Investors are increasingly turning their attention to real estate social infrastructure sectors such as childcare, seniors housing (manufactured housing, retirement villages and aged care), student accommodation, government premises (police stations, courthouses, etc), medical and health facilities as legitimate investment options.

Positive drivers

The growth in real estate social infrastructure opportunities is primarily being driven by:

- demographic and social changes - our aging population is increasing the demand for seniors housing and health services, higher participation of females in the workforce and the growing number of 0-5 year olds is increasing the demand for childcare whilst the rise of international students is one reason the student accommodation market is booming

- the demand for better quality facilities – operators (tenants) and their customers are requiring higher quality facilities. For example, the childcare sector is moving from ‘child minding’ to early learning which is changing the design and layout of centres away from converted houses, the health care sector is being driven by advances in medical technology and procedures and the aged care sector, supported by government regulation on quality standards, is increasing the demand for higher quality aged care facilities

- government financing and budget constraints - the public sector’s ability to fund the level of infrastructure required to meet the needs of the community is under pressure and governments are increasingly seeking private sector participation

- relative high population growth rates and greater density and urbanisation of our major cities - increases the need for investment on social infrastructure assets that support communities both in the inner city and on the urban fringes and

- the growing realisation that operators should focus on their core business - managing and delivering services to the community rather than the provision, ownership and management of the underlying real estate assets.

Drivers add to the investment quality

Real estate social infrastructure is an attractive real estate investment given:

- relatively high yields – social infrastructure assets typically have yields of between 100 and 150 basis points higher than major office, retail and industrial assets

- attractive lease structure - a combination of a long duration initial lease term of circa 10 years plus, inflation protection given rental increases are typically linked to CPI changes and a triple-net structure which means that all capital expenditure and refurbishments related to the asset are paid by the tenant

- stickiness of tenants – tenants are inherently linked to their premises due, in many cases, to the specialised nature of the assets, particularly the internal fit-outs

- strong demand - the favourable demand drivers (noted above) for early learning, health and medical, student accommodation and seniors living

- government support - many of the social infrastructure sectors receive some form of government subsidies or payments and

- the attractive investment characteristics – social infrastructure assets typically exhibit low volatility and generate consistent cash flows as a result of the less cyclical demand drivers, and therefore, offer a low correlation with other asset classes, resulting in attractive diversification benefits for investors.

Risk of investing in social infrastructure

The benefits of social infrastructure assets need to be considered in light of the risks.

The key risk to investors is the specialised nature and often the critical importance of the operator leasing the asset. Owning a private hospital is a highly-specialised asset and having a well-capitalised and competent hospital operator such as Ramsay Health Care is critical. Successful investing in this sector requires a sound relationship between the operator (sometimes a government agency) and the real estate owner and an understanding of the underlying businesses operating within the facility.

Also, social infrastructure sectors to varying degrees have high levels of government regulation and intervention which are susceptible to change. However, this can also be a positive, especially if the government is partially or fully underwriting the cash flows of the sector.

While the increased operating leverage and other industry risks clearly warrant a risk premium, the sectors risk-reward profile has improved greatly as many of these social infrastructure sectors have grown and matured. For many of them, they are no longer a cottage industry. Consolidation of operators in the early learning, health and aged care sectors is well underway. Many of the operators are publicly-listed companies such as G8 in the early learning sector, Ramsay Health Care and Primary Health Care in the healthcare sector and Japarra, Regis and Estia in the aged care space.

Listed and unlisted investment options

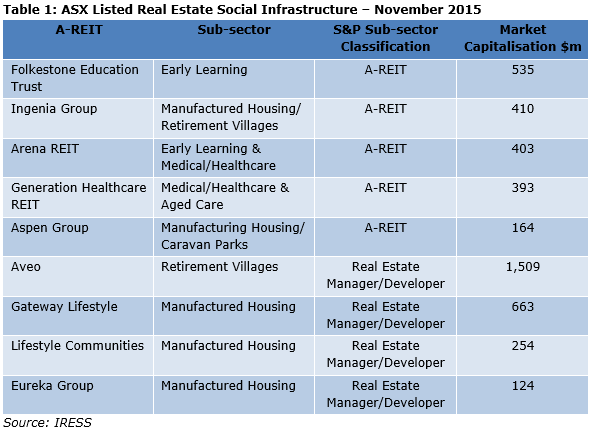

There are now five sector specialist A-REITs and four sector specialist real estate developers and managers listed on the ASX providing exposure to early learning, manufactured housing, retirement, aged care and health/medical (Table 1). It is early days, as these entities represent less than 0.5% of the entire listed A-REIT and real estate manager or developer sectors. By way of comparison, social infrastructure real estate represents more than 20% of the market capitalisation of the US REIT Index.

The performance of the social real estate focused A-REITs has generally been positive. The two best performing A-REITs in the S&P/ASX300 Index over the three years to 31 October 2015 were both real estate-related social infrastructure A-REITs – the Folkestone Education Trust (early learning) and Ingenia (seniors living) with total returns of 30.8% p.a. and 24.7% p.a. respectively, outperforming the S&P/ASX300 A-REIT Index’s 16.0% p.a.

The unlisted market is also embracing the real estate social infrastructure sector. Three notable unlisted social infrastructure funds are the Australian Unity Healthcare Fund which owns more than $760 million of hospitals, medical clinics, nursing homes, day surgeries, consulting rooms, rehabilitation units, radiology and pathology centres; the Folkestone-managed CIB Fund which owns a portfolio of police stations and courthouses leased back to the Victorian government; and the Transfield-managed Campus Living Villages Fund which owns a portfolio of student accommodation facilities in Australia, New Zealand, the US and UK.

Real estate is not only the big end of town

Much of the real estate media focus is on large office buildings, major shopping centres and infrastructure assets like toll roads and ports. Social infrastructure features solid demand drivers, the evolution of tenants from cottage industry operators and attractive investment characteristics. We expect real estate social infrastructure (both listed and unlisted) to attract more longer-term investment capital and become a viable component of many more real estate investment portfolios.

Adrian Harrington is Head of Funds Management at Folkestone Limited (ASX:FLK). This article is for general education purposes and does not address the needs of any individual.