Anyone hoping superannuation regulations will remain unchanged again in the next Federal Budget on 9 May 2023 is likely to be disappointed. Super was untouched in 2022 but the Financial Services Minister, Stephen Jones, has done enough jawboning to indicate he is ready to target high balances in super. This is despite the superannuation system introduced by his party 30 years ago in 1992 encouraging savers to use the wonders of compounding to build such large amounts.

Most large superannuation institutions have rolled over and even the industry lobby group, the Association of Superannuation Funds of Australia (ASFA), supports a cap. In its submission to the October 2022 Budget, ASFA said:

“A balance of $5 million in concessionally taxed superannuation cannot reasonably be justified as necessary to support a comfortable lifestyle in retirement. ASFA estimates that introducing a $5 million cap on the amount that an individual could hold in superannuation would lead to additional revenue of around $1.5 billion a year, although the exact amount raised would depend on how excess balances were invested after they were withdrawn from the superannuation system.”

Likewise, the Australian Institute of Superannuation Trustees (AIST) supports the cap and nominates a date, 1 July 2024, when the amount in excess of $5 million should be withdrawn from super.

It's not often a new limit on super members is waved through so readily. It's either that the industry and retail funds know they are substantially unaffected at $5 million, or it’s better to promote a high cap than resist a smaller cap. It adds further complexity and another regulation to a retirement system that already confuses most Australians.

Super is only for retirement income, not bequests

The Government needs some political wins to rein in the budget deficit and the 11,000 Australians with more than $5 million in super are an easy target. That oft-quoted number comes from 2018 and it’s probably closer to 20,000 or 30,000 now. The Retirement Income Review claimed a person with $5 million in super receives annual tax concessions worth about $70,000 because balances over $1.7 million are taxed at only 15%.

Minister Jones believes the first step is to define the purpose of superannuation, which has languished since the days of the 2014 Financial Systems Inquiry (FSI). In October 2015, Treasury announced:

“The Government has accepted the recommendation of the FSI that the objective of the superannuation system is to provide income in retirement to substitute or supplement the age pension.”

Once a purpose or objective is in place, Jones has the framework he needs to set a cap, with statements such as:

“I’ve got to say $5 million is a lot closer to the purpose of superannuation than $100 million ... If people have got superannuation balances in excess of $100 million, or even $50 million, I think it’s pretty hard to argue that that’s about retirement income ... It might be about estate management, it might be about tax management, but it’s not about retirement income, and that really is not the purpose of superannuation.”

Confirming his view on 3 February 2023 on ABC Radio Breakfast, Jones said the consultation paper on the objective would be issued “very, very soon”. I have previously written on different objective here, arguing that superannuation policy always considered its role as part of an estate.

The growing momentum is supported by think tanks such as the Australia Institute, who upped the ante by producing a paper called 'Self-funded or state-funded retirees? The cost of super tax concessions' claiming super tax concessions will cost the budget about $53 billion in the 2022–23 year which is marginally more than the age pension cost and an increase from 1.5% of GDP to over 2% in 20 years.

Other arguments for a lower cap include David Knox of Mercer (also featured in this edition of Firstlinks) who favours a limit of double the current $1.7 million transfer balance cap, although that is set to rise to $1.9 billion on 1 July 2023 due to CPI linking, which would take the proposed cap to $3.8 million. The Grattan Institute says lowering the cap to $2 million per person would raise almost $3 billion annually.

Five reasons against introducing a $5 million cap

To put the $5 million in perspective, let's consider what is possible based on other superannuation rules. By 1 July 2024, both the Transfer Balance Cap and the Total Superannuation Balance will probably reach $2.1 million per person due to indexation. Over 70% of people enter retirement in a couple and it's legitimate to focus on household assets rather than individuals. A married couple will have access to $4.2 million in a tax-free super pension by 1 July 2024.

Why are we introducing a new $5 million cap at the same time that other limits are rising close to the same level? It's more complexity in the super system. A one-person household with $5 million and $1.6 million in pension will pay far more tax than a household couple with $4.2 million tax-free.

As opposition to introducing the cap withers, let’s look at the case for no change. And yes, I admit that I have a dog in this race.

1. That’s how long-term compounding works

When Chris Jordan, the Commissioner of Taxation, was asked at a conference how members had accumulated such large amounts in their SMSFs, he said balances were usually accumulated for over 30 years or funds held one or two investments that had done extremely well. He called the large SMSFs "accidents of history" and he added, "Don’t design the system for the last worst person.”

