SMSF trustees are a heterogeneous group, choosing the vehicle for their superannuation because it offers control and flexibility. Although SMSFs account for 25% of all super balances, only 1.1 million people are SMSF trustees while over 17 million people have a super account. While almost any investment is allowed in an SMSF, a top-level picture can be drawn showing what SMSF trustees invest in, despite variances in data sources.

For the most part, SMSFs are genuinely ‘self-managed’ because the majority of trustees make their own investment decisions. Where guided by advisers, use of platforms and managed funds is higher because advisers use these structures to facilitate their own administration, giving a consistent back-office experience.

Similar but important differences in SMSF data sources

There are three main sources for top-level SMSF data:

1. Australian Taxation Office (ATO)

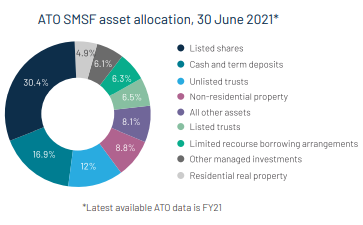

The ATO is the regulator for the SMSF sector and collects data on asset allocation, as shown below. As SMSFs lodge returns with considerable delays, the data is often a couple of years old, and some categories are highly aggregated. For example, it is impossible to know how much SMSFs invest in global equities based on ATO data because ‘unlisted trusts’, ‘listed trusts’ and ‘other managed investments’ are lumped together. Nevertheless, ‘listed shares’ is easily the top category at 30.4%, followed by ‘cash and term deposits’ at 16.9%.

2. Investment Trends

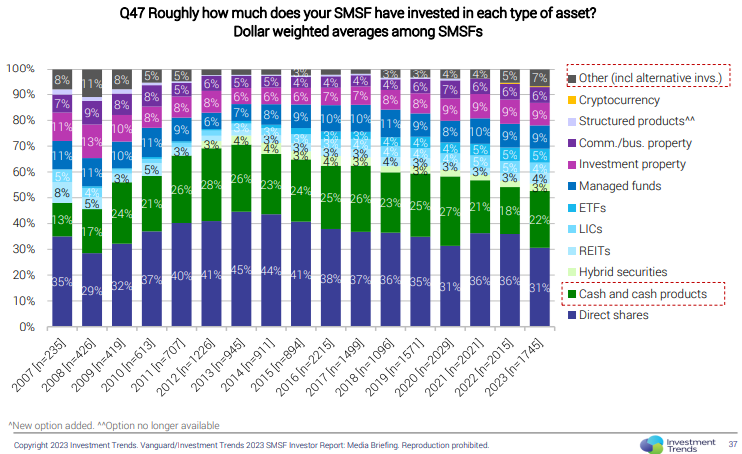

Research firm Investment Trends dives into the data at source by asking online a large sample of SMSF trustees about their portfolio. In the 2023 SMSF Investor Report, ‘direct shares’ are also the largest asset class followed by cash, and a combination of structures such as managed funds, ETFs and LICs make up the third category.

3. Class Benchmark Report

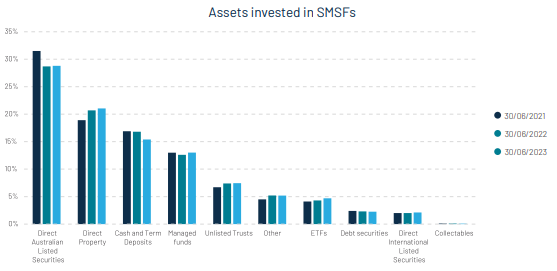

Class is a software provider to SMSF administrators, and of the $875 billion in SMSFs, Class covers about $310 billion across 185,000 SMSFs and 350,000 members. There is therefore a good sample reflected in its annual Benchmark Report, but it is probably the top end. Their average SMSF holds $1.7 million in assets with an average of $900,000 per member.

Class data shows about 28% of SMSF assets are in Australian listed shares but unlike the other sources, the second largest asset class is direct property, pushing cash and term deposits as low as 15% in third place. Then come the group of managed funds, ETFs and unlisted trusts.

What does the data tell us?

