There's a new contender defining how much savings and income are needed in retirement. For many years, the 'standards' for both have come from the Association of Superannuation Funds of Australia (ASFA), and they are regularly used by policymakers and financial planners in setting goals. The new standards from Super Consumers Australia (SCA), now in partnership with CHOICE, aim "to counter the established industry lobby groups". They claim that ASFA numbers are too high due to a vested interest campaign for more super so it is no surprise the SCA numbers are smaller.

We'd better not let them know what Firstlinks readers expect because it's a heck of a lot more than either of them.

The ASFA and Firstlinks results

ASFA's latest lifestyle standards required for retirees aged 65 to 84 are shown below and defined in more detail on its website.

The corresponding amount of assets required for the above 'comfortable' lifestyle is as follows, allowing for qualification for some age pension.

In our recent retirement survey of Firstlinks readers, the income required showed 62% need around $75,000 or more.

Firstlinks readers are way above average, which I guess is why they are reading this publication.

The SCA results

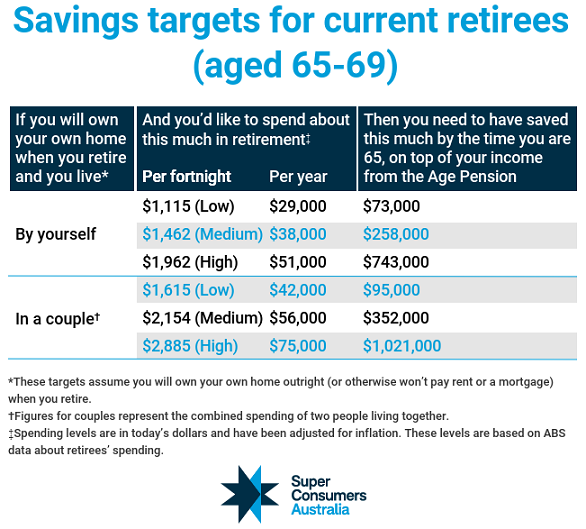

SCA defines savings targets to sustain a desired standard of living for people without a mortgage. SCA consulted widely among consumers, academics, regulators, industry experts and superannuation funds, and recognises that most Australians will access at least a part age pension. SCA said:

“These savings targets are based on what people spend in retirement with a buffer built in to provide confidence that people’s savings can weather the type of market volatility we’re currently experiencing. Having credible targets, based on actual spending, means people can confidently spend and get on with enjoying their retirement.”

SCA has ambitious goals for its research, expecting the targets to be used by the superannuation industry as part of the Retirement Income Covenant obligations "to help members make sense of their retirement income needs”.

Whereas ASFA sets a 'comfortable' level of assets required for a couple at $640,000 to give an annual income of $65,000, SCA says only $352,000 is required for its medium spenders requiring $56,000 a year.

SCA taking on ASFA

SCA directly criticises ASFA for "representing the superannuation industry", quoting the Productivity Commission which said the retirement income standard is "more than many people spend before retirement" and "no more than an arbitrary benchmark that should be ignored in policymaking".

The result is that middle-income earners need to compromise their living standards before retirement to achieve the ASFA levels. SCA also quotes from the Household, Income and Labour Dynamics in Australia (HILDA) surveys that 88% of recent retirees are financially satisfied or neutral about their retirement spending. Hence SCA looks more at actual spending rather than something higher and aspirational.

SCA argues ASFA ‘comfortable’ levels were designed for the top 20% of retirees, and create unrealistic expectations for most people. Based on the table above, SCA says a single person retiring between age 65 to 69 today would need to have saved $258,000 in super to draw a 'medium' level of income in retirement of $38,000 a year, including income drawn from super and the age pension.

Reaction from other media

The well-known 'Barefoot Investor', Scott Pape, quoted the SCA numbers in a recent newsletter, and then reports this response:

Wow-wee! Last week’s column – on how much you need to retire – triggered an avalanche of reader responses.

“That’s WAY TOO LOW!” “Are they eating baked beans in retirement?” “You need AT LEAST $1 million to do anything half decent in retirement!”

My view? The million dollar retirement number is a myth ... As long as you own your own home, you can live a meaningful, purposeful, retirement with much less money. After all, we have the amazingly good fortune to be living in the greatest country on earth, with a strong social safety net based on the aged pension plus subsidised medical and aged care."

Then Jessica Irvine, writing in The Sydney Morning Herald, said:

"If I were to cut out overseas holidays, eating out, gym fees and stop driving to work, I’m fairly confident I could get myself somewhere closer to the industry’s 'modest' standard. And that’s comforting, indeed. Learning how to live on less is definitely the most empowering thing you can do when it comes to setting yourself up for retirement. Don’t forget that once you’re retired, you’ll have more time to cook meals at home and less need to spend money to offset the stresses of work."

So how much do you need?

... is a different question to how much do you want? Our opinions must be influenced by our environment. Yes, a couple that own their home could live on the SCA 'low' spending level of $42,000 (which is remarkably close to ASFA's 'modest' of $43,000 despite the criticism), requiring only $95,000 of assets because the overwhelming majority comes from the age pension.

But when a 50-year-old sees a financial adviser, few plan to live on less than $1,000 a week. They outline a strategy to reach goals that finance a rewarding retirement with annual holidays, a new car every five years, eating out regularly, helping the grandchildren, drinking good wine and private health insurance to stay well enough to enjoy it.

Following the release of the SCA numbers, many in the media are accusing the superannuation industry of "fearmongering tactics" making Australians believe their retirement savings will be inadequate and they need to save more. Sure, in retirement, time with friends and family, walking on the beach and smelling the trees in the forests, are the greatest rewards, but it helps if you've got the money to do it in some style. Plan for it - it's amazing how much savings compound given enough time.

Graham Hand in Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any individual.