In superannuation, the word ‘risk’ is thrown around more than ‘boujee’ is on TikTok. It’s such a nebulous word, but understanding ‘risk’ is key to selecting your investment mix in super. And it can really impact the size of your account balance at retirement. Let’s unpack how to define investment risk, how to take investment risk, and what to know about it when selecting the right investment mix.

What is investment risk?

Let’s start with the word ‘risk’. One dictionary definition: “the possibility of financial loss”, with synonyms: ‘uncertainty’ and ‘unpredictability’. Investing feels uncertain and unpredictable so, is that ‘investment risk’? The truth is, there’s no perfect definition – but many agree 'permanent capital loss' is the best fit. For example, when WeWork, the co-working office space company, filed for bankruptcy – investors lost almost all money invested, which is definitely ‘investment risk’.

Another common definition is ‘volatility’ - the 'degree of variation' in share prices or 'market ups and downs'. So, if one share price moves up and down more wildly than another, it is more ‘volatile’. Wild share price moves feel uncertain, but they don’t necessarily lead to 'permanent capital loss'. Many companies’ share prices move up and down yet are solid long-term investments.

However, ‘volatility’ can become ‘investment risk’ when you simply lose your nerve and sell out of an investment just because its price has fallen, crystallising a 'permanent capital loss'. This is why advice to ‘stay the course’ is often offered (meaning - avoid the temptation to sell just because the share price has fallen).

Taking investment risk: the risk vs return trade-off

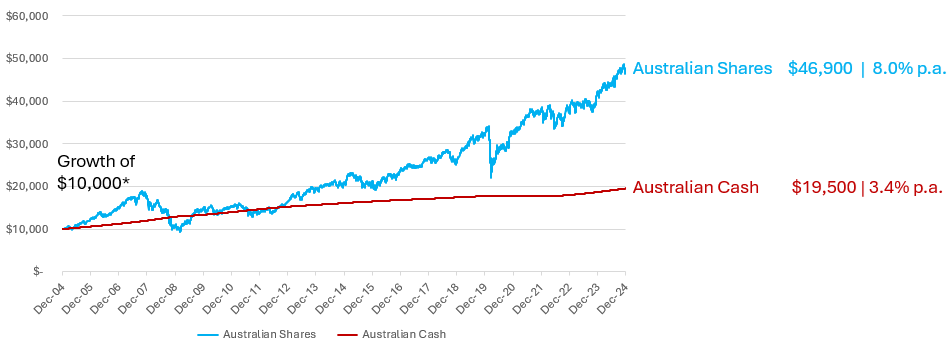

To simplify, assume an investor takes investment risk by only investing in cash or shares. Over time, cash has generated lower returns with lower risk, and shares - higher returns with higher risk. This is the concept of risk and return. An important side note: investing in cash over the long-term comes with another risk – inflation can erode purchasing power, but that’s a separate article. Exhibit 1 shows the long-term performance of cash and shares.

Exhibit 1: Investment returns and risk over 20 years: Shares versus Cash

Source: Bloomberg, UniSuper. Australian Shares is the S&P/ASX 200 Total Return Index1 and Australian Cash is Bloomberg AusBond Bank Bill Index2. Daily return series applied. *Assumes income is reinvested and no fees, costs, taxes are incurred. Dollar figures are rounded to the nearest 100 for simplicity. Past performance is not an indicator of future performance.

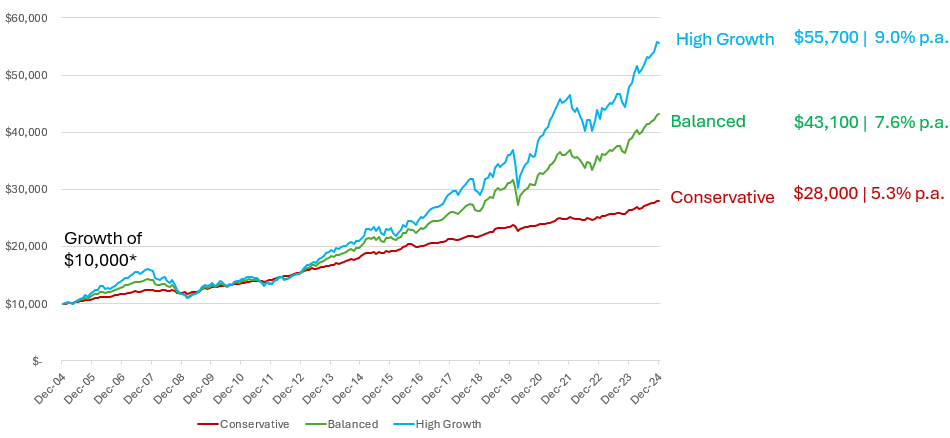

In super, an investment mix is delivered through an ‘option’ or ‘fund’. An option labelled as ‘conservative’ generally holds more cash and means lower returns - less investment risk; and ‘high growth’ generally holds more shares and means higher returns - more investment risk. ‘Balanced’ is a mix in the middle. The graph below shows how these typical options have performed over the long-term.

