There has never been a greater need for personal financial advice and advisers, but much of the industry is in turmoil. Although ‘digital’ advice aspires to replace person-to-person contact, it is a long way from meeting all but simple investment needs. Full service financial advice involves not only investing but budgeting, retirement planning (including superannuation), insurance, taxation, social security, estate planning, mortgages, even lifestyle coaching. Nearly all of the 700 Australians who retire every day, the majority with a pension account from a superannuation fund, would benefit from obtaining financial advice.

The Financial Services Royal Commission of 2017 to 2019 was a disaster zone for the reputation of financial advice. Advisers and licensees were exposed day after day by the Commission’s legal team, with little attempt by witnesses to defend their businesses. Subsequently, the major banks ran up the white flag and substantially exited personal advice, paying billions of dollars in compensation on the way out. Their dreams of vertically-integrated wealth management delivering multiple products to clients were in tatters.

Demand for advice services

Why is an industry with such obvious consumer demand in trouble? Government enquiries and trade publications have devoted millions of words to this question, and we can only scratch the surface here. In its 2021 Financial Advice Report, Investment Trends estimates that although 1.8 million people receive advice each year, that represents only about 10% of adults. A further 12.6 million have unmet advice needs and 3.2 million want advice but are discouraged by the perception of high costs and inadequate investible funds.

Consider the need in superannuation advice. Retirees have a vast array of alternative ways to make contributions, withdraw money to live on and invest their retirement savings. Superannuation is expected to reach almost 250% of GDP by 2060, according to the 2021 Intergenerational Report, with annual withdrawals rising from the current 2.3% of GDP to 6%. With annual super inflows of $120 billion and a total pool of $3.4 trillion, even if we ignore all the other aspects of personal financial advice, the need to maximise the efficiency of this pool to fund retirement is obvious.

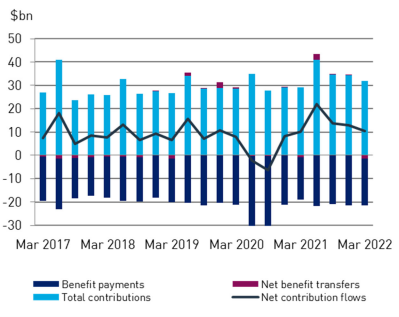

The table below shows that every quarter in recent years, Australians withdrew about $20 billion from super, offset by $30 billion in contributions, a net addition of $10 billion every three months. While these flows will switch with an ageing population drawing large pensions, the balance in super will depend substantially on market movements. Superannuation is expected to exceed $10 trillion by 2040 according to Deloitte, making the shortage of financial advisers an even greater unmet need.

Quarterly Benefit Payments and Contributions from Superannuation

Source: APRA Quarterly Superannuation Highlights, March 2022 (released 4 May 2022).

Let’s consider four more charts that show the current state of financial advice.

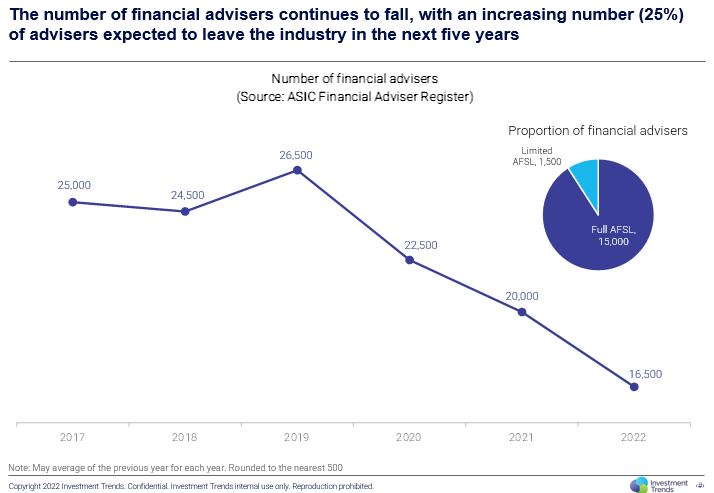

1. Financial advisers leaving the industry

In less than five years, the number of financial advisers has almost halved and is expected to fall below 15,000 by the end of 2022. There are weekly announcements in the trade media of advisers leaving firms of all sizes, particularly from large dealer groups. For example, Wealth Data reported last week: “A lot of movement this week across several licensees indicating that the adviser market is still volatile. Net change of advisers (-24)."

Here is the latest data from Investment Trends, reproduced with permission.

2. Reasons for financial adviser exodus

A new client cannot drop into a financial adviser’s office and ask a single question that should take half an hour. The initial discovery required to accept a client is more onerous than visiting a new doctor.