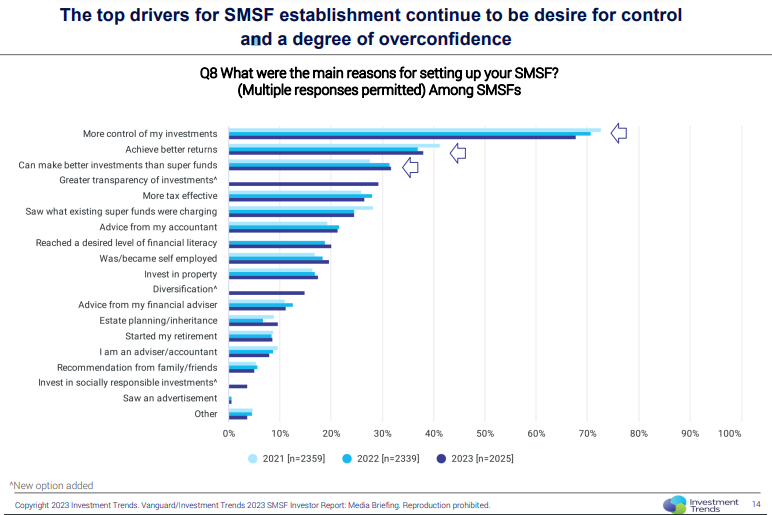

According to Investment Trends, only 27% of SMSF trustees use an investment adviser. The main reasons given are that trustees want to control their own investments, they lack trust in advisers and want to avoid the cost. In every survey on why SMSFs are established, control tops the list, and other strong factors include confidence in achieving returns, transparency of investments and tax efficiency.

In other words, most SMSF trustees are comfortable in their own ability and financial literacy and prefer to avoid the cost of an investment adviser.

The end result is that SMSF trustees buy Australian shares and funds they are familiar with, and leave a decent amount in cash and term deposits for conservative investment allocation and liquidity access reasons. They know, for example, that in pension phase, they are obliged to pay minimum pensions which require some level of access to cash.

What shares do SMSF trustee Invest in?

One additional benefit of Class knowing the exact investments of its hundreds of thousands of users is that data is available by stock and fund, which the other providers do not offer. In this snapshot, we divide investments into four categories: a) direct domestic shares, b) direct global shares, c) managed funds and d) ETFs.

(The following charts are sourced from the Class Benchmark Report 2023).

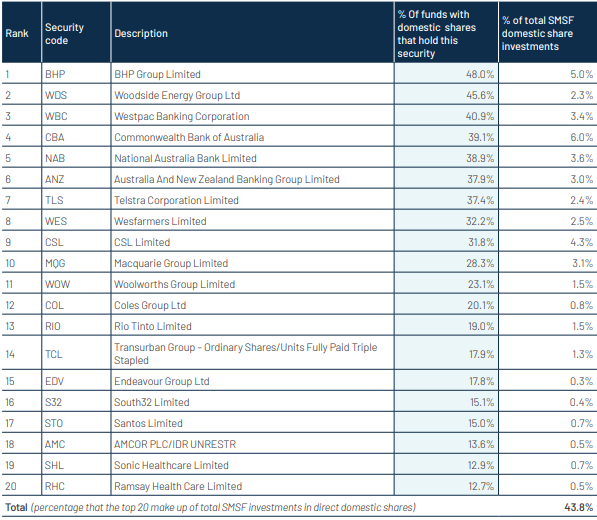

a) Direct holdings of domestic equities

About two-thirds of all SMSFs in the sample hold some allocation to the Top 20 domestic shares listed below as at 30 June 2023. BHP and Woodside are the most popular, followed by the four major banks, Telstra, Wesfarmers, CSL and Macquarie. Note this is popularity by number but the right-hand column shows the dollar amount invested, with CBA at number 1 and CSL rising to number 3.

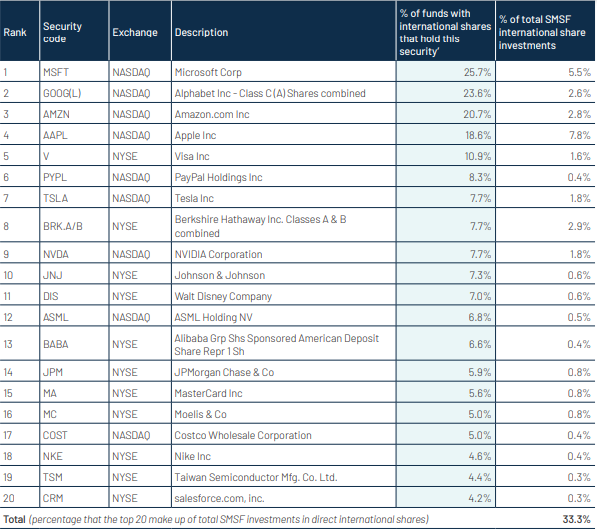

b) Direct holdings of global equities

Direct holding of global shares is much less common, comprising only 2.2% of SMSF assets and held by only 10% of funds. This number is often misunderstood because it does not show the extent of SMSF investment in global equities, as trustees normally invest indirectly through ETFs and managed funds.

