Australian Real Estate Investment Trusts listed on the ASX (A-REITs) entered the August 2015 reporting season with a black cloud hanging over the global financial markets. During the course of that month, both the global and the A-REIT sector experienced a roller coaster ride and by the end, the heavens had opened and markets across the globe capitulated. So how has listed real estate performed recently and over time?

A-REIT performance

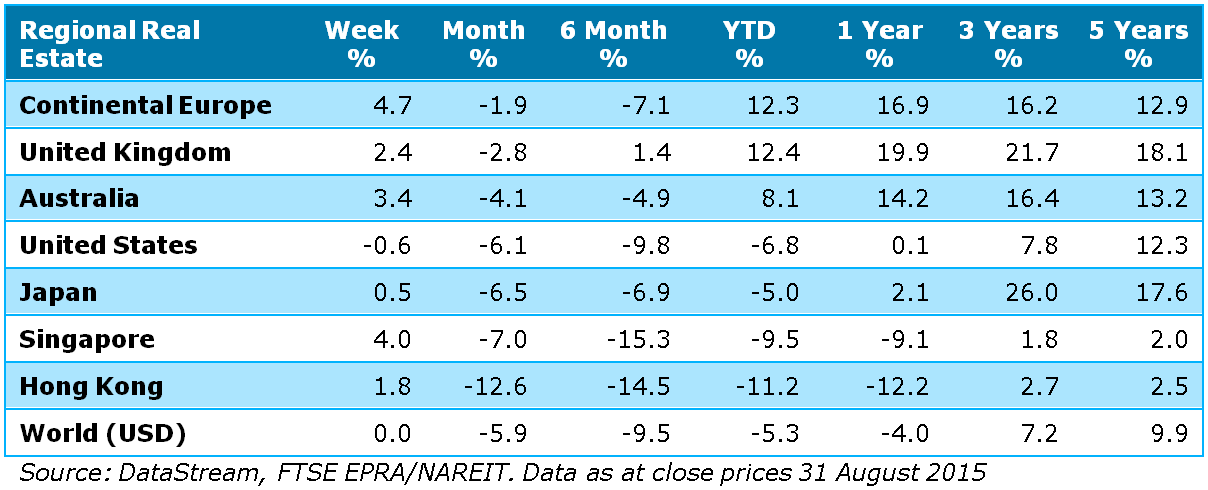

The A-REIT sector held up quite well and offered a relative safe haven amongst the market turmoil. Taking the global comparison first, in local currency terms, Australian A-REITs outperformed the global REIT index by 180bps (-4.1% vs -5.9%) (see Table 1). On both a year to date and one year basis, A-REITs have also done well compared to their global counterparts.

Table 1: Total Returns - Listed Real Estate (local currency): 31 August 2015

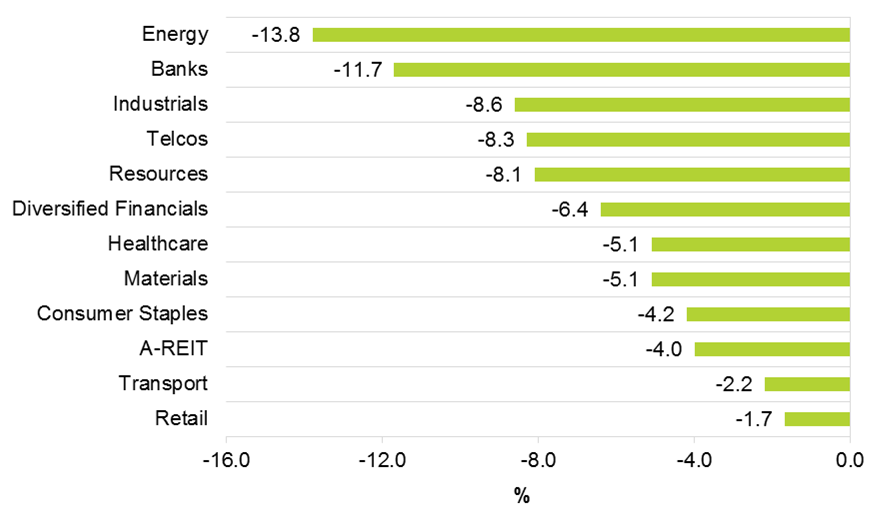

Turning to the domestic comparison relative to equities, A-REIT’s outperformed equities by 3.6% in August (-4.1% vs -7.7%), and over one year have outperformed equities by a massive 17.4% (14.2% vs -3.2%). Figure 1 shows there were few places to hide in the equity market sectors.

