The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

"The best economist I know is the inside of the stock market." Stanley Druckenmiller

Economic data and stock markets are sending very different signals about the outlooks for the US and Australia.

On the face of it, the US economy is booming. A year ago, almost every economist was forecasting that the US would soon face a recession. That hasn’t happened. Recent US GDP soared to 4.9% in the third quarter, the highest rate since the end of 2021 and a significant uptick from the 2.1% recorded in the second quarter.

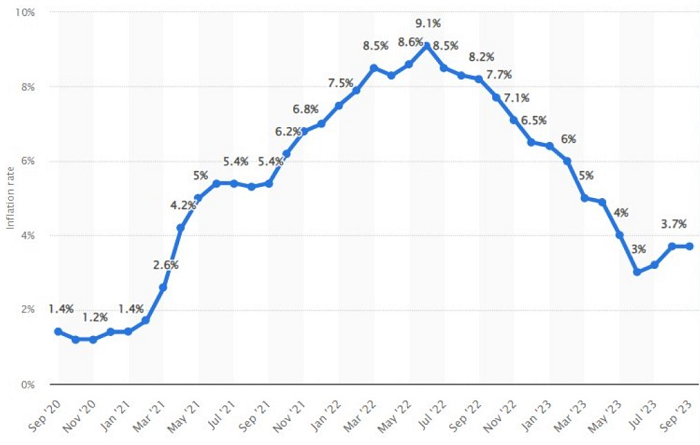

Not only that but wages growth remains strong. Private nominal wage growth is relatively steady at 4.5% year-on-year. Meanwhile, employment remains plentiful. The US employment rate of 3.8% is off the lows, yet still reflects a tight labor market. Also, tax collections are at record highs.

c/o Ray Macken, Schroders

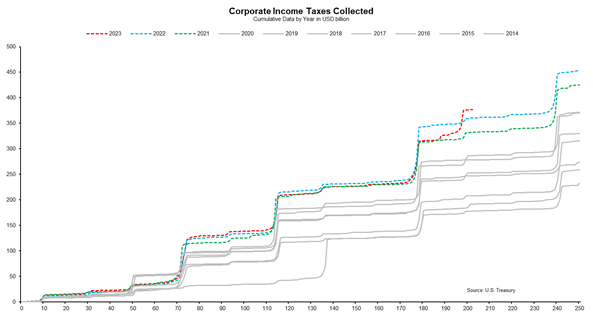

Best of all, inflation has come down towards the Federal Reserve’s target rate of 2%. The inflation rate is 3.7%, down from a peak of 9.1%.

US inflation rate

Source: Bureau of Labor Statistics

Yet, the US stock market is telling a different narrative from the economic statistics. Yes, the Nasdaq is up an extraordinary 32% this year. And the S&P 500 has risen a still healthy 11%.

These gains have been driven by what was called ‘The Magnificent Seven’ stocks, though should really be renamed ‘The Enormous Eight’ (including Netflix as the 8th). Here are the year-to-date returns for these stocks:

Nvidia (NVDA) +182%

Meta (META) +152%

Tesla (TSLA) +60%

Amazon (AMZN) +58%

Microsoft (MSFT) +42%

Alphabet (GOOGL) +41%

Netflix (NFLX) +39%

Apple (AAPL) +32%

Zoom in on the US market though, and the picture becomes murkier. An equal weighted index of S&P 500 stocks is down 4% this year. And US small caps are off 5% over the same period.

Economically sensitive transport stocks have tanked since July.

The percentage of S&P 500 stocks trading above their 200-day moving average also peaked in July at 67%, and that’s now down to just 25%.

More worrying is the performance of the large US banks. They’re down 25% this year. The larger retail banks such as Citi and Bank of America are 47% off their highs reached in 2021-2022. Investment banks like Morgan Stanley and Goldman Sachs are down 17% and 12% respectively year-to-date.

The retail banks are of particular concern. Recently, Bank of America revealed that the unrealized balance sheet losses from so-called held-to-maturity securities was US$132 billion - that's 63% of the bank's US$208 billion market capitalisation. These securities are mostly bonds that the bank bought when interest rates were near zero. Now that rates are up 500 basis points, these securities are deeply underwater. Bank of America is far from the only bank sitting on losses from these bonds.

The concern isn’t that the banks will have to realise these losses any time soon. They won’t. It’s more that it’s likely to restrict banks from making loans going forward.

There are signs that this is already happening.

What are the conclusions to draw from all this? Morningstar’s Peter Warnes told me on this week’s Wealth of Experience that today’s events remind him of 2007, before the financial crisis. Back then, there were a few bank failures in 2006-2007, and things only accelerated downhill about 12 months later. Peter sees parallels with Silicon Valley Bank and Credit Suisse’s downfalls earlier this year, and the potential for further bank failures into next year.

UniSuper’s Chief Investment Officer, Jon Pearce, seems to be taking the other side of that bet. He revealed to the same podcast that he’d recently bought heavily into the US banking sector.

