The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

I have been overseas for a month, and instead of reading the continuous news stream received sitting at my desk each day, I dipped into my emails less often. And it is striking how much of the hourly and daily milieu is useless noise for most long-term investors. Seen from a distance, the perpetual output from economists and analysts on the Reserve Bank cash rate, the US Fed funds rate, the direction of the stockmarket, the expected company results and consequences for markets and the economy look like contradictory guesses. Forecasts read a couple of days after publication are already wrong.

A recent headline in the leading global investment publication, Seeking Alpha, reads:

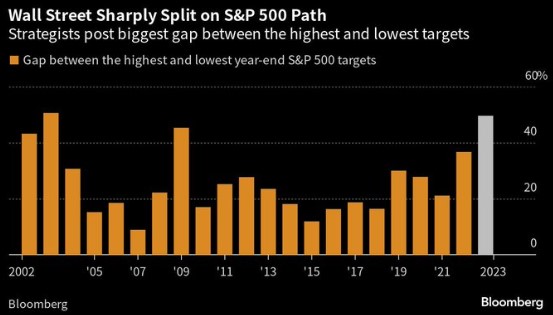

The S&P500 is currently about 4,500. And guess what. May be the S&P500 is heading for 4,700. According to Bloomberg, the range of Wall Street analysts' S&P500 targets for the end of 2023 is about 50%.

Where one expert announces "The Reserve Bank's next move is down", the next says "Reserve Bank not finished yet" while another has two bob each way with "Next Reserve Bank move uncertain". It might be relevant for day traders but long-term investors who react to speculation on what might happen tomorrow will condemn themselves to over-trading, exiting the market and struggling to find a reinvestment level. Selling with an intention to re-enter is an attempt to make two correct guesses and is likely to fail. I explain the challenges this week in the context of an investment exit I made on my personal account in early 2022 which for a long time looked inspired. Until it didn't.

The other headline subject that looks useless from a distance is the common claim that these are 'volatile' or 'difficult' or 'uncertain' investment markets. It does nothing but induce caution or worse, exiting the market, when all that is happening is the regular movement of share prices.

Consider this quote on the rapid changes in financial markets:

"In recent years the pace of change and innovation in financial markets and institutions here and around the world has increased enormously as have the speed, volume and value of financial transactions. The period has also seen a greatly heightened degree of aggressive competition in the financial sector. All of this is taking place in the context of a legal and a regulatory framework which is increasingly outdated and ill-equipped to meet the challenges of the day. This has led to … concern that the fragility of the system has increased, in part because the degree of operational, liquidity and credit interdependency has risen sharply."

Was this said last week in these volatile and uncertain times? No, it is Gerald Corrigan, ex-President of the New York Fed, speaking in January 1987. Let's not pretend volatility is new just for the sake of a headline. There are always reasons to sell, and what looks like a crisis usually turns out to be little more than ongoing noise. Tune it out.

Let's take one simple example of how wrong forecasts can be, as Westpac reported this week.

"At the time of the May 2023 Budget, the Federal Government forecast an underlying cash surplus in 2022/23 of $4.2bn, to be followed by deficits in 2023/24 and 2024/25 of $13.9bn and $35.1bn respectively. These forecasts were based on the government’s economic forecasts, which include employment; wages; inflation; output and commodity prices; as well as their forecasts for government expenditure.

Westpac’s forecasts for the budget positions over that period indicate a surplus of $22bn in 2022/23; a surplus of $11bn in 2023/24; and a deficit of $16bn in 2024/25. That would mean a combined improvement in the cumulative Budget positions over the three years of $62bn."

May 2023 was only a few months ago, and the best brains in Treasury missed a cool $62 billion of improvements. $62 billion!