Figure 1: Total Returns – S&P/ASX300 Sectors: 31 August 2015

Source: Bloomberg

Despite posting two of the best results, the larger A-REITs in Stockland (-8.0%) and Mirvac (-7.4%) underperformed as investors focused on the growing headwinds in the residential sector. APRA investor lending controls, deteriorating affordability levels and Mirvac CEO’s frank assessment of where we are in residential cycle:

“Previous cycles would suggest that activity, i.e., volume of sales, should moderate over the next year or two by 15%. Importantly, we don't believe this will lead to price falls, but rather we expect price growth to moderate away from the high double-digit growth rate that it's been experiencing in recent years.”

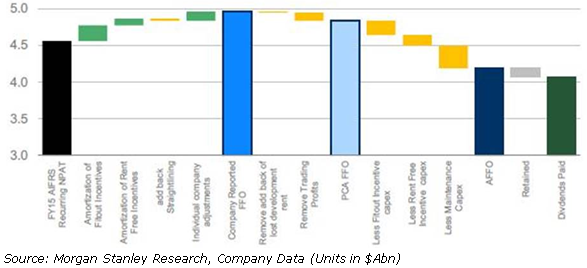

A positive for the sector was the move by many of the A-REITs to follow the Property Council’s Guidelines for Reporting and adopt Funds from Operations (FFO) to more closely align the underlying cashflow generated by the business with reported earnings. It has long been a frustration that there were so many inconsistencies across A-REITs particularly in relation to their treatment of tenant incentives (which for the office A-REITs remain elevated), trading profits and lost rent on developments to name a few.

Dividends and revaluation rates

In an environment where investors are focused on sustainable earnings and income, the A-REIT sector’s dividend remains sound. As Figure 2 shows the dividend yield is cash covered, even after adjusting for cash received from trading activities which are typically one-offs.

Figure 2: Reconciliation between NPAT and Dividend Paid - FY15 ($Abn)

As Morgan Stanley’s Research team point out, the A-REIT sector:

“… currently retains enough capital to fund ongoing capex requirements - despite an increase in the number of stocks supporting dividends via non-recurring profits (eg, trading profits) … FFO/DPS growth is likely to remain smooth and sustainable for the majority of A-REITs as the debt cost lever is likely to offset cyclical weakness in operating conditions or the year-on-year impact from trading profits.”

At the asset level, retail and industrial assets performed well with specialty retail sales growth stronger than it has been in years. Income growth from the office sector was the one negative, with rising tenant incentives offsetting FFO growth. Strong demand for real estate assets has driven cap rate compression, although there still appears to be a lag between A-REIT cap rates and recent market evidence (the Chinese sovereign wealth fund, Chinese Investment Corporation’s $2.45bn acquisition of the Investa office portfolio on a 5% yield and Ascendas, a Singaporean REIT’s, $1.1bn acquisition of the GIC industrial on a sharp yield of 6%). This should support further increases in the carrying value of A-REIT assets in the year ahead.

Memories of the GFC remain

Capital management remains high on the agenda for both the A-REITs and investors. The GFC may have been seven years ago but fortunately memories still remain. Across the board, capital management is much better now and A-REIT’s balance sheets are in a stronger position. With record low interest rates, the A-REITs have not been tempted to increase gearing (with some exceptions such as Cromwell following its acquisition of the Valad Europe funds management platform). In fact, the A-REIT sector’s gearing fell almost 2% in the past year to circa 30%. At the same time, a number of the A-REITs took advantage of the yield curve to blend and extend their interest rate costs. Lower debt costs will continue to be a key earnings driver in FY16.

M&A activity could prove a positive catalyst for A-REITs in the year ahead. Rising asset values, historically low interest rates and intense competition for assets means that A-REITs will find it increasingly difficult to grow organically.

After the sell-off in August, the valuation of A-REITs looks more attractive. At the end of August 2015, the sector was trading on a FY15 cumulatively-adjusted EPS/DPS yield of 6.4%/5.3%, a healthy premium to bank bill rates (yielding around 2.2%) and 10-year bonds (2.7%). This is above the average distribution spread over the past ten years, normally less than 2%. The sector was trading on a 3% discount to Net Asset Value and a 27% premium to Net Tangible Assets (in fact, most funds are trading at a premium to NTA). Given the number of stapled securities in the sector who have funds management and development platforms that are not captured in the NTA, the NTA as a measure is becoming less relevant.

Stock selection as always remains key. Quality management and portfolios, together with conservative balance sheets and sustainable earnings growth, are fundamental, especially with financial market volatility expected to continue.

Adrian Harrington is Head of Funds Management at Folkestone Limited (ASX:FLK). This article is for general information only and does not take individual investment objectives into account.