You don’t need to be Einstein (who never actually said compound interest is the Eighth Wonder of the World, but let’s go with it) to use a calculator and work out the dramatic impact of compounding. Anyone with a good income and spare savings who decides to invest in equities in super for decades will accumulate large amounts of money. That’s the power of compounding.

Sure, $5 million is a lot of money but it does not take vast wealth to accumulate such an amount with consistent investment over long periods. Consider how many working-class people now own $3 million homes in the western suburbs of Sydney by committing to a long-term savings pattern over 30 years called – wait for it ... it’s a devious scheme that should be capped – ‘paying off your home’. And many also qualify for the age pension.

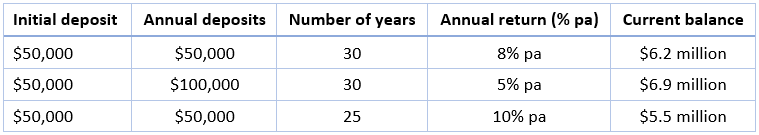

Consider these examples:

This is consistent saving over time. Successive governments of both colours not only allowed but encouraged significantly higher amounts than these to go into superannuation.

2. Retrospective changes hit those who saved in super not homes

Australians are living longer and many will spend 40 years in retirement. The days of work until 60 and drop dead at 70 are long gone. Since the introduction of compulsory super in 1992, Australians have been encouraged by the superannuation system and governments of the day to forego current day consumption to save for retirement. The system has legitimately allowed annual contributions (concessional and non-concessional) over 30 years plus one-off injections of up to $1 million.

The most obvious personal investment alternative over years is to upsize the family home. In my own case, I lived in the same house from 1989 to 2020, or 32 years. Instead of trading up to a more expensive home, savings went into superannuation. Is Stephen Jones telling me I should have bought the fancier house capital gains tax-free and now worth the GDP of a small Pacific nation?

So why is the person who decided to forego the extravagant home, Ferrari and lifestyle spending for 30 years and invest in a government-sponsored retirement system now forced to take out an excess? As Chief Executive of the SMSF Association, John Maroney, argues:

“Constant changes to the superannuation tax settings erode confidence in the system and discourage members from making long-term savings plans.”

3. Cost calculations assume no change in behaviour

People respond to incentives. The calculations on the cost of superannuation assume a person with a personal marginal tax rate of 45% makes big tax savings by going into super taxed at 15%. Then this 30% tax saving is repeated for, say, 40 years on the super earnings to give the overall cost. Consider this example from The Australia Institute:

“Assume someone on the 45% marginal tax rate puts away $10,000 in real terms every year for 40 years into a fund earning 7.5% nominal or 5.0% after inflation of 2.5%. With the tax of 15% on contributions and earnings that person would have a sum of $784,310 at the end of 40 years. However, if the contributor had to pay the actual applicable marginal tax rate of 45% then the balance at the end of 40 years would fall to $306,496.8. The difference, $477,813.20 is due to the tax concessions on both the contributions and the income in the fund. Hence the taxpayer contribution accounts for 61% of the 'self-funded retirement' in this example.”

Two qualifications are needed on the overall costings.

First, the main reason for the large super balances is not the compulsory Superannuation Guarantee, the size of which is limited and today stands at only $27,500 a year. Large balances are accumulated due to non-concessional contributions (NCCs), which on several occasions in the past, were permitted up to $1 million. Even now, the downsizer contribution allows $300,000 per person or $600,000 per couple without counting towards the Total Superannuation Balance. These NCCs are made from after-tax dollars after tax was already paid at the marginal tax rate.

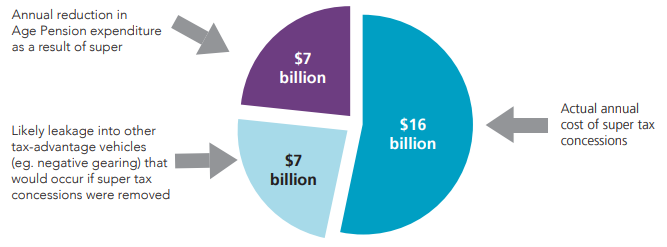

Second, the cost calculations take no account of how behaviour may change. In 2016, when the estimated cost of superannuation was about $30 billion, ASFA made the following calculations:

“When you take into account the savings the government makes on the age pension as a result of super, and the impact of behavioural change (people shifting money from one tax-effective vehicle to another) that would occur if super tax concessions were removed, a more accurate estimate would be around $16 billion a year. This is shown in the diagram below.”

