After-tax returns are the real measure that matters to investors. However, the funds management industry is configured to present investment returns on a pre-tax basis and this can lead to the underpricing of franking credits. For example, over the six tax years to June 2022, the Cromwell Phoenix Property Securities Fund (Fund) has delivered franking credits that have ‘topped up’ investors income by an average of 0.51% per annum but that extra is not normally quoted in performance numbers.

This article takes a closer look at franking credits and how they can help to maximise your after-tax returns.

The theory

Some of the stocks held in the portfolio are traditional corporates, subject to Australian tax, and are therefore likely to generate franking credits under the Australian dividend imputation scheme. These are valuable to investors and should influence how the portfolio is managed.

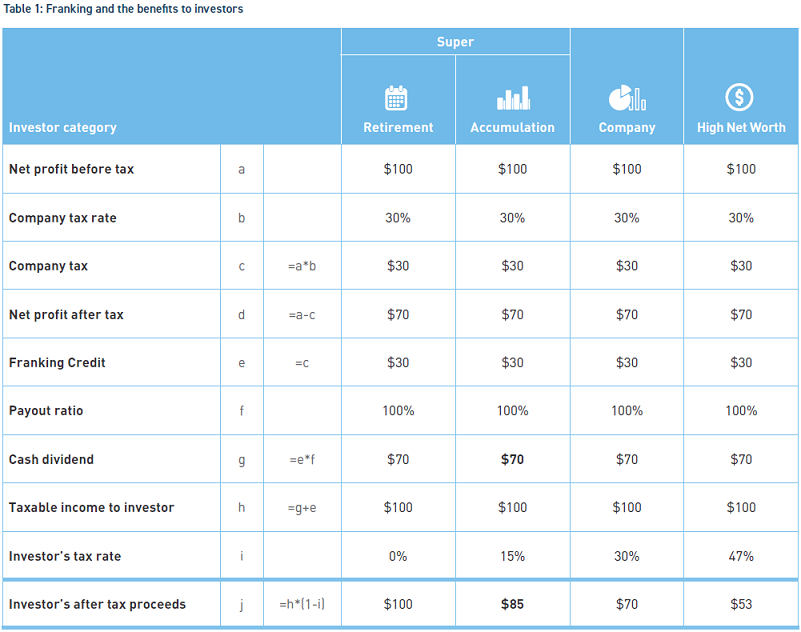

The table set out above shows the impact, with each column representing a different investor category. For example, the second column, labelled ‘Accumulation’ shows how a super fund investor in accumulation phase receives $85 of after-tax value from a $70 fully franked dividend. The performance figures for a fund only capture the $70 of cash dividend. The uplift goes unreported but is clearly valuable.

In practice: Goodman Group versus Charter Hall Group

Goodman Group (ASX:GMG) (Goodman) and Charter Hall Group (ASX:CHC) (Charter Hall) are both Australian listed property securities that derive earnings from a combination of rental income, development and funds management activities. Goodman is focused on industrial property and is diversified geographically with operations in the US, Europe and Asia in addition to Australia and New Zealand. Charter Hall is diversified across multiple property sub-sectors, but the business is focused geographically on Australia.

There are of course many other differences between these two companies, but Charter Hall’s domestic focus results in its corporate earnings being subject to Australian tax. Charter Hall is a stapled security that includes both a trust and a company but only the company pays a franked dividend, so the overall franking level is less than 100%. The last dividend paid by Charter Hall Group in August 2022 was 45% franked.

Goodman’s global business, on the other hand, will likely pay at least some tax in foreign jurisdictions, and these tax payments will not carry franking credits. For instance, Goodman’s last dividend was 0% franked.

All else equal, an Australian investor should prefer the domestic business, because their after-tax returns will be higher.

Sometimes it gets even better

The Cromwell Phoenix Property Securities Fund holds a position in property development company Sunland Group (ASX:SDG) (Sunland). Sunland has been a profitable business for many years and has retained some of its profits to grow the business and it has built up a significant franking credit balance.

Following a strategic review, Sunland has elected to wind up its business and return all capital to shareholders. Phoenix likes the business and management team and we believe the company has been an excellent steward of shareholders’ capital.

A wind-up of the business may seem like a drastic step, but the sharemarket has never really valued Sunland appropriately. The stock price has traded at a material discount to the book value of the company’s assets for most of its listed life, thereby ascribing negative value to the goodwill of the business. Furthermore, a sizeable franking credit balance has also been ignored by investors. For a tax-aware investor like Phoenix, we find this appealing.

At the risk of over-simplifying the transaction, as Sunland goes through the process of completing projects and selling inventory, it will pay out all cash proceeds as a combination of fully franked dividends and a return of capital.

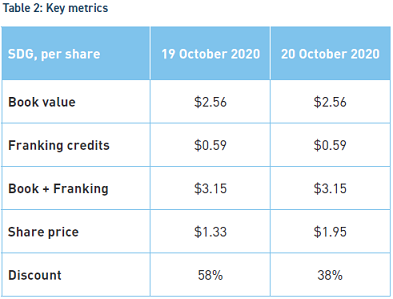

Table 2 shows some key metrics immediately prior to the announcement of the Sunland Group Strategic Plan, and the share price reaction to the announcement on 20 October 2020. This is now about two years ago but it shows the opportunities when the franking credits are undervalued by the market, as well as misunderstanding the company's value

Despite the strong share price reaction to the announcement, we lifted exposure to the stock given the increased certainty of the recognition of value.

Over the subsequent period, Sunland has made significant progress towards its strategic goal and has recognised further profits from the sale or completion of several development projects, such that the eventual outcome is likely to be even better than the original estimates.

For Australian taxpayers on low tax rates, such as super funds or foundations, the value of such a transaction is ‘super-charged’. Pun intended.

Portfolio construction needs to consider a myriad of factors and most of them require estimates of the future. At least with tax and franking credits, the framework for analysis is reasonably steady, and a tax-aware strategy can deliver more certainty in an uncertain world.

Stuart Cartledge is Managing Director of Phoenix Portfolios, a boutique investment manager partly owned by staff and partly owned by ASX-listed Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.