Much has been made of the rise in retail participation in the stock market during 2020, and this trend is set to continue in 2021. The world was captured by the Gamestop (NYSE:GME) saga, where a now old-fashioned North American bricks-and-mortar videogame retailer saw an eight-fold increase in its stock price in less than a week, fuelled by a frenzy of activity from online communities and social media platforms, most notably from a Reddit user group called WallStreetBets.

The proliferation of zero-cost brokerage, fractional investing, finance social media, heightened volatility, and continued fiscal and monetary stimulus have created a perfect storm for larger than typical retail risk-appetite. In Australia, our market regulator, ASIC, issued a media release in May 2020 stating that retail investors were taking increased levels of risk in a volatile market.

In July 2020, local academics Professor Carole Comerton-Forde (UNSW) and Dr Zhuo Zhang (University of Melbourne) showed that between March 2020 and May 2020 retail investors were net buyers of the dip, buttressing markets at a time when institutional investors were selling.

Towards the end of 2020, Gemma Dale of nabtrade explained within Firstlinks three ways that ‘retail’ is not dumb money.

Chart 1: Which Australian exchange has a higher percentage of retail trading?

Retail participation is an essential component to a vibrant, healthy and liquid stock market that attracts diverse participants and trading motivations. It is important for a stock exchange to keep track of the amount of trading by retail investors.

The first way that we examine retail participation in the stock market is via retail investor use of each stock exchange, both Cboe and the ASX. This is shown in the chart below for the period from July 2018 to February 2021. The chart shows the value traded by all retail brokers as a percentage of all ‘on-market’ trading on Cboe and then compares the same calculation on the ASX. In June 2019 for the first time, retail participation on Cboe exceeded that on the ASX, and it has since grown much larger.

Note: Chi-X Australia rebranded to Cboe Australia on 1 Feb 2022.

Note: Chi-X Australia rebranded to Cboe Australia on 1 Feb 2022.

This chart best shows the increase of retail participation in the stock market during 2020, and it has continued in the first two months of 2021. To reinforce the point, in February 2021, over 30% of all trading on Cboe came from retail brokers. It may be a surprise, even to some industry insiders, that as a proportion, retail investors trade more on an exchange that many of them don’t even know exists.

Over the last several years Cboe Australia has launched a number of new markets for Australian investors, including depositary receipts on US stocks (TraCRs), Warrants, and most recently Funds, with 12 Active ETFs available so far and more to come. Each of these markets were specifically designed to appeal to retail investors.

Chart 2: What percentage of the stock market do retail brokers represent?

The second way that Cboe monitors the contribution to trading by retail investors is by segmenting all trading member participants into the three broad categories:

1) Institutional brokers

2) Trading firms

3) Retail brokers.

The relative market share of value traded by each of these segments for the Australian market is shown in the chart below from July 2018 to February 2021.

The vast majority of transactions in the Australian stock market are undertaken by institutional brokers, both in terms of number and value. These brokers are responsible for some 80-85% of all trading and are usually large international banks such as UBS, JP Morgan, Credit Suisse and Citi. Retail investors generally only use institutional brokers indirectly as advised customers, such as via investment platforms.

The least well understood segment are trading firms. Trading firms include global financial services companies such as Virtu Financial (NASDAQ: VIRTU) and Susquehanna International Group, but also local firms like Nine Mile Financial. Trading firms play an important role in price discovery and market making.

Retail investors often interact with trading firms in the ETF market because they act as liquidity providers by supplying units in ETFs to buy or sell at a fair market price. Trading firms are explicitly only responsible for less than 5% of share trading in Australia. This is the value traded by those trading firms that are direct member participants of Cboe and the ASX.

However, there are many trading firms that transact in the market via institutional brokers, to such an extent that we estimate the implicit market share of trading firms in Australia to be at least 30%.

