Against the hype generated by the local residential property market, the listed property sector is easily overlooked by Australian investors.

Both are forms of real estate which provide an important role for society and the economy with transposable land at their core. Global listed property, otherwise known as Global Real Estate Investment Trusts (GREITs), allows investors, large and small, to gain exposure to the returns of some of the world’s best institutional-grade real estate in a liquid form, managed by the world’s best-of-breed property management teams.

GREITs have delivered competitive risk adjusted through-cycle returns, including a prominent income component. The income component is supported by the fact that REITs have a legislated minimum dividend payout ratio in many jurisdictions.

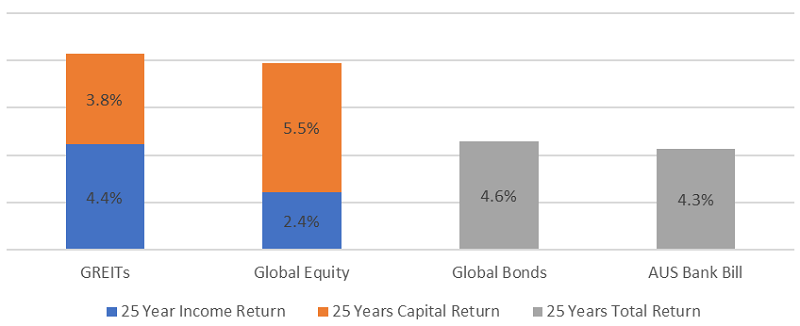

Furthermore, GREITS can add diversity to global bonds, equities and unlisted property exposures. The chart below highlights the performance of global equities versus GREITs and other asset classes over a 25-year period.

There are also many GREIT sectors such as warehouses, data centres and healthcare facilities which are not highly correlated with the domestic residential housing market.

25-year total return composition to 31 December 2021

Source: Factset. GREITS: FTSE EPRA NAREIT Developed Index in AUD. Global Equities: MSCI World Index in AUD. Global Bonds: Bloomberg Aggregate in AUD.

REITs against a backdrop of rising inflation

Rising inflation and interest rate pressures top the concerns on investors’ minds right now. The narrative painted by the investment management industry has periodically changed, ignoring previously-held tenets in favour of a new way of looking at issues sometimes contrary to the prior views.

I started out in the industry back in the 1980’s when interest rates were at double-digits. At the time the narrative was ‘property is a hedge against inflation.’ When inflation started to dissipate and interest rates fell, the narrative changed to ‘property is a yield play.’

Now we are once again hearing concerns about REITs in the context of rising rates and inflation.

To say that REITs are highly affected by interest rates is a convenient catchphrase that needs to be properly analysed. Interest rates matter to all investments and the consequences are complicated. Critical examination requires consideration of real estate market conditions and the shape of the broader economy, in a nutshell supply and demand, as well as the extent of the sector’s financial leverage, i.e., debt levels.

Whilst long-term interest rates do effect the cost of capital, and provided there isn’t excessive property vacancy levels, a growing economy should drive higher tenant demand to compete for limited space. Landlords can increase rents at least equal to or greater than the higher costs. In addition, higher building construction costs also mean that competitive new supply is more expensive to develop as the ‘economic rent’ a developer needs to underwrite a new project increases. Hence existing building owners are afforded some buffer to the threat of new buildings.

What we can say is that good property is capable of delivering competitive returns in inflationary environments, provided the underlying property has certain key ingredients, namely that it is relevant to the needs of a growing and healthy economy, and that supply is constrained. The key ingredients we look for are attractive supply and demand characteristics that create pricing power, strong balance sheets, and quality management teams capable of extracting the most value from the underlying land and buildings.

The Resolution Capital Global Real Estate portfolio is currently focused on strong secular tailwinds which benefit from dominant trends such as the ageing population, housing shortages and growing household formation rates and the growth in digitisation and ecommerce.

Two companies enjoying favourable trends

Welltower Inc. (NYSE:WELL)

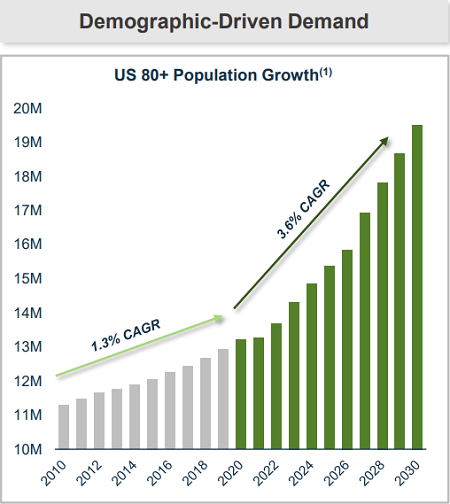

Seniors housing is benefiting from both cyclical and secular tailwinds. Aging populations along with moderating supply caused by COVID-19, rising costs, and less favourable construction finance provides a strong backdrop for existing landlords to grow rents and cash flows in the years to come.

