For many, retirement means dream holidays, reading books and spending time with grandchildren.

However, for some Australians, the notion of enjoying their golden years after a lifetime of hard work hit a roadblock last year when COVID-19 struck and hit economies and markets hard. Many businesses were affected and the associated restrictions impacted employers, employees, profit margins and, ultimately, dividends. Retirees have been feeling the pinch, particularly self-funded retirees, and those that utilise investment properties as a source of retirement funding may also feel the effects with rental reductions and an influx of properties on the market.

Against this background, retirees still need to take measured risk to meet their goals, but they may need to plan differently than they would have in the past.

Why do investors need investment risk?

Regardless of retirement status, all investors face investment risk of some kind. Risk refers to the degree of uncertainty or potential financial loss that is inevitable in any investment decision. Typically, as investment risks rise, investors seek higher returns to counteract their own anxieties for taking such risks.

However, retirees usually view the world differently from when they were working, and perhaps the single largest change they experience is how they respond to risk. Typically investors are much more ‘loss averse’ in retirement, that is they fear losses much more than gains feel good.

Nevertheless, it is still necessary to take some degree of investment risk with their superannuation assets. If retirees opt to take little or no investment risk, then their investment outcomes will probably be less than needed to achieve their lifestyle goals.

Investment strategies need to take into account each unique risk profile. This profile includes risk tolerance, risk capacity and risk requirement.

Risk tolerance refers to an investor’s subjective attitude towards taking risk. It’s a measure of how they feel when markets become volatile and uncertain.

However even if people are willing to take the risk, they may in fact not be able to afford it - what they can actually afford is referred to as risk capacity.

And risk requirement is the amount of risk people need to take in order to achieve their desired returns.

A solid retirement strategy balances all three of these risk components.

Strategies designed for retirement

Of course, there is no single investment strategy likely to suit all Australians. Retirees need to take into account of their risk profile, their financial circumstances and objectives, the taxation system and Centrelink benefits.

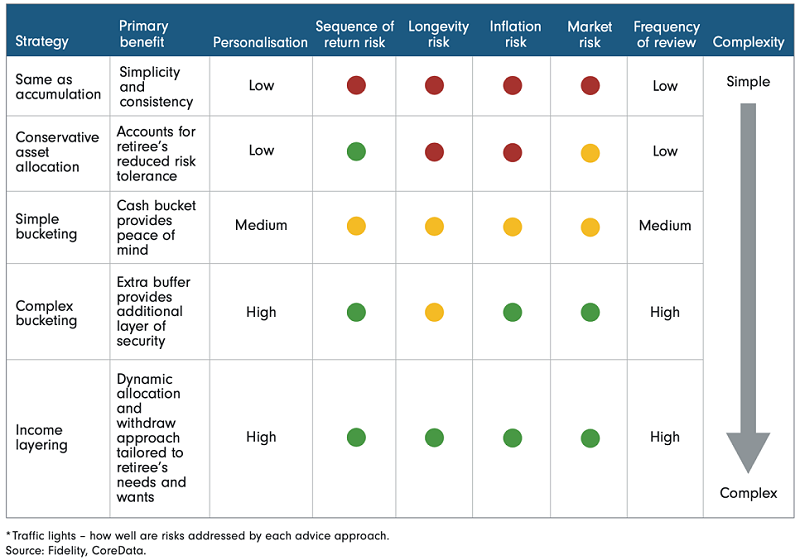

The spectrum of retirement investment strategies ranges from a ‘business as usual’ approach to a significantly more complex ‘income layering’. The spectrum allows for varying degrees of personalisation, and not all of them address all of the risks investors face in retirement.

The table below compares features of each of the most common approaches used by advisers for retirement strategies and how well each approach deals with the primary risks.

Strategy 1: Same as accumulation phase

This is a ‘business as usual’ approach and involves retirees simply extending the same investment strategy from the accumulation phase into the retirement phase. As the goal in the accumulation phase will usually be to maximise total return on investment, retirees opting for this approach implicitly remain long-term investors with the ability to continue to tolerate market risk.

This strategy potentially overlooks the sequence of return risk and fails to consider most retirees’ reducing risk capacity as they age.

Strategy 2: Transition to a more conservative asset allocation

Many Australians opt to move to a more conservative asset allocation strategy in retirement. Generally, retirees’ portfolios have a large percentage of the total portfolio allocated to low-risk and low-volatility assets such as conservative equities, fixed income and money market securities.

