“In the short run the market is a voting machine but in the long run it is a weighing machine.” – Benjamin Graham

The father of value investing, Benjamin Graham, said it so eloquently. In the short run many different things seem to matter. Investors focus on reports from journalists, brokers, market commentators, and anyone else trying to explain short-term gyrations in markets and prices. The post hoc causes of the dramatic recent market sell-off that we have read about include rising bond yields, inverse volatility, exchange traded notes, rising wages, the US Government deficit, computers running complex algorithms, profit taking after strong global markets … the list goes on. In the short run, all of these factors seem to get a vote. The weighing machine of earnings and valuation can take a backseat as the market voting machine swings into action.

Ultimately, earnings matter

In the long run what is being weighed by the market are earnings, because ultimately earnings drive share prices. Earnings are what long term investors focus on. Short-term share price movements and gyrations in the broader market are hard to predict. Short-term movements in share prices are often random. They can be a function of an investor that decides one morning to buy or sell. They can be in response to someone leveraging or deleveraging their portfolio. They can move because of macroeconomic events. They can move on changes in investor sentiment. We are not aware of any person who has repeatedly and successfully predicted these short-term movements. We are, on the other hand, aware of many investors who have unsuccessfully tried to ‘time’ their investments.

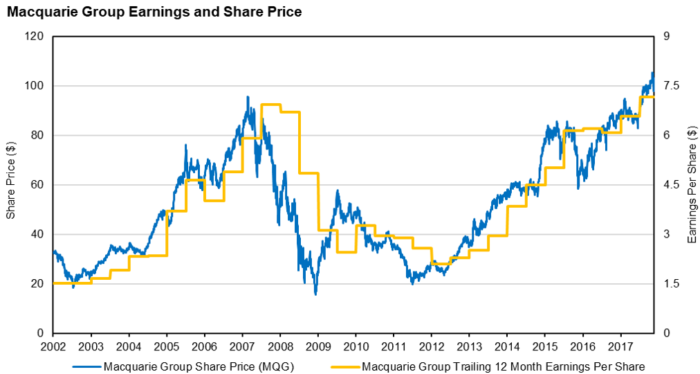

Macquarie is an example of a high-quality business, with a strong return on capital, good cash generation, and a sensibly geared balance sheet. It has exposure to a number of financial sectors that are experiencing strong tailwinds. Its largest profit contributor is an asset management business centred around a global infrastructure portfolio.

However, its share price moves around wildly. During a recent market sell-off, Macquarie Group announced a near 10% upgrade to earnings, yet its share price fell over 8% in a matter of a few days. Did the value of Macquarie Group fall over 8% in this period? We suggest not. There will be many commentators espousing a post hoc view as to why Macquarie Group fell so significantly.

The simple fact is that more people wanted to sell the stock than buy the stock at a particular point in time so the price declined. What matters is what happens to earnings over time. And for very good reason. Ultimately the market will weigh the earnings of the company, which will be reflected in the share price. The evidence is clear in the fifteen-year chart below. Eventually the share price will follow the earnings of every listed company.

Click to enlarge. Source: Bloomberg, Auscap

Stock price volatility that is not a response to volatility in company earnings is an opportunity for the patient investor who understands that it is the weighing machine not the voting machine. Focusing on the medium to long-term earnings profile of a company is the most sensible approach to long term investing.

Tim Carleton is Principal and Portfolio Manager at Auscap Asset Management, a boutique Australian equities-focussed long/short investment manager. This article is general information and does not consider the circumstances of any individual.