Exhibit 2: Investment Returns and Risk Over 20 Years: Superannuation Options

Source: UniSuper. Conservative is the UniSuper Conservative Option - Accumulation; Balanced is the UniSuper Balanced Option - Accumulation; and High Growth is the UniSuper High Growth Option - Accumulation. Monthly return series applied. *Returns are after fund taxes and investment expenses but before account-based fees. Assumes income is reinvested. Dollar figures are rounded to the nearest 100 for simplicity. Past performance is not an indicator of future performance.

What do you need to know about taking investment risk?

Your investment mix and level of investment risk is unique to you and your circumstances. Here’s a few considerations when selecting the right investment mix in super:

Know your timeframe: Superannuation is a long-term game. A 50-year-old female’s investment time horizon, on average, is more than 30 years! In Exhibit 1, we saw how shares outperformed cash historically, but they can and do go down at times. Remember, a price fall doesn’t necessarily mean 'permanent capital loss' (unless you sell it) and a long timeframe means you can wait for a recovery.

- Key point: investing in shares and higher risk assets can make sense if you have a long timeframe.

Know your ‘why’ and yourself: Human nature means it’s hard to see your superannuation balance falling, even if only temporarily. But if you know taking investment risk can be necessary to beat inflation and generate higher returns to enjoy a more comfortable retirement, it can be easier to manage uncomfortable emotions, ride out downturns, and stick to the plan. Of course, if you can’t sleep at night worrying about market falls and won’t stay the course, you might need to accept lower returns and less risk.

- Key point: develop a plan for retirement (it’s never too soon!), understand the right investment mix to achieve your goals, and educate yourself about market ups and downs and the emotions they will bring.

Diversify: if all your super was invested in WeWork, watching it file for bankruptcy would have hurt. But many diversified options in super own hundreds of investments. This diversification means that if one company’s shares become worthless you will suffer a permanent loss of capital, but it won’t wipe you out.

- Key point: super offers many ‘diversified options’: owning shares, property, infrastructure – all sorts of assets from around the world. Focus on selecting a well-diversified option.

Outsource: everyone knows buying a house is time-consuming. Looking online, inspections, contracts, and settlement. Buying any investment takes time. And constructing a portfolio with hundreds of investments takes a lot of time. In superannuation, there are many well-resourced teams who invest for you; understand risk and take time to do thorough research.

- Key point: make the very important decision of which ‘diversified option’ is best for you (e.g. growth or balanced) and outsource the rest.

Know your illiquidity levels: illiquid assets are generally those that can’t be readily converted into cash. As super is a long-term game, you probably don’t need to access all your money quickly. But in retirement, when cash withdrawals from your super are made, high levels of illiquid assets can be problematic.

- Key point: know what level of assets cannot be readily converted to cash. If you need to access a high proportion of your balance in the short to medium term, illiquid levels should be lower.

Know what to expect: unrealistic expectations are an investor’s worse enemy. Everyone knows someone’s friend who made 100% return investing in Bitcoin or a speculative mining stock. To put it in perspective, over the last 20 years, the Australian market earned, on average, about 8% each year, not 100%. And that was not earned in a straight line. Some years the annual return was down over 20%, other years up over 20%.

- Key point: past performance is not an indicator of future performance but know historical return levels and patterns to help set expectations.

Investment risk feels very uncertain at times, but understanding it helps you pick the right investment mix in super. This mix drives investment returns and the size of your account balance in retirement. And prior to retirement, the right investment mix is one of the most important decisions you’ll make. So, take time to understand whether your current mix is appropriate and get back to living your best ‘boujee’ life.

Annika Bradley is an Investment Specialist at UniSuper, a sponsor of Firstlinks. In previous roles Annika worked with Morningstar and QSuper. The information in this article is of a general nature and may include general advice. It doesn’t take into account your personal financial situation, needs or objectives. Before making any investment decision, you should consider your circumstances, the PDS and TMD relevant to the financial product, and whether to consult a qualified financial adviser.

1 The S&P/ASX 200 Total Return Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by UniSuper Management Pty Ltd. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by UniSuper Management Pty Ltd. UniSuper’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/ASX 200 Total Return Index.

2 Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) are not affiliated with UniSuper Management Pty Ltd and do not approve, endorse, review, or recommend this report or any information included herein. BLOOMBERG and the Bloomberg AusBond Bank Bill Index are trademarks or service marks of Bloomberg and have been licensed to UniSuper Management Pty Ltd. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Bloomberg AusBond Bank Bill Index.