People tend to observe the world through a deterministic lens, with outcomes determined to be a consequence of a series of logical and ‘inevitable’ steps. In reality, the path of history is chaotic, with outcomes hugely sensitive to small changes in, and interactions between, thousands of variables. Future uncertainty and the fact that infinitely more things can happen than will happen, is the nature of investment risk.

Macro trends versus stock picking

Some investors spend a great deal of time trying to predict macro trends. Where will the S&P 500 be at the end of 2018? Will the Fed raise rates three or four times? Will ‘FAANG’ (Facebook, Apple, Amazon, Netflix, and Google) or ‘MCBM’ (McDonald’s, Caterpillar, Boeing and 3M, apparently pronounced ‘macbim’) continue to outpace the market? But the chaotic nature of investment renders predictions unproductive at best and harmful to your long-term financial health at worst.

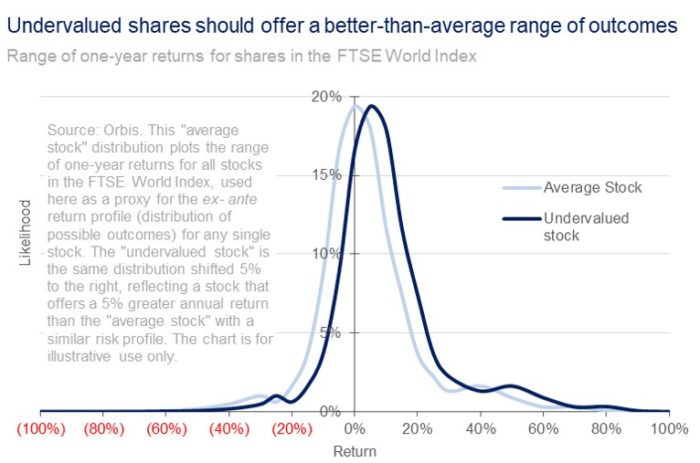

Rather than forecasting macro trends, a better approach is to estimate what a business is worth via an assessment of the likely range of outcomes for growth and cash flow over the very long term for that business. If we can find instances where we believe a share price embeds a significantly less optimistic outlook for the fundamentals of the company than our estimate, then we will buy the shares. If we are successful, we create a selection of investments that have a range of outcomes that are superior to that of the average stock. An estimate of future returns might look like the chart below.

We cannot know the outcomes for any share in advance, but the estimated distribution is based on real data and should be a reasonable approximation. Such a chart shows the degree to which ‘uncertainty’ or ‘risk’ will likely dictate the outcome for any single investment. The high ‘noise to signal’ ratio highlights the importance of careful position-size management as well as identifying a number of uncorrelated mispricings in order to diversify risk.

It also illustrates why ‘lumpy’ fund returns are almost mathematically certain, irrespective of how much skill you have in identifying undervalued stocks. It is also extremely rare to find manager ‘hit rates’ (the ex-post ratio of winners to losers in a portfolio) that exceed 50% by any meaningful degree. Too many ex-ante ‘good decisions’ will end up as ex-post losers, purely by chance.

The share selection approach is especially apt today, an environment in which we find attractive opportunities in the less predictable areas of the market.

One illustration: XPO

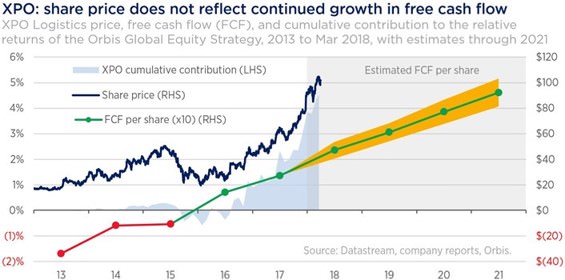

XPO Logistics, currently the largest holding in Orbis Global, is a good illustration. It has been the biggest contributor to Orbis Global’s performance over the past 12 months and is among its top ten contributors since inception in 1990. Today, at $102 per share, XPO’s price has more than quadrupled since our initial purchase in 2013.

But it was hardly an obvious opportunity at the time. The company had negative tangible book value, negative earnings before interest, tax, depreciation, and amortisation (EBITDA), negative cash from operations, and negative free cash flow (FCF). We developed a deep conviction in management’s ability to create significant long-term value for shareholders through the company’s aggressive acquisition strategy in the transportation and logistics industry.

Many of our analysts vocally challenged the thesis and argued that we should sell the position. A firm with a consensus-based system would probably not have owned XPO. Similarly, those with more dogmatic approaches to valuation or style would likely have avoided the stock. And it would have been hard for many to stick with the position during the uncomfortable period when it wasn’t adding value in the short term. As the chart below shows, performance doesn’t come in a straight line and that’s why a long-term perspective is so critical. Fortunately, we empower stock pickers to express unpopular views and to stick with them in the moments of greatest opportunity.

Through strategic vision, savvy capital allocation, and strong execution, management has built XPO into a global logistics leader with highly differentiated technology and capabilities in the area of contract logistics. In particular, the opportunity to provide logistics services to e-commerce customers, which are a source for nearly a third of XPO’s revenue, is driving approximately 10% per annum organic revenue growth for XPO. This is likely to fuel mid-teens growth in EBITDA and 20-30% growth in FCF.

Even this enthusiastic outlook for XPO’s prospects does not give any credit for management’s ability to create incremental value through additional acquisitions, something management is actively pursuing. With an exceptional track record, there is significant potential to build on its tiny 1.5% share of the trillion-dollar global logistics market.

Selection diversity

Assessing that the range of outcomes are favourably skewed far from guarantees a pleasing realised return. Nobody can forecast accurately what will unfold in the coming years. The long-term value XPO is able to unlock from its acquisition and e-commerce strategies over the next decade will be sensitive to a number of unpredictable variables.

Volatile outcomes are a natural and inevitable consequence of active investing. Investors need to look through shorter-term gyrations and focus on the long term with a spread of stock selection.

Graeme Forster is Portfolio Manager at Orbis Investments, a sponsor of Cuffelinks. This report constitutes general advice only and not personal financial or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person. It reflects Orbis’ views at 31 March 2018 and Orbis may have bought or sold any of the investments referred to.