Investors have a problem. Strategic Asset Allocation (SAA) does not sufficiently protect capital on the downside during stock market crashes, when protection is most needed. Unfortunately, most stocks crash together, regardless of their quality, sector or region.

This analysis uses US market data but it applies to a significant extent to the Australian market, and the lessons are the same.

Investors tend to ‘follow the market’ with their equities asset allocation. They buy more shares at the top of the market just before it falls and sell at the bottom when the market is about to recover.

Allocation Switch is a powerful risk mitigation tool

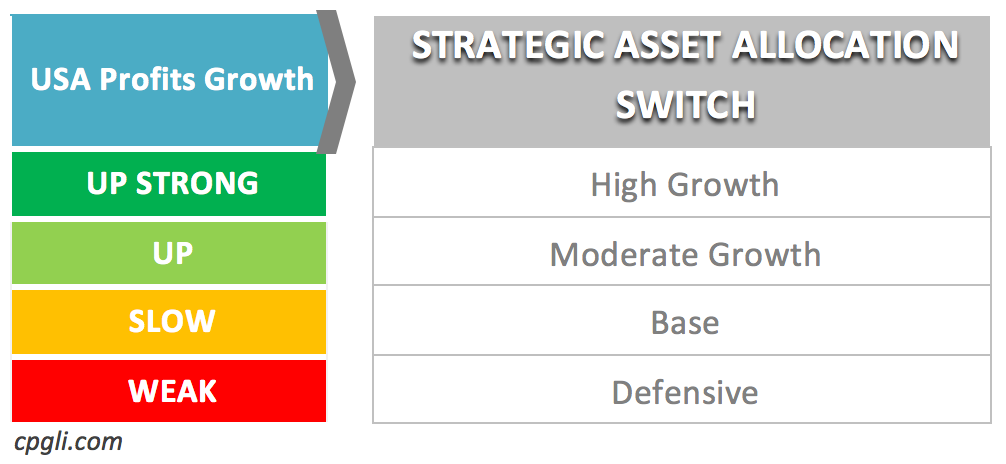

Investors should switch SAA in line with corporate profits growth trends. The allocation should be more defensive when profit growth is weak and towards a growth option when profits are clearly rising.

The Allocation Switch methodology requires switching the SAA every one to five years. The long periods between SAA switches make the strategy a powerful risk mitigation tool that financial advisers can use at their annual client reviews.

Allocation Switch follows the profits

Switching from ‘follow the market’ with asset allocations to ‘follow the profits’ is summarised in this graphic:

The Allocation Switch is particularly applicable to risk tolerant investors, who choose as default a High Growth SAA with maximum exposure to equities. Any switch by high growth investors can only reduce allocation to risky equities and, hence, reduce portfolio drawdown. Reduction in shares allocation can also result in lower returns but investors value downside protection more.

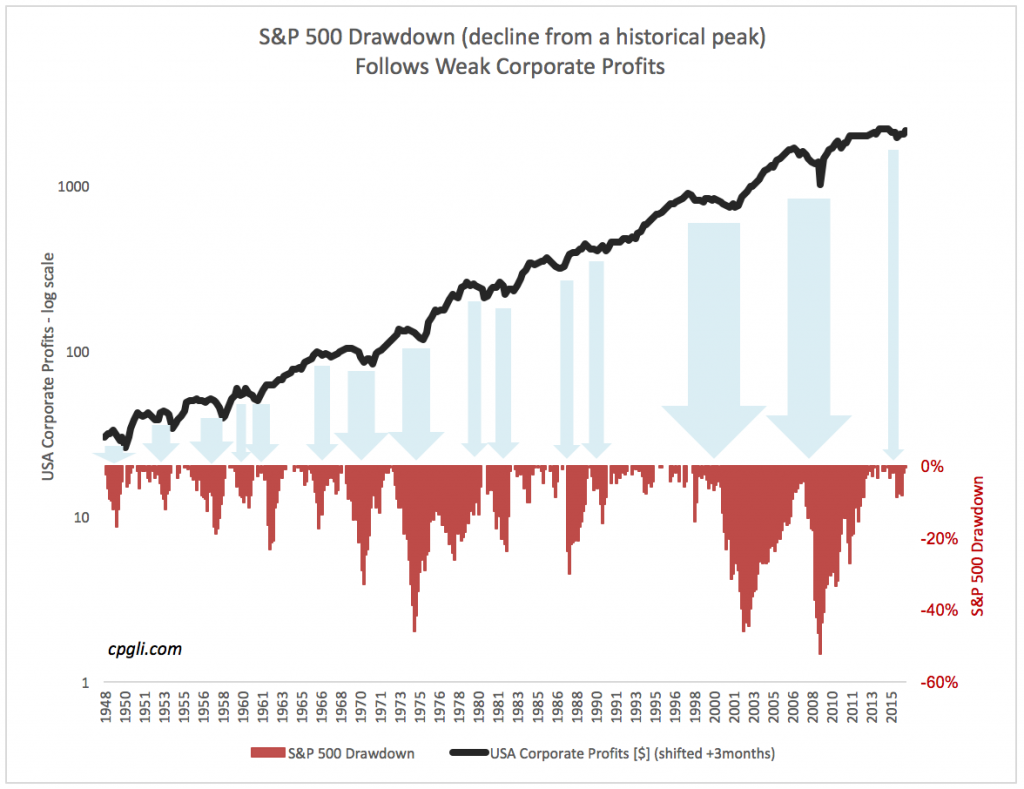

Historically, almost half of the ‘weak’ profits growth periods experienced a stock market crash with falls exceeding 20%. Chasing the last profits in a cycle with exposure to large drawdown is not worth it. The drawdown (defined as a decline in the market from an historical peak) deepened when profits growth was weaker, as shown the chart below.

