There was a strong response to our election survey, with some surprising results.

We acknowledge up front that the results from opt-in polls are not as significant and independent as those using a statistical method to pick respondents. It’s important how people are selected, and where the respondents choose themselves, pollsters argue the sample does not reflect the general sentiment.

With this qualification, there were some unexpected results from the 530 responses to date. The hundreds of comments in the survey give more insights into the ways our readers are thinking. The survey will remain open for a few more days in this article.

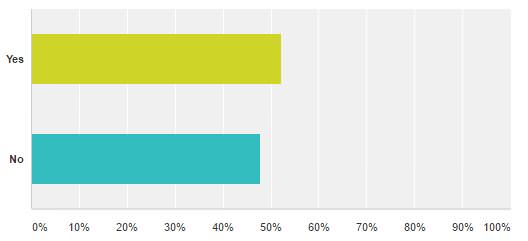

Q1. Did the Government’s proposed changes to superannuation policies influence your vote?

The majority of respondents advised that the proposed super changes influenced their vote (although as one person commented, the question assumes an adverse reaction). The public debate has been intense since the election on whether superannuation issues were significant enough to change votes. This result and many of the comments provide evidence that the changes did motivate voters.

Q2. Which proposed change had a significant impact on your vote?

While responses were evenly spread and multiple answers were allowed, the breaking of a previous commitment gathered the most votes. Some of the comments mentioned the reduced concessional cap of $25,000 as a major factor, reducing the ability to salary sacrifice into super.

Q3. Do you believe the proposed superannuation changes affected the overall election outcome?

Another unexpected result, with the majority of people believing the super changes had some impact on the election result, and only 14% going for the firm ‘no’.

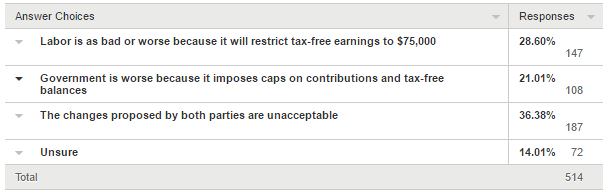

Q4. How do you compare the Government’s proposed super policy changes with Labor’s?

While 36% said the changes proposed by both parties were unacceptable, 28% nominated that Labor was as bad or worse based on their proposed $75,000 tax-free earnings threshold. Only 21% said the Government was worse due to the caps on contributions and the new tax-free limits. This suggests many people not only changed their vote away from the Government but also Labor due to both parties breaking previous promises. Perhaps it explains some of the success of independents in the election, especially as a Senate protest vote.

Q5. Do you expect the election results to lead to changes in the super proposals?

Over two-thirds of respondents expect changes, due both to a backlash within the Government, and problems in the Senate. Question 6 invited further comments and the responses are worth reading.

Concluding comments

This issue will run for months. Foreign Minister Julie Bishop said she visited 80 electorates during the campaign and told Malcolm Turnbull and Scott Morrison that she was hearing a lot of negative feedback. Two Government Senators have called for a review. On 9 July 2016 in The Australian, Economics Editor Judith Sloan wrote a column titled, ‘That was not such a good idea after all’, including:

“The superannuation issue came close to derailing the Liberals’ campaign as floods of complaints were fielded: party resignations from longstanding members were reluctantly accepted; donations dried up; and previously willing volunteers refused to help in any way.”

In my opinion, the most likely change is the removal of the backdating to 2007 of the $500,000 non-concessional (after-tax) limit. Not only will it be complex to administer and require data going back further than some tax records, but it is the change most vulnerable to the retrospective argument.