The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

When my children were in primary school, a favourite activity on fund-raising evenings was the 'head and tails' game. Parents would pay to play and guess whether a coin toss would land on heads (place hands on head) or tails (hands on bottom or tail). After each round, the winners stay for another spin and so on until only one person remains.

Each time a round was played, a strange thing happened. Those who win cheer loudly and laugh at the losers. As the rounds pass by, the winners become louder and more enthusiastic, and the crowd applauds like it is witnessing a sporting event. It's all good fun of course, but eventually, the winner of a bottle of wine waves his or her hands in the air in triumph and friends shake the hand of the expert at picking coin tosses.

A similar event is described in the legendary book first published in 1940 called "Where are the Customers' Yachts?" or "A Good Hard Look at Wall Street" by Fred Schwed Jr. At the 2016 Berkshire Hathaway meeting, Warren Buffett claimed he read the book when he was 10-years-old and it was foundational in his investing. This is a long extract but worth reading.

"Let us have 400,000 men and women engage in this contest at one time. (Something like the number in this country who try being speculators.) We line them up, facing each other in pairs, across a refectory table miles long.

Each player is going to play the person facing him a series of games, the game chosen being a matter of pure luck, say matching coins. Two hundred thousand on one side of the table face 200,000 on the other side. If the reader is at all mathematically inclined he should cease reading and work out for himself what is now bound to occur.

Otherwise: The referee gives a signal for the first game and 400,000 coins flash in the sun as they are tossed. The scorers make their tabulations, and discover that 200,000 people are winners and 200,000 are losers. Then the second game is played. Of the original 200,000 winners, about half of them win again. We now have about 100,000 who have won two games and an equal number who have been so unfortunate as to lose both games. The rest have so far broken even.

The simplest thing from now on is to keep our eyes on the winners. (No one is ever much interested in the losers, anyway) The third game is played, and of the 100,000 who have won both games half of them are again successful. These 50,000, in the fourth game, are reduced to 25,000, and in the fifth to 12,500. These 12,500 have won five straight without a loss and are no doubt beginning to fancy themselves as coin flippers. They feel they have an 'instinct' for it.

However, in the sixth game, 6,250 play on and are successively reduced in number until less than a thousand are left. This little band has won some nine straight without a loss, and by this time most of them have at least a local reputation for their ability. People come from some distance to consult them about their method of calling heads and tails, and they modestly give explanations of how they have achieved their success.

Eventually there are about a dozen men or women who have won every single time for about 15 games. These are regarded as the experts, the greatest coin flippers in history, the people who never lose, and they have their biographies written." (my bolding)

Fred does not go on to say funds management is the same, but there are a lot of coin tossers out there. How do we know that a fund manager experiencing a strong run of outperformance is not simply a winning coin flipper? We don't. The main challenge when hearing fund manager presentations is not to think that just because they are a confident and entertaining orator, they are also a skilled investor. Many are the opposite.

Look beyond the charisma and charm for unique insights and ideas which might reveal a deeper thinker who identifies different opportunities. There's no point hearing the same platitudes as every other fund manager and expecting to outperform. There are talented fund managers but it's hard to identify them in advance, and that's all that matters.

***

The most consistently-sobering assessment of the market's potential in 2023 comes from Morgan Stanley in the US, which has criticised the equity rally since it began in 2023. This week, the investment bank argued:

"Price action is not reflective of the deteriorating fundamentals or the fact that the Fed is hiking during an earnings recession - drivers that should ultimately determine the lows for this bear market later this [US] spring. Risk-reward is as poor as it’s been in our view."

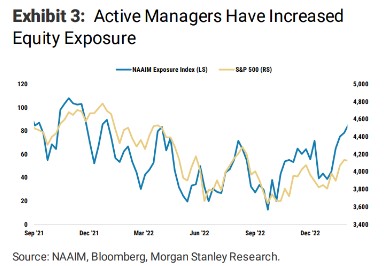

They are at odds with many active fund managers, who are "refusing to accept this reality" of higher rates and lower earnings. In fact, the National Association of Active Investment Managers (NAAIM) publishes an index each week which measures the average exposure to US equity markets by its members, and this has been increasing rapidly since the end of 2022. Looks like we are in for another year where the results of active managers will vary widely.

