Investment returns in super are a big focus – the media never fail to report on them. But the chance of a comfortable retirement is not just about investment returns. Outliving your savings, inflation, and not sticking to the plan are three risks that can make a big difference to your golden years and should be tracked closely.

Risk 1: the risk of outliving your savings

What is the risk of outliving your savings?

Either living longer than anticipated (it happens) or simply not having enough money to live comfortably to an ‘average’ life expectancy. According to the 2023 Intergenerational Report, living longer is a reality. Currently life expectancies at birth are around 81 years for men and 85 years for women. This is expected to rise to about 87 years for men and 90 years for women by 2063.

How to manage the risk of outliving your savings?

- Know your timeframe: when are you going to die? A macabre question. No-one knows, but over half of us haven’t even thought about it1. Estimating life expectancy is key to managing this risk. A 40-year-old female is expected to live to about 85 years old2 – round up to at least 90 to be on the safe side. That’s an “investment time horizon” of over 50 years!

- Know your spending levels: How much do you need and want to spend in retirement? Forecasting this is not a precise science, but there are rules of thumb to help you estimate your desired “retirement income”.

- Know your starting point: What’s your superannuation account balance? How much do you earn? Have you got any savings or debt? When do expect to retire? What’s your current ‘investment mix’?

Now use an online tool to project your super account balance in retirement and how long your desired ‘retirement income’ will last. These tools can be found on super fund or government websites. It feels complex, but rough estimates are fine and the tools often pre-fill some information to assist you.

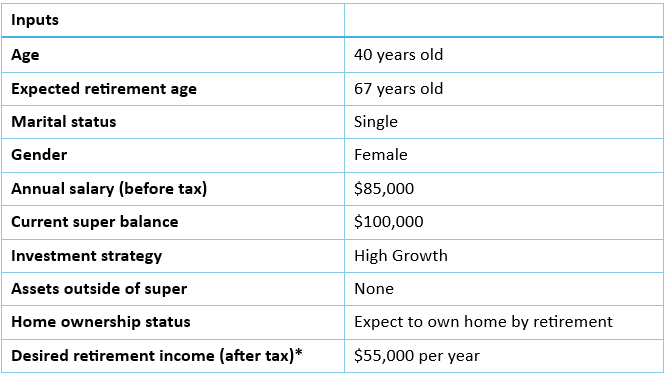

Exhibit 1: Will I outlive my savings?

*This represents over 80% of the current annual salary. Note: annual salary is before tax; desired retirement income is after tax.

Sample result: Asset levels – Assets grow to over $600,000 and last past 90 years old

Source: UniSuper Retirement Savings Calculator

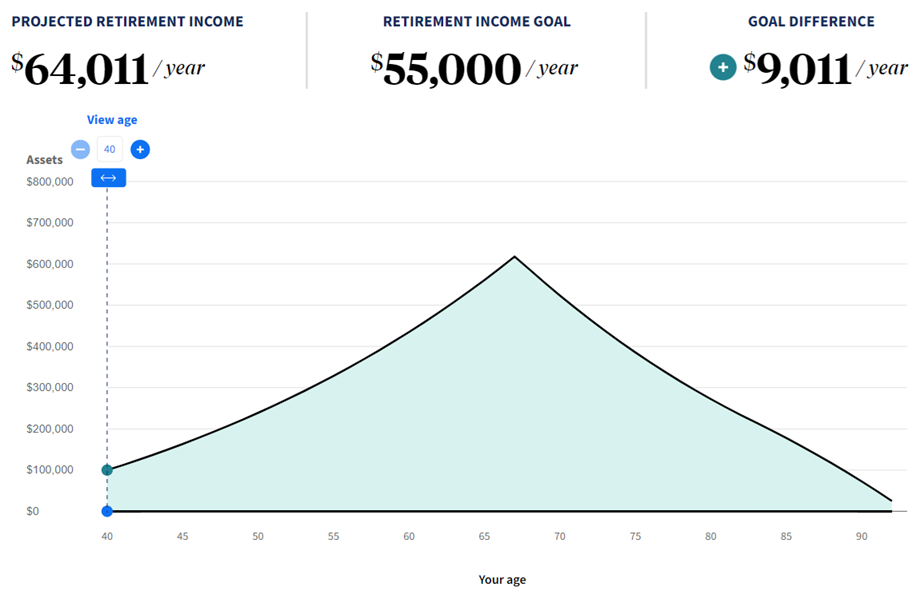

Results: Income levels – Retirement income goal is exceeded

Source: UniSuper Retirement Savings Calculator

Risk 2: the risk of inflation

What is inflation risk?

Inflation reduces the value of your savings over time. That is, the $100 you save today won’t buy as much in the future. Post COVID-19, inflation (or CPI) has increased. If a loaf of bread cost $3.50 in 2019, it now costs $4.50. So, the $100 you saved bought you 29 loaves of bread in 2019, but it only buys 22 loaves today. This diminished buying power is inflation risk.

How to manage the risk of inflation?

