A strong reporting season vindicated our expectations of a continued economic rebound underpinned by high consumer savings rates and a clear path emerging from the east coast lockdowns.

There will be some pockets of weakness, but the impact on the broader listed environment is likely to be seen as ‘one-off’ in nature as we can see plenty of pent-up demand for reopening trade – travel, hotels, restaurants - heading into the festive season. On costs, however, we suspect the current inflationary environment will be more than just transitionary and likely an ongoing theme.

Beneficiaries or victims of this environment?

The major highlights of reporting season were the banks and some retailers delivering strong updates along with the dividends paid out by some of the big resources companies. Specifically, the sustainability of the sales line surprised a lot of people with some of the retail stocks.

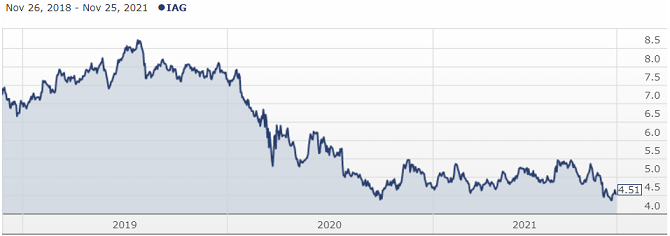

The major banks are still very well capitalised, but we generally prefer the general insurers as we start to see price rises in motor and home insurance. Suncorp delivered a strong result and while there were some concerns about IAG, they were bullish on the commercial insurance business. We have been big beneficiaries of Suncorp’s performance whilst IAG continues to offer strong relative value.

Medibank Private (ASX:MPL) has momentum in the core brand, with annual growth reported in policyholders for the first time since listing. The main driver of this is the significant reduction in churn. We would expect this to normalise somewhat going forward, but the company is still expecting policyholder growth in the core brand in FY22. The company continues to be conservatively provisioned for the expected uplift in hospital utilisation once we are through lockdowns. This is despite returning some of these excess provisions to customers during FY22, which should also assist with retention. It should be noted that the market is a little bit sceptical of whether this is a new trend or whether it's just a response to COVID-19 as people think more about their health and consider protecting themselves.

Looking forward, Qantas is a stock we also like. Not only is the company well positioned for post lockdown travel, but we feel that Qantas has the ability to increase its market dominance and market share in Australia, which is a very big profit driver for the national carrier. Key competitor Virgin is now owned by private equity and air travel will be characterised by more rational and profitable competition within the duopoly they enjoy. However, we acknowledge that lots of things can change around domestic and international travel. We were pleasantly surprised at how well Qantas performed during lockdown. We've seen some of the reopening trades actually retrace but Qantas continues trading at high levels.

Post reporting season, expectations are for growth to continue, and this will be strengthened as the uncertainty around lockdowns is removed. Discretionary retailers have seen sales hold up far better than expected but the jury is out on to what extent COVID-19 lockdowns pulled forward future sales. Our view is mixed on the discretionary retail sector leading into Christmas as online retailers must again contend with brick-and-mortar shop fronts.

It also seems likely that lockdown-wary consumers will start directing their spending away from buying more electronics or furniture to experiences and services, such as offered by companies such as Flight Centre and Event.

Inflation in parts of businesses

Our view is that whilst there is a lot of pent-up demand in the system, and we feel that the economy is rebounding quite well, there are risks in the form of rising costs and the potential for interest rates to rise sooner than expected.

Companies we speak to are seeing inflation in various parts of their businesses, for example, in the supply chain because of disruptions, freight and other inflationary pressures on input costs. We continue to be mindful of higher interest rates and how these will likely impact on various companies and sectors moving forward, especially those companies and consumers who have levered up during a long period of record low rates.

Inflation is a positive for many stocks, especially resources, and we have selected a range of these for our investors especially where demand/supply imbalance is highly supportive of the business longer term. This includes nickel and copper markets where structural demand will be high for years due to high usage in electric vehicles, which will increasingly replace petrol cars.

One area where we have been doing a lot of work is the decarbonisation theme. This is top of mind given what we are seeing in energy prices currently, especially in Europe. The transition to a net zero world will be expensive and consumers will have to pay more. Some regions are putting up trade barriers to reflect the different paths. In Europe, the proposed Carbon Border Adjustment Mechanism is one such example.

This is highly inflationary and whilst it protects domestic industries, products such as cement - where technology to drive a significant step down in emissions has yet to be developed - will need to simply wear higher costs. We therefore expect a bumpy ride as a range of shocks, disruptions and policy decisions rumble through global markets.

Finally, to assist investors with the trends and themes they should know before investing, Perpetual Asset Management has produced a special edition eBook. With the reopening across major developed economies on track, the eBook explores where to next for Australian shares. Download the eBook for more information on topics such as:

- The role of deep research in active portfolio management

- More than a rebound: why inflation is here to stay

- Disciplined management being the key to good governance

- The six red flags to watch for when looking to invest

To download a copy, click here.

Paul Skamvougeras is Head of Equities and Portfolio Manager (Concentrated Equity, Pure Equity Alpha, Pure Value) at Perpetual Asset Management, a sponsor of Firstlinks. This article contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. Stock charts are provided by Morningstar.

For more articles and papers from Perpetual, please click here.

Media Release, 29 November - Perpetual Asset Management Australia launches Active ETFs.