But taking care to read these numbers correctly as direct holdings only, not via funds (and the percentages are ‘of international funds’, not ‘of total assets’), it is no surprise to see the tech giants of Microsoft, Alphabet, Amazon and Apple at the top. These stocks have performed strongly in 2023 delivering astute rewards for many SMSFs.

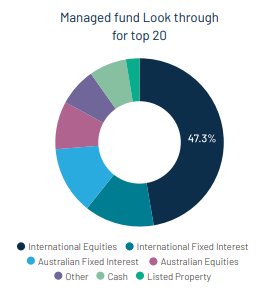

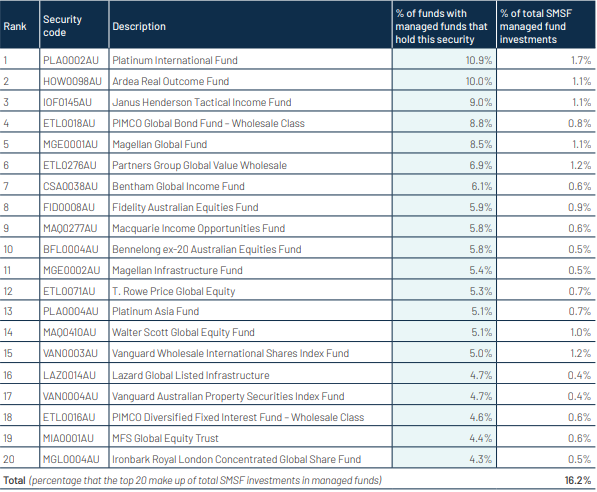

c) Managed funds

Although ETFs receive a higher profile, managed funds occupy a significantly larger proportion of SMSF assets (12.9%) than ETFs (4.7%). And confirming the point made above that Australians use funds rather than direct investments, almost half of managed funds are international equities.

Showing how it established an early lead under the high-profile Kerr Neilson, Platinum remains the most common managed fund in SMSF portfolios. The Ardea and Janus Henderson funds may not be as well known to many SMSF trustees but are favoured by financial advisers for their broad market exposures, with a PIMCO bond fund and the large Magellan Global Fund (non-listed version) rounding out the Top 5. Note again that the right-hand column shows dollar amounts in managed funds, not all assets.

d) Exchange Traded Funds (ETFs)

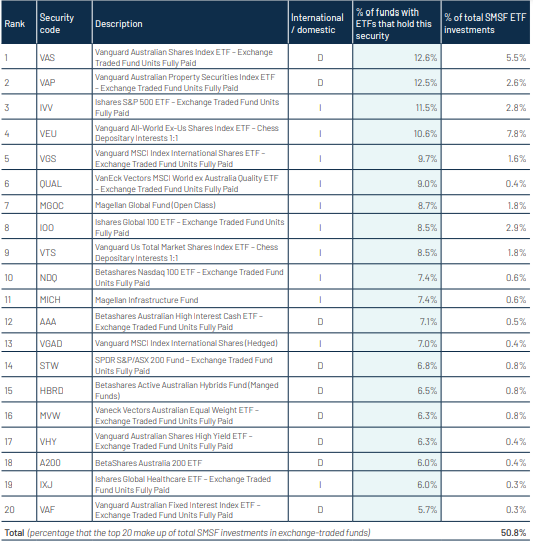

Fast-growing as a sector with now almost $160 billion under management, ETFs are still the new kids on the block compared with other asset categories, but again, almost half represent global exposures.

Most popular among SMSFs that use ETFs are two Vanguard funds, Australian Shares (ASX:VAS) and Australia Property (ASX:VAP) but the major ETF providers – Vanguard, iShares, VanEck, BetaShares and Magellan - are all in the Top 10. Notable exceptions from the broad-cap market indexes are VanEck’s Global Quality (ASX:QUAL), BetaShares NASDAQ 100 (ASX:NDQ), Magellan Infrastructure (ASX:MICH) and BetaShares Cash (ASX:AAA). Most of the Top 10 popular funds are international.

SMSF trustees doing their own thing

Trustees select SMSFs for the high degree of control and they can hold almost anything that looks like an ‘investment’, such as collectibles, wine, art and cars. A report by SuperConcepts in 2019 showed its SMSFs held weird investments such as frozen semen, ATMs, vending machines, water rights, cattle and taxi plates.

However, Class data shows a concentration of over 85% of SMSF assets in five categories: Australian listed shares, direct property, cash and term deposits, managed funds and unlisted trusts. SMSFs show a home bias due to familiarity with the investments and the franking credits regime.

The data indicates that of the 1.1 million trustees with 610,000 funds, the majority are doing their own thing, if not picking the shares directly, then identifying the active or index investments to look after their retirement savings.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information.