This strategy ultimately helps to manage the sequence of return risk, potentially making it suitable for retirees who value downside protection more than the upside growth. However, if the strategy is overly conservative, the relatively constrained upside potential of the strategy may expose investors to greater inflation risk.

Strategy 3: Simple bucketing

This strategy divides investors’ portfolios into separate components (or buckets) with each bucket serving different objectives.

A simple bucketing approach has only two buckets: a cash bucket and a diversified investment bucket. This approach provides retirees with a short-term cash buffer against market shocks. When combined with a rebalancing discipline this approach can be effective in providing the right amount of risk exposure whilst providing the investor with sufficient liquidity for their short-term needs during periods of market volatility. Investors can better manage both sequencing risk and market risk.

Strategy 4: Complex bucketing

Retirees seeking a more bespoke approach which divides accumulated savings into discrete pools with different objectives. The complex bucketing strategy also helps to manage retirees’ sequencing and inflation risks by segmenting the retirement savings pool into different time horizons.

This approach can be viewed as an asset-liability matching strategy as it seeks to match short-term liabilities (or spending requirements) with cash and short-term bonds, providing investors with confidence that money will be available when needed, even in declining markets.

It also seeks to match investors long-term liabilities (or expected expenses) with relatively long-term assets such as equities, with the aim of providing greater return and ultimately, the resources to meet their expected future spending needs. By not needing to draw on the long-term assets when markets are volatile, the benefits of compounding are able to come through with this type of strategy.

Strategy 5: Income layering

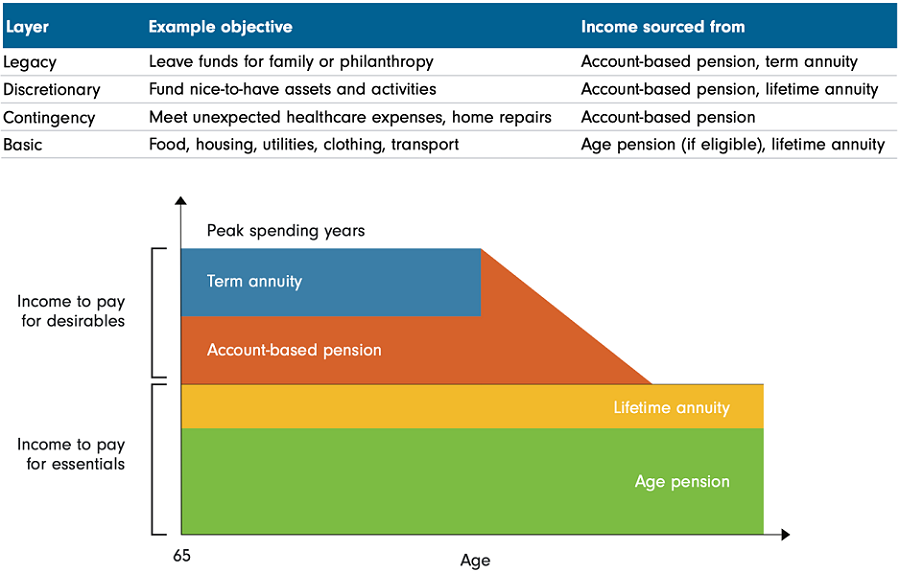

This strategy divides retirees’ portfolios into separate components, based on their spending needs for life. Spending needs can be grouped into four distinct categories: basic living expenses, contingency expenditures, discretionary expenses and legacy (children’s inheritance), as shown below.

Source: Challenger

This type of strategy matches investors’ income priorities with their spending priorities and separates their needs from their wants, while prioritising income accordingly. Term annuities or bond ladders can be used to provide the shorter-term income needs.

Conclusion

To summarise, a certain level of risk-taking is necessary for retirees to achieve their investment objectives and a solid retirement strategy balances all three components of a retirees’ risk profile, allowing them to sleep soundly at night without needing to worry about their investments.

Richard Dinham is Head of Client Solutions and Retirement at Fidelity International, a sponsor of Firstlinks. This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL 409340 (‘Fidelity Australia’), a member of the FIL Limited group of companies commonly known as Fidelity International. This document is intended as general information only. You should consider the relevant Product Disclosure Statement available on our website www.fidelity.com.au.

For more articles and papers from Fidelity, please click here.

© 2021 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited. FD18634.