The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

There's been a lot of talk about how the 'Magnificent Seven' stocks (Apple, Microsoft, Nvidia, Alphabet, Amazon, Tesla, Meta) in the US have driven most of the market's gains year-to-date. These stocks contributed 73% of the first half rise in the S&P 500.

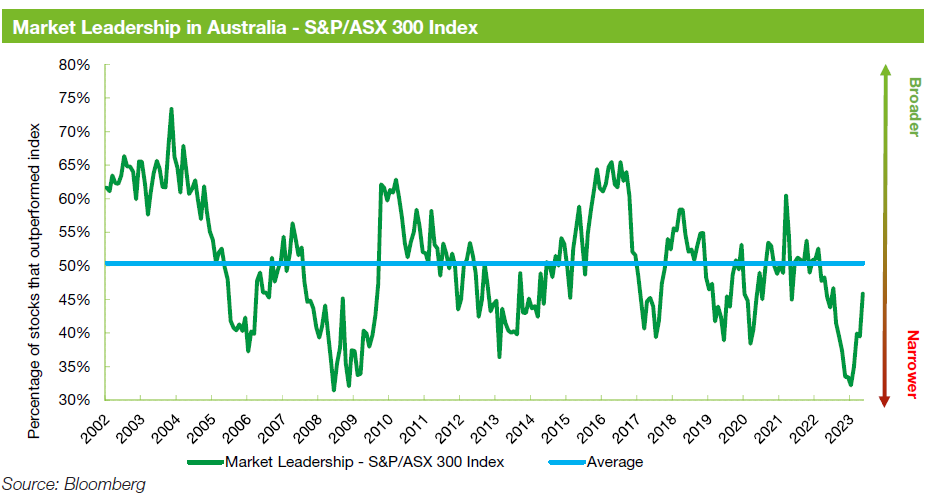

Yet a new report suggests that this phenomenon hasn't just been limited to America. In Australia too, so-called market leadership narrowed over the past 12 months. Despite the S&P/ASX 300's positive return in the year to June, 55% of stocks decreased in value.

As the chart from Zenith Investment Partners shows, market leadership declined during the year to levels last seen during the GFC. A silver lining is that it's partially recovered from these extreme levels.

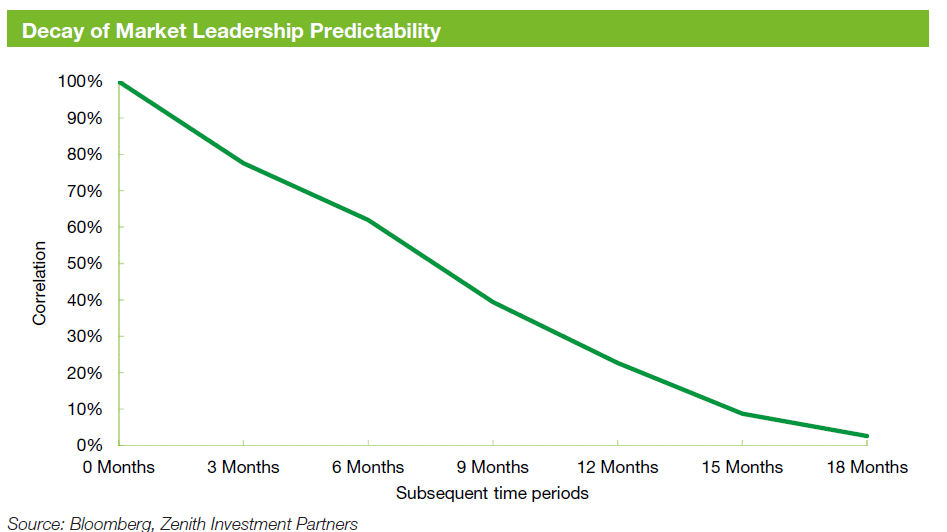

The good news for fund managers and individual investors is that market leadership usually mean reverts within 12-18 months. Put simply, a broader range of stocks is likely to participate in market gains or losses in future.