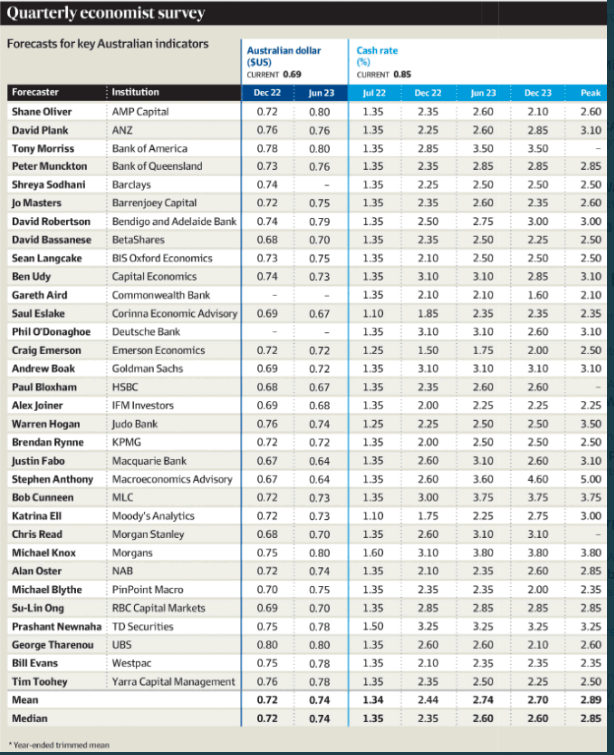

Check this table from The Australian Financial Review a little over a year ago showing their Quarterly Economist Survey forecasts for June 2023 and December 2023. Most have a peak cash rate in the 2s and some have an Aussie dollar at 80 cents. The current cash rate is 4.1% and the exchange rate is about 65 cents. As the saying goes, 'If you must forecast, forecast often.'

While we were overseas, we visited the spectacular, UNESCO-world heritage listed Cologne Cathedral, well worth adding to a European journey. It claims the largest church façade ever built and the heaviest swinging bell in the world, cast in 1448 and weighing 11 tons. And this from the church's brochure:

"On a first visit to Cologne Cathedral (begun in 1248) one is astonished to learn that it took 632 years to complete it. This was made possible only because no generation of builders departed from the original masterplan. Everyone who began and continued this building project over centuries was aware that they would never see completion."

Say what? A consistent plan for 632 years, in the face of politicians, architects and builders who no doubt came with their own opinions and desires. Most of us can't stick to a long-term investment plan for a few years.

Another high-profile forecast which has defied most analysts is Australia home prices, driven by high immigration and low unemployment. However, as shown below, according to the Westpac/MI survey, perceptions of whether now is a good time to buy a dwelling are at their lowest level since the GFC, while prices are rising. As AMP's Shane Oliver says, it questions the durability of the property price upswing.

Source: Shane Oliver, AMP

Source: Shane Oliver, AMP

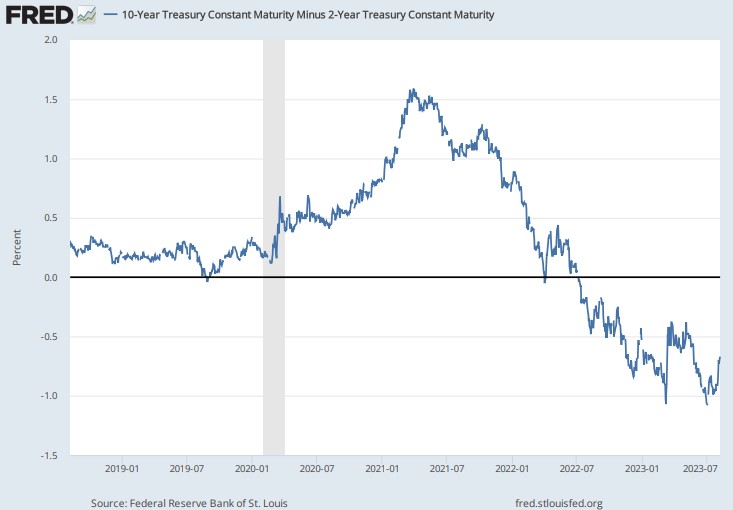

We have all read the articles in the last year on how an inverse yield curve is a strong predictor of a recession. The rationale is that if long-term rates are lower than short term, it means the bond market expects the outlook for the economy to be poor and interest rates will fall. This chart shows the persistence over 2023 of the 2-year US Treasury rate above the 10-year (ie a negative or inverse yield curve), yet US equity markets, driven by tech companies, continue to ignore the recession threat. One of the markets is correct, and in my experience, it's usually bonds.