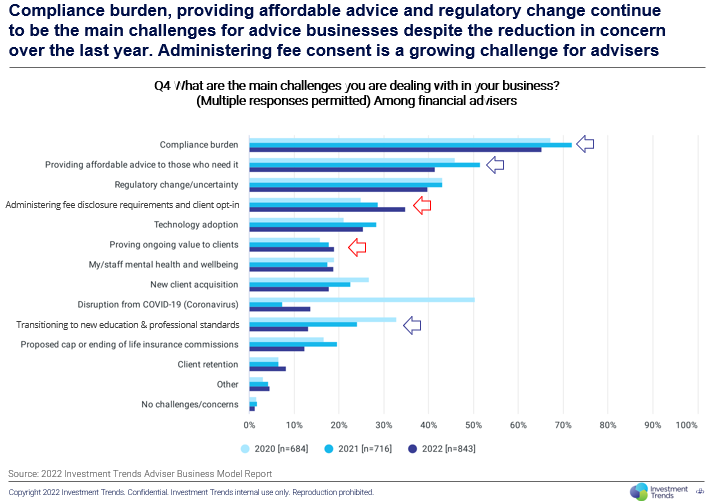

When asked about the main challenges facing a financial advice business, the ‘compliance burden’ is identified by two-thirds of advisers. This is despite many years of attempts to streamline operations, such as automated Statements of Advice (SOA) and developments in the sophistication of software designed to make an adviser’s administration burden easier.

Other areas of concern relating to the work burden, as shown in the chart below, include:

- Regulatory change and uncertainty

- Administering fee disclosure requirements and client opt-in

- Technology adoption

- Transitioning to new education and professional standards

It is also worrying that ‘My/staff mental health and wellbeing” ranks highly.

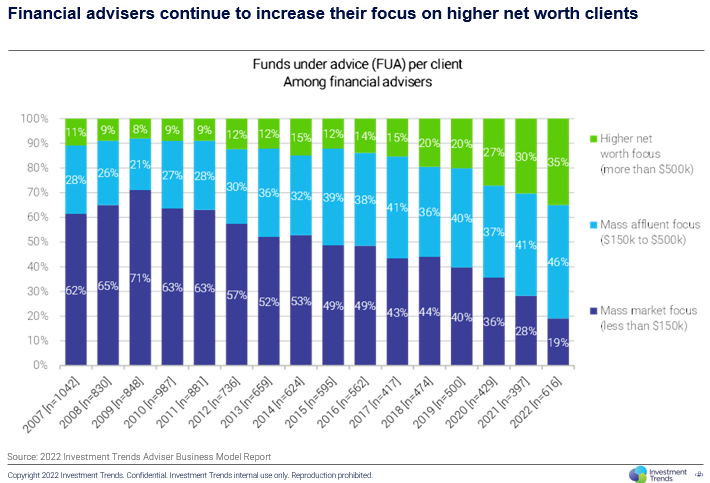

3. Adviser focus on wealthier clients

A major concern above is the inability to provide affordable advice to those who need it, as the administrative and cost burdens force advisers to focus on wealthier clients.

The chart below shows the top category of clients with funds under advice (FUA), sometimes called investible assets, with more than $500,000 has risen from 9% of clients in 2011 to 15% in 2017 to 35% in 2022. The ‘mass market focus’ with less than $150,000 in FUA has fallen from a high of 71% in 2009, 28% as recently as 2021 and only 19% in 2022. Financial advice revenue models vary but some firms that specialise in high value advice will not take a new client for annual fees of less than $30,000. In some businesses, 1% of FUA is a common model, so a client with $1 million pays $10,000 a year plus extra in the first year of establishment. Others agree a flat fee for ongoing advice.

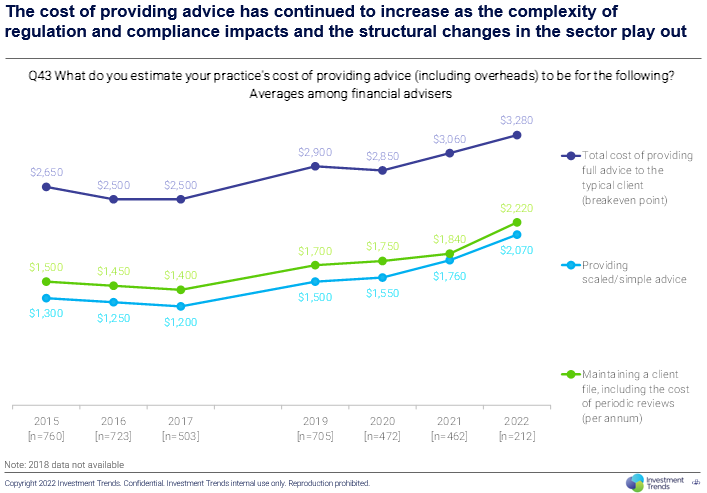

4. The cost of providing financial advice

Related to the need to find high value clients is the rising cost of providing financial advice, which is estimated to have increased from $2,500 per client to $3,280 over five years. Financial advisers and their staff are professionals, and while not quite in the league of most lawyers and architects, expect to charge their services at around $250 an hour or more. That makes an initial 10 hours of SOA work and reporting to a new client at least $2,500.

