Over the past five years, we have used a simple rule of thumb to assess the value of the new style/Basel III compliant Australian major bank hybrids:

- Excellent value at a five-year credit margin approaching +500bps

- Expensive when the five-year margin is +300bps or lower

This simple rule is based on the tightest and widest issues we have seen from the major banks since Basel III Additional Tier 1 (AT1) hybrids were first issued in January 2013. The two ‘book-ends’ were both issued by CBA and only 18 months apart, which shows how quickly the market can move:

- CBA Perls VII (CBAPD) – issued in October 2014 at a credit margin of +280bps to call in 8.2 years

- CBA Perls VIII (CBAPE) – issued in March 2016 at a credit margin of +520bps to call in 5.5 years

Significant tightening of margins

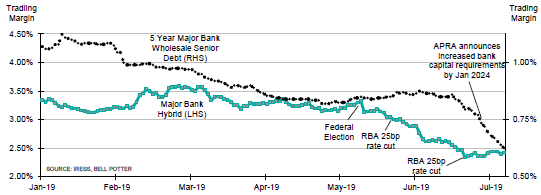

Australian bank and insurance AT1 hybrid spreads have been tightening for some time but that trend has picked up since the May 2019 election win by the Coalition which removed the risk that Labor’s franking policy posed, as the black line in the chart below demonstrates.

Source: Bell Potter

With demand increasing following the election, supply has been constrained with a dearth of new issues and little replacement funding expected in the near term. Issues approaching call/maturity dates in the next 12 months include just one major bank:

- IANG (IAG) 16 December 2019 ($550 million)

- NABPC (NAB) 23 March 2020 ($1,343 million)

- MBLPA (Macquarie Bank) 24 March 2020 ($430 million)

- CGFPA (Challenger) 25 May 2020 ($345 million)

- SUNPE (Suncorp) 24 June 202 ($400 million)

Against this backdrop and the market’s search for value, AT1 hybrid spreads are now the tightest we have seen since the new breed of Basel III compliant hybrids first hit the market in early 2013. The widest margin of any of the major bank hybrids (as at 22 July 23019) was the NABPF June 2026 call AT1 with a trading margin of just +288bps.

Inadequate reward for hybrid risks

Margins for the AT1s with a first call in five years are closer to +270bps. This is in contrast to last week’s ANZ 10-year subordinated bond issue with a margin of +200bps. We argue that a differential of just 70bps is too low for the additional risks that AT1 hybrids present, including extension/non-call risk, no maturity date, automatic conversion to equity if Core Equity Tier 1 ratio falls below 5.125% and potential for coupons to be cancelled.

We believe it is time to take profits on bank and insurance company AT1 hybrids. We still see value in the legacy hybrids such as NABHA and MBLHB which are still trading at a discount to par, but those too have rallied strongly in recent times.

Whilst there is no immediate threat or trigger point to cause hybrid spreads to widen, history tells us that spreads are tight.

An opportunity to re-enter the market might be seen in the coming 12 months if the banks use the retail ASX-listed market to help raise the additional $50 billion Tier 2 capital required over the next four years, following APRA’s clarification of capital requirements earlier this month. We suspect we will see a number of large, well-priced listed Tier 2 issues with margins in the low-200bps. There is also the potential for some out of cycle/non-rollover AT1 issues which could present good new issue margins.

One further impact of the tight major bank credit spreads was the recent BNP AT1 in AUD. It was initially launched with a margin of 412bps but priced 75bps tighter at a margin of 337bps. Despite the tightening in issue spread, the size of the order book (demand) and the relatively small issue size (supply) provided a pathway for the strong secondary performance which we have seen to date.

** Justin will be hosting the ASA webinar 'Bonds, hybrids and inverse yield curve effect on equity markets' on 8 August 2019, outlining how in a low-interest environment you can maximise yield through the use of bonds and hybrids. **

Justin McCarthy is Head of Research at BGC Fixed Income Solutions, a division of BGC Brokers, and a sponsor of Cuffelinks. The views expressed herein are the personal views of the author and not the views of the BGC Group. This article does not consider the circumstances of any individual investor.

For more articles from Mint Partners and BGC, click here.