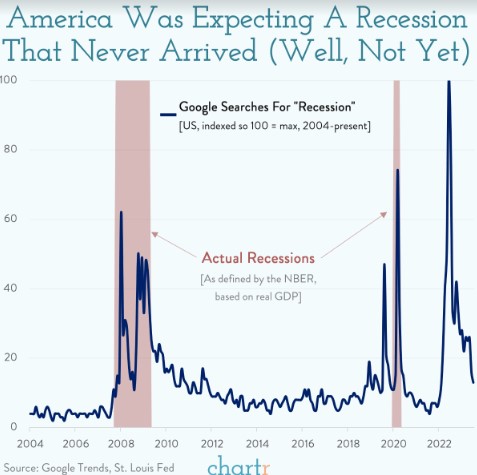

But we can always find other evidence. Another predictor of recessions is how many people search for the word 'recession'. The good news is that while searches were at record highs in 2022, they have significantly fallen in 2023, probably due to lower inflation and robust employment. Hopes for the 'soft landing' yet.

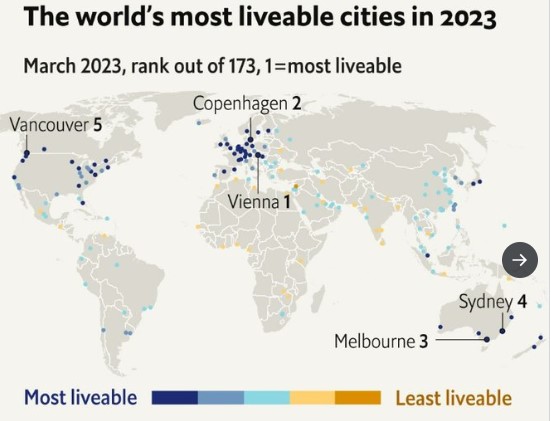

Thanks for the strong engagement in my article last week on my European travels. For anyone who read the article just after publication, dozens of great comments came in later. And in case anyone doubts that Australia is a great place to live, see the latest global city rankings from The Economist. Tiny Australia holds two of the top four places.

Graham Hand

Also in this week's edition ...

Continuing on from Graham's examples of investing in Microsoft, Apple and Alphabet comes Blair duQuesnay's thoughts on Apple. It is the ecosystem of product links that meet basic needs that makes the company so strong.

Further on this theme which is driving US markets, Chris Demasi from Montaka argues that while the rapid increases in the share prices of the 'Magnificent Seven' have pushed up valuations, they are great companies whose rise is not yet finished.

Many SMSF members know that their fund stops paying income tax on some or all of its investment earnings when it starts paying ‘retirement phase’ pensions. This tax break can mean a complete tax exemption on capital gains that have built up over many years, but is it essential to start the pension before selling assets? Meg Heffron has some answers.

Meanwhile, SMSFs have been increasing their allocations to cash and cash-like products. It indicates that capital protection remains a priority for these funds. Yet Balaji Gopal from Vanguard Australia warns that cash isn't a risk-free asset, especially when its returns still trail inflation. He suggests that SMSFs should instead look at other defensive assets.

This week's Wealth of Experience podcast features special guest, John Abernethy, from Clime Investment Management. John has seemingly done it all in his 40-plus years in investing, and in a broad-ranging interview, he questions whether size is becoming a problem for Australia's super funds. Peter Warnes offers a different take on super and their unlisted assets, while Graham Hand looks at retiree fears of running out of money.

Moving yourself or a loved one to a nursing home can be emotional and difficult. It's an important and complex decision that can affect your income, wealth, means-tested aged care fee, and bequests. Anam Bilgrami of Macquarie University offers some tips to help you with the decision.

Two extra articles from Morningstar for the weekend, one on Woodside's LNG stake sale, and Christine St Anne asks whether CBA can keep its bumper dividend,

Finally, in this week's White Paper, First Sentier has recently met management at North American infrastructure companies, as well as with regulators, and it details key findings.

***

Weekend market update

On Friday in the US, the indices finished mixed. The Dow was up 0.3%, though the S&P 500 finished marginally down 0.1% and the Nasdaq was 0.7% lower. The Nasdaq capped its worst two week stretch since December as rising yields, and rich valuations saw investors take money off the table. The NYSE Fang + Index fell 1.2% with declines of 3.6% for Nvidia, 1.1% for Tesla, and 1.3% for Meta. The yield on the US 10-year note rose 5 basis points to 4.15%. Brent crude increased 0.5% to US$86.81, making it seven straight weeks of gains. The VIX fell below 15.