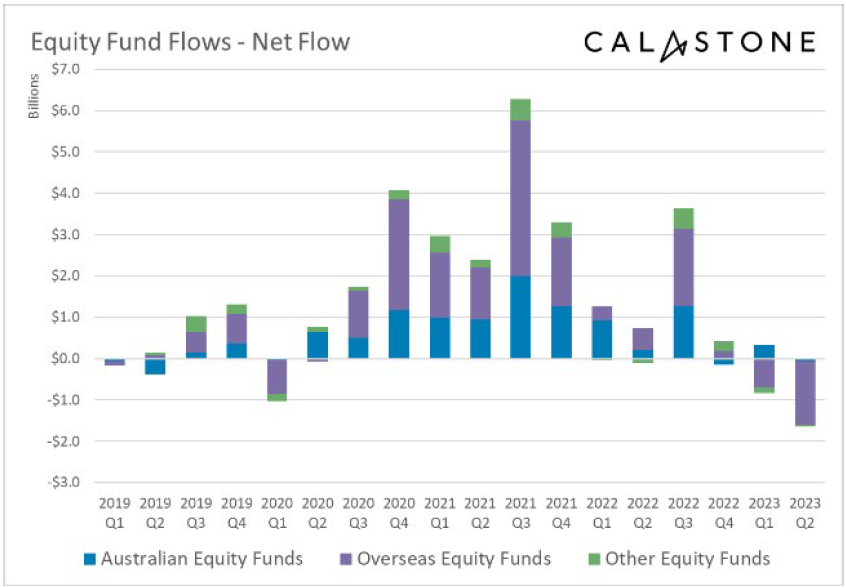

Many investors aren't waiting to find out though. In the second quarter of this year, they bailed on equities in favour of fixed interest and cash.

Net outflows from managed equity funds totalled $1.65 billion from April to June, according to figures from Calastone.

As the chart shows though, international equity funds bore the brunt of the outflows. Australian equity funds saw a net outflow of just $59 million.

The big winner was fixed interest which saw net inflows of $582 billion in the second quarter. It seems investors are attracted to the higher yields on offer from both bonds and cash.

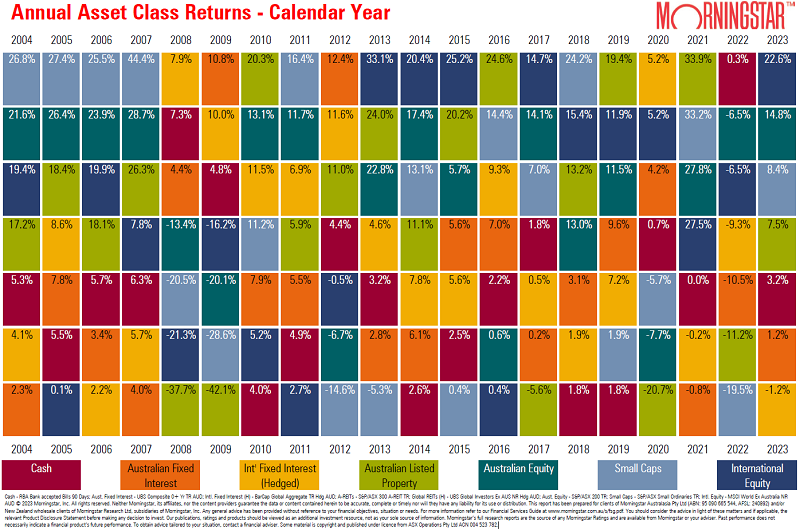

The flow data is ironic given that investors normally chase performance. And as Morningstar's new Asset Class Gameboard shows, equities significantly outperformed other asset classes in the first half of 2023.

Note that the figures are to June 30, 2023, and international returns are hedged into Australian dollars.

The gameboard does a good job of highlighting the winners and laggards from seven major asset classes for each year over the past two decades. And it also shows how difficult it is to pick future winners. For instance, who would have thought that equities would come roaring back this year after the hiding they got in 2022?

Gameboard lessons

While the Gameboard won’t help identify future winners, it can provide some useful lessons for investors, including:

- Cash is gradually becoming more useful. Interest rates above zero will do that. Cash was at the top of the class in 2022 and though it slid in the first half of this year, the 3.2% year-to-date return is the highest return on this asset since 2013.

- Fixed interest has had a poor two-and-a-half years. While it’s stopped the hemorrhaging of last year, it hasn’t bounced as much as some would have hoped. Given the steep hike in rates, perhaps the second half of this year may see a change in fortunes. Many of the investors highlighted in Calastone's data will be hoping so.

- International equities have had a stellar decade. It’s again the best performing asset class this year. Surprisingly, Europe and Japan have been strong performers, benefiting partly from a declining US dollar.