Philip Lowe probably has the highest exposure of any Reserve Bank Governor in history this week, so we don't need to repeat coverage of his travails. However, his presentation to the Senate on Wednesday included an interesting reveal. He repeatedly said that decisions are not his but those of the nine members of the Board and their views were unanimous: "We all come to the same conclusions." This is remarkable given that the Governor has apologised for mistakes made in 2021, and yet nine experienced Board members agreed unanimously on interest rate decisions through three years of monthly loosening and tightening. Did nobody believe a small uptick in rates at the end of 2021 or early 2022 was worthwhile to take the steam out of the housing market and start the work against inflation? Lowe also complained that whoever spoke to the media after his lunchtime discussions at Barrenjoey broke the protocols on how to behave after these events.

While sympathy rightly goes to heavily-indebted borrowers who will face a tough year, the other side of the same coin is that retiree incomes are rising, at least in nominal terms. A comment received from a reader, James, last week is typical of how many feel.

"Stop the focus on home borrowers - it’s great for the retirees!!!! At long last retirees don’t have to take crazy risk in mkts to get a return they can live on - who is going to print the truth!"

That's the agony of using such a blunt tool as the cash rate to slow the economy. It targets one group of people but others are gaining a major income boost, which will stimulate the economy if they spend it, accepting that retirees tend to consume less than younger people.

Here are a couple of charts from Australian banks which suggest borrowers need to tough it out for 2023 before some relief next year. First, from ANZ-Roy Morgan, consumer confidence is falling rapidly, which should feed into lower consumption. The sub-index of 'Is it a good time to buy a major household item' dropped to its lowest level in two years, especially among mortgage holders.

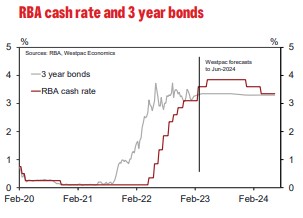

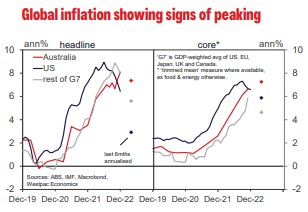

Second, the latest Westpac forecasts see a cash rate of 3.85% by the end of 2023 but falling back to 3.35% quickly in 2024. Westpac is also confident we have seen the peak of US inflation, as supply-side constraints ease for fuel, food, energy, goods, and building costs.

And note that the ATO has confirmed the Transfer Balance Cap (TBC) for superannuation will increase by $200,000 on 1 July 2023, reminding us:

"No single TBC will apply to all individuals. Individuals will have a personal TBC between $1.6 and $1.9 million. If an individual already has a TBC, the only place they can view their personal TBC is in ATO online services through myGov."

Which continues our irrational approach to setting superannuation limits. At the same time that we are encouraging more into super by raising the TBC, Financial Services Minister Stephen Jones has decided to cap superannuation balances at $5 million, probably from 1 July 2024. By then, a couple will be welcome to hold $4.2 million in super (based on a new indexed limit of $2.1 million each) but an individual cannot hold more than $5 million. All these rules with minor differences are adding even more complexity to the superannuation system, after governments have encouraged people to pour money in for the last 30 years. My article this week takes a critical look at the $5 million cap plan.

Graham Hand

Also this week ...

Jon Kalkman explores whether it makes sense to invest in the family home to maximise the pension. He thinks it may not be the best option as it can put retirees at the mercy of bureaucrats and comes at a high price in terms of reduced income and loss of discretion over personal affairs.

Noel Whittaker is cranky this week. He's upset at banks that charge increased interest rates on those who fall behind on home loan payments. Noel believes it's a widespread policy that kicks people when they're down and it needs to stop.

On the TBC increase to $1.9 million from 1 July 2023, only those who don't start pensions until then will receive the full increase. Many retirees are wondering if they should wait to start pensions in their SMSFs, and Meg Heffron has some answers.

James Gruber says interest rates are political dynamite in Australia but increased rates aren't bad for everyone and they are exactly what's needed after the serious central banking errors of the past decade.

Dr David Knox at Mercer believes superannuation taxes in Australia need an overhaul. David says the current system is complex, inequitable and subject to regular change. He proposes five ways to make the system fairer.

The common perception of contrarian investing is that it's about doing the opposite of everyone else but Eric Marais says that's not the case. Instead, it's having courage in your convictions and a disciplined investment process. Eric provides three stock examples to demonstrate Orbis Investment's unique approach.

