Avoiding complex investments is a good guiding principle for most investors. Bank hybrid notes are an exception to that rule. They are complex relative to plain vanilla shares and bonds, but their reward-to-risk ratio, and their defensive qualities are attractive. Investors should consider bank hybrids despite their complexity.

It can help to understand hybrid notes as a combination of low risk bonds plus embedded put options. It is the embedding of ‘deep out-of-the-money puts’ that make hybrids especially appealing to affluent investors. By way of an example, modelling of the value of these puts shows that investors in the CBAPD hybrid notes are getting a yield of about 1.30% per annum more than is justified by the risk.

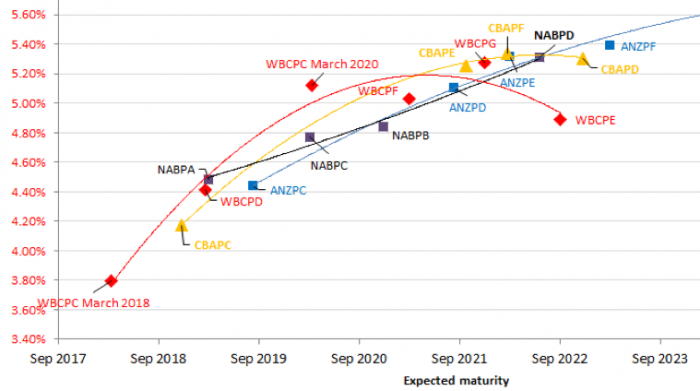

Yield vs time to maturity for Big 4 bank hybrids

Source: Michael Saba of Evans and Partners.

Australia's four big banks each have several issues of hybrid notes which trade on the ASX. The graph above shows how the yield on these securities increases with their time to maturity. Comparable hybrid note issues by the banks are CBAPD, ANZPE, WBCPE and NABPD, which all have similar maturity dates.

CBAPD notes bought at a price of $97.10 will yield a total return of 5.35% per year to maturity (assuming they are called) at the end of 2022.

Why CBAPD notes and not other hybrid note issues?

I like CBAPDs because:

1. CBAPDs are by far the largest issue of hybrids in the market; with the largest turnover, which makes them more liquid and more rationally priced than other issues. The $3 billion of CBAPDs make up about 7% of the total $42 billion of bank and insurer hybrids listed on the ASX.

2. CBA hybrids are attractive relative to CBA shares in risk-versus-return terms. CBA shares are far more risky than CBAPD hybrid notes, but the grossed-up yield on CBA shares (7.8%) is only 2.4% more than the yield on CBAPD hybrid notes (5.4%). The same yield gap between the shares and the hybrid notes of the other big banks is over 3%, which suggests that the hybrid notes versus shares comparison is less favourable to hybrid notes in those banks.

The mandatory conversion provision in CBAPD

If Australia suffered a banking crisis in which many bank loans were defaulted on, then the shareholder equity of Australia's banks would be rapidly depleted. The equity of any firm is the buffer that allows it to suffer losses without going bankrupt. In a banking crisis banks would need to replenish their equity, and this is where bank hybrids come in. In a crisis, the banking regulator APRA can force the conversion of bank hybrids notes into shareholder equity by insisting that banks invoke the conversion provisions in their hybrid notes.

In a mandatory (APRA forced) conversion, the holders of CBAPDs would hand over their notes. In exchange, they would receive either:

- 6.4 shares, if the share price was less than $15.90 at the time of conversion or

- $101 worth of shares if the share price was more than $15.90.

The slightly rounded numbers were fixed at the time CBAPD notes were first issued, based on the share price at that time.

Assuming mandatory conversion will only occur if the share price is less than say $15.90, mandatory conversion provision are equivalent to CBA having the option to 'put' 6.4 CBA shares to the CBAPD note holders to discharge CBA's $100 liability to the note holder.

Or, equally, $15.90 of liability is discharged for every share put to the note holder by CBA, and $15.90 is what CBA receives for every put option exercised, being the 'exercise price' of the puts.

If in a crisis the CBA share price fell to $10, then the put options would be $5.90 'in-the-money' for CBA because CBA could hand over a share worth only $10 and discharge a liability of $15.90.

CBA's share price today is not $10, but at time of writing, $78.30. So, the puts embedded in CBAPDs are currently $78.30 - $15.90 = $62.40 'out-of-the-money' (OTM). They are 'deep' OTM puts.

Compensation investors receive for selling the embedded puts

If CBA exercised its put options when the share price is $10, then CBAPD note holders would suffer a capital loss of 6.4 x ($15.90-$10) = $37.75. So, the main risk that hybrid note holders face is the risk that the put options that are embedded in the notes will be exercised when the options are in-the-money. We can estimate how much compensation CBAPD note holders receive for bearing this risk, and whether that compensation is large compared to compensation for bearing CBA share price risk.

How much would the CBAPDs be worth if investors were certain that the CBA share price would never fall below $15.90. The notes would then be risk free. The price of the notes would rise to $111.70 to give a yield of 2.85%, which is 0.40% (40 basis points or bps) above the yield on equivalent Australian Government bonds. The extra 40 bps is for illiquidity of bank hybrids compared to Government bonds, guaranteed by the Federal Government.

But, hybrid notes are not risk free, because of the embedded put options. And, their price is not $111.70, but instead, $97.10. The discount of $111.70-$97.10=$14.60 is the price that new CBAPD investors are being paid for writing (selling) the 6.4 embedded put options. In effect CBAPD note holders are buyers of a risk-free note from CBA (for $111.70) and sellers of put options on CBA shares (for $14.60).

Option pricing theory using the Binomial Method estimates the value of the put option being $103.55, which equates to a yield of 4.04%. In the calculation, volatility of 40% is included as deep OTM puts should be valued with much higher probabilities of extreme changes in prices. Comparing the yield of 4.04% with the actual yield of 5.35% on CBAPDs implies that buyers of CBAPDs at current prices are getting about 130 basis points more yield than is justified by the risk they face.

Other risks on CBAPD

The risk of loss of capital in the mandatory conversion process is one risk, but other risks include that coupons are cut to zero (which for hybrid notes is not considered a default, and dividends would have to be cut to zero first). But, with a deep banking crisis mandatory conversion would occur anyway, although if this was not the case the results above (the 1.30% figure) only changes by a few basis points. There is also a risk that the notes will not be called in 2022, but this requires much wider analysis.

Dr. Sam Wylie is a Principal Fellow of the Melbourne Business School and a Director of Windlestone Education. Please seek professional advice on structuring and tax planning from a qualified accountant or financial planner. This article is general information and does not consider the circumstances of any individual.