The remaining group is retail brokers, who are responsible for the vast majority of transactions from retail investors, on average representing 15% of value traded across the Australian market over 2020.

However, retail brokers are the largest set of exchange participants by number at 32 across both Cboe and the ASX. They are also the most diverse, so we divide these into three further sub-sectors:

1) Online brokers

2) Full-service brokers

3) Wholesale brokers.

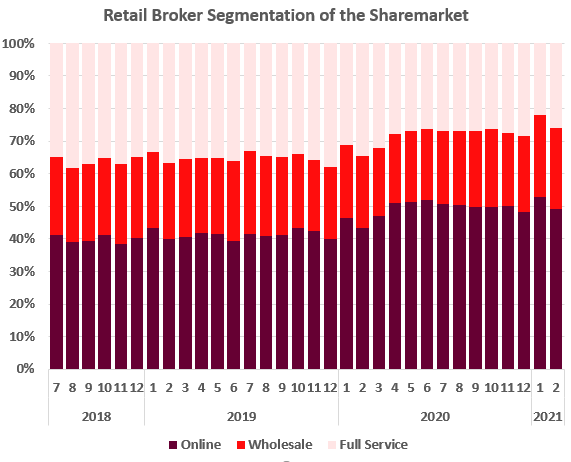

Here are the relative sizes of these segments over the same period of July 2018 to January 2021.

Chart 3: Which type of retail broker do you use?

What do these retail brokers do?

Full-service brokers broadly encompass traditional stockbroking firms such as Morgans Financial, Ord Minnett, Shaw & Partners, Wilsons and others. Although many full-service brokers also maintain institutional desks, much of the value traded originates from retail investors.

The retail users of full-service brokers are often considered to be advised rather than direct investors, although there is clearly a combination of both. Within the rise of retail investors, we observe that the market share of full-service brokers has declined from almost 37% in July 2018 down to 25% in February 2021.

Wholesale brokers include a mix of online and full-service capability. Overall, they have remained stable with about 25% of retail-executed values across the entire period. The mixed set of investors using wholesale brokers is best exemplified by Ausiex which was recently sold by the Commonwealth Bank to Nomura Research Institute (NRI). Ausiex provides trading services to online investors, financial advisers, brokers, accountants and some of Australia’s largest investment platforms.

Lastly, online brokers include well-known retail brands such as Commsec, nabtrade, CMC Markets and Bell Direct. Users of online brokers select their investments themselves and hence are usually referred to as self-directed or direct investors. From the chart we observe that the market share of all retail value traded by online brokers grew from 40% in July 2018 to 50% by the end of February 2021.

The increased use of online brokers is part of a multi-decade trend that essentially started when Commsec entered the market in 1995. More recently, rapid growth in online shopping has been one of the major developments of the COVID-19 pandemic. That included online shopping for shares as online brokers were the main driver in the rise of the retail investor during 2020.

Shane Miller is the Chief Commercial Officer and Howie Zhang is a Quantitative Analyst at Cboe Australia, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any person.

For more articles and papers from Cboe, click here.

Cboe Australia announces two new products

Elstree Investment Management in Hybrids

Elstree Investment Management Limited has launched its first hybrid fund on the Cboe Australia stock exchange, in response to the growing demand for stable income returns by Australian investors.

The Elstree Hybrid Fund (EHF1) adopts the same investment strategy as the successful unlisted wholesale fund, the Elstree Enhanced Income Fund, which has outperformed both the cash rate (bank bills) and the Elstree Hybrid Index on a per annum basis. Read more...

AllianceBernstein in Managed Volatility Equities

Global asset manager AllianceBernstein (AB) has partnered with Cboe Australia to make one of its leading funds available to Australian investors via the Cboe Australia stock exchange.

The AB Managed Volatility Equities Fund (Managed Fund)—MVE Class (AMVE) joins a growing list of funds to commence trading on the Cboe Australia platform amid strong demand for exchange-traded products. Read more...