing third-party services that, if taken up, will result in premium discounts for a period of time. Insurance should be correctly priced on its own merits from the outset.

- Some larger insurers are prepared to use predatory price discounting for the first few years of a policy to stifle the competitiveness of smaller insurers. Then, as larger groups acquire smaller insurers (which has been the case), it exacerbates the legacy book pricing issues.

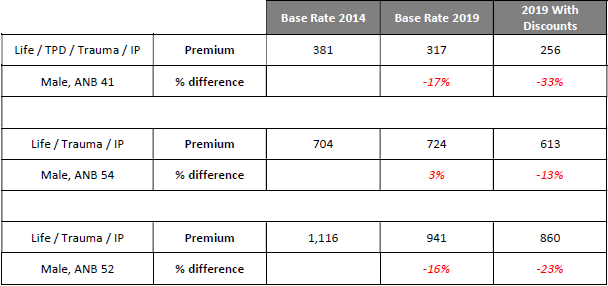

Table 1 below cites three insurer examples (same product series) with 2019 base rates and initial discounts offered compared to policies taken out in 2014.

Source: Fairbridge

How can insurers offer these discounts and at the same time apply base rate increases to existing policy holders?

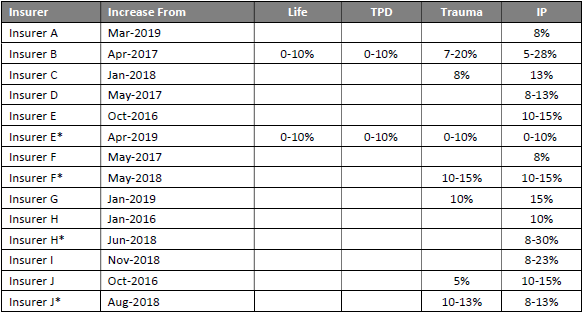

Table 2 illustrates the base rate increases across the market for existing policy holders for the three years up to March 2019. The insurers will generally have an increase within a range depending on the exact product as outlined below.

Table 2 Insurer pricing increases last 3 years to March 2019

Source: Fairbridge. * Note that a number of insurers will have multiple increases during this period.

According to APRA, the Australian life insurance industry lost $417.8 million in the year to June 2019, down from a profit of $990.6 million the previous year. These are sobering statistics which highlight the urgent need for pricing reform in order to ensure a sustainable industry that is committed to protecting the future of millions of Australians.

Reasons insurers give for increasing rates

- Bad claims experience - Insurers use claims experience to price their books. If the claims in respect of the existing book are above expectation, this should be factored into the pricing of the new book. In fact, we see the opposite and history has shown that new products are artificially priced lower.

- Reinsurer treaty arrangements - These arrangements are not well designed and are not priced for the long term. Reinsurer ‘musical chairs’ with insurers is an issue.

- Past poor engagement with disability claimants - Every legitimate claim must be paid and this must be done in good faith.

- Income protection policies have been too generous on replacement amounts - If this was true, then current new business Income Protection premiums should be much higher than they are.

- Low interest rate environments - This is the most recent excuse given by insurers for income protection rate increases, yet those increases are not applied across the board.

Potential solutions

Insurer-appointed Actuaries, or Chief Actuary, should:

- stand separate and independent from the management of the company and not be party to campaigns to drive new business at any cost.

- have a ‘trustee’-like responsibility to ensure the product is sustainably priced for consumers, providing the counterbalance required.

- report to the regulator each time base rates are increased and provide an acceptable justification and/or explanation.

- report to the regulator each time they price reduce within a product series for new clients and do not immediately pass this back to existing clients.

Insurers should:

- not force clients to change products (or change within a product series) to obtain better rates that are on offer.

- be obliged to pass back pricing improvements to existing clients.

- not be allowed to have multiple series within a single product. This allows for price and definition changes but creates an impression the product has not changed. Instead, you get a conga line of legacy products.

- price insurance policies correctly at the outset.

- not allow short-term discounts on new policies.

The regulator should:

- penalise insurers for poor pricing models.

- monitor and step in when there is gross under-pricing, or incentive discounting.

- not allow for products to be closed without a clearly defined and acceptable strategy to manage the closed book of business.

Notably, with reference to the sale of AMP Insurance to Resolution Life and the closure to new business, millions of Australian consumers are going to find themselves locked into expensive insurance policies as healthy lives leave AMP as clients. This is a disaster in the making as this will become the largest legacy book in Australian history.

APRA recently advised all insurers that from April 2020 they can no longer offer what are known as agreed benefit income protection policies. APRA has further advised that the structure of these products will need to change. However, there is scant detail on how these products will provide effective cover for Australians who would rely heavily on this type of insurance to protect themselves and their families. This is not a solution and frankly all of the current agreed value policy holders are going to find themselves price forced off products as APRA has handed them (the insurers) a licence to do so. The evidence for this can be found in the recent Protect Your Superannuation legislation as insurers have been able to increase insurance premiums to unaffordable amounts, thus contributing to the erosion of superannuation account balances. We had a client have a premium increase of 46% using PYS as an excuse. How is this acceptable?

Most risk specialist advisers do an outstanding job for their clients and as an industry we have been pleading for years for these pricing practices to stop, but unfortunately to no avail.

Roy Agranat is a specialist risk adviser with Fairbridge Financial Services. This article is general information and does not consider the circumstances of any individual. Rates quoted are indicative only and may not apply for all people.