Banks are walking away from major resources projects, super funds are dumping stocks based on human rights induced investment risks and climate change related shareholder resolutions are gaining 98% support.

Few in the investment industry have failed to see a change underway, as some of the nation’s largest investors start taking a more active role in understanding issues that were traditionally considered non-financial.

Environmental, social and corporate governance issues – or ESG – are attracting an ever-stronger focus by investors, companies and shareholders, and these factors are proving to be as critical to understanding market valuations as EBITDA.

It’s not about suddenly becoming ethical

This is evidenced in the advisory relationship between CBA and the Indian listed company Adani recently coming to an end, super fund HESTA selling down its stake in Transfield last week, and earlier this year, BP supporting a climate change resolution at its AGM, which attracted an unprecedented 98% of the vote.

No, the majority of investors are not suddenly becoming ethical investors. Recent trends highlight how these ESG issues are clearly core business risks that investors are closely monitoring as part of their investment decision-making. And yes, at times, they are choosing to sell out of companies (dare I say, divest).

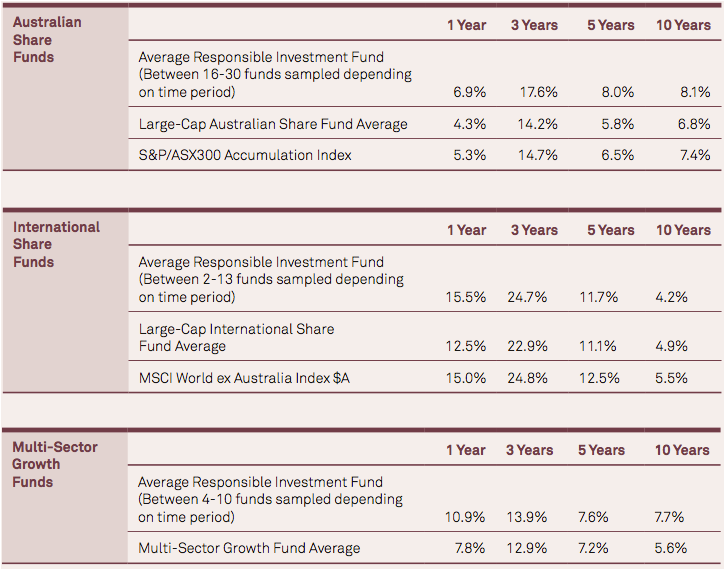

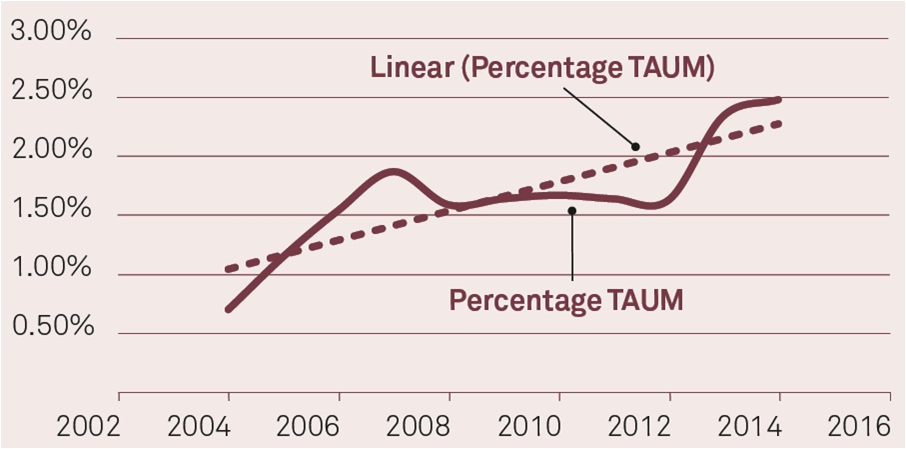

Responsible investment is a broad term that captures many different investment approaches, and an increasingly major part of Australian’s investment community. Indeed, the recently launched Responsible Investment Benchmark Report 2015 found that responsible investment strategies now sit atop 50% of professionally managed assets in Australia, at $630 billion in Assets Under Management (AUM).

The styles range from integrating ESG factors into investment decision-making (accounting for 95% of the $630 billion AUM), through to screening investments (positive, negative and best of sector), sustainability-themed investing, and impact investment. The last three categories accounted for $32 billion AUM at the end of 2014.

What investment action is really underway?

Uniting all of these investors is the commitment to systematically considering ESG and/or ethical issues as a core part of the investment decision-making process. Not instead of, but in addition to, deep systematic financial analysis.

According to CalPERs and many of the world’s largest asset owners, undertaking ESG becomes the requirement to win mandates, with those who don’t manage these risks having “a sub-par investment process”.

Nine of Australia’s largest 10 asset managers, and around 50% of the top 50 super funds have stated a commitment to understanding a broader set of risks and investment drivers than those reported in financial statements.

Source: Responsible Investment Benchmark Report 2015

This strong uptake is resulting in an increasing appetite in Australia to drive a variety of strategies to better understand and mitigate these risks. We’re seeing much greater corporate engagement, both direct and collaborative, between investors and listed companies, a strong focus on voting, as well as weighting portfolios, based on ESG factors (including carbon), allocating to sustainability-themed funds (e.g. green bonds, green property, sustainable agriculture and forestry), and selectively divesting of certain holdings or industries.

Perhaps best exemplifying the change currently underway is the rapid move of around 30 super funds over the past two years to sell out of tobacco stocks. This is notable in the way it signals a willingness to act strongly on certain issues.

It’s not only for institutional investors

One of the most interesting movements of all is the sudden awakening by retail investors (including charities, high net worth and family offices) to the fact that there are options to invest in line with their values and beliefs.

This segment of the market has lead a surge in retail demand for ethical investments that has seen AUM double in just two years, to $31.6 billion. Where there were four fund managers managing over $1 billion in ethically-managed AUM three years ago, there are now eight (and soon to be nine).

Source: Responsible Investment Benchmark Report 2015

To those in the super industry, it would not come as a surprise that the surge in consumer demand for these options comes when member engagement with their super seems to have started to improve. Polling tells us that a massive 69% of Australians expect that their superannuation is invested responsibly and does no harm. These are not ethical investors, but mainstream Australians who simply expect their retirement savings to be managed with their base level of values being respected. There are, after all, few out there who would put their hands up to profit off the production of cluster bombs or child labour.

As members of the public start to open the letters from their super funds to look at who they are invested in, there are increasing numbers who aren’t pleased with what they are discovering.

This retail story is inextricably linked with the institutional story as one feeds the other with growing momentum.

There are multiple drivers at play which are directing more consumers towards responsible investment products. With ethics and economics fairly closely tied together, this is delivering on investment outcomes.

Responsible investment is truly what a fiduciary should be delivering if they are deeply grappling with investment risks over all time frames in the best interests of their clients.

Simon O’Connor is Chief Executive Officer of the Responsible Investment Association Australasia (RIAA).