- Australian small caps have been all over the shop over the past decade. The key trend has been that they’ve underperformed large caps by a wide margin. In theory, small caps should offer higher long-term returns than large caps to compensate investors for the risks of investing in them. Yet that hasn’t proven the case in Australia for a long time. A contrarian bet, perhaps?

- Australian equities have been strong, consistent performers over the past five years. Yes, they significantly lagged international equities in the first half, though given headwinds from China, commodities, and bank margins/costs, the result should be more than satisfactory to investors.

- Australian listed property surprised your author, being the fourth best performing asset class in 2023. The bounce in house prices has obviously helped developers such as Stockland and Mirvac. It’s worthwhile noting how volatile this asset class has been since 2015, moving from bottom to top and bottom again on a regular basis. I imagine many investors see listed property as a steady asset, but the Gameboard shows it’s anything but.

From 2004, the average annual return of each asset class is tabled below, from best to worst.

|

Annual asset class returns 2004-2023

|

Average

|

Best

|

Worst

|

|

Australian equity

|

9.00%

|

28.70%

|

-20.10%

|

|

International equity

|

8.40%

|

33.10%

|

-21.30%

|

|

Australian small caps

|

6.30%

|

44.40%

|

-28.60%

|

|

Australian listed property

|

5.30%

|

33.90%

|

-42.10%

|

|

International fixed interest (hedged)

|

4.90%

|

11.60%

|

-9.30%

|

|

Australian fixed interest

|

4.20%

|

12.40%

|

-10.50%

|

|

Cash

|

3.40%

|

7.30%

|

0.00%

|

As you’d expect, equities come out on top over the long-term, albeit with greater volatility. It does make me wonder why so many Australians have their super in a default balanced fund given the underperformance of bonds and cash over long periods. Surely volatility is less of a concern if super is being held for 10, 20 or 40 years?

UniSuper investment boss, John Pearce, may disagree with me. His balanced fund delivered a 10.34% return to beat all other mega funds over the year to June. I report on a recent update that Pearce gave to UniSuper members where he said that unlike most other superannuation funds, UniSuper hadn't piled into unlisted assets in recent years. And as a result, it’s got extra cash on hand to take advantage of opportunities opening up from current market volatility.

James Gruber

Also in this week's edition ...

Firstlinks welcomes Clime Investment Management's John Abernethy to the newsletter. John and his colleagues will contribute a regular column. John has 40+ years experience in markets and brings broad expertise across asset allocation, macroeconomics, financial advice, and equity markets. This week, in his first article, John suggests that the RBA isn't independent of Government and explains why that's actually a good thing.

Meg Heffron is back, this time addressing the thorny issue of whether you should bring your children into your SMSF. Meg conveys her personal story on the subject, and how she weighed the pros and cons of her decision. She hopes her story can help Firstlinks readers make their own call on the issue.

Van Eck's Jamie Hannah thinks the US is in the last stage of the economic cycle with a recession likely by the end of 2023. If right, he names five assets that can potentially shield investors from any downturn that takes place.

Graham Hand returns with part 2 of his report on famed investor Howard Mark's recent chat with MBA students. In part 1, Marks expressed scepticism toward macroeconomic forecasts, though this week he qualifies that. He also looks at how he balances aggressive and defensive investing. And Marks reveals how his investment portfolio is positioned now.

Who will emerge as the largest multinationals in the decades to come? John Stavliotis from Antipodes attempts to answer this fascinating question. Surprisingly, he doesn't think the future global powerhouses will come from the developed world.

Global asset owners have historically allocated capital to two distinct equity asset classes: global large cap and/or global small cap. Nicholas Paul from MFS believes there's a good argument for a small-mid-cap fund to be part of investor portfolios.

Two extra articles from Morningstar for the weekend. Susan Dziubinski outlines the 10 best US dividend stocks while Joshua Peach asks what's driving the rally in Megaport's shares?

Finally, we normally feature a whitepaper in our newsletter though we've decided to mix things up this week. We've instead included a new 'Demystifying Debt' video series of ten short clips from Metrics Credit Partners seeking to debunk common myths about investing in private debt. Enjoy.

***

Weekend market update

In the US on Friday, stocks remained little changed late in the day ahead of the Nasdaq 100’s special rebalancing on Monday, while Treasurys likewise saw a status quo session. Gold edged lower to $1,964 an ounce, WTI crude pushed to a near-three month high at $77 a barrel and the VIX stayed below 14.

