Most of you reading Firstlinks already understand the need to plan and the value of advice. It’s not always the same in the general community. Some people will say “advice is too expensive, I can get most of what I need online”, while others believe “there’s no use planning, you never know what’s ahead”.

Nine months ago, I came to understand the latter personally as my husband of five years was diagnosed with bowel cancer, which has since spread to his liver. He has just turned 61.

It has made me appreciate the value of advice and getting our finances in order well in advance of retirement. We had income protection, knew exactly where our super was, and how to access funds when we needed – I made the call to my financial adviser as soon as I got my head around my husband’s diagnosis and treatment plan. We are living proof that planning helps and advice matters.

My own research has been tracking the benefits of retirement planning over the past 17 years with a special emphasis on holistic models over the past 12 years. After the results came back from our latest project, I am more convinced than ever of the importance of planning that goes beyond just the financial aspects of retirement.

In this study, we developed three online modules (career, health, and finance) combined with individual consultations that aimed to help older workers to make more considered decisions about retirement.

Background to the study

As people approach retirement, money matters. But there are broader considerations, including when and how they want to leave work, do they want to leave the workforce permanently or do they want to continue to work part-time? If they plan never to retire, will their health help them to go the distance? These are not questions that a financial advisor can necessarily answer for any individual but having clients consider them ahead of time can help to crystallise thinking about what the best options are.

So, the key questions in the study focused on whether a holistic model that includes career, health, and finance could work better than finance alone? Can an online intervention help shift some of those retirement planning behaviours? Or is advice needed in addition to the online tools to really make a difference?

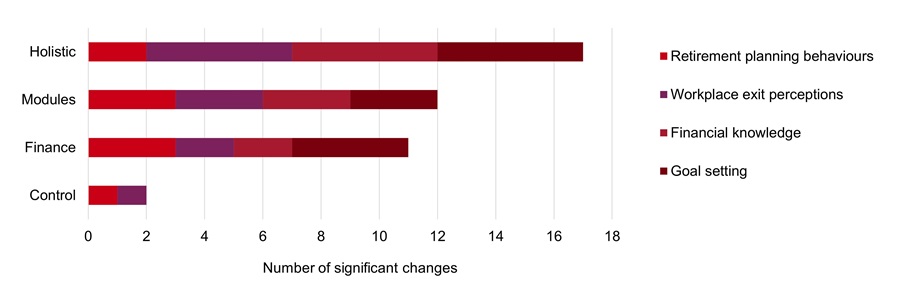

The study monitored several different metrics such as retirement planning behaviours, workplace exit perceptions, financial decision making, and goal setting.

The study compared four different groups of people: one group acted as a control and there were three experimental groups: online modules, online modules plus advice; finance only. The control simply completed before and after measures to see whether or not any of their behaviours had shifted over the passage of time. The online group completed three one-hour modules over a 3-week period: one on careers, one on health and the other on finances – this is referred to as the holistic group. The holistic plus advice group also completed the online modules but they attended advice sessions soon after completing the online modules too. The third experimental group completed the online finance module followed by seeing a registered financial adviser.

The results

All three interventions made a difference on some of the metrics compared to the control group. In terms of improvements to the metrics that were monitored, the greatest number of changes were seen in the holistic + advice group, then the online modules followed by financial advice group. Whilst all three experimental groups showed improvements in some of the metrics including financial literacy and estimates of net income, as well as striving to meet career and financial goals, it was the holistic group combining online training with advice that was most different to the control group. Differences were found on financial self-efficacy, estimated retirement spending, health goals, retirement age confidence and preparation for exit.

Put simply, older workers who completed the retirement planning course reduced their expected retirement age by an average of just over a year, felt more confident in making financial decisions and felt better prepared to leave the workforce.

The implications of the research are clear: as more Australians investigate retirement, there is an opportunity to expand advice models to include careers and health considerations alongside financial ones.

Questions remain about who is best placed to provide this advice. Should future advice models look to expand the expertise of financial advisers, or should we be aiming to develop multidisciplinary teams that include health and career practitioners? We will leave you to ponder that old chestnut.

Joanne Earl is a Professor of Psychology at Macquarie University.

Professor Earl and colleagues’ academic study can be accessed here. An 8-minute video on the study details is also available.

The online modules mentioned are now being offered publicly at a small cost and all the funds go back into research to keep the modules updated over the coming year.