In his 2022 Berkshire Hathaway shareholder letter, Warren Buffett discussed the ‘secret sauce’ to investing, highlighting growing dividends at two of his long-term holdings: Coca-Cola (NYSE:KO) and American Express (NYSE:AXP).

Berkshire bought shares of Coke for a total cost of US$1.3 billion in 1994. The cash dividend that Berkshire received from Coke in that year was $75 million. By 2022, the Coke dividend paid to Berkshire was US$704 million.

Of this, Buffett said: “Growth occurred every year, just as certain as birthdays. All [business partner Charlie Munger] and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.”

American Express has been a similar story. Berkshire completed the purchase of the company’s shares in 1995, also for US$1.3 billion. Annual dividends from Amex grew from US$41 million then to US$302 million in 2022.

The dividend growth from these companies has been incredible for both Berkshire and Buffett. The dividend from Coke grew 9.4x over the 28 years to 2022, at a compound annual growth rate (CAGR) of 8.3% per annum (p.a.).

The 2022 dividend from Coke represented an annual yield of 54% on Buffett’s original purchase price (it’s now 60%). In other words, for every dollar that Buffett invested in the company, he’s now getting 60 cents in annual dividends. In total, he’s received US$10.72 billion in dividend income, against a cost of US1.3 billion, and he’s used that dividend money to buy stakes in other businesses and shares through the years.

Likewise, American Express grew dividends by 7.4x over 27 years, at a CAGR of 7.7%. Buffett is now getting an annual dividend yield of 23% on his original purchase price.

The wrong conclusion to draw from this is that Buffett bought these companies for their dividends. He didn’t. Amazingly, Coke did offer close to a 6% yield in 1994 because Buffett bought it on the cheap. By contrast, his purchase of America Express was when the stock was on a yield of about 3.2%.

But Buffett purchased Coke and American Express because of their ability to grow earnings over the long term. The dividends were merely a by-product of the earnings growth. Without the earnings power of the companies, dividends wouldn’t have been able to increase at the clip they did.

Earnings drive dividends

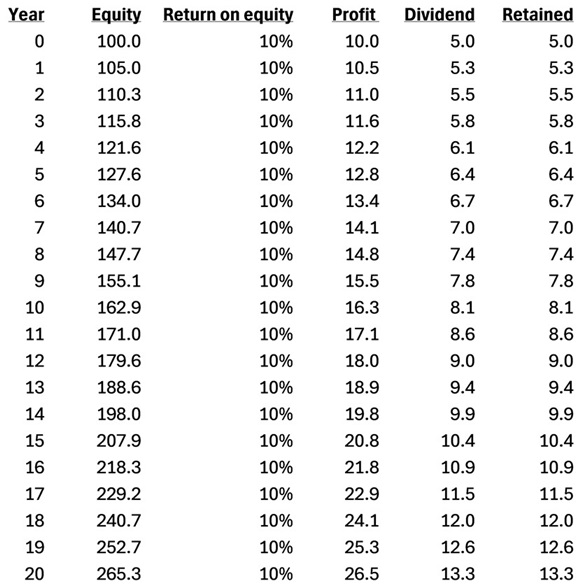

An example can illustrate the point. Let’s take a stock called ‘Good Dividend Yield Corp’. The business has $100 dollars in equity, and it makes a reasonable return on that equity of 10%, resulting in $10 worth of profit. Of that profit, it pays out 50% as a dividend, equivalent to $5. It retains the remaining $5 in earnings for reinvestment in the business.

I buy this stock for $100. That equates to a price-to-earnings (PE) ratio of 10x and a dividend yield of 5%.

By year 20, the company has increased profits to $26.50 from $10. Dividends are up from $5 to $13.30, at a CAGR of 5%. By year 20, the annual dividend yield at cost for the business is 13.3%.

If the shares trade at a similar PE ratio of 10x, they would be worth $265.50 in year 20. That would equate to a share price return of 5% p.a. ex-dividends. Not too bad.

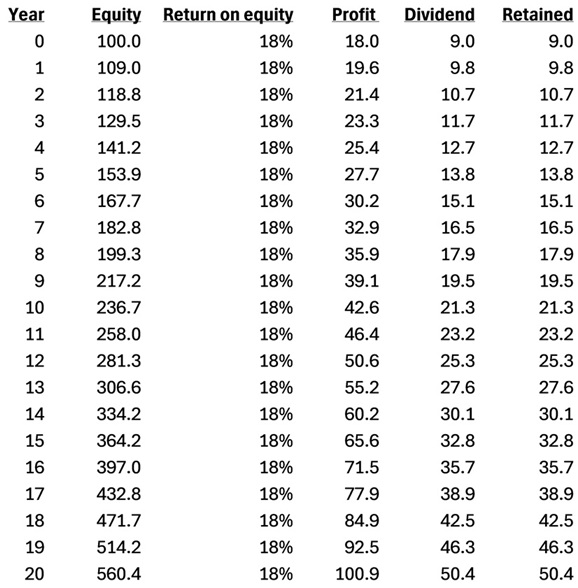

Let’s now look at another company called ‘Faster Growing Corp’. This business has $100 in shareholders equity but earns a better return on equity of 18%, resulting in net profit of $18. Of that profit, it pays out 50% as dividends, equating to $9. It retains the remaining $9 in earnings for reinvestment in the business.

I buy this stock for $350. That puts it on a PE ratio of 19.4x – not cheap but probably fair given the growth in the company. The dividend yield is 2.6%, lower than I’d like.

By the end of year 20, ‘Faster Growing Corp’ has increased profits to $101 from $18, up 5.6x, at a CAGR of 9%. Dividends have followed suit, growing from $9 to $50.40 over the same period, also a 9% CAGR.

By year 20, the annual dividend yield at cost for the business is 14.4%. In other words, though ‘Faster Growing Corp’ had a dividend yield about half that of ‘Good Dividend Yield Corp’ in year 0, the yield at cost for the former had risen to more than latter by year 20.

That’s not the full story, though. If we assume the same PE ratio for ‘Company B’ of 19.4x at year 20, the stock price would be $1,941, up from $350 at initial purchase, equivalent to a return of 9% p.a. ex-dividends.

By the end of year 20, ‘Company B’ has a higher dividend yield at cost, a faster growing dividend, all the while having achieved a higher total return over the preceding period.

The lesson is that earnings drive dividends. You want to own businesses that can grow earnings over the long term and pay out a portion of those growing earnings as dividends over time. By doing this, you stand a chance of being in the enviable position that Buffett is with Coke and American Express.

Another way to maximise dividend income

The other overlooked aspect of dividend investing is the importance of reinvesting dividends.

Now, the great Warren Buffett doesn’t reinvest the dividends from his stock holdings. That’s because he takes that money to invest in other businesses which he thinks can offer even better returns.

I’d suggest that you don’t follow Buffett’s example here. Buffett is an exceptional investor and that’s why he does what he does.

For mere mortals, if you find a good company that can sustainably grow earnings and dividends over time, it’s best to reinvest the dividends. That way, you get to fully enjoy the fruits of compounding returns from the business.

Of course, it’s not always possible to reinvest all cash dividends. Some investors are on high tax rates that can cut into dividends. Others must take dividends out for everyday expenses.

Like everything, much depends on your personal circumstances. As a general rule, though, reinvesting dividends in a great business is a sound long-term strategy.

James Gruber is Editor of Firstlinks.