No need to forecast

There are models that attempt to forecast profits growth. However, to implement the Allocation Switch in its basic form, investors can watch actual quarterly profits and switch the allocation in line with the main emerging profit trends.

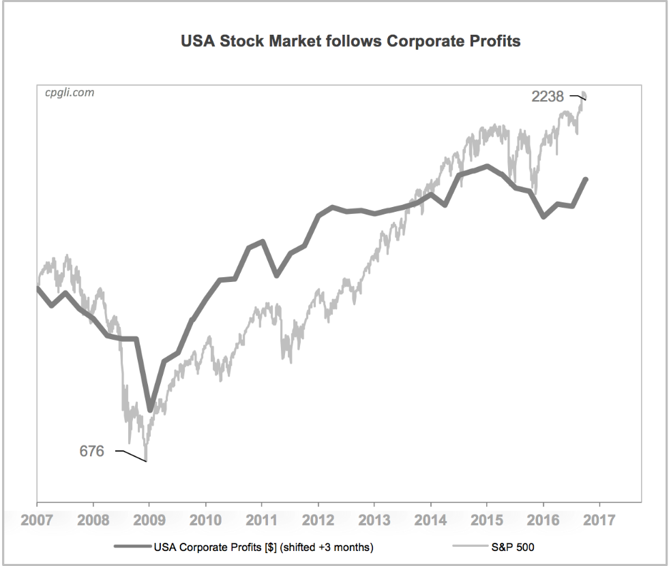

Over the past 70 years, the corporate profits for the whole USA economy were over 90% correlated with the S&P500 index, a representative of the broad USA equities exposure. Two lines trending together on the chart below depict the fundamental relationship during and post GFC.

The profits indicated on the chart are the seasonally adjusted National Income and Product Accounts (NIPA) Corporate Profits. They are calculated quarterly by the USA Government Bureau of Economic Analysis (www.bea.gov).

An SAA that is matched initially to the client’s risk profile (call it a ‘Base’ SAA) requires committing to the static asset allocation for the long term, typically 10 years. This commitment is in the hope that all asset classes should return their historical averages over time. In reality, the static SAA mantra of ‘staying put’ is not practiced by individual or professional investors, who quite often switch their asset allocation at a wrong time.

The Allocation Switch, based on corporate profits, calls for moving up or down (i.e. more or less exposure to equities) from the Base SAA option in response to changing market risk. It provides investors and their advisers with a rational tool to stop them making the wrong emotional re-allocation choices. In the process, application of the Allocation Switch to the initial Base SAA should reduce portfolio drawdown.

Investors sell at the worst time

Allocation adjustments are made irrationally at the wrong time by investors responding emotionally to extreme stock market swings, resulting in painful losses. Financial advisers are usually not involved in making re-allocation decisions but rather are blamed by investors for not trying earlier to protect them on the downside. Investors tend to panic when the stock market crashes 20% to 50% and many sell at the worst time.

Professional investment strategists who advise large fund managers are on average no different to individual investors in this regard. Perhaps they are also reluctant to stand up against the prevailing mood of the market, influenced by their fiduciary duties.

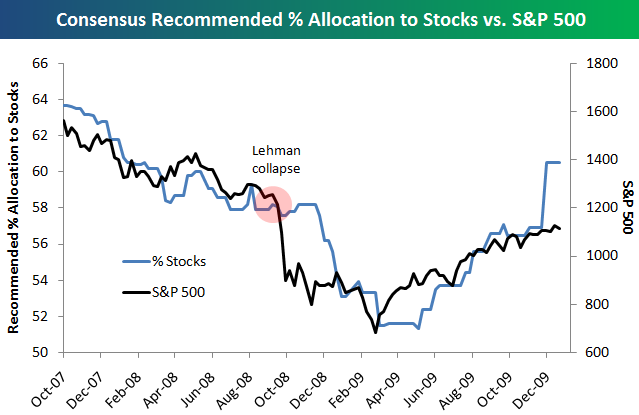

For example, consensus allocation to stocks on the chart below was reduced in line with the falling stock market through to early 2009 and then only gradually increased with the rising market.

Source: Bespoke Investment Group, Bloomberg Survey of Wall Street Strategists, Jan 2010. Reproduced with permission.

The point of lowest allocation to equities coincided with the March 2009 market bottom. Looking back, it was the best time to switch to a High Growth SAA option at the beginning of the multi-year V-shape rally.

Perception of risk depends on the state of the market

The SAA methodology measures risk in terms of a long-term historical average volatility without referring to current valuations. It implies that the market can move in either direction by the same magnitude from any entry price point.

But surely, the entry price does matter. And one does not need to forecast the market to know that the risk of a fall is bigger at very high valuations because history shows that markets are cyclical. Yet, static SAA expects the same allocation to equities at both low and high valuation entry points. Clearly, there is a need for rational asset re-allocation tools. Investors look at the drawdown of their portfolios on a given day when they think about their downside risk. Investors’ perception of risk changes with market performance.

Warren Buffett, among others, illustrated how irrational investor behaviour is. When we see a ‘sale’ sign in a shop, we rush to buy more of the goods at discounted prices and when prices rise we buy less. However, when it comes to the stock market, we do the reverse: we buy less when shares are cheap after a crash and buy more when shares are expensive and likely to fall. That is how humans react to painful loss thus there is a clear need for rational tools to counter such irrational and costly behaviour.

George Bijak, MBA, is Director, Investment Strategy for Sydney-based GB Capital Pty Ltd, see www.cpgli.com. This article is for general educational purposes and does not consider the circumstances of any investor.