From AAP Netdesk:

The local share market on Friday edged lower after central bankers in Australia and the United States tried to temper expectations cooling inflation meant their work raising rates was done.

The S&P/ASX200 index on Friday fell 17.3 points, or 0.24%, to 7,340.1, while the broader All Ordinaries dropped 14.3 points, or 0.19%, to 7,554.2. For the mostly quiet week, the ASX200 rose 14.8 points or 0.2%, after last week snapping a three-week winning streak.

The ASX's 11 sectors finished mixed on Friday, with energy the biggest mover, falling 1.9%.

Woodside dropped 2% to $38.22, Santos fell 1.6% to $7.92 and Whitehaven Coal dropped 3% to $7.23.

Retailers gained after furniture retailer Nick Scali posted a record profit of $101.1 million as revenue increased 15.1% to $507.7 million. While managing director Anthony Scali cautioned trading during the year had been "variable and challenging" as sentiment soured in line with interest rate hikes, Nick Scali shares surged 13.4% to a six-month high of $12.12.

Adairs rose 5.3% to a two-month high of $1.805, JB Hi-Fi rose 2.5% to a six-month high of $47.21 and Harvey Norman jumped 3.2% to a five-month high of $3.87.

Elsewhere, Star Entertainment soared 18% to a two-month high of $1.15 after the casino owner was granted a reprieve from sky-high poker machine taxes for the next seven years.

The Big Four banks had a quiet day, with ANZ the biggest mover, dipping 0.2% to $25.35.

In the heavyweight materials , Boral rose 4.6% to $4.96 after the building and construction materials supplier reported its underlying full-year profit had quadrupled to $142.7 million, with CEO Vik Bansal reporting clear improvement across the entire business.

Newcrest dropped 0.4% to $25.85 after the goldminer announced its full-year profit for 2022/23 was down 11% to $US778 million, in what will likely be its last set of earnings results before its acquisition by New York Stock Exchange-listed Newmont Corp.

Among the big iron ore miners, BHP edged 0.1% lower at $45.73, but Fortescue Metals dropped 2.2% to $21 and Rio Tinto fell 0.6% to $109.

From Shane Oliver, AMP:

- Share markets were mixed over the last week, on the back of higher energy prices and ongoing upwards pressure on bond yields. For the week US shares fell 0.3% and Eurozone shares fell 0.4%. Chinese shares also fell 3.4% with weak data. But Japanese shares rose 0.9%. Bond yields rose in the US and Europe but fell in Japan and Australia. Oil prices continued to rise and gas prices surged on the back of a possible strike in Australia affecting global gas supplies. Metal prices fell and the iron ore price was little changed. The $A fell as the $US rose.

- RBA Governor Lowe’s House Economics Committee testimony reiterated the RBA’s softened tightening bias that “its possible that some further tightening in monetary policy may be required” and this will depend on economic data and the risks. His commentary continued to reflect the more balanced assessment of risks with uncertainties around the consumer and services inflation. He did note that if the expected pick up in productivity did not occur then high inflation could persist. Coming data on wages, jobs, retail sales and inflation ahead of the next RBA meeting will be critical.

- In terms of the implementation of RBA Review, Governor Lowe is right to point that “it makes sense to take time to get the details right” around the proposed Monetary Policy Board. Being dominated by outsiders it could diminish RBA responsibility and authority and having all Board members out giving speeches on monetary policy will lead to confusion. There is no evidence that the Bank of England and Bank of Canada models, which are proposed for Australia, have delivered better outcomes.

- Mixed messages on Australian interest rates in the last week from data releases - but our base case remains that we have seen the top or if not are now very close to it. On the one hand the NAB business survey reported a renewed surge in labour costs and selling prices in July likely reflecting the faster increase in minimum and award wages this year, the Superannuation Guarantee increase and higher power prices providing a reminder that the risks for interest rates are still on the upside. Against this though the ABS’ Household Spending Indicator has slowed to a crawl in nominal terms suggesting that overall real consumer spending may have gone backwards in the June quarter. This is telling us that demand is rapidly slowing and this will push inflation down as companies discount to clear stock and cut hiring and so the RBA should continue to exercise patience and so leave rates on hold. Our base case remains that rates have peaked (with 60% probability) but the risk of another hike is high (at 40%).

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website