Now we’re into 2016, investors are asking the question, “Are real estate markets peaking, or is there more upside in this cycle?"

Since the lows of the GFC, non-residential real estate and listed A-REITs (Australian Real Estate Investment Trusts) have delivered positive risk-adjusted returns. In fact, A-REITs have been the standout performer over the past five years, taking the title as the best performer in four of the past five years.

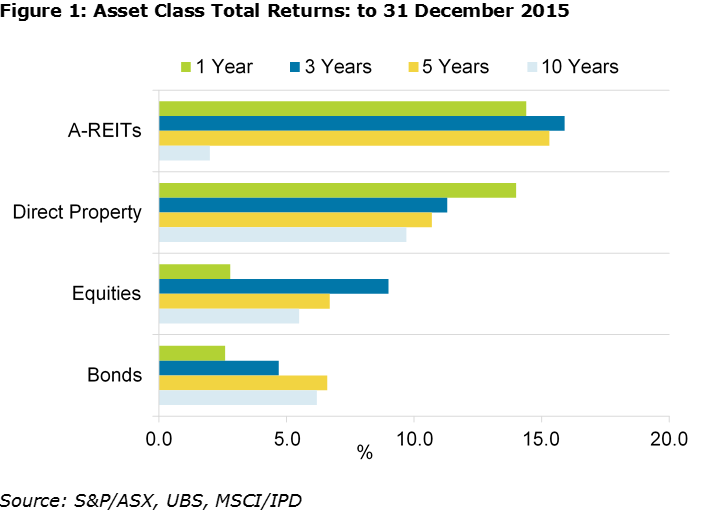

Over the five years to 31 December 2015, A-REITs delivered a total return of 15.3% per annum, more than double the 6.7% per annum from equities and 6.6% from bonds, and higher than the 10.7% from direct property, as shown in Figure 1. The one-year 2015 performance is also strong.

It is not surprising that investors are increasingly asking, “Is this as good as it gets?”

We believe the strong performance of both listed and unlisted real estate sectors won’t be repeated to the same extent in 2016, but we also believe that a major downturn is unlikely. The one caveat is if the volatility and negative investor sentiment that hit global financial markets in the first two months of this year returns, leading to a major tightening of liquidity in financial markets, then real estate, whether listed or unlisted, won’t be immune to the fallout. Having said that, prime real estate with secure income and strong A-REITs with quality assets and management will look relatively attractive.

Foreign investment set to continue

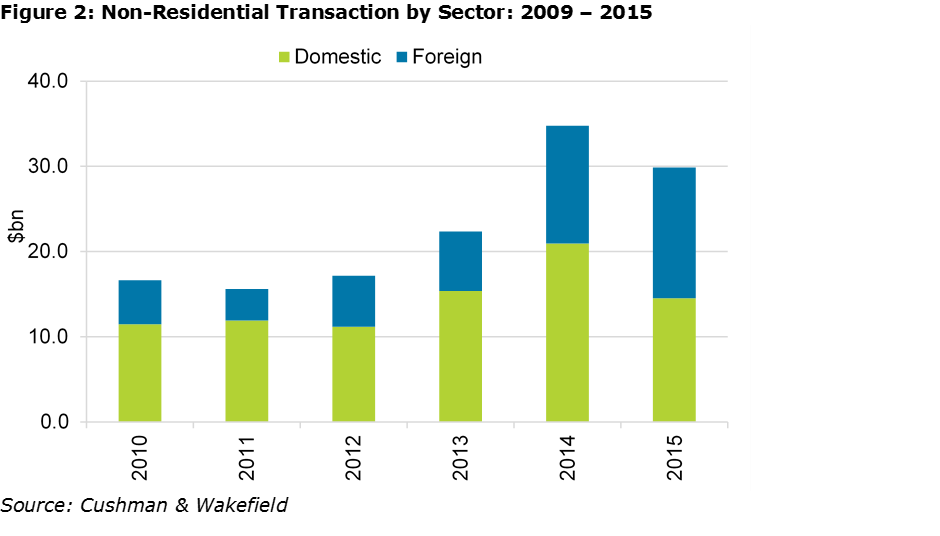

International capital was a feature of the Australian market in 2015 and will be again in 2016. According to Cushman & Wakefield, non-residential transactions topped $29.9 billion, with foreign investors accounting for just over 50% of total transactions by value, as shown in Figure 2.

Foreign investment activity in non-residential real estate (and also the listed A-REIT sector) has been growing steadily over the past few years driven by a confluence of factors, including:

- global investors chasing Australia’s relatively high yields

- Australia’s transparent and relatively stable market

- growth in Asia-Pacific focused real estate funds which are allocating capital to Australia as part of their regional mandates

- China’s insurance companies targeting real estate investments, together with a relaxation of restrictions on their international investing activities

- the decline in the Australian dollar.

A challenging year to deploy capital

International investors will continue to be active buyers in Australia particularly for prime office, retail and industrial assets, making it difficult for local investors who typically have a higher cost of capital to compete. We also see the listed A-REIT market as being attractive to foreign capital in 2016 for much the same reasons as direct real estate.

We are now seven years into the up-cycle, and we see less upside to many markets than we have in recent years. Valuations in the direct market are not cheap enough in many instances to reflect the risk we see from the macroeconomic headwinds.

We expect steady real estate demand across most non-residential sectors with the exception of Perth and to a lesser extent Brisbane, which are affected by the resource sector downturn. Notwithstanding cap rates are nearing pre-GFC lows, given the weight of money chasing real estate assets, capital values for quality assets (i.e. those with strong covenants, long leases and quality locations) will rise in the year ahead.

The availability of equity from domestic and international investors and debt from lenders will be critical. Should one or both of these sources of capital contract due to concerns about economic or capital market conditions, it could place pressure on values, especially for secondary assets unless there is a clear strategy for value creation.

The challenge in this environment is to avoid broad ‘beta’ plays on real estate (investing in the hope that the market uplift will drive asset performance) or simply taking greater risk in search of higher (yield) returns.

Given we are close to full valuations in some markets, earnings growth rather than yield compression will be the key driver of value creation going forward.

Investors seeking higher returns by taking on more risk may not be rewarded. Instead investors should focus on value-creation through active management of assets via releasing, repositioning or refurbishing. Now is not the time to stretch on price or overcommit to acquisition-driven strategies. Be disciplined and be patient. Sometimes being defensive, including raising some extra cash, is actually an offensive move as it creates optionality when the future appears most uncertain. In our view, the next 12 to 24 months could be one of those times.

We continue to believe that real estate related social infrastructure (childcare, seniors living, healthcare and student housing) will offer attractive investment returns in the coming year. The demographic drivers and a shortage of quality accommodation in these sectors will see investors increasingly look at these investments as a legitimate part of a real estate portfolio.

A-REITs still attractive as a defensive play

The A-REIT sector has generally been disciplined in its capital allocation, including:

- focusing on core investment strategies and not undertaking risky global expansion plays like it did prior to the GFC

- maintaining relatively low leverage

- employing sustainable pay-out ratios

- growing earnings through active asset management.

We expect A-REITs to deliver a total return of circa 10% in 2016, underpinned by a dividend yield of 5%. A-REITs present well on yield relative to the cash rate and other ASX-listed equity sectors and global REIT markets and should continue to be well supported given their relatively visible earnings and distribution growth.

To access the Folkestone 2016 Real Estate Outlook paper, please click here.

Adrian Harrington is Head of Funds Management at Folkestone (ASX:FLK). This article is general information and does not address the specific investment needs of any individual.