My views sit somewhere between these two men. I tend to agree with Steve Eisman, famed for shorting the US housing bubble and featured in Michael Lewis’ book, The Big Short, who sees American banks as uninvestable, though the financial system itself is in ok shape. Eisman says net interest margins at the banks are being squeezed as customers demand higher deposits, and yet they are earning less on long-term loans such as mortgages, which are locked in for several decades. Add in new regulations requiring the banks to hold more capital, and it doesn’t paint a pretty picture.

The issue is whether the US banks further tighten credit. If that happens, an economic slowdown if not a recession, seems inevitable.

Australia is different from the US. GDP growth is nowhere not as strong, the last print at 2.2%. Like the US though, the employment market is tight, with the unemployment rate at 3.7%.

Australia unemployment rate

Unlike the US, inflation remains high in Australia, at 5.4%. Sure, it’s down from the peak of 7.8% in the December quarter of last year, yet it is still well above the RBA’s target of 2-3%.

Spending habits appear strong. Australian retail sales in September increased 0.9% from August, well above market estimates for a 0.3% rise.

And housing seems to be as bubbly as ever. Recently, this house, located 31 kilometres west of the Sydney CBD, sold for $4.6 million, some 2.6 million above the reserve.

Source: realestate.com.au

Of the sale, one of the agents told the AFR:

“If I see $2.6 million over reserve in Bondi for a $10 million waterfront property, that’s expected – look at the view, the location. You wouldn’t see that in the west or south-west. I can’t explain it. It’s something I’d see out of Seinfeld.”

It seems the RBA has some work to do to slow overheated parts of the economy and bring the inflation number down.

So, what’s the ASX telling us? Well, it’s duller than the US and that mightn’t be a bad thing. The ASX 200 is down 2% this year in price terms, banks are off a little more at 4%, and small caps have declined 7%.

More than a quarter of ASX 200 stocks are at 52-week lows, and only 30% are trading above their 200-day moving average.

Source: Bloomberg

Unlike in America, there are few red flags in Australia’s stock market. However, that could change if things go south in the US.

James Gruber

Also in this week's edition...

Vanguard founder, John Bogle, famously advocated US-based investors need just two funds in their portfolio: one covering the entire US stock market and the other the bond market. Recently, James Gruber tried to create an Australian version of the Bogle portfolio and he found that what seems like a simple task can quickly turn complicated. He describes the journey and the lessons learned.

Zac Gross from Monash University takes issue with an ASX tool to gauge market predictions for the RBA cash rate. It's a tool widely used by news outlets and RBA watchers, though Zac believes it's flawed. He says adjustments are needed to ensure a more accurate barometer for interest rate expectations.

James Gruber reviews a charming book by Roger Rosenblatt called Rules for Ageing. James chooses the top 18 rules from the book for ageing well including, 'the unexamined life lasts longer', 'change no more than one-eighth of your life at a time', 'nobody is thinking about you', and 'pursue virtue but don’t sweat it'.

Textbooks tell us there are two main ways to allocate assets: via strategic asset allocation (SAA) and tactical asset allocation (TAA). The first is largely a set-and-forget allocation while the latter is about taking more active positions. Vanguard's Maziar Nikpour explains why he thinks TAA is fraught with danger.

Many investors have a perennial fear of market crashes. Yet how likely are they? There's new academic research on the issue and Larry Swedroe puts it into plain English for us.

There's a lot of red ink among Australian listed property companies or A-REITs this year. The question that everyone seems to be asking is whether now is the time to buy or add to them. Charter Hall's Mark Ferguson thinks sector fundamentals remain solid and the sell down in A-REITs offers opportunities for the astute investor.

Two extra articles from Morningstar for the weekend. Shani Jayamanne reports on a materially undervalued ASX blue chip stock, and an Australian tech stock has been added to Morningstar's Global Best Ideas List.

And lastly in this week's whitepaper, Montaka outlines the three pillars of active management outperformance.

***

Weekend market update

On Friday in the US, the bulls wrapped up the week in appropriate fashion as a softer than expected October payrolls keyed another big rally: stocks rose nearly 1% on the S&P 500 to settle nearly 6% above last Friday’s finish, while two-year yields dove 15 basis points to 4.83% and the long bond declined to 4.78%, its lowest since Oct. 11. Gold edged higher to $1,993 per ounce, WTI crude pulled back below $81 a barrel and the VIX settled south of 15.

From AAP Netdesk:

The local share market on Friday closed higher for a fourth straight day, enjoying its best weekly performance in months on hopes the Fed has finished raising rates and the war in Gaza won't spread. The benchmark S&P/ASX200 index on Friday finished up 78.2 points, or 1.14%, to 6,978.2 - its highest finish since October 19. The broader All Ordinaries rose 81.1 points, or 1.13%, to 7,175.1. For the week, the ASX200 gained 2.2%, its best weekly performance since a 2.3% gain from August 28 - September 1.

Every sector of the ASX finished higher on Friday except for energy, with property the biggest gainer rising 2.1%.

Block was the biggest gainer in the ASX200, soaring 25.2% to a month-and-a-half high of $81.18 after the Afterpay owner reported stronger-than-expected third-quarter earnings and strong growth in both its Cash App and Square revenue.