What are some other issues facing the industry?

Financial advisers face a continuous onslaught from changing regulations, such as FoFA, DDO, LIF and the RC (don’t worry what these all stand for), and now there’s QAR.

a) Quality of Advice Review

The new Government is continuing the Quality of Advice Review (QAR) started by Senator Jane Hume in the previous administration, to assess how the regulatory framework can deliver better outcomes for consumers. Michelle Levy is the main reviewer, and her report is due to Treasury by 16 December 2022. She recently told an SMSF Association Technical Summit that she was surprised by the level of adviser fear relating to the regulators, ASIC and AFCA.

“I am actually taken somewhat aback and, maybe I shouldn’t be, but there’s a real concern that very minor breaches or very minor things are going to lead to very serious consequences. If you look at the cases that ASIC has actually brought, they are in the main quite serious issues so that surprises me and that’s a hard one to solve. How do you address fear? It’s obviously having a big effect on what people do.”

At the same forum, the Financial Planning Association’s CEO, Sarah Abood, also said that an “environment of fear” exists in the financial advice industry.

“It's very much the case that advisers are literally terrified of forgetting a page of the SOA or something of that nature. Advisers and dealer groups have a genuine fear that their businesses will be destroyed and that their PI insurance will be broken because of something like that.”

Advisers are responding by designing their systems in case they need to defend their advice in a courtroom. Everyone must interpret regulations and AFCA decisions and decide how to respond, when they would rather focus on serving clients.

Future advice availability will be further limited as many financial advisers are close to retirement, and the training grounds provided for young advisers at major banks no longer exist. Many older advisers could not be bothered with the new exams, standards and regulations and there are not enough younger people coming into the other end of the pipeline.

b) Digital, online and robo-advice

Many have come and few have succeeded in providing some form of online financial advice. Names that have left the industry include GigSuper, Brightday, Zuper, Super Prophets, Human Super, FairVine, BigFuture, Clover and McMahon Super. There has been some success in what is better called ‘digital investing’ than ‘digital financial advice’ because it is far from full service. The offer asks a few simple questions to identify a basic risk appetite, then clients are placed into a suitable portfolio with competitive fees. This article is not the place for a full review of these stuctures but Stockspot, Raiz, Spaceship and Pearler among others are finding enough support to sustain their businesses.

With the major banks showing no aspirations in this space, it is left to the likes of Vanguard to bring institutional capabilities. Vanguard’s submission to the QAR calls for a “scale of regulatory compliance” to enable more Australians to afford advice, ranging from lightly-regulated protection for limited advice through to full service comprehensive advice based on current safeguards. Vanguard hopes to fit its model into these scales, including digital advice allowing technology to deliver advice to the masses.

c) Mandatory education and standards

Faced with the challenge of making financial advice more of a 'profession' with standards and qualifications beyond obtaining a simple diploma, the Morrison Government introduced mandatory education standards. Now in Opposition, former ministers admit the rules were poorly executed and contributed to the increase in the price of advice and thousands of advisers leaving the industry. There was a requirement for an approved university degree by 2026, but the new Albanese Government will exempt advisers with 10 years of experience and a good regulatory record. There is also a controversial code of ethics where many advisers dispute the wording.

The new Government has promised to remove the regulatory burden on advisers, but is likely to wait for the results of the Levy Review before major changes. Exams and standards will remain but how difficult they will be and who needs to pass them is yet to be decided.

Cries from the heart

The daily reporting of dire problems facing financial advice plagues their trade media, with a steady stream of comments showing ongoing frustrations. Consider this post to the Professional Planner newsletter by a financial adviser responding to an article about 100,000 fewer Australians receiving advice every year:

“What an absolute mess! This is what happens when you have people at the wheel who have no idea what they are doing. They should hang their heads in shame instead of gloating over the size of their RC payday.

The regulator has focused so much on what doesn’t matter (product) and nothing on what really matters (advice and people). They’ve listened too much to the noise and not enough to the professionals. If the money they spent decimating the industry had been spent on the conduct of the minority then the right people would have been targeted.

Now a large number of good advisers have left this industry and a lot more will go when the retrospective education standards are enforced.

Advice costs have spiraled, people have been pushed into products based on price and the net benefit to the naïve end user is confusion, disengagement and asking the trusted adviser to please explain what the hell has happened.

Soon, they will have no one to ask other some dimwitted actor on an escalator.”

Sums it up. People need financial advice, and better to go to a qualified, experienced professional than a finfluencer (there’s another story!) who is more skilled at gathering an online audience than covering the complexities of a seasoned adviser.

Let's finish on a more optimistic note. There are thousands of good financial advisers helping millions of Australians. Most who remain in the industry have moved with the times, are dedicated to better outcomes for their clients and have invested in their businesses and systems to make them sustainable. After too many difficult years, it's time to stop the denunciations.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information and does not consider the circumstances of any person. The charts provided by Investment Trends are republished with permission from their vast database available to subscribers.