Quick and simple digital advice makes investing easy, but do the long-term consequences outweigh the short-term benefits? A new report by US market regulator, the Financial Industry Regulatory Authority (FINRA), draws attention to this question by sharing the digital investment advice practices employed across the securities industry. It's a reminder of the obligations that come with robo advice and the standards FINRA expects to underpin a financial advice service.

FINRA CEO Richard Katchum questions the adequacy of robo risk tolerance practices when he contrasts them with personal advice delivered by a human advisor:

"The same requirements are in place — the same expectations that you understand your customer, both from the standpoint of what their risk appetites are, and also that you have asked enough questions to really understand their financial situation and that they can accept risk and the risk of loss."

Furthermore, advisors need to be able to explain both to clients and the regulator how their tools and products work. There is no defence in the argument that ‘I'm just following instructions from head office.’ Black-box solutions are not acceptable.

Undergoing a complete investor profile

Many robo advisors do not develop an appropriate investor profile of clients. One of the most fundamental aspects of delivering suitable advice is to ascertain the level of risk that a client is willing to take. This is referenced as ‘risk willingness’ in the FINRA report and is commonly referred to as risk tolerance. The regulator questions whether it's possible to accurately measure the amount of risk that an investor is willing to take by asking a small number of risk tolerance questions – in some cases just one.

There are no lower standards expected for robo advice compared to human advice. FINRA’s ultimate concern is investor protection, and the importance of accurately assessing risk tolerance cannot be ignored. When investors take more risk than they are comfortable with, they are more likely to bail-out of the market when the going gets tough and then wait too long to get back in. This pattern of buy high and sell low makes it difficult for investors to achieve their financial goals. Furthermore, over-exposed investors suffer adverse behavioural reactions to financial loss such as anxiety, loss of sleep, and relationship problems.

It is common industry practice to treat investment time horizon as a sub-factor of risk tolerance when, in fact, time horizon is an aspect of risk required (the level of risk needed to achieve your goals). Simply put, this requirement is a catalyst for change. Most risk tests used in the market place would be non-compliant according to these principles.

FINRA also makes a distinction between risk tolerance and investors’ capacity for loss, making customer profiling critical because it drives recommendations to customers. The message is clearly aimed at the executives at the top of the enterprise:

“Two other areas of digital investment advice - customer risk tolerance assessment and portfolio analysis - reinforces the need for broker-dealers to establish and implement effective governance and supervision of their digital investment advice tool. Good governance involves understanding if the approach to assessing customer risk tolerance is consistent with the firm’s approach. Firms must apply good practices across all distribution channels, not just robo advice.”

Analysis of seven robo recommendations

FINRA details seven robo advisors' portfolio recommendations for a young worker. Let's call him Michael. Of particular concern is the wide range of 60% to 90% in growth asset recommendations and how they match to his risk tolerance. If growth exposures are greater than what is consistent with risk tolerance, then the likelihood increases that the investor will be disturbed by a market correction. If not satisfied by the advice, clients may sell down growth assets at the wrong time, and in the worst cases, seek legal redress. Dissatisfied clients are a blight to all businesses, more so in financial services in the last few years.

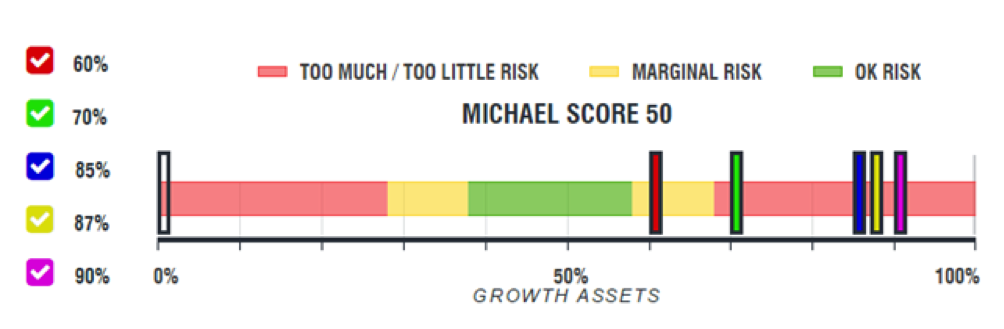

Let's assume that Michael has a FinaMetrica risk tolerance score of 50 (out of 100) and is placed in Risk Group 4. Based on a score of 50, Michael would be comfortable with between 39% to 58% growth asset exposure. Most people in Michael’s Risk Group would typically be discomforted when the value of their entire investment fell by 20%.

If we look at the seven portfolios illustrated in the FINRA report from the standpoint of who would be comfortable based on risk tolerance alone, the riskiest portfolio with a 90% exposure to growth assets matches the risk tolerance score of just the top 5% of the population. This rarefied group generally includes hedge fund managers, bankers, entrepreneurs and high risk tolerant individuals.

When we map the seven recommendations (shown by the vertical bars below) on to Michael comfort zones, none of the portfolios is consistent with Michael’s risk tolerance and all but one are in the 'Too Much Risk' red zone.

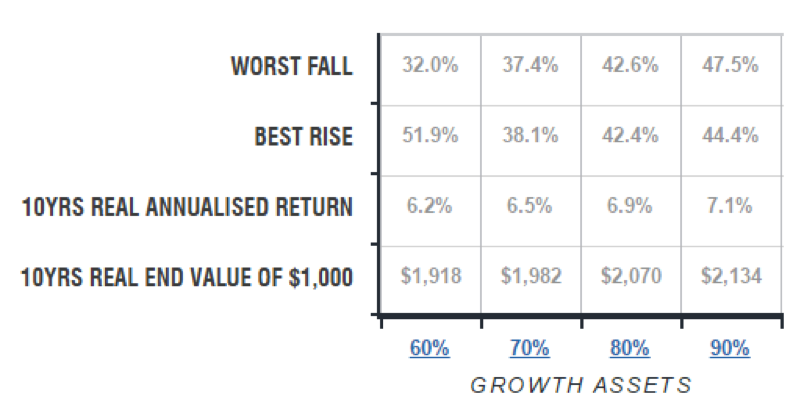

To test sensitivity, we look at four broadly diversified portfolios with 60%, 70%, 80% and 90% growth assets. These portfolios were back-tested to 1972 using indices rebalanced once a year. Even the 60% equity-exposed portfolio exceeded the 20% drawdown that investors whose risk score is 50 typically tell us they are comfortable with.

We are regularly reminded that the past is not a precursor of the future in terms of investment performance, so we don’t need to be reminded that unhappy investors are a scourge on our industry's/profession's successful and profitable future. If we don't manage the matching of investments to investors' needs effectively, we can be assured that regulators will continue to do it for us. Risk tolerance is not hard to assess accurately, it just needs a little science and a dash of common sense.

Paul Resnik is Co-Founder and Director of Finametrica, a risk profiling system that guides ‘best-fit’ investment decisions.

The Australian regulator, ASIC, recently completed its consultation feedback for its own policies on robo advice.