- Invest to outpace inflation: you’ll notice many superannuation funds set objectives at CPI (inflation) plus 2%, 3% or 4% per annum. This is because inflation is a real risk over long periods, and it is important to outpace it if you want to maintain your buying power over time.

- Cash is not king long-term: while investing in cash might feel ‘safe’, over the long-term it likely means buying less bread. Cash might be fine to fund shorter term goals, but time horizons in super are measured in decades, not years.

Risk 3: the risk of not sticking to the plan

What is the risk of not sticking to the plan?

Changing your investment mix based on market moves. That is, selling your investments when markets are falling or chasing higher investment returns when markets are rising. This switching activity can reduce your account balance in retirement.

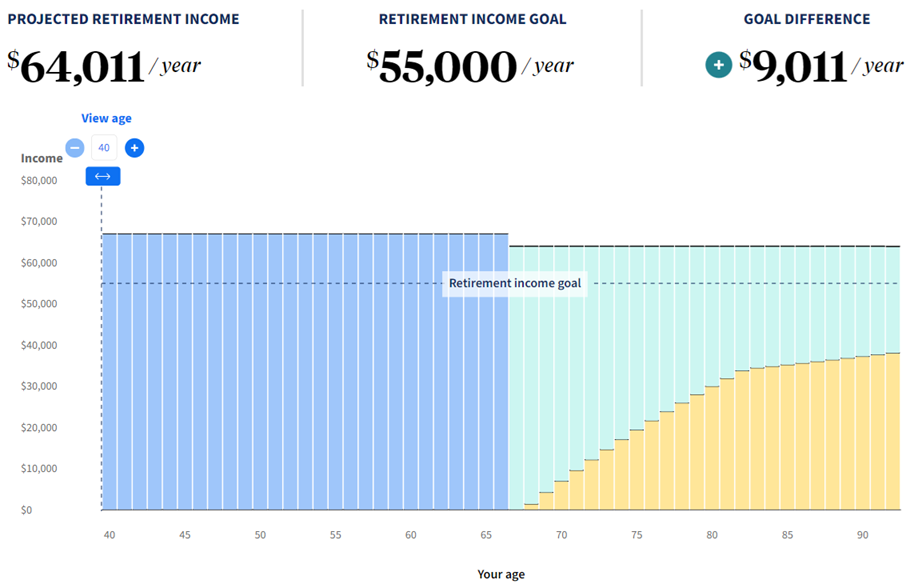

Cast your mind back to early 2020 – it was a very uncertain time and markets were falling sharply. Let’s look at Exhibit 2: there are three scenarios laid out for an investor who put $10,000 in Australian shares at the end of 2018:

- Stick to the plan: the investor who rides out the COVID market volatility. Investment return generated = 10.5% p.a.

- Switch back: the investor who switches out of shares and into cash in March 2020 at peak uncertainty. At the end of 2020, once vaccines are approved, the investor switches back into shares. Cost of switching? $4,500 worse-off (relative to ‘Stick to the plan’). Investment return generated = 5.4% p.a.

- No switch back: the investor who switches into cash in March 2020, but can’t decide when to switch back to shares. Cost of switching? $7,900 worse-off (relative to ‘Stick to the plan’). Investment return generated = 0.5% p.a.

Exhibit 2: Cost of switching during COVID-19: Australian Shares and Australian Cash

Source: Bloomberg, UniSuper. Australian Shares is the S&P/ASX 200 Total Return Index3 and Australian Cash is Bloomberg AusBond Bank Bill Index4. Daily return series applied. *Assumes income is reinvested and no fees, costs, taxes are incurred. Dollar figures are rounded to the nearest 100 for simplicity. Past performance is not an indicator of future performance.

How to manage the risk of not sticking to the plan?

- Know your why: if you’re clear on your retirement goals, it can be easier to stick to the plan. In retirement, your super may be your main source of income, so feeling ‘comfortable’ investing in cash is tempting. But investing in cash likely reduces the chance of achieving your retirement goals and outpacing inflation over time.

- Know your risk tolerance: what’s your willingness to take risk and how do you behave? Everyone reacts to risk differently – it’s influenced by gender, past experiences and financial literacy5. Sometimes an investment mix is set purely based on risk tolerance - risk averse investors may prefer investments that fall less in a downturn. But this comes with the likelihood of lower returns. Prioritise selecting an investment mix that best supports your retirement goals and manage your emotions in a downturn.

- Know the costs: Exhibit 2 shows there are two decisions to make when switching – the point to sell and the point to buy. Timing these decisions consistently well is nearly impossible. The “no switch back” investor cost themselves almost $8,000. It can be expensive to react emotionally to market up and downs.

