The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

When interest rates fell close to zero in 2020, including on short-term deposits and investment grade bonds, many investors took on extra risk in a search for yield and income to live on. This included moving along the yield curve (that is, investing in longer-term bonds, and we now know how badly that ended for Silicon Valley Bank) or down the credit or capital spectrum. As interest rates rose, 2022 delivered the worst results in bond markets for decades, even without the impact of a recession on credit quality.

For example, a popular Australia ETF such as Vanguard's International Fixed Interest Index (Hedged) ETF (ASX:VIF) holds around 1,500 government bonds from 35 large countries. About 90% of the securities have a credit rating of A- or higher. The credit quality of this bond is impeccable, as Vanguard explains:

"Government debt has historically been a stable investment, offering peace of mind during more volatile periods for share markets."

How has this 'stable investment' performed? Investors only need one statistic to know the picture was not pretty. The duration of the portfolio is 7.4 years, meaning for every 1% rise in rates, the capital value of the portfolio fell by about 7.4%. The price of VIF is down 25% in three years, and none of that is due to poor credit quality. Vanguard was simply replicating a bond index, the result has nothing to do with their security selection.

Source: Morningstar

Source: Morningstar

Australian retail investors are also major holders of local hybrids, especially issued by banks. With the write-off of AT1 capital securities issued by Credit Suisse, the differences between the Swiss and Australian documentation have reassured investors that local hybrids are materially stronger. Not only are Australian banks more profitable and better managed, but these hybrids sit above shareholder capital in the payment waterfall.

Investors looking for yield are attracted to the extra margin on hybrids, despite the higher risk. Wholesale trading platform, AUSIEX, reported December 2022 hybrid trading volumes were double the level in December 2021, and:

"Trade volume among financial advisers increased 15.7% over the 2022 calendar year, compared with 2021. Across generations, for advised accounts, Gen X showed a significant lift in interest, with the proportion of trades increasing from 31% to 37.7%."

Something else happened with investor appetite when interest rates headed to zero. Those who qualified as 'wholesale' turned to fixed interest brokers for direct bonds, but in many cases, the clients knew insufficient about credit and duration risk in their quest for yield. Some clients have since learnt the hard way that 'bond' does not necessarily mean 'defensive'.

Retail investors considering direct exposure to unrated bonds must assess their ability to understand company balance sheets, debt structures, loan covenants, payment tiering, and industry and macro conditions. A broker might provide a detailed offer document but inexperienced investors cannot rely on the broker to make the investment decision.

All this reading and assessment is required just to ensure money is returned, as in bonds, there is no upside beyond repayment at par, unlike in equities.

On the other hand, some of the bonds placed with unsophisticated investors were issued by high quality companies, such as Aurizon with a coupon of 2.9%, maturing in 2030. While holders of this bond now face a large revaluation 'loss', at least if they hold to maturity, they should receive par. Again, this is due to duration risk, not a credit loss. Similar long bonds were issued by Lend Lease, Pacific National and Transurban, which all look good from a credit perspective.

It is in the non-investment grade securities where the credit problems have already occurred, even before any sign of a recession. Examples include:

1. Virgin

The best known of the recent bond failures, and when Virgin entered voluntary administration in April 2020, its new owner, Bain Capital, said bondholders would receive less than 10 cents of the par value for their bonds.

2. Privium

On 29 November 2021, The Australian Financial Review reported:

"Privium failure hits more than 2000 home buyers ... The company went under with liabilities of $23 million in secured notes and $17 million in unsecured liabilities equally split between subcontractors and suppliers."

3. Axsesstoday

Axsesstoday was placed into liquidation in April 2019 and retail investors in its July 2018 bond issue were left with a security which might be worth around 5% of its face value when investors are eventually paid out. These notes were listed on the exchange (ASX:AXLHA) and readily available to anybody.

4. Mackay Sugar

Mackay Sugar bonds, issued with a coupon of 7.75% in 2013 as a ‘wholesale corporate bond’ and expected to mature in 2018, holders were offered half the face value on their notes when the sugar refiner hit financial problems.

5. CF Asia Pacific

Anchorage Capital Partners bought distressed transport company CF Asia Pacific in 2019 with senior lenders taking priority over its subordinated notes.

Many more companies will not survive a climate of high interest rates and recessionary trading conditions. Most 'retail' investors wanting exposure to bonds should stay with investment grade companies or bond funds where fund managers access the issuer risk. And even then, as large European funds holding Credit Suisse AT1s have learned, professionals can miss the detail hidden in plain sight in the offer documents. Ratings agencies are already reporting that global corporate defaults, at this stage mainly in the US, are reaching GFC levels, and borrowers in Australia have not yet reached the 'mortgage cliff'.

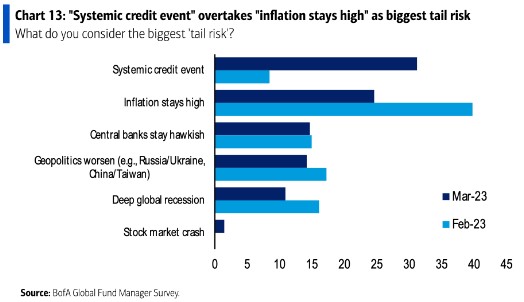

So it is credit which is now worrying fund managers most. To show how quickly market sentiment can change, the Bank of America Fund Manager Survey for March 2023 shows how 'systemic credit event' has replaced 'inflation stays high' as the major 'tail risk'.

