The Australian Labor Party (ALP) proposal to limit cash refunds of franking credits will clearly impact many pension phase SMSFs, but we believe it also has the potential to impact many other superannuation funds.

In this paper, we build a model of the key variables which determine whether a superannuation fund is likely to lose refunds of net franking credits under the ALP proposal. Our model is consistent with and helps explain an article in The Australian which reported that $309 million in franking credit refunds were paid to over 2000 APRA-regulated superannuation funds, including 50 (out of a total of 240) large APRA funds, in 2015-16, impacting 2.6 million member accounts.

The ALP proposal

On 13 March 2018, the ALP announced a proposal to abolish the net refunding of franking credits to Australian investors other than for charities and endowments. The initial proposal was expected to impact 1.17 million individuals and superannuation funds and generate $59 billion in government savings over 10 years.

On 26 March, the ALP revised their proposal in the light of significant public criticism. Direct investments by welfare pensioners (part and full on aged, disability and other Centrelink pensions) were also excluded, ensuring 306,000 pensioners will continue to receive cash refunds. SMSFs are also exempt if they had at least one welfare pensioner before 28 March 2018. We understand this exemption does not apply to other superannuation funds.

Which super funds are affected?

Note that franking credits themselves are not abolished. Australian investors can continue to use franking credits to offset income tax payable and for a superannuation fund, contributions tax payable.

The ALP believes the main superannuation funds impacted by this proposal will be pension phase SMSFs. However, ATO taxation data (as quoted in The Australian) and analysis of APRA statistics show that many APRA-regulated funds will likely also be affected. This implies the impact may be far broader than initially predicted.

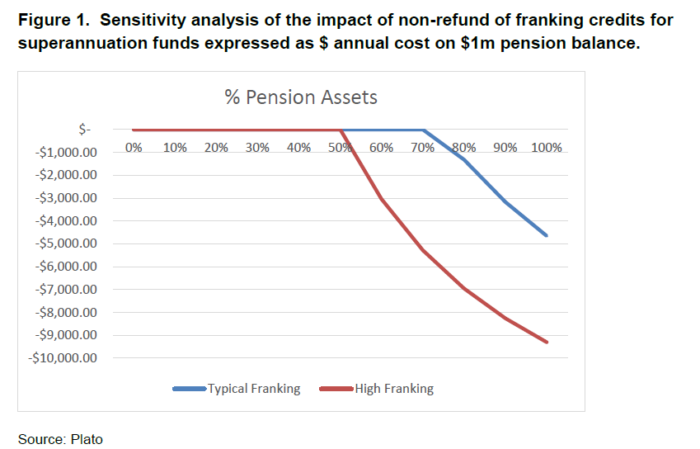

We have built a superannuation tax model under which we undertake sensitivity analysis of the key drivers to losing franking credit refunds and their potential magnitude.

Franking credits will be lost if total tax payable by a superannuation fund is less than franking credits received. Tax payable is a function of tax on investment earnings on the accumulation portion of a fund, as well as contributions tax payable on normal contributions. The percentage of pension phase assets, the level of taxable earnings and the level of contributions will vary from fund to fund and may vary from year to year.

For example, taxable investment earnings will be largely determined by the state of investment markets. The level of franking credits can also vary between funds and over time. We base our estimate of the typical impact of imputation assuming an average SMSF exposure to Australian shares based on March 2018 ATO statistics of 31%, and the franking credit yield of the S&P/ASX200 Index which has averaged approximately 1.5% pa over the 10 years to December 2017.

Investors with higher allocations to Australian shares, or allocations to higher-yielding Australian shares could earn even higher levels of franking credits. They stand to lose more if franking credit refunds are denied. In our sensitivity analysis we double the level of franking credits in our high-franking scenario.

Loss of refunds depends on pension v accumulation and franking levels

We then varied the proportion of a superannuation fund devoted to pension and accumulation as well as the levels of franking credits, contributions tax and taxable income [1].

Figure 1 illustrates the outcome of our sensitivity analysis varying the proportion of pension assets and the level of franking credits.

Clearly funds with 100% pension assets will lose all their franking credits. We estimate that for a typical level of franking credits, funds with 70% or less in pension assets should not expect to lose franking credits. For funds with double the typical level of franking credits, this number drops to 50%.

If accumulation phase (or 15% taxed) members aren’t paying contributions and therefore aren’t paying contributions tax, funds are more likely to lose franking credits. Funds with higher levels of taxable income would be less likely to lose franking credits. Higher levels of taxable income are usually associated with strong markets or the realisation of capital gains.

The number of funds impacted will vary from year to year in response to the level of investment returns. When investment returns are very low or negative, tax on investment earnings will also be low, increasing the chance that the value of franking credits received by a fund exceeds tax payable.

Accordingly, when investment returns are low, a higher percentage of superannuation funds may miss out on some or all of their franking credits, exacerbating the low investment returns.

The winners and the losers

We find that the loss of franking credits is likely to be positively related to:

1) The percentage of assets in pension, with maximum loss at 100% pension assets, but losses starting to occur from 50% to 70% pension assets

2) The level of franking credits generated by the underlying assets (the more franking credits generated the more likely you are to lose some).

The loss will be negatively related to:

3) The level of taxable income generated from the underlying assets (with losses in franking credits more likely in periods of weak investment markets meaning investors may receive a double hit to returns)

4) The level of contributions and contributions tax payable by accumulation members (the less contributions tax payable the more likely a fund loses franking credits).

Our model explains why The Australian reported that 50 large APRA-regulated superannuation funds (out of 240) received net refunds of franking credits in the 2015/16 tax year.

Mature funds may suffer most from loss of refund

Our model finds that any relatively mature superannuation fund, where maturity is defined by the percentage of member balances in pension mode, may be in a net franking credit refund position.

While many SMSF members have been vocal critics of this proposal, we believe members of other superannuation funds probably don’t even know they receive franking credit refunds (they are not reported on investment summaries) and probably won’t know whether they might miss out on franking credits should this proposal be enacted.

We suggest these members or their advisers should ask: Will my superannuation fund lose net franking credit refunds?

Finally, we believe that as the superannuation industry matures as a whole, as more members migrate to pension status, the loss of franking credit refunds will impact a growing number of people, be they members of government, industry, retail or SMSFs.

As such we believe this proposal may represent a ticking time bomb for the whole superannuation industry.

Dr Don Hamson is Managing Director at Plato Investment Management Limited. This article is for general information only and does not take account of any person’s financial circumstances.

1. We vary pension proportions in rests of 10% from 0% to 100%. For franking credits we used a normal level of franking credits as discussed above and then we doubled the level of franking credits to reflect a higher exposure to Australian shares and/or a higher franking yield from the Australian portfolios. We use two levels of contributions – none (reflecting for instance pension phase SMSF with greater than $1.6 million balances per member) and 7% of the accumulation balance which attract contributions tax of 15%. Similarly, we varied the taxable income level which can be caused by (for instance) realisation of capital gains. Full details of our assumptions are available on request.