Welltower is the largest diversified healthcare REIT in the US. Around 65% of its portfolio is concentrated in seniors housing.

Source: Greenstreet

Welltower’s balance sheet is strong with a net debt-to-EBITDA ratio of 6.5x, while management has impressively navigated through COVID in probably one of the hardest-hit sectors. Nearly all staff and residents are now vaccinated, and occupancy is recovering strongly following the initial COVID disruption.

Welltower is also expected to see occupancy recoup the 13% lost during the pandemic by the end of 2023, all the while growing rents above inflationary levels as prospective tenant demand for this demographically necessary housing format remains strong. With strong tenant demand in the face of moderate new supply levels, Welltower we believe should enjoy earnings growth above 10% in the next couple of years.

Prologis Inc. (NYSE:PLD)

The e-commerce trend needs no introduction and it has led to demand for warehouses like never before. In the domestic market Goodman Group (ASX:GMG) has been a market darling. It’s a great business, but relative to Prologis, we believe Goodman is trading at an excessive valuation.

Prologis is a global leader in logistics real estate with a property and development portfolio spanning over 90 million square metres located close to major population centres across 19 countries.

Changes in supply chain management should drive demand for warehouse space along two key thematical lines.

One, the ongoing reconfiguration of distribution channels to place greater emphasis on proximity to the end consumer. With same day delivery becoming more common, locations that minimise the cost and speed of distribution to the end customer are paramount.

Two, supply bottlenecks, symbolised by the record number of container ships that were seen sitting off ports around the world towards the end of 2021. This has led to the focus of supply chain management shifting from efficiency to resiliency, with a resultant increase in inventory levels stored in key locations.

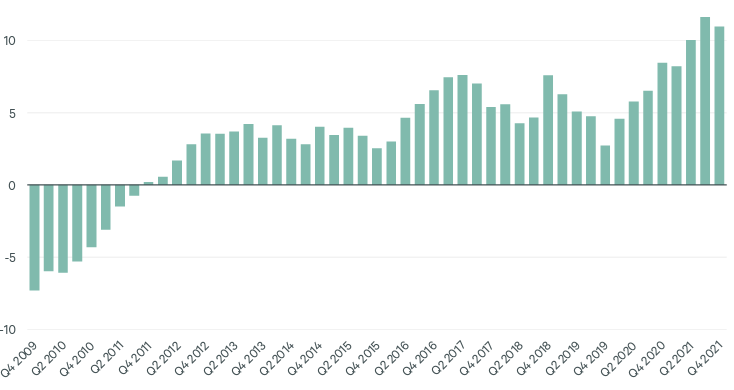

Prologis is a beneficiary of these trends which are driving exceptional demand for warehouse space, resulting in record low vacancy rates and substantial rental pricing power, particularly in urban in-fill locations.

US logistics average asking rent % growth (year-over-year)

With a strong balance sheet and conservative payout ratio, Prologis generates surplus cashflow to re-invest in new development projects without relying on external financing. Combined with portfolio rental income growth in the mid-single-digit levels, Prologis is well placed to deliver earning per share growth of around 10%pa, demonstrating its ability to meet or exceed inflation.

An additional pillar of portfolio strength

Following the impacts of COVID and the responses by health authorities and central planners, we view the economy and capital markets to be somewhat distorted. While no investor can claim to be prepared for all the knowns and unknowns on the horizon, the need for effective portfolio diversification is vital. Current events in Eastern Europe further highlight the constant that uncertainties are ever present.

We see limited evidence of heightened risks specific to GREITs. In general, commercial property vacancy rates are not excessive, supply is moderate and new constructions costs are increasing. Furthermore, and as a generalisation, REIT balance sheets are sound with moderate debt levels and limited short-term debt maturities.

For many years, the GREIT investment landscape has been largely dominated by institutions. We hope this asset class will be considered by a broader range of investors as we give access to some of the world’s best institutional grade real estate. It’s global bricks and mortar … that just happens to be listed.

Andrew Parsons is a Co-Founder and Chief Investment Officer at Resolution Capital, an affiliate manager of Pinnacle Investment Management. Pinnacle is a sponsor of Firstlinks. Resolution has launched the only active GREIT Fund in Australia (ASX:RCAP).

This article is for general information purposes only and does not consider any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on this information as the basis for making an investment, financial or other decision.

For more articles and papers from Pinnacle Investment Management and affiliate managers, click here.