Tax planners will find creative solutions to the cap, such as transferring balances to lower balance members in an SMSF. A common way to receive the income of large SMSFs at the moment is to set up a family trust or investment company to receive the pension payment and members draw out only what they need at their personal marginal tax rate, which in some cases may be nil.

With an estimated saving of $1.5 billion on the calculated cost of the superannuation system of $53 billion, is it worth all this effort and angst to save 2.8% of super’s ‘cost?'? The Stage 3 tax cuts which remain government policy will cost $254 billion over 10 years and they will benefit far more ‘rich’ people.

Even within superannuation itself, abandoning the scheduled increases in Transfer Balance Caps and Total Super Balances from 1 July 2023 would save more money, as would reducing the Division 293 threshold (where high-income earners pay higher tax on super contributions) from the current $250,000 to say $180,000, as super fund HESTA has advocated.

Instead, this proposal introduces another layer of complexity and Australians will turn more to expensive houses to capitalise on a competing tax advantage. Money out of super and into houses ... that's just what the country needs.

4. Super high balances will reduce over time

The strongest lobbying opposing the cap comes from the SMSF Association. This is to be expected because more of the 1.1 million members of SMSFs would be forced to divest money from super than in retail and industry funds. Chief Executive John Maroney argues that extremely high super balances are a legacy issue and limits on contributions imposed in 2017 will remove these balances as older members die.

When large balances built up by previous generations are passed to children, the money will need to leave the super system.

5. The devil will be in the detail

How might the proposed $5 million cap work? Let’s check some potential implementation problems:

a) Forced asset sales

One proposal says amounts over $5 million should be withdrawn from super by 1 July 2024, but this may force asset sales. According to ATO statistics for SMSFs, over 10% of the assets of SMSFs with balances over $5 million (and over $10 million as the average number of people in each SMSF is about two) is in ‘Non-residential real property’. Much of this is professionals such as doctors, lawyers and architects who run their business from an office which is owned by the SMSF. This asset is not intended to be liquidated and, in some cases, might comprise the majority of the fund.

A further 4% is in ‘Residential real property’ and about 15% is in ‘Unlisted trusts’, and some of these trusts, especially in alternative assets and commercial property, are tied up for long periods.

Funds already need to hold liquidity to meet pension payments, but some funds will not have ready cash to withdraw from the super system. Maroney says:

“It’s our position that any proposal to restrict retention of extremely large balances in superannuation needs to be handled carefully to ensure that any rule changes allow adequate time to manage the restructuring that would be involved, especially where large illiquid assets are involved."

b) Tax on unrealised capital gains

In the same way that balances are currently allocated between pension and accumulation and taxed accordingly, a third tier could tax earnings on asset levels proportionally above $5 million at the top marginal tax rate. This would avoid the need to sell assets.

However, tax is only payable on realised capital gains. If an asset has been held for many years, maybe decades, no tax has been paid on the unrealised capital gain. If the asset is sold when the balance is over $5 million, an SMSF may generate a huge capital gain. Will this be taxed at the maximum personal rate even if it has been held in super for 19 years of its 20-year investment life?

c) Market falls reduce balances below $5 million

As Chris Jordan identified, many of the larger balances are due to windfall gains on investments. It is common for start-up tech investments to be held in an SMSF, and if the value increases dramatically, the balance could surge past $5 million. But then in a tech crash, or if the start-up hits problems, it can fall just as quickly. Will a member go in and out of the $5 million cap and how will this be treated?

d) Impact on downsizer scheme

The Government proudly introduced the downsizer scheme to allow more money to move into superannuation, but a downsizer contribution does not count towards any caps and does not affect the Total Superannuation Balance. Does this mean a downsizer contribution that takes someone over the $5 million cap will have its earnings taxed at top marginal rates?

This change is politically easy

Changes which impose costs on a group of stakeholders usually face fierce opposition, but Stephen Jones is finding this one a walk in the park. Industry funds, retail funds and their lobby groups are supportive because the large balances mainly reside in SMSFs.

Of course, $5 million is a lot of money, but it is often the result of a multi-decade savings journey that a retiree has pursued with discipline on other spending, appreciating the impact of 30 to 50 years of compounding at decent investment returns. A house bought near a major city 40 years ago has improved by similar amounts. It’s prudent investing over a long time under a government-sanctioned retirement scheme, in the same super system which will encourage a couple to hold $4.2 million tax free by the same implementation date. Oh, that's fine, is it?

Graham Hand is Editor-at-Large for Firstlinks. This article is general information.