At least hardly anyone believes there will be a stockmarket crash.

***

The NSW state election demonstrated a problem facing the Reserve Bank in slowing the economy. While Governor Philip Lowe tries to reduce consumer spending by increasing cash rates, voters are offered energy subsidies, road toll relief, increased infrastructure spending and business subsidies. It's similar at a Federal level, with the Government struggling to find meaningful spending cuts but plenty of reasons for handouts. Nothing Phil can do about this.

On interest rates, while talk of the US Fed stopping at 5% still has its supporters, it is less often mentioned how much the market expects the Fed to ease over the next couple of years. With Chairman Powell vowing to drive inflation back to 2%, the market thinks he will succeed and probably take the economy down in the process.

There was more room for optimism that the Reserve Bank will at least pause at its next meeting, following the release of the CPI yesterday. Michelle Marquardt, ABS Head of Prices Statistics, said:

"This month's annual increase of 6.8% is lower than the 7.4% annual rise reported in January 2023. This marks the second consecutive month of lower annual inflation, also known as ‘disinflation’, from the peak of 8.4% in December 2022."

Of course, economists remain divided, with ANZ still calling for two more rate increases and a top of 4.15%, but they are now in the minority.

Finally, many thanks to the 800 or so people who filled in our Reader Survey. It will influence our future content, although without too much change as a common theme was 'keep doing what you are doing'.

Graham Hand

Also this week ...

The research into the performance of US and global stocks by Hendrick Bessembinder surprised many, as it identified that relatively few stocks generate all the stockmarket's outperformance. He visited Australia recently, and read what he says about his research including whether it lends weight to active or passive investing.

Andrew Gale's long career in consulting and investing included time as Chair of the SMSF Association. While he has sympathy for a limit on the concessions available on large super balances, he says the Government's proposed mechanism to identify who should pay more tax has serious flaws.

Still on superannuation, we know that industry funds, retail funds and SMSFs are alternative ways to hold retirement savings and they are generally subject to the same rules. But in her continuing monthly series, Meg Heffron shows four ways in which SMSFs might be better for paying pensions from super.

There's a common perception that the main reason that growth stocks outperformed value stocks in the decade to 2021 was because of lower interest rates. Andrew Mitchell from Ophir thinks that's a furphy and provides compelling evidence for his contrarian view.

Roger Montgomery reassures us that this latest banking crisis isn't the GFC 2.0. Yes, there are still risks, but the crisis is also providing opportunities for bargain hunters. According to Roger, price-to-earnings ratios have pulled back, and stocks with solid earnings profiles are looking attractive.

Meanwhile, Andrew Canobi of Franklin Templeton zeros in on what he sees as the real issue behind the banking turmoil: the constriction of credit supply that central banks are inducing amidst their assault on inflation. He says that in a highly-financialised world fuelled by liquidity and availability of credit, sooner or later things start to break when central banks withdraw that credit and liquidity as rapidly as they have.

Almost all of the large funds management companies are experimenting with blockchains and digital coins. Adam Belding of Calastone gives an insider's view on the potential of so-called tokenisation to transform the finance industry.

In the weekend update by Morningstar, Christine St Anne looks at four charts on the outlook for Australian retailers, and the stocks set to outperform, while Kate Lin reports on Alibaba's restructuring plans and whether they can translate into better shareholder returns.

Lastly, this week's white paper from Martin Currie summarises the recent reporting season and the key themes to come from it.

***

Weekend market update

On Friday in the US, bulls wrapped up the quarter in style as stocks advanced 1.4% on the S&P 500 and 1.7% on the Nasdaq 100 to leave those indices higher by 7.5% and 21.3% respectively this year. Treasurys also enjoyed a strong bid as the two-year yield slipped four basis points to 4.06% and the long bond settled at 3.67%. Gold edged back to $1,987 per ounce, WTI crude gained to near $76 a barrel and the VIX settled near its year-to-date lows below 19.

From AAP Netdesk:

The Australian share market broke its longest weekly losing streak since the global financial crisis and reached a three-week peak in the process, but still closed out the month in the red.

The benchmark S&P/ASX200 index finished on Friday up 55.5 points, or 0.78%, to 7,177.8, while the All Ordinaries rose 60.9 points, or 0.83%, to 7,373.3. The market was up 3.2% for the week. It ended the quarter up nearly 2% but finished March 1.1% lower from where it started.

Eight of 11 ASX sectors finished in the black on Friday, with materials strongest.

Aurelia Metals' share price jumped 25% jump to $1.25 after the company announced it was close to securing more credit to finance its minerals mine in NSW.

Fortescue Metals led the gains among the mining behemoths, closing up 88 points or 4.07% to reach $22.49. It was closely followed by Rio Tinto which was up 2.46% by the end of trade. The WA-based miner announced it had inked a deal with Canadian metals miner First Quantum to develop a copper mine in Peru. BHP was not far behind, gaining 2.5% to $47.23 to end the week.

The banks saw mixed results with CBA gaining a little 0.5% to reach $98.32 after announcing a share buyback. ANZ and Westpac ended the day slightly up, gaining 0.26% and 0.18%, respectively, while NAB saw a decline of 0.16%.

EML rose almost 31% to $55 after the global payments company confirmed a regulatory move by the Irish Central Bank on its subsidiary did not affected the company's guidance for the 2023 financial year.

Analysts will be closely watching next Tuesday's interest rates decision by the Reserve Bank.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website