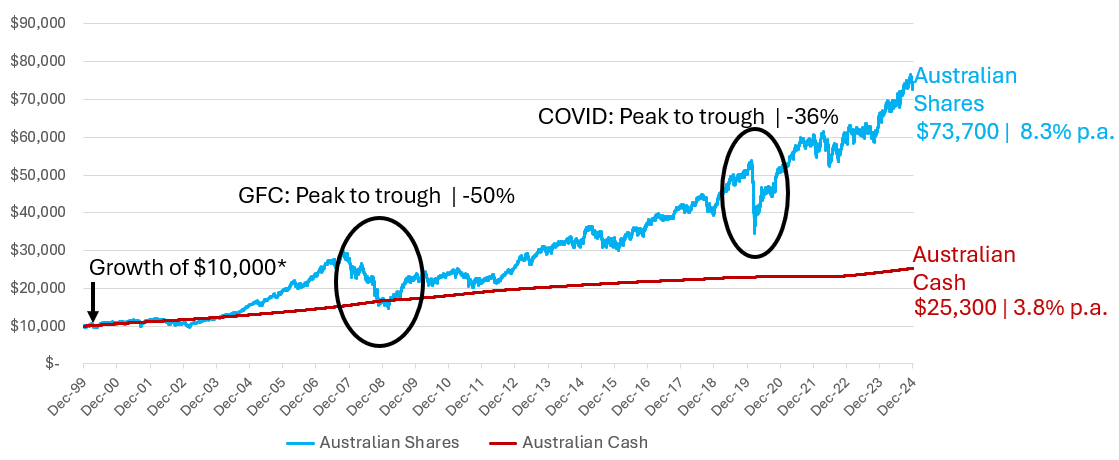

- Know what to expect: past performance is no guarantee of future performance, but it provides perspective. Exhibit 3 shows the peak to trough drawdown during the Global Financial Crisis was -50%! Yet, over average, the share market has delivered over 8% each year - well ahead of cash.

Exhibit 3: Australian Shares and Australian Cash Over 25 Years: Market Falls During The Global Financial Crisis and COVID-19

Source: Bloomberg, UniSuper. Australian Shares is the S&P/ASX 200 Total Return Index3 and Australian Cash is Bloomberg AusBond Bank Bill Index4. Daily return series applied. *Assumes income is reinvested and no fees, costs, taxes are incurred. Dollar figures are rounded to the nearest 100 for simplicity. Past performance is not an indicator of future performance.

- Don’t look!: if sharemarkets are making the headlines, one great strategy is not to look at your account balance. ‘Engagement’ with your super is understanding how it works, not constantly logging in to check your account balance.

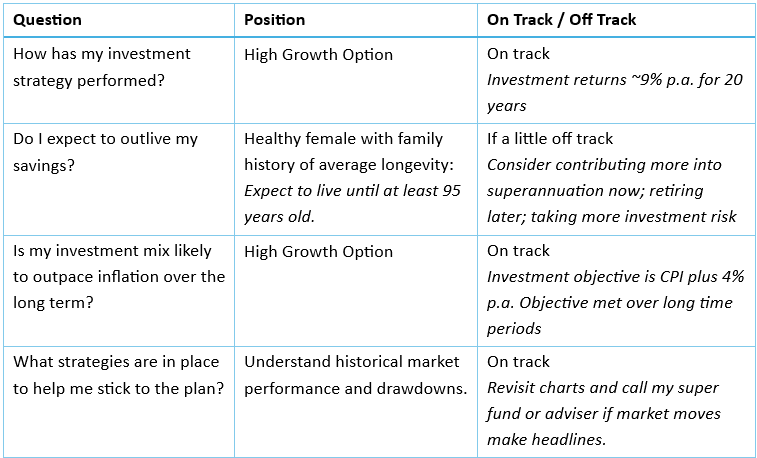

Add three risks to your scorecard

A successful retirement investment strategy goes well beyond investment performance. Ultimately each investor’s scorecard of success is personal, but consider adding these questions:

Exhibit 4: Retirement success scorecard

This scorecard is for illustrative purposes only

These risks might be underrated, but they are key to comfort in your golden years. So, add them to your scorecard and revisit every few years to make sure you’re on track for a comfortable retirement.

Annika Bradley is an Investment Specialist at UniSuper, a sponsor of Firstlinks. In previous roles Annika worked with Morningstar and QSuper. The information in this article is of a general nature and may include general advice. It doesn’t take into account your personal financial situation, needs or objectives. Before making any investment decision, you should consider your circumstances, the PDS and TMD relevant to the financial product, and whether to consult a qualified financial adviser.

For more articles and papers from UniSuper, click here.

1 Vanguard: How Australia Retires, 2024

2 Australian Bureau of Statistics, 2024: https://www.abs.gov.au/statistics/people/population/life-expectancy/latest-release

3 The S&P/ASX 200 Total Return Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by UniSuper Management Pty Ltd. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by UniSuper Management Pty Ltd. UniSuper’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/ASX 200 Total Return Index.

4 Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) are not affiliated with UniSuper Management Pty Ltd and do not approve, endorse, review, or recommend this report or any information included herein. BLOOMBERG and the Bloomberg AusBond Bank Bill Index are trademarks or service marks of Bloomberg and have been licensed to UniSuper Management Pty Ltd. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Bloomberg AusBond Bank Bill Index.

5 CFA Institute: Risk Profiling and Tolerance: Insights for the Private Wealth Manager