From AAP Netdesk:

In Australia, the local bourse finished lower on Friday as traders took something off the table following a red-hot jobs report and ahead of several key events.

The benchmark S&P/ASX200 index on Friday finished down 11.1 points, or 0.15%, to 7,313.9. The broader All Ordinaries dropped 15.1 points, or 0.2%, to 7,526.8.

There is a big week ahead including an "all-important" second-quarter domestic consumer price index print on Wednesday.

The ASX's 11 sectors finished mixed on Friday with tech the biggest mover, falling 2.7% after an overnight selloff on Wall Street following a disappointing earnings report from Netflix.

Wisetech Global dropped 2.4% to $80.05, Xero fell 3.9% to $122.20 and Technology One retreated 2.9% to $15.33.

The heavyweight mining sector was 0.5% lower despite gains by both BHP and Rio Tinto. The big Australian climbed 0.9% to $45.02 and Rio advanced 0.3% to $116.78, but Fortescue dipped 0.2% to $22.54.

Both gold and lithium miners lost ground.

Coronado Global Resources added 2.8% to $1.65 after the coking coal producer reaffirmed guidance and posted strong second-quarter production numbers.

The big four banks were lower, with CBA falling 0.7% to $104.55, ANZ down 0.8% to $25.16, NAB dipping 0.1% to $27.90 and Westpac 0.6% lower at $21.98.

Macquarie slipped 1.4% to $182.83.

Blackmores finished basically flat at $94.73 in its last day of trading on the ASX. A subsidiary of Japan's Kirin Holdings agreed to acquire the vitamins maker in April for $1.9 billion, or $95 a share. The 85-year-old company will be replaced in the ASX200 on Monday by Ventia Services Group, an infrastructure services provider.

In health care, Starpharma shot up 14.9% to 42.5c after its radio-diagnostic candidate showed imaging benefits in a breast cancer model.

From Shane Oliver, AMP:

- Global shares were mixed over the last week as investors digested the strong gains of the previous week and as central bank interest rate expectations were revised up a bit in some countries. For the week US shares rose 0.7%, Eurozone shares rose 0.4%, Japanese shares lost 0.3% and Chinese shares fell 2%. Australian shares rose just 0.1% not helped by stronger than expected jobs growth pushing up RBA rate hike expectations with falls in materials and telcos offsetting gains in financials and health shares. Bond yields were mixed but mostly little changed. Oil prices rose but metal and iron or prices fell. And the $A fell as the $US rose slightly.

- Shares remain at risk of a short-term correction given high recession risks, worries about Chinese growth, the risk of more rate hikes with central banks, including the RBA, remaining wary and the seasonally rougher patch often seen through August to October. But the ongoing fall in global inflation with the promise of a peak in interest rates is consistent with our positive 12-month view on shares and appears to be dominating for now. So, any pull back may be shallow.

- The past week saw more countries report falls in inflation, following the fall in inflation to 3%yoy in the US. This is all adding to evidence that global inflationary pressures are in retreat:

- Canadian inflation fell to 2.8%yoy in June (from 3.4%) with the average of its underlying measures falling to 3.8%yoy (from 3.9%).

- NZ inflation fell to 6%yoy in the June quarter from 6.7%, with core (ex-energy & food) inflation falling to 6.1%yoy from 6.5%.

- UK inflation fell to 7.9%yoy from 8.7% with core inflation falling to 6.9% from 7.1%.

- Sticky core inflation is a concern and keeps central banks on edge for now. This risks another 0.25% hike in Canada and New Zealand. And the Bank of England continues to face a bigger problem given the surge in its wages growth to 7.3%yoy so is still likely to hike at its August meeting, but probably now by 0.25% rather than 0.5%. But the UK is a special case given the inflationary shock of Brexit and its less functional Monetary Policy Committee. And in a bigger picture sense the decline in inflation is likely to continue as demand continues to cool adding to confidence that interest rates are at or near the top globally.

- RBA minutes pivot to be a bit less hawkish consistent with recent messaging from Governor Lowe, but after the strong June jobs report another rate hike still looks likely in August at this stage. The decline in global inflationary pressure is a positive for Australia too and adds to the likelihood that the RBA is at or near the top on rates.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website