In the weekend update by Morningstar, Sarah Dowling looks at the halfway point of the February reporting season and what it's revealed so far, while Greggory Warren reports on Berkshire Hathaway selling US$10 billion worth of stock last quarter.

In this week's white paper, Montaka Global Investments looks at why AI is the world's most important investment theme.

***

Weekend market update

On Friday in the US, shares finished mixed with the S&P 500 -0.3%, the Nasdaq -0.6% and the Dow +0.4%. Stocks tumbled early on renewed concerns about how much higher the Federal Reserve is prepared to lift interest rates to check persistent inflation, though those losses were pared. Treasurys also caught a solid afternoon bid as the long bond dipped to 3.88%, down four basis points on the session. A bearish reversal in the US dollar did no favors for the oil patch, as WTI crude fell 3% to $76.50 a barrel, gold edged higher to $1,852 per ounce and the VIX retreated to 20 after yesterdays upward jolt.

From AAP Netdesk: On Friday in Australia, the share market ended a second consecutive week in the red. The benchmark S&P/ASX200 index fell 63.5 points, or 0.86%, to 7,346.8. The broader All Ordinaries closed 68.5 points lower, or 0.9%, at 7,552.2.

Nine of the ASX's 11 sectors finished lower on Friday. Tech was the hardest hit, falling 2.2%.

Xero was down 5.6%, Afterpay owner Block dropped 7.8%, and WiseTech Global was down 3.6% as it announced the $603 million acquisition of intermodal rail solutions provider Blume Global.

Utilities were the biggest winners of the day, led by electricity generator Origin, up 1.7% to $7.00.

Consumer staples also finished up, boosted by A2 Milk, which climbed 6.3% to $7.10 as it closes in on approval to sell infant formula in China.

Of the big banks, NAB was the worst performer, down 2.2% to $29.85. Westpac climbed 0.1% to $22.78, while CBA fell 0.5% to $100.99 and ANZ was 1% lower at $24.67.

Insurer QBE jumped 7.4% to a near three-year high of $14.39 after announcing a 5% increase in its full-year cash profit to $847 million.

The heavyweight mining sector fell 0.7%, with Rio Tinto the only notable name in the green, up 0.5% to $124.26. BHP and Fortescue were down 0.3% to $48.00 and $22.26, respectively, while goldminer Newcrest fell 1.4% and mineral sands producer Iluka was down 2%.

Of the handful of companies reporting on Friday, Baby Bunting fared the worst, down 6.1% to $2.31, after chief executive Matt Spencer announced his departure at the end of the year

From Shane Oliver, AMP:

- Global share markets were mixed over the last week as concerns about rate hikes continue to impact. Eurozone shares rose 1.9% for the week but US shares fell 0.3%, Japanese shares fell 0.6% and Chinese shares fell 1.7%. Australian shares lost 1.2% for the week partly reflecting ongoing concerns about the impact of more aggressive RBA rate hikes on the economy and earnings and company reports pointing to signs of weakening demand with falls led by financials and resources stocks. Bond yields rose in the US as Fed rate hike expectations pushed higher. Oil prices fell but iron ore and copper prices rose. The $A fell below $US0.69 as the $US rose.

- Inflation and interest rates remained the main story. US monthly inflation picked up in January and the breadth of high inflation readings across CPI items increased a bit but the broader trend towards lower inflation continued with annual inflation falling to 6.4%yoy, core inflation falling to 5.6%yoy, 3 month annualised goods price inflation remaining negative and 3 month annualised core services inflation excluding dwellings starting to slow and even rental growth starting to cool (with further falls ahead given a sharp slowing in market rents).

- RBA Governor Lowe reiterated the RBA’s hawkish message. Governor Lowe and colleagues’ Senate and House of Reps appearances showed how political the issues around the RBA have become but didn’t really add anything that was new regarding the outlook for interest rates. We agree with the Governor’s assessment about the long term damage continuing high inflation will do to the economy, but our assessment is that it has likely already done enough to bring inflation down.

- So, we are allowing for another 0.25% hike next month. Thereafter another set of soft retail sales and jobs outcomes and maybe somewhat softer monthly inflation data could set the scene for a pause in April – consistent with Governor Lowe’s comments that the RBA would review its rate hikes if “we saw another weak jobs report”, but the risk of a further hike in April or May is high.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website