All of the big four banks finished higher, with NAB climbing 1.7% to $29.06, Westpac adding 1.6% to $21.50, CBA advancing 1.5% to $99.93 and ANZ gaining 0.9% to $25.60.

In the heavyweight mining sector, Rio Tinto added 0.7% to $122.60 and BHP rose 0.3% to $45.50, while goldminer Newmont gained 1.2% to $58.94.

Coles rose 0.8% to $15.45 as the supermarket group held its annual general meeting in Melbourne, with chief executive Leah Weckert highlighting efforts to modernise its supply chain with new automated warehouses.

Treasury Wine Estate fell 7.8% to a three-month low of $11.04 as the Penfolds owner completed a $604 million capital raising at $10.80 a share to help fund its $1.6 billion acquisition of California winemaker DAOU Vineyards.

In health care, Integral Diagnostics plummeted 27.2% to a six-year low of $1.93 after the radiologist and diagnostic imaging provider said clinical staff shortages, particularly in regional areas, and cost inflation had continued into the September quarter, putting a crimp on operating earnings.

Neuren climbed 8.5% to $12.25 after the drug development company reported better-than-expected sales for its new treatment for a rare genetic disorder called Rett syndrome. Neuren stands to make $26 million to $28 million in royalties in 2023 from Daybue, it said.

From Shane Oliver, AMP:

The Fed has likely finished raising rates.

As widely expected, the Fed left its Fed Funds rate on hold at 5.25-5.5%. While Fed Chair Powell indicated that the Fed is still not confident it has done enough and that it could still hike again, he also noted that the Fed is now “proceeding carefully”, acknowledged again that the rise in bond yields has tightened financial conditions and noted that the risks are “more two sided now”. Of course, this does not mean that the Fed has relaxed its high for longer message on rates. It’s still determined to get inflation down to target and conscious that the rise in bond yields over the last six months may reflect expectations of higher for longer policy rates so it may still have to sound tough for a while otherwise it risks seeing the financial tightening from higher bond yields reverse before it wants it too (as we have seen a bit in the last week).

It’s likely that all developed country central banks have finished tightening with the probable exception of Japan and Australia.

The Bank of Japan has yet to even start raising rates. However, it did take another baby step in that direction by further relaxing its cap on 10-year bond yields by dropping a pledge to buy bonds when the yield is at 1% to now describing 1% as just a “reference” suggesting it will tolerate a rise above 1%. This of course saw Japanese bond yields rise further. With core inflation spending more time above 2% a further removal of easy money is likely ahead of a rate hike next year. This will gradually reduce one source of demand for US Government bonds, but the impact will be modest as Japanese bond yields will still be very low.

In Australia, we expect that the RBA will raise its cash rate again on Tuesday by another 0.25% taking it to 4.35%.

In the last few weeks, the RBA has warned that it has a “low tolerance” for a slower fall in inflation than expected and Governor Bullock noted the RBA “will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation”. While headline inflation in the September quarter was close enough to RBA forecasts, underlying inflation was about 0.4% higher and that along with ongoing signs of sticky services inflation and stronger than expected demand on the back of surging population growth is likely to drive an upwards revision to its inflation forecasts that its likely to regard as “material” and hence justification for another rate hike. The IMF often reflects official thinking and its upwards revision to its inflation forecasts for Australia and call for the RBA to raise rates further after having just been in Australia and met with the RBA may reflect the RBA’s own views.

However, while we expect another rate hike on Tuesday it looks like a close call for three key reasons:

- While September quarter underlying inflation was worse than expected and it’s important to keep long term inflation expectations down, our own view is that the RBA should give more time for the lags with which rate hikes impact the economy to play out and so should remain in wait and see mode for longer. This is particularly so given faltering household spending on a per capita basis, 1 in 7 households with a mortgage already being cashflow negative based on RBA analysis, inflation still falling and likely on our Inflation Indicator to fall further and increasing uncertainty globally. Continuing to raise rates will further ratchet up the already high risk of recession next year. It’s possible that the RBA could come to a similar view.

- The RBA may conclude that any upwards revision to its inflation forecasts is not “material” like Treasurer Chalmers has stated.

- Finally, the RBA’s influence on the Board is arguably a bit less at present and political pressure on it looks to be intense. A new Deputy Governor has not yet been appointed so Governor Bullock will be on her own at the Board meeting in terms of those having a vote, recent Government appointees to the Board may be a bit less hawkish and the Treasury Secretary who is on the Board may have a similar view on the inflation outlook as the Treasurer. The RBA may also want to be a bit more cautious given upcoming implementation of some parts of the recent RBA Review and discussion over the wording of its objectives.

The final point suggests a bit more politics around the decision than normal. Of course, this could go the other way with the Governor/RBA wanting to underline its independence in the face of perceived pressure from the Government, but all up we see the decision as finely balanced and put the probability of a Melbourne Cup Day hike at 55%. In fact, while most economists expect a rate hike the money market puts the chance of a hike on Tuesday at 48%, but with a 100% chance by February. Either way we expect the RBA to reiterate that “some further tightening of monetary policy may be required.”

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Quarterly ETFInvestor